We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Rate predictions 2022, 2023

Comments

-

My folks tell me of times when their mortgage was 12%, and they had no savings etc to fall back on. Ouch. But there you go, they managed somehow, which is impressive, and probably instilled good money values into me and my brothers for the future

Back on track, so we're still in a position of cash being minus 10% real rate really . Ouch again.

. Ouch again.

I've had a fair few accounts send through rate increases already, I wonder if many more will follow...0 -

Of course we would, especially those desperate to get on the housing ladder.jimexbox said:

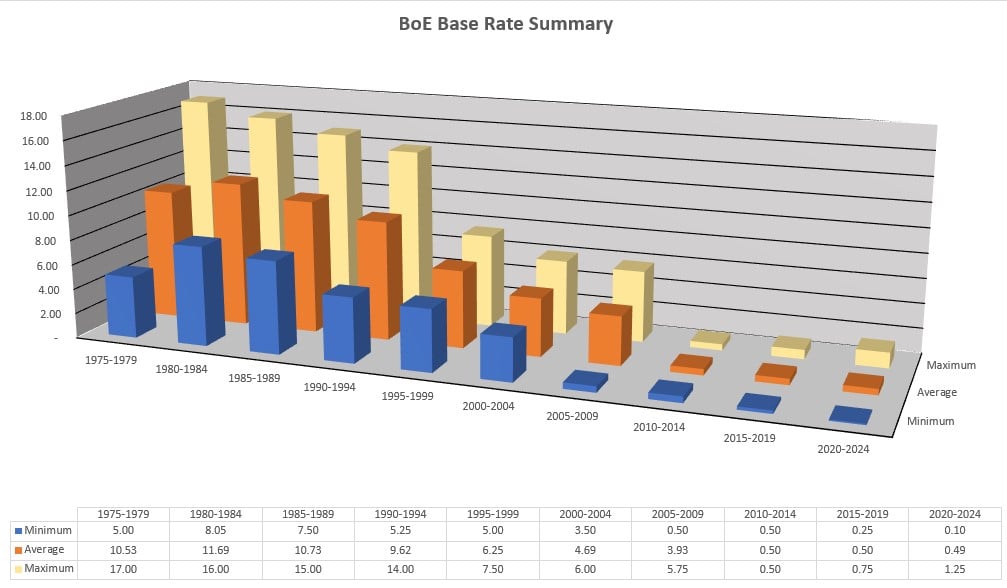

My first house, a two bedroom bungalow was 33k in 1996. My last house I bought in 2005 was 235k, now notionally worth over 500k.Oasis1 said:financialbliss said:Just to paint a picture of past rates and where we are now at 1.25%...

2022.

We’ve got four decision dates left in 2022: 4th August, 15th September, 3rd November and 15th December. I’m guessing we’ll have three 0.25% increases and one 0.50% increase, giving a 2022 year end base rate of 2.50%

2023.

Don't think we'll have such as an agressive round of increases in 2023 - just two I think, giving a year end base rate of 3.00%.

Thanks for sharing. Very interesting. Makes me wonder how people got mortgages in the 70s-90s with those eye-watering interest rates (I'm sure there's a logical explanation which people will kindly fill me in on!).

We'd all be better off if house prices rose the same as wage inflation.0 -

Even more so if wage inflation rose the same as house prices

0

0 -

We purchased our first house in 1988, 100% endowment mortgage. I worked 10 hours a week overtime coz we shared a car and it took all my wages to pay the mortgage. OH then [ex now] used to go out for two pints on a Sunday night and that was it ... house cost £65k and sunk to £45k a couple of years laterSave £12k in 2022 #54 reporting for duty0

-

Because a house could be bought for a 3 or 4x multiple of just one of a couples salary. A decent house too.Thanks for sharing. Very interesting. Makes me wonder how people got mortgages in the 70s-90s with those eye-watering interest rates (I'm sure there's a logical explanation which people will kindly fill me in on!).

Yes interest rates were high, but some people's houses have "earned" as much as they have in the past 30-40 years.0 -

Lastonestanding said:

Producer input prices for June were 24%, up from the previous month of 22%Millyonare said:Wholesale prices (leading indicator) are (mostly) plunging like a stone. Oil spot is down 10-15% in just a few weeks, the Food Price Index has fallen for 3 months in a row, UK used-car prices are shrinking once again. Inflation arrows are starting to point down, not up.

Where do you get your info from?

Loads of price info out there. Oil down, food down, cars down.

https://oilprice.com/oil-price-charts/

https://www.fao.org/worldfoodsituation/foodpricesindex/en/

https://www.autocar.co.uk/opinion/business-dealership,-sales-and-marketing/inside-industry-bubble-about-burst-used-car-prices

My guess is the Tories will step in and subsidise the UK retail energy market this winter (like the French are doing now), and this will help to bring inflation down further. Price rises will be moderated. The Tories will not want 10-20% UK inflation just before the big 2024 national election. They will want 5-10% levels by spring 2023, to setup a feelgood summer ahead of the polls. Dyor, etc.0 -

But you cannot judge one countries inflation by world prices.Millyonare said:

Loads of price info out there. Oil down, food down, cars down.

https://oilprice.com/oil-price-charts/

https://www.fao.org/worldfoodsituation/foodpricesindex/en/1 -

Brent (UK) crude is down (a lot).Lastonestanding said:

But you cannot judge one countries inflation by world prices.Millyonare said:

Loads of price info out there. Oil down, food down, cars down.

https://oilprice.com/oil-price-charts/

https://www.fao.org/worldfoodsituation/foodpricesindex/en/

UK imports 50-80% of its food and ingredients from abroad, and trades other foodstuff at global spot or future prices.

UK used-car prices are starting to slide (see article).

We live in a globalised world.

0 -

They can't do that, Britain is nearly bankrupt. Doing so will only feed into inflation and then the government will become addicted to handing out more free money, Inflation doom loopMillyonare said:

My guess is the Tories will step in and subsidise the UK retail energy market this winter (like the French are doing now), and this will help to bring inflation down further. Price rises will be moderated. The Tories will not want 10-20% UK inflation just before the big 2024 national election. They will want 5-10% levels by spring 2023, to setup a feelgood summer ahead of the polls. Dyor, etc.

1 -

They can easily do that. The UK could easily throw £50 billion at a winter-energy subsidy this Xmas and add to its debt pile and nobody would bat an eyelid.MiserlyMartin said:

They can't do that, Britain is nearly bankrupt. Doing so will only feed into inflation and then the government will become addicted to handing out more free money, Inflation doom loopMillyonare said:

My guess is the Tories will step in and subsidise the UK retail energy market this winter (like the French are doing now), and this will help to bring inflation down further. Price rises will be moderated. The Tories will not want 10-20% UK inflation just before the big 2024 national election. They will want 5-10% levels by spring 2023, to setup a feelgood summer ahead of the polls. Dyor, etc.

France has similar state debt and they're already pouring tens of billions (£20b+) into their energy / fuel subsidy, right now, today, as we speak!

Not to mention a further windfall tax on UK oil-gas firms, banks, or the National Grid. They could easily soak them for a few more billion in 2023.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.8K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.9K Work, Benefits & Business

- 603.4K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards