We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

How much longer will this bear market go on for?

Comments

-

OK, fair point.Cus said:

You can base it however you want to, but on this thread the point was that the market has not collapsed, it has even recovered. To make that point I would only use what was already invested imoSwipe said:That's why I base it on net worth. As an example I'm £80K better off today than I was on June 13th and as most of my salary goes into my pension, only about £2K came from my pay cheque. So where did the extra money come from?0 -

It wouldn't be my prediction.Swipe said:

A 70% drop in 3 months is a pretty tall order even by 1929 standardscoyrls said:

I think that was by the end of the year, so not disproved yet.adindas said:

Pay attention the last which monumental: the stock Market would tank 80%.coyrls said:Yes but as Type_45 predicted both a rise (prior to a fall) and a fall, it's hard to know what would disprove his predictions in the short term.

0 -

Apparently we can expect the answer any day now.....

https://www.nasdaq.com/articles/the-technical-indicator-that-always-calls-the-end-of-bear-markets

“Like a bunch of cod fishermen after all the cod’s been overfished, they don’t catch a lot of cod, but they keep on fishing in the same waters. That’s what’s happened to all these value investors. Maybe they should move to where the fish are.” Charlie Munger, vice chairman, Berkshire Hathaway1 -

Steve182 said:Apparently we can expect the answer any day now.....

https://www.nasdaq.com/articles/the-technical-indicator-that-always-calls-the-end-of-bear-markets

If that article was written on the Morning of the 12th, and they were waiting for the S&P500 to go through 4231, then note, it closed at 4280.

So lets see what happens to the markets this coming week/month!!!!How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0 -

Sea_Shell said:Steve182 said:Apparently we can expect the answer any day now.....

https://www.nasdaq.com/articles/the-technical-indicator-that-always-calls-the-end-of-bear-markets

If that article was written on the Morning of the 12th, and they were waiting for the S&P500 to go through 4231, then note, it closed at 4280.

So lets see what happens to the markets this coming week/month!!!!PUBLISHEDAUG 12, 2022 11:00AM EDT

Perhaps just the fact that it's reached that technical milestone will trigger a flurry of buying and create an upward spiral in the market?“Like a bunch of cod fishermen after all the cod’s been overfished, they don’t catch a lot of cod, but they keep on fishing in the same waters. That’s what’s happened to all these value investors. Maybe they should move to where the fish are.” Charlie Munger, vice chairman, Berkshire Hathaway3 -

Steve182 said:Sea_Shell said:Steve182 said:Apparently we can expect the answer any day now.....

https://www.nasdaq.com/articles/the-technical-indicator-that-always-calls-the-end-of-bear-markets

If that article was written on the Morning of the 12th, and they were waiting for the S&P500 to go through 4231, then note, it closed at 4280.

So lets see what happens to the markets this coming week/month!!!!PUBLISHEDAUG 12, 2022 11:00AM EDT

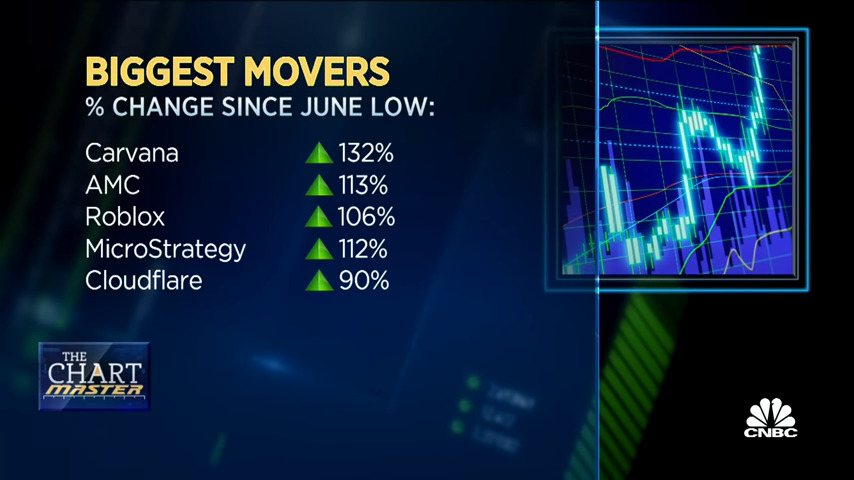

Perhaps just the fact that it's reached that technical milestone will trigger a flurry of buying and create an upward spiral in the market?Many high growth stocks have moved significantly which might indicate that people are more confident to throw money into the stock market ?? The money could come from reserve cash or people moving their money from other type of assets such as bonds.That is why high growth stocks are called high risk high reward. Those who understand well before buying these types of stocks should understand that down 50%, 70% should not trigger a panic selling as long as the investment thesis still hold true and they are not heading to bankruptcy as when they recover they also recover quickly. Even a very good high growth stocks with high growth in revenue they could head for bankruptcy if they are running out of cash to maintain their operation.Below is just a few of many examples of high growth stocks up 100%+ in less than two months. There are some even more than 300%. This move is very difficult to be triggered by P&D as they are not penny stocks. Also because typically there are a lot of shares outstanding (float) available.

0 -

Steve182 said:Apparently we can expect the answer any day now.....

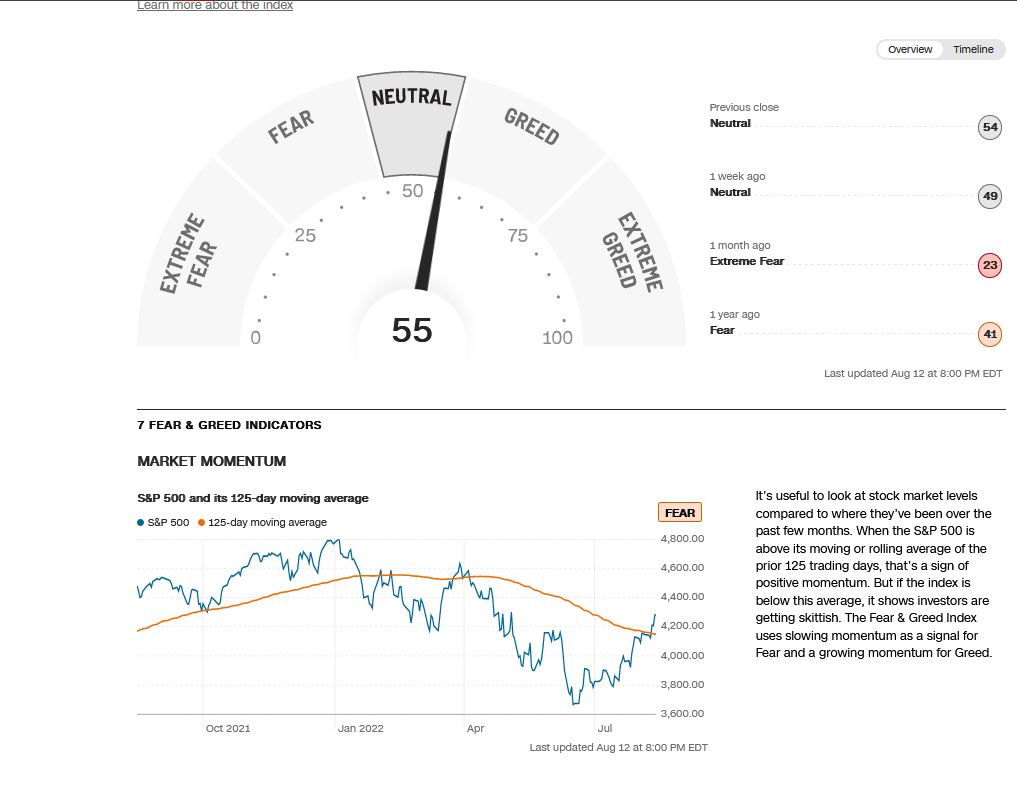

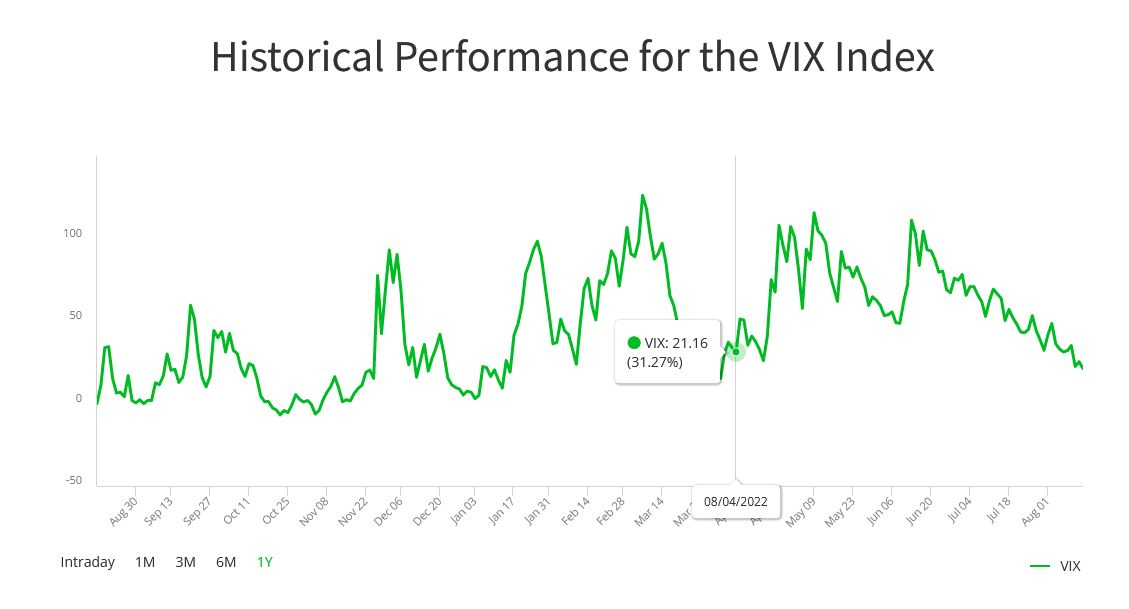

https://www.nasdaq.com/articles/the-technical-indicator-that-always-calls-the-end-of-bear-marketsI am not quite sure what type of indicator that analyst is using in the article above. He is talking about US$4,231 level. S&P 500 closed at US$4,280.15 at market close 12 August 2022. The Fibonacci retracement indicators mentioned on the article above that will indicate the levels that help traders to determine critical support and resistance levels are available in many technical chartings tools.This is what the stock market barometer Fear and Geed (F&G) Index, the VIX are showing. So it is showing fear is easing and volatility in the market keep decreasing. But as usual technical indicators are not a crystal ball, it is not 100% Accurate. Let see what other analysts / strategist are saying have they reached general consensus ?

Michael Burry, the big short call it typical Bear Market rallyJust be aware Michael Burry typically make money in the short side of the market in the declining market, so it is his best interest to keep preaching the Bear Market. This is what he said in his twit !

Michael Burry, the big short call it typical Bear Market rallyJust be aware Michael Burry typically make money in the short side of the market in the declining market, so it is his best interest to keep preaching the Bear Market. This is what he said in his twit ! 1

1 -

I'm certainly pleased to see my SMT holding has recovered somewhat, 50% drops are always difficult to stomach, even when in your own mind you're sure it's only a matter of time.

I am tempted to sell some of my value holdings and pile the money into BG US growth which has now recovered to £1.94 from a low of £1.46 in May, having dropped from a 2021 peak of £3.52

The problem is much of my value holding is gold mining and US natural gas, both of which I'm currently very bullish on...mmmm

“Like a bunch of cod fishermen after all the cod’s been overfished, they don’t catch a lot of cod, but they keep on fishing in the same waters. That’s what’s happened to all these value investors. Maybe they should move to where the fish are.” Charlie Munger, vice chairman, Berkshire Hathaway0 -

Another interesting article...

https://biz.crast.net/volatility-investor-warns-of-false-dawn-for-us-stock-market/

“Like a bunch of cod fishermen after all the cod’s been overfished, they don’t catch a lot of cod, but they keep on fishing in the same waters. That’s what’s happened to all these value investors. Maybe they should move to where the fish are.” Charlie Munger, vice chairman, Berkshire Hathaway0 -

Sea_Shell said:Steve182 said:Apparently we can expect the answer any day now.....

https://www.nasdaq.com/articles/the-technical-indicator-that-always-calls-the-end-of-bear-markets

If that article was written on the Morning of the 12th, and they were waiting for the S&P500 to go through 4231, then note, it closed at 4280.

So lets see what happens to the markets this coming week/month!!!!

Although that level of 4231 has been crossed, and based on that prediction, the bear market is confirmed is over, it does not mean that there will be no more pull back, go lower than the market closed at 4280 or even 4231. Pull back, going zigzag is inherent feature of the market when there is an overbought. Also because the stock market has never gone up in the straight line in the history. But what it should not do if that prediction is correct is to go lower than the bottom we saw in June 2022. If it ever goes down again below the June bottom in the near future than that prediction is wrong.

1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards