We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

How much longer will this bear market go on for?

Comments

-

The 50bp change from 1.25% to 1.75% represented a 40% increase, whereas the 200bp (from 10% to 12%) in 1984 was a 20% increase.sevenhills said:

It's thirty years since rates moved by 1% and our media are now hyping up a mere 0.5% increase.Type_45 said:

Why not enlighten us.

https://www.bankofengland.co.uk/boeapps/database/Bank-Rate.asp

Is anyone predicting more than a 0.5% increase?

1 -

A 1% increase in 1984 would have increased mortgage payments by £xx the same as in 2022, doesn't matter if you call it bp or %masonic said:The 50bp change from 1.25% to 1.75% represented a 40% increase, whereas the 200bp (from 10% to 12%) in 1984 was a 20% increase.0 -

It certainly wouldn't increase them by 1%, so it is not a 1% increase.sevenhills said:

A 1% increase in 1984 would have increased mortgage payments by £xx the same as in 2022, doesn't matter if you call it bp or %masonic said:The 50bp change from 1.25% to 1.75% represented a 40% increase, whereas the 200bp (from 10% to 12%) in 1984 was a 20% increase.

0 -

Now you are not making sense!masonic said:It certainly wouldn't increase them by 1%, so it is not a 1% increase.0 -

sevenhills said:

Now you are not making sense!masonic said:It certainly wouldn't increase them by 1%, so it is not a 1% increase.It's quite simple really, if someone is paying £800 per month, then a 100bp increase in base rate is going to result in them paying a lot more than £808 per month. The actual percentage increase will be dependent on the particulars of their mortgage, but is likely to add on 10%+ to the the cost of their repayments when interest rates are low, or a lower percentage if interest rates are already high. It will be about the same absolute increase in bp and £ monthly repayment, but not % increase.What this means is that when rates are high, a larger change is required to give an equivalent disincentive to borrowing. Of course, that's assuming rates are not wholly disconnected from inflation to begin with. At the moment debt is being inflated away at a far faster rate than interest is accruing.0 -

sevenhills said:

A 1% increase in 1984 would have increased mortgage payments by £xx the same as in 2022, doesn't matter if you call it bp or %masonic said:The 50bp change from 1.25% to 1.75% represented a 40% increase, whereas the 200bp (from 10% to 12%) in 1984 was a 20% increase.

Due to the way mortgage payments work it's not exactly the same. When rates are higher already an increase actually has more impact on monthly payment

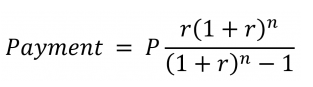

r = Annual interest rate (APRC)/12 (months)

P = Principal (starting balance) of the loan

n = Number of payments in total: if you make one mortgage payment every month for 25 years, that’s 25*12 = 300

To show using examples:

100k mortgage at 2% with 25 years left - 424 per month

1% increase in rate to 3% - 473 per month.

So £49 more, an 11% increase in payment

100k mortgage at 10% - 909

1% increase in rate to 11% - 980

So £71 more, or an 8% increase in payment

Also note average mortgage in 1984 < average mortgage in 2022. So someone with a 100k mortgage in 1984 and a 100k mortgage in 2022 are in very different positions.

Note also assumed BOE increase completely passed on to borrower - only guaranteed in the case of a BOE tracker.4 -

Exactly. It's like asking someone to drink a gallon of water in a day, and another person to drink a gallon of water over a week.masonic said:

The 50bp change from 1.25% to 1.75% represented a 40% increase, whereas the 200bp (from 10% to 12%) in 1984 was a 20% increase.sevenhills said:

It's thirty years since rates moved by 1% and our media are now hyping up a mere 0.5% increase.Type_45 said:

Why not enlighten us.

https://www.bankofengland.co.uk/boeapps/database/Bank-Rate.asp

Is anyone predicting more than a 0.5% increase?

It's the rate of change that's important here.0 -

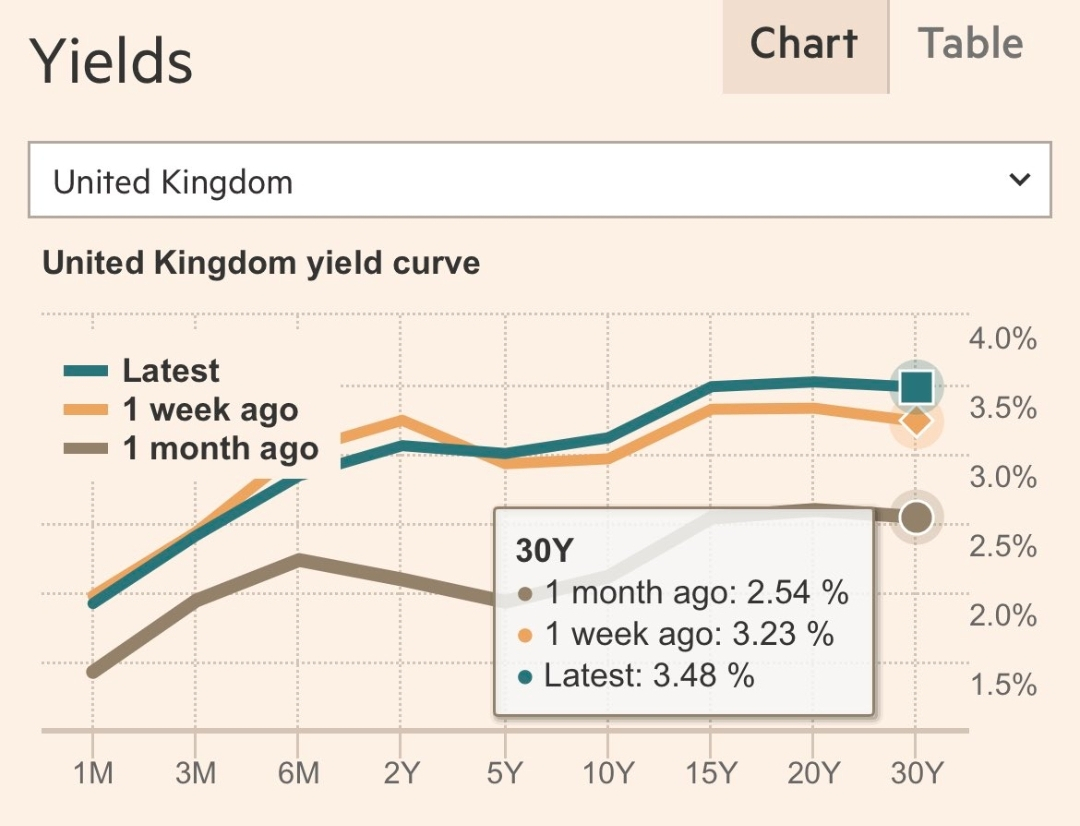

I'm sure someone will be along shortly to tell us how bullish this chart is for stocks...

0 -

I don’t know about that but I remember at the beginning of last week you were blowing about the bloodletting continuing, by the end of the week major indices all finished +ve for the week, some by 4-5%.Type_45 said:I'm sure someone will be along shortly to tell us how bullish this chart is for stocks... 0

0 -

Alistair31 said:

I don’t know about that but I remember at the beginning of last week you were blowing about the bloodletting continuing, by the end of the week major indices all finished +ve for the week, some by 4-5%.Type_45 said:I'm sure someone will be along shortly to tell us how bullish this chart is for stocks...

Retail investors BTD. Good luck to them.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards