We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

How much longer will this bear market go on for?

Comments

-

Prism said:Type_45 said:Prism said:If suggesting to most people that investing regularly regardless of the markets is 'egging on' then I misunderstand the phrase. Anyone with a workplace pension will be invested in the S&P500 and adding to it every month. Hardly something to discourage.

The S&P has lost 4% since Tuesday.

Why does that matter? Might be cheaper for next months contribution

I imagine it will indeed be.0 -

Oh dear...

0 -

Stop looking at the stock market and pay attention to the bond market.

0 -

The UK has just about the lowest state debt in the whole G7. Kwarteng's tax budget barely added a tiny 1-3% extra to that debt (perhaps less). Thus, the run on the UK bond market is not caused by the Tories... It is caused by the Bank of England. The BoE (in effect) cut rates to expectation by -0.25% in Sep 2022, in the face of roaring inflation, and this has rattled gilts. It's broadly the same set of events as Turkey, who have also been decreasing central-bank rates as inflation increased. The BoE needs a shock-and-awe rate rise of +1% in Nov 2022, to get back on track.2

-

Some of these look attractive. Does anyone here on iWeb have bonds?

0 -

Millyonare said:The UK has just about the lowest state debt in the whole G7. Kwarteng's tax budget barely added a tiny 1-3% extra to that debt (perhaps less). Thus, the run on the UK bond market is not caused by the Tories... It is caused by the Bank of England. The BoE (in effect) cut rates to expectation by -0.25% in Sep 2022, in the face of roaring inflation, and this has rattled gilts. It's broadly the same set of events as Turkey, who have also been decreasing central-bank rates as inflation increased. The BoE needs a shock-and-awe rate rise of +1% in Nov 2022, to get back on track.

Raising rates will choke an already-imploding economy.0 -

Remind you of anyone? 2

2 -

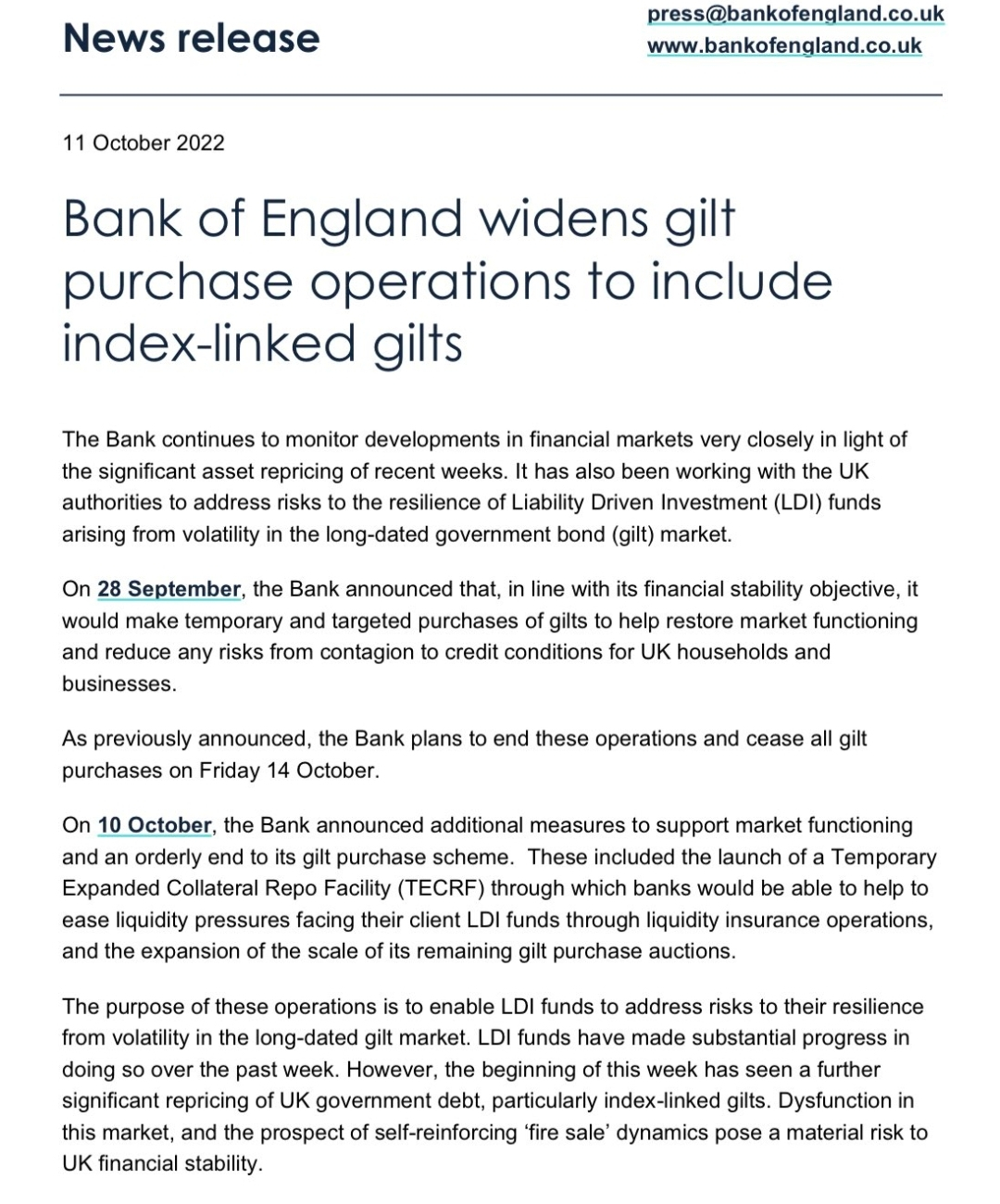

Bank of England doubles its quantitative easing bond purchases to £10 billion per day0

-

Even buying the inflation-linked bonds.

0 -

Type_45 said:Millyonare said:The UK has just about the lowest state debt in the whole G7. Kwarteng's tax budget barely added a tiny 1-3% extra to that debt (perhaps less). Thus, the run on the UK bond market is not caused by the Tories... It is caused by the Bank of England. The BoE (in effect) cut rates to expectation by -0.25% in Sep 2022, in the face of roaring inflation, and this has rattled gilts. It's broadly the same set of events as Turkey, who have also been decreasing central-bank rates as inflation increased. The BoE needs a shock-and-awe rate rise of +1% in Nov 2022, to get back on track.

Raising rates will choke an already-imploding economy.

It is important not to get dragged into the emotional knee-jerk hysteria driven by the clickbait frenzy of the often loss-making British media.

The UK economy grew at a healthy +4% YoY in Q2 2022.

UK unemployment sits today at 3.5%, just about the lowest rate in recorded history.

The UK economy has plenty of headroom for more rate rises, to bring inflation and market-panic back under control. Just a handful of rises is all it needs, and then they can start coming down again.1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards