We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Rate predictions 2022, 2023

Comments

-

Wholesale prices (leading indicator) are (mostly) plunging like a stone. Oil spot is down 10-15% in just a few weeks, the Food Price Index has fallen for 3 months in a row, UK used-car prices are shrinking once again. Inflation arrows are starting to point down, not up.0

-

Millyonare said:Wholesale prices (leading indicator) are (mostly) plunging like a stone. Oil spot is down 10-15% in just a few weeks, the Food Price Index has fallen for 3 months in a row, UK used-car prices are shrinking once again. Inflation arrows are starting to point down, not up.

The Bank of England faces the grim prospect of overseeing the largest inflation surge in recent memory, with prices rising more than seven times faster than its target, a top think tank warned today.

A sustained surge in energy costs triggered by Russia’s invasion of Ukraine and a sudden burst in demand after the Covid-19 unlocking will lift inflation in the UK to more than 15 per cent early next year.

0 -

Producer input prices for June were 24%, up from the previous month of 22%Millyonare said:Wholesale prices (leading indicator) are (mostly) plunging like a stone. Oil spot is down 10-15% in just a few weeks, the Food Price Index has fallen for 3 months in a row, UK used-car prices are shrinking once again. Inflation arrows are starting to point down, not up.

Where do you get your info from?0 -

From today's Telegraph.

Andrew Bailey, the Governor, is expected to unveil forecasts showing inflation will still be significantly above 10pc in 2023 as Britain battles soaring energy bills sparked by the war in Ukraine.

0 -

Speculation is that we see a 0.5%increase today, putting BoE BR at 1.75%. Great for me as I’m saving for a deposit for a mortgage, hopefully things will be on the decline when I actually come to buy, if not, not great for me! Or anyone else…..

Seems like certain banks with savings accounts will jump straight on a rate rise whilst others really drag their heels.

If you believe you can, you will. If you believe you can't, you won't.

Secured/Unsecured loans x 1

Credit Cards x 8 (total limit £55,050)

Creation FS Retail Account x 1

Creation Credit Sale 0% x 1 = £112.50pm x 20 mths

0% Overdraft x 1 (£0 / £250)

Mortgage Outstanding - £137,707.00 (Payment 13/360)

Total Debt = £7,400 (0%APR) @ £100pm - Stoozing0 -

0.5 as widely expected.1

-

BoE now predicting inflation of 13% omg, with UK entering recession.

I can see base rates hitting 2.25% by Christmas.0 -

-

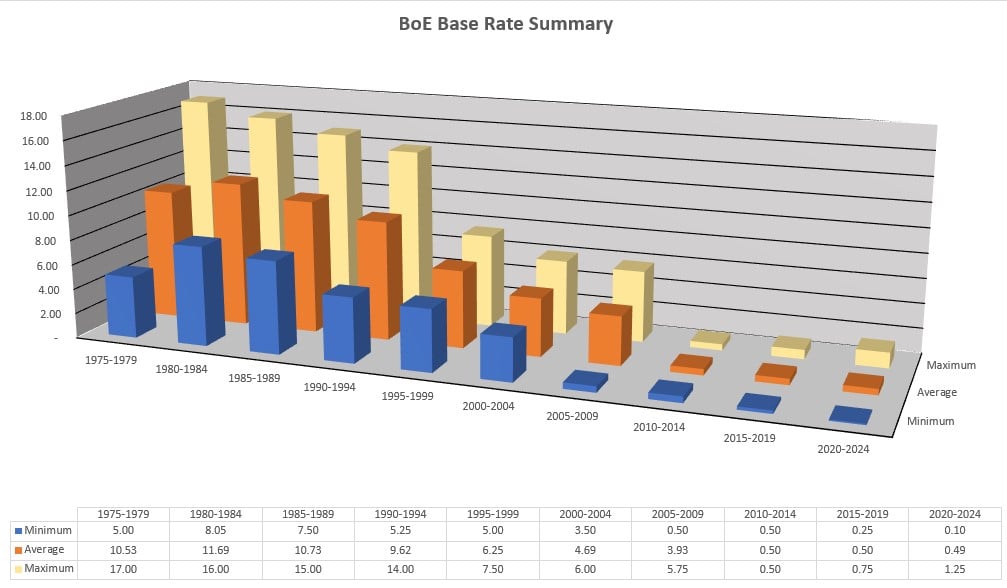

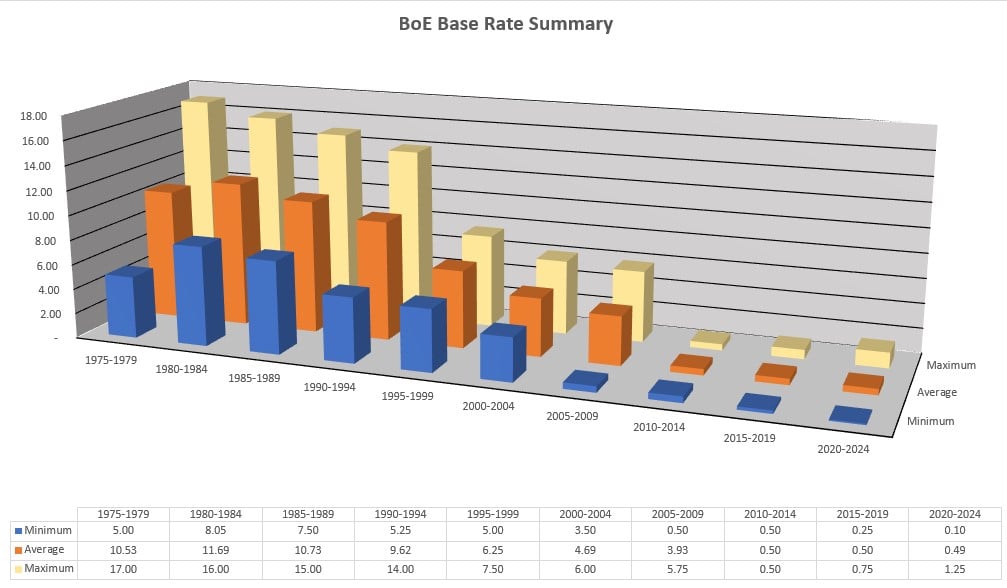

financialbliss said:Just to paint a picture of past rates and where we are now at 1.25%...

2022.

We’ve got four decision dates left in 2022: 4th August, 15th September, 3rd November and 15th December. I’m guessing we’ll have three 0.25% increases and one 0.50% increase, giving a 2022 year end base rate of 2.50%

2023.

Don't think we'll have such as an agressive round of increases in 2023 - just two I think, giving a year end base rate of 3.00%.

Thanks for sharing. Very interesting. Makes me wonder how people got mortgages in the 70s-90s with those eye-watering interest rates (I'm sure there's a logical explanation which people will kindly fill me in on!).

0 -

My first house, a two bedroom bungalow was 33k in 1996. My last house I bought in 2005 was 235k, now notionally worth over 500k.Oasis1 said:financialbliss said:Just to paint a picture of past rates and where we are now at 1.25%...

2022.

We’ve got four decision dates left in 2022: 4th August, 15th September, 3rd November and 15th December. I’m guessing we’ll have three 0.25% increases and one 0.50% increase, giving a 2022 year end base rate of 2.50%

2023.

Don't think we'll have such as an agressive round of increases in 2023 - just two I think, giving a year end base rate of 3.00%.

Thanks for sharing. Very interesting. Makes me wonder how people got mortgages in the 70s-90s with those eye-watering interest rates (I'm sure there's a logical explanation which people will kindly fill me in on!).

We'd all be better off if house prices rose the same as wage inflation.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards