We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

How much longer will this bear market go on for?

Comments

-

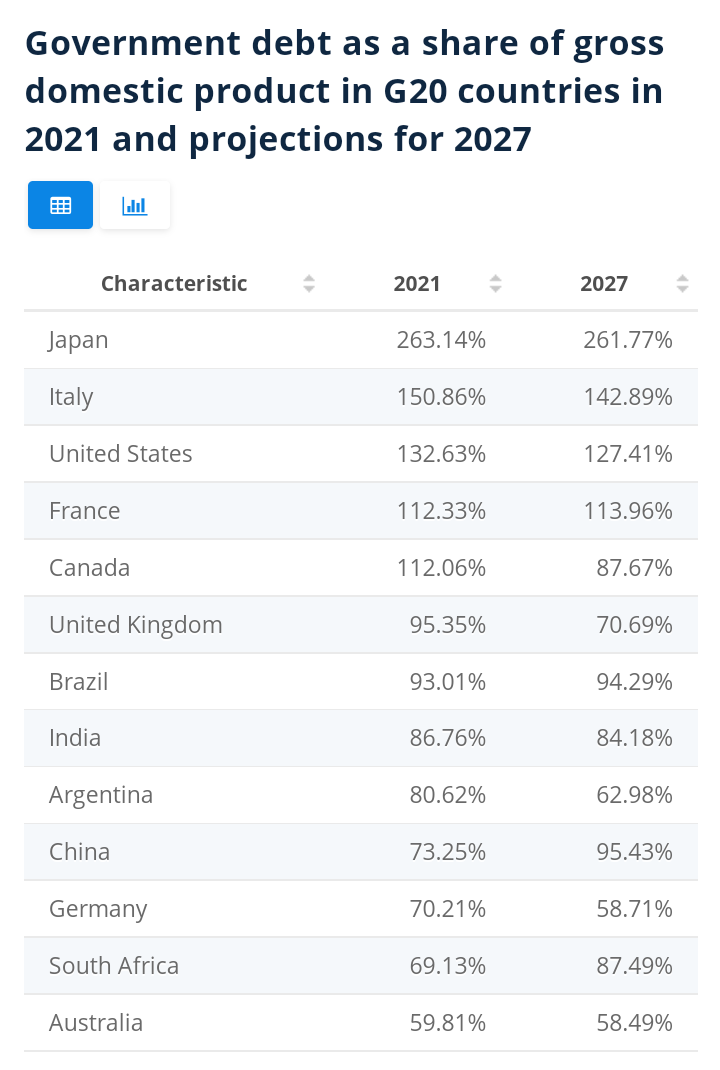

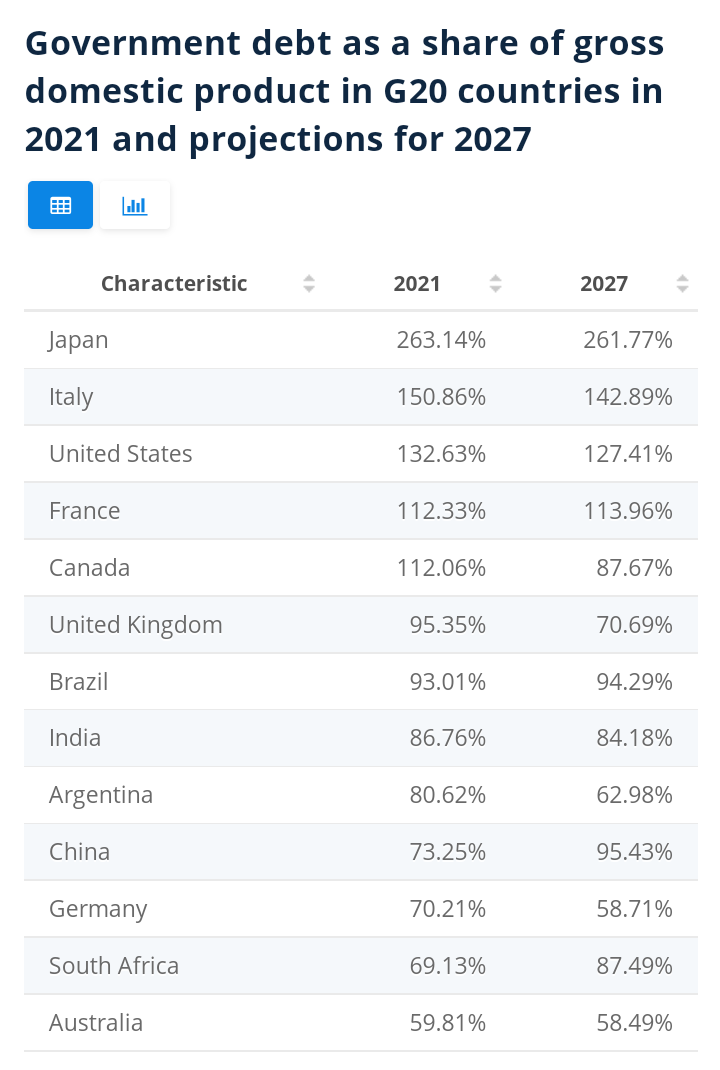

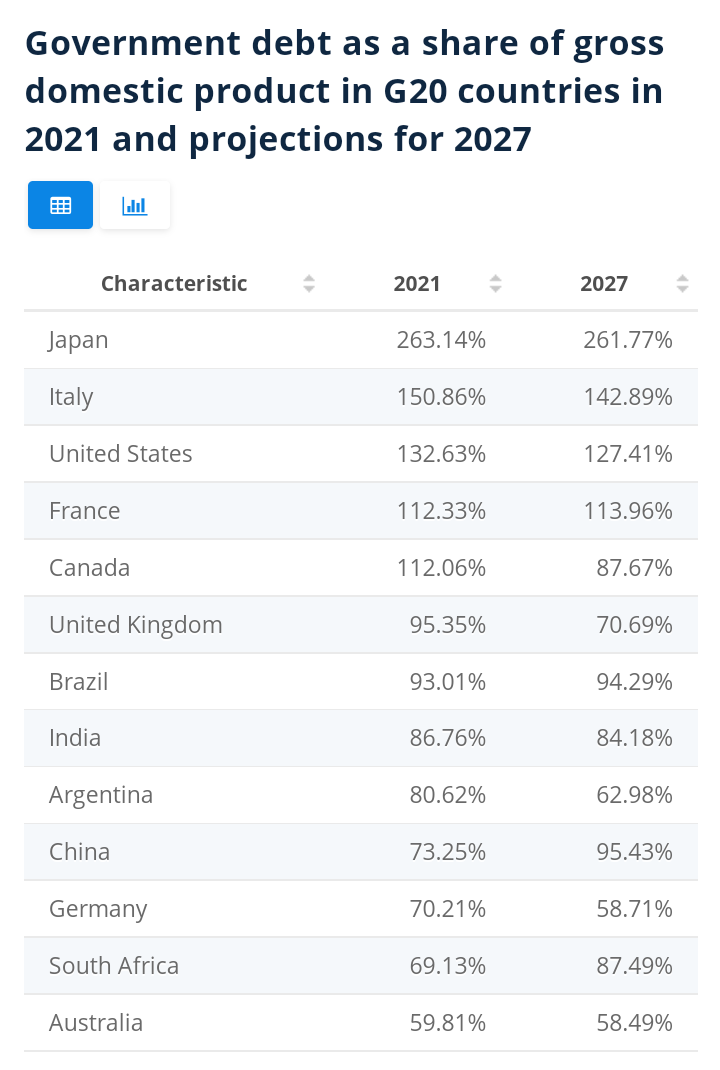

This was our debt compared to the G20 countries in 2021, things have got worse since then, UK debt GDP is now 99.6%Millyonare saidUK economic stats look pretty good.

National UK state debt is just about the lowest in the entire G7 world group.

1 -

It would no doubt have grown higher than 100% if our new PM clown had got her own way. Interesting that the USA is so high.sevenhills said:

This was our debt compared to the G20 countries in 2021, things have got worse since then, UK debt GDP is now 99.6%Millyonare saidUK economic stats look pretty good.

National UK state debt is just about the lowest in the entire G7 world group. “Like a bunch of cod fishermen after all the cod’s been overfished, they don’t catch a lot of cod, but they keep on fishing in the same waters. That’s what’s happened to all these value investors. Maybe they should move to where the fish are.” Charlie Munger, vice chairman, Berkshire Hathaway0

“Like a bunch of cod fishermen after all the cod’s been overfished, they don’t catch a lot of cod, but they keep on fishing in the same waters. That’s what’s happened to all these value investors. Maybe they should move to where the fish are.” Charlie Munger, vice chairman, Berkshire Hathaway0 -

Steve182 said:

It would no doubt have grown higher than 100% if our new PM clown had got her own way. Interesting that the USA is so high.sevenhills said:

This was our debt compared to the G20 countries in 2021, things have got worse since then, UK debt GDP is now 99.6%Millyonare saidUK economic stats look pretty good.

National UK state debt is just about the lowest in the entire G7 world group.

UK debt is the 2nd lowest in the whole G7 in 2021/22. Debt is forecasted to go even lower, to 71%, by 2027.

Truss's tax budget added a miniscule 1-3% extra to that state debt (perhaps less). It was totally affordable.

But that is not a narrative people want to hear.1 -

When the rush for liquidity happens everything will crash as margin calls need to be met. Including gold and silver. That's the perfect time to buy the shiny stuff. Then watch it go to the moon.1

-

Hedge Fund Titan Warns UK Pension Crisis Is Just the Start

- Billionaire Marshall says pensions are acting like hedge funds

- Crispin Odey says the LDI crisis is only just beginning

0 -

These guys are just trying their best to influence the market so as to better improve the results from their own hedge funds, which happen to have been good recently. Difficult to do with so many voices but still they try. In other news ... its all priced in.1

-

An interesting alternative view of the current high inflation and future outlook from Russell Napier here:

Russell Napier: The world will experience a capex boom (themarket.ch)

"What will this new world mean for investors?First of all: avoid government bonds. Investors in government debt are the ones who will be robbed slowly. Within equities, there are sectors that will do very well. The great problems we have – energy, climate change, defence, inequality, our dependence on production from China – will all be solved by massive investment. This capex boom could last for a long time. Companies that are geared to this renaissance of capital spending will do well. Gold will do well once people realise that inflation won’t come down to pre-2020 levels but will settle between 4 and 6%. The disappointing performance of gold this year is somewhat clouded by the strong dollar. In yen, euro or sterling, gold has done pretty well already."

-1 -

So if you piggy-back the performance of gold onto the rise of the dollar against the pound, a 20% dump over the last two years turns into a mere 7.5% plop. At a time when gold should in theory be doing very well. (The FTSE All World TR is up 20% over the same period in Sterling even after 2022's fall.)Russel Napier said:The disappointing performance of gold this year is somewhat clouded by the strong dollar. In yen, euro or sterling, gold has done pretty well already."

If you have to use the performance of a fiat currency to make gold look good (well, slightly less bad), doesn't that rather defeat the purpose of buying shiny metal?1 -

"there are only 2 types of expert - those who don't know and those who don't know they don't know"3 -

Adyinvestment said:

"there are only 2 types of expert - those who don't know and those who don't know they don't know"

That's is the mantra to live by, and as Prism touches on, be sceptical of what you read, there is often an agenda behind it.

Too many people talk with certainties in an uncertain topic, including on here.

I prefer to listen to those that point out thought provoking points with direction one way or another.

I hope that my posts come across as open ended (on the stick market, not necessarily elsewhere)

With that in mind, the s&p looks set to pop 5% in two days. They say you never see the bottom coming. Let's see how this plays.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards