We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

How much longer will this bear market go on for?

Comments

-

FTSE 100 just opened the day by recording its lowest number of 2022. Could be a long day.0

-

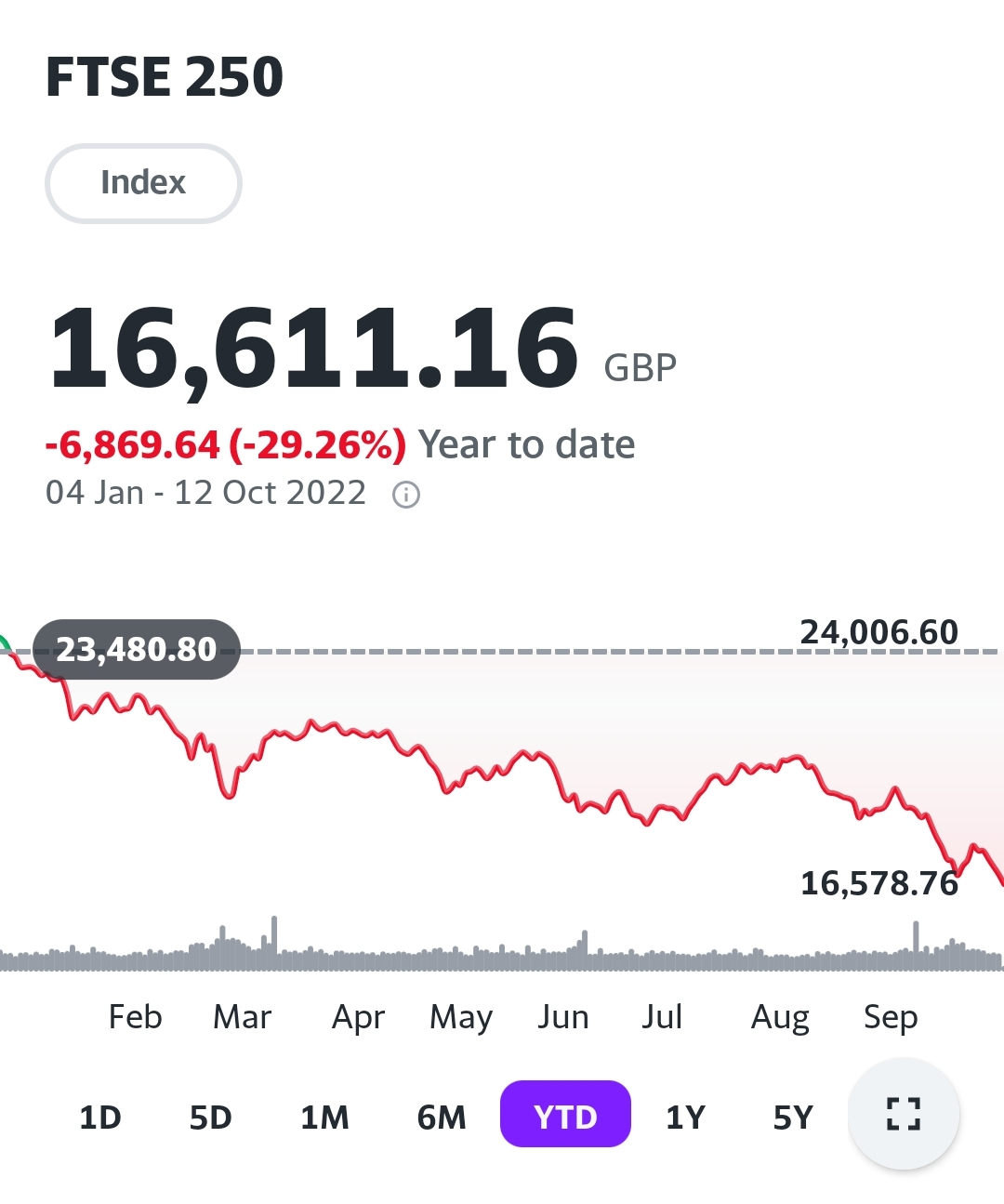

Close to halving?Type_45 said:FTSE 250 is close to halving in 2022. And we haven't even begun the economic collapse yet.

From 16578, it still has another 27% to fall to hit 12000.

Also, markets are forward looking.....so an economic downturn is largely baked into the price. Of course it can go down even further if it is worse than expected or something unexpected happens.0 -

VWRP still higher than I paid for it in mid-June.

Today will hinge on US inflation figures.......0 -

Type_45 said:FTSE 100 just opened the day by recording its lowest number of 2022. Could be a long day.

I'm sure you'll be commenting throughout to help us through it!

0 -

Well the guidance is already provided in this MSE thread, link is as belowInvesterJones said:Type_45 said:FTSE 100 just opened the day by recording its lowest number of 2022. Could be a long day.

I'm sure you'll be commenting throughout to help us through it! People who are aiming for wealth creation (not wealth preservation), good luck with that following advice/strategy from random guys on the internet and not from proven billionaires investors or where the evidence are overwhelming.

People who are aiming for wealth creation (not wealth preservation), good luck with that following advice/strategy from random guys on the internet and not from proven billionaires investors or where the evidence are overwhelming.

0 -

do you think liz will go soon?Nebulous2 said:The BoE and the treasury pulling in opposite directions doesn't help.

For point 3, I don't believe the Bank knew what was coming for tax cuts in the mini-budget when they made their interest rate decision. I think they were blindsided by it as much as the markets were.

This is a straightforward plain language analysis of the issues, that chimes with me.

What on earth is happening in UK markets and why is the Bank of England struggling to address it? | Business News | Sky News

In particular:-

"But to understand what a tricky position it's in, you need to zoom out even further. For while it's tempting to blame everything on the government and its mini-budget, it's fairer to see this as the straw that broke the market's back."

It was entirely tone-deaf for an unknown and untrusted pairing in 10 and 11 to sack the senior civil servant in the treasury, refuse an OBR analysis, and throw in unexpected tax cuts to inflate the economy, at a time the Bank was trying to let the air out of it. Rightly or wrongly, they have both been found wanting, and I can't see any way back for either of them.

isn't the political setup such that the Tories cannot get rid now?0 -

MarcoM said:

do you think liz will go soon?Nebulous2 said:The BoE and the treasury pulling in opposite directions doesn't help.

For point 3, I don't believe the Bank knew what was coming for tax cuts in the mini-budget when they made their interest rate decision. I think they were blindsided by it as much as the markets were.

This is a straightforward plain language analysis of the issues, that chimes with me.

What on earth is happening in UK markets and why is the Bank of England struggling to address it? | Business News | Sky News

In particular:-

"But to understand what a tricky position it's in, you need to zoom out even further. For while it's tempting to blame everything on the government and its mini-budget, it's fairer to see this as the straw that broke the market's back."

It was entirely tone-deaf for an unknown and untrusted pairing in 10 and 11 to sack the senior civil servant in the treasury, refuse an OBR analysis, and throw in unexpected tax cuts to inflate the economy, at a time the Bank was trying to let the air out of it. Rightly or wrongly, they have both been found wanting, and I can't see any way back for either of them.

isn't the political setup such that the Tories cannot get rid now?

I've no idea. The MPs can't demand another contest for a year, but they are considering changing the rules. I've seen a Mordaunt / Sunak combination touted as a possible replacement. It might depend on some worthies going to her and asking her to stand aside in the interest of the party.

Regardless of how it plays out, they are two lame ducks, and I expect them to be for as long as they are in their positions.....1 -

It doesn't matter who's in charge. What's happening is because the central banks and politicians have bankrupted the world. It's going to come to a head very soon. And it will, of course, be blamed on anyone and anything other than the central banks and politicians who got us here.0

-

Or maybe we are all in a better place today than we have been for years. Central banks are beginning to sell off their QE bonds, interest rates are rising to a more normal level where there is actually some return. Equities have fallen from their highs to a more reasonable level. Sure, we will get a recession but thats entirely normal and not to be worried about.

There are several UK specific things that are in a mess but globally I'm not worried.7

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards