We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

How much longer will this bear market go on for?

Comments

-

the rates will be back to zero when the recession hits

we came very close to a Lehmann moment last week

and the risks not gone away

1 -

IWeb are a bit of a pain as they only offer telephone dealing. You'd be best staying in the shallow end away from the BoE action. Prices at the deep end are being artificially inflated to allow pension funds to keep their casino banking operations afloat. Don't buy what you wouldn't be willing to hold until maturity.Type_45 said:Some of these look attractive. Does anyone here on iWeb have bonds?

1 -

But this is a thread about the stock market. Maybe post about bonds somewhere else?Type_45 said:Stop looking at the stock market

0 -

InvesterJones said:

But this is a thread about the stock market. Maybe post about bonds somewhere else?Type_45 said:Stop looking at the stock market

What I meant is: "look at the bond market!"0 -

A stock market is somewhere that financial securities are bought and sold so it includes government bonds, sometimes known as 'government stock.'InvesterJones said:

But this is a thread about the stock market. Maybe post about bonds somewhere else?Type_45 said:Stop looking at the stock market

They're certainly rather pertinent to insurance companies at the moment...0 -

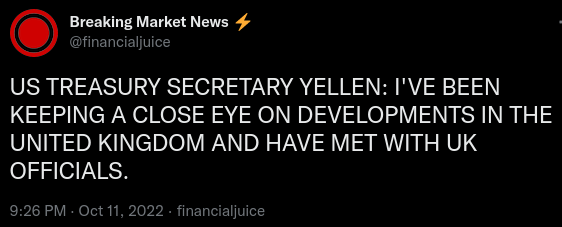

Andrew Bailey has just crashed the pound again:Millyonare said:The UK has just about the lowest state debt in the whole G7. Kwarteng's tax budget barely added a tiny 1-3% extra to that debt (perhaps less). Thus, the run on the UK bond market is not caused by the Tories... It is caused by the Bank of England. The BoE (in effect) cut rates to expectation by -0.25% in Sep 2022, in the face of roaring inflation, and this has rattled gilts. It's broadly the same set of events as Turkey, who have also been decreasing central-bank rates as inflation increased. The BoE needs a shock-and-awe rate rise of +1% in Nov 2022, to get back on track.

"Pound falls sharply as Bailey insists he will not extend emergency supportThe pound fell sharply against the dollar after Andrew Bailey insisted he will not extend emergency intervention in the gilt markets intended to support pension funds.

Sterling reached lows of $1.0973 immediately after the comments, dropping 1.3pc in the space of a few minutes and wiping out gains since the start of the month."

I started a thread on these boards a month or so back asking why he still had a job, but it was deleted for some reason. I'd still love to know the answer. Rather than swanning around in Washington he might want to get his fat gut back to the UK and actually address the problem's he's done much to create.

6 -

hallmark said:

Andrew Bailey has just crashed the pound again:Millyonare said:The UK has just about the lowest state debt in the whole G7. Kwarteng's tax budget barely added a tiny 1-3% extra to that debt (perhaps less). Thus, the run on the UK bond market is not caused by the Tories... It is caused by the Bank of England. The BoE (in effect) cut rates to expectation by -0.25% in Sep 2022, in the face of roaring inflation, and this has rattled gilts. It's broadly the same set of events as Turkey, who have also been decreasing central-bank rates as inflation increased. The BoE needs a shock-and-awe rate rise of +1% in Nov 2022, to get back on track.

"Pound falls sharply as Bailey insists he will not extend emergency supportThe pound fell sharply against the dollar after Andrew Bailey insisted he will not extend emergency intervention in the gilt markets intended to support pension funds.

Sterling reached lows of $1.0973 immediately after the comments, dropping 1.3pc in the space of a few minutes and wiping out gains since the start of the month."

I started a thread on these boards a month or so back asking why he still had a job, but it was deleted for some reason. I'd still love to know the answer. Rather than swanning around in Washington he might want to get his fat gut back to the UK and actually address the problem's he's done much to create.

Agreed.

He's like a human wrecking ball, thru the FCA and now the BoE 2

2 -

Were Andrew Bailey to be immediately replaced by Andrew Sentance then things would soon be looking very different! And moving forward in a much better way! In my humble opinion I should add, I don’t want to upset anyone who may be even slightly offended by this suggestion.Millyonare said:hallmark said:

Andrew Bailey has just crashed the pound again:Millyonare said:The UK has just about the lowest state debt in the whole G7. Kwarteng's tax budget barely added a tiny 1-3% extra to that debt (perhaps less). Thus, the run on the UK bond market is not caused by the Tories... It is caused by the Bank of England. The BoE (in effect) cut rates to expectation by -0.25% in Sep 2022, in the face of roaring inflation, and this has rattled gilts. It's broadly the same set of events as Turkey, who have also been decreasing central-bank rates as inflation increased. The BoE needs a shock-and-awe rate rise of +1% in Nov 2022, to get back on track.

"Pound falls sharply as Bailey insists he will not extend emergency supportThe pound fell sharply against the dollar after Andrew Bailey insisted he will not extend emergency intervention in the gilt markets intended to support pension funds.

Sterling reached lows of $1.0973 immediately after the comments, dropping 1.3pc in the space of a few minutes and wiping out gains since the start of the month."

I started a thread on these boards a month or so back asking why he still had a job, but it was deleted for some reason. I'd still love to know the answer. Rather than swanning around in Washington he might want to get his fat gut back to the UK and actually address the problem's he's done much to create.

Agreed.

He's like a human wrecking ball, thru the FCA and now the BoE 3

3 -

Probably nothing...

0 -

And now BOE officials have "privately signalled" they'll extend the bond purchasing scheme beyond Friday.

Absolute clown show. That they need to intervene is bad enough. That they're doing so in literally the worst way possible is indefensible. Genuinely comes across like they WANT to destroy the pound.7

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards