We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Mental Debt Struggle...

Comments

-

Yep @Sun_Addict s those pre teens really did a number on me (it's all the unnecessary excited squealing) and my head was throbbing! Thank you for your kind words too 🤗.

The brain fog is always there @Cherryfudge to some extent, but work has definitely made it worse. I'm struggling to focus because I'm bored and uninterested. I don't have a case load as yet to make it more interesting. The job was always stressful and boring, due to the volume of work as opposed to the complexity. But I was always doing things over and above my job role which kept me entertained but let to unmanageable stress. Now I just have the boredom part. But I've found some wellbeing courses that my workplace has started running and they will help me with the transition of work and to pass the time. But I've definitely changed in the last year. I'm still depressed, but I'm in a much better place than I was.

We do truly have to make the most of life @Makingabobor2, and I've been thinking more about what would work for me and how I actually want to live my life. And I realised that being more creative is definitely the way to go, as I don't have much fun in my life. And I need to connect with people more and create memories instead of always putting things off to a time when I have more money, or time or my mood is better. As life is happening now. That suff you recommended on Ikigai is really fascinating and helpful.

I like having the security of a stable income to pay off debt and try to build savings for the future. So I'm going to focus on finding another part time admin job, maybe in finance, and I'll start job hunting at the end of this year. That way, by the time I find something suitable, my sickness absence should have dropped off. I figured, I'll always be working part time until I can longer handle it, so I might as well do a job that I'll actually enjoy. That way I'll have an income but also have enough motivation to enjoy creative outlets as well.

I've been stockpiling my £1 coins from my change each week and I went down to the bank today nice and slowly with my walking stick and via the bus. It was so clear and empty, so I think mid-mornings during the week looks like a good time to go there.

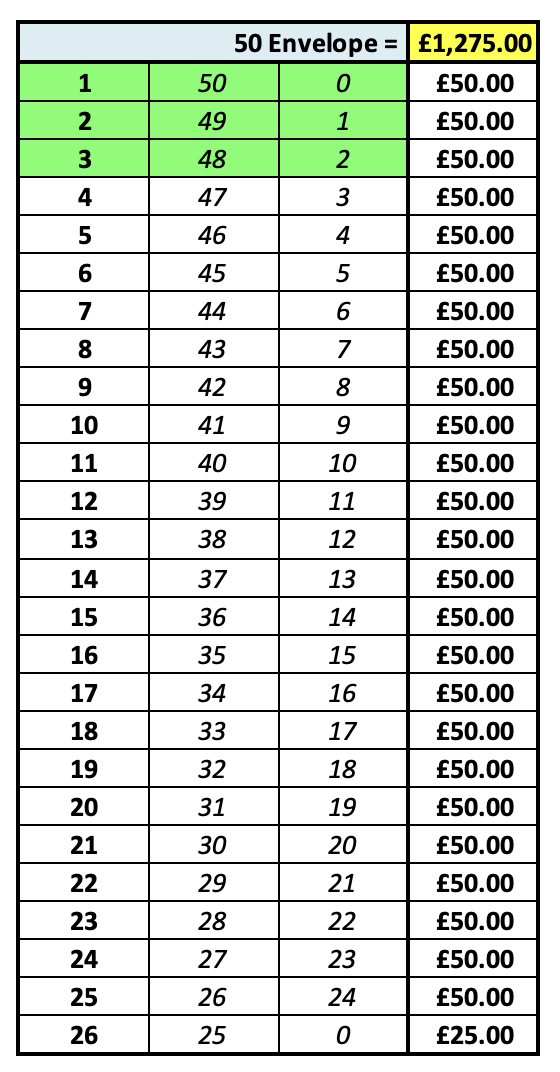

Anyways, I had £36 in total and I withdrew £30 to put in my 50 envelope challenge. So now, as I had some other money set aside from changing coins into notes, I've been able to cross off number 2 and number 48. I squirrel away any change or left over money from my budget and then change them into notes and then keep doing that until I have £50 in notes, and then I cross off the next two envelopes. It's better for me that way, as I don't have to worry about having the exact change for the different numbers (especially as I'm not putting them into envelopes and I'm storing them all in one wallet). By doing all of that, I've so far managed to cross off number 50, numbers 1 and 49 and now numbers 2 and 48.

It wasn't that hard to do, as it all came from leftover money. So I stand a better chance of being able to actually complete the challenge for the first time. Also, when I went to Norfolk on the weekend to see my friends, we took the kids to the beach and the arcades, and they had the time of their lives on the 2p machines. I decided to have a go as well and won a £5 note attached to a magnet! I never win things, so that was lucky and it went towards my envelope challenge.

It was so nice to see the clear skies... 🤗.

Debt Free Diary:- The Mental Debt Struggle

(Original Debt on 15/07/2016 was £33,056.76) 🙈 but Debt Free on 09/02/2025 🎉

Career Loan £150/£3,000 (5% repaid)6 -

Seaside and sunshine! Lovely! It makes such a difference to the day.

A thought that occurred to me as I read: I wonder whether any second post might actually be working from home? You have loads of experience so I'm sure there will be employers queuing up for you!I think a bit of sunshine is good for frugal living. (Cranky40)

The sun's been out and I think I’m solar powered (Onebrokelady)

Fashion on the Ration 2025: Fabric 2, men's socks 3, Duvet 7.5, 2 t-shirts 10, men's socks 3, uniform top 0, hat 0, shoes 5 = 30.5/68

2024: Trainers 5, dress 7, slippers 5, 2 prs socks (gift) 2, 3 prs white socks 3, t-shirts x 2 10, 6 prs socks: mostly gifts 6, duvet set 7.5 = 45.5/68 coupons

20.5 coupons used in 2020. 62.5 used in 2021. 94.5 remaining as of 21/3/222 -

Sea & sun. Food for the soul.I am a Forum Ambassador and I support the Forum Team on Mortgage Free Wannabe & Local Money Saving Scotland & Disability Money Matters. If you need any help on those boards, do let me know.Please note that Ambassadors are not moderators. Any post you spot in breach of the Forum Rules should be reported via the report button , or by emailing forumteam@moneysavingexpert.com. All views are my own & not the official line of Money Saving Expert.

Lou~ Debt free Wanabe No 55 DF 03/14.**Credit card debt free 30/06/10~** MFW. Finally mortgage free O2/ 2021****

"A large income is the best recipe for happiness I ever heard of" Jane Austen in Mansfield Park.

***Fall down seven times,stand up eight*** ~~Japanese proverb. ***Keep plodding*** Out of debt, out of danger. ***Be the difference.***

One debt remaining. Home improvement loan.2 -

Not been over to Norfolk for years. Some lovely places there.

Glad you are finding the Ikigai useful. I love books like that.Making the debt go down and savings go up

LBM 2015 - debt £57K / Now £27,424....its going down

Mortgage Free December 9th 2024! 18mths ahead of schedule.Challenges

EF £1200/£3000

.

Studies/surveys January £86.85

Decluttering items 1402/2025. 80/2026

Books read 23 in 2025. 2026- 3 (target is 52)

Jigsaws done 20 in 2025. 2 this year.

My debt free diary...https://forums.moneysavingexpert.com/discussion/6396218/we-will-get-this-debt-d£own-the-savings-up1 -

Some peoples minds work in mysterious ways. So todays silly comment that passed through my mind. You've done 1 & 49 and 2 & 48 but what will you do when you get down to just 25.

1 -

I'll definitely be looking for a hybrid role @Cherryfudge, but I'll want to work in the office one day a week like I do now, so that I don't get too isolated and I can learn from others face to face. Once I'm more confident in that type of role, then I'll consider just home working, as I do prefer it. Thanks for the vote of confidence in my employability skills 🤗.

Sun and sea is definitely food for the soul @beanielou and although the sea air for some reason made me tired, it was a really nice tired if that makes sense? That photo was from Hunstanton beach @Makingabobor2, and yes I agree, there are some really beautiful places in Norfolk.

It's not a silly comment about envelope 25 @badmemory (I had it too so declared that it's not silly 😂), but when I get there, I'll just breath a sigh of relief as it'll be the last envelope and half the value. I have 25 rounds of £50 to save and then the last round is £25. I made a spreadsheet to keep me on track and to keep motivated.

Debt Free Diary:- The Mental Debt Struggle

(Original Debt on 15/07/2016 was £33,056.76) 🙈 but Debt Free on 09/02/2025 🎉

Career Loan £150/£3,000 (5% repaid)1 -

I was going to say that looks like Sunny Hunny. I love Norfolk and Hunstanton is a proper old fashioned seaside resort.I get knocked down but I get up again (Chumbawamba, Tubthumping)1

-

Loving that blue sky Keedie. It’s been nice getting the odd nice day between the heavy rain.I guess for now your work You’re very is very much a means to an end. It’s good to have plans to change what you’re going to do in the future, but also good that your current role is currently helping you get into that position and that you are coping coping with your return to work27/5/17 Mort 64705 BTs 1904031/12/17 Mort 59815 BT 1673007/04/20 Mort 49208 BT 1572128/07/20 Mort 47387 BT 1263414/11/20 Mort 45905 BT 10134 20/05/21 Mort 42335 BT 686811/08/22 Mort 32050 BT 2915Sealed Pot Challenge 16 Number 52

-

Thought it was Hunstanton. We used to go there a lot when inlaws had a caravan at HeachamMaking the debt go down and savings go up

LBM 2015 - debt £57K / Now £27,424....its going down

Mortgage Free December 9th 2024! 18mths ahead of schedule.Challenges

EF £1200/£3000

.

Studies/surveys January £86.85

Decluttering items 1402/2025. 80/2026

Books read 23 in 2025. 2026- 3 (target is 52)

Jigsaws done 20 in 2025. 2 this year.

My debt free diary...https://forums.moneysavingexpert.com/discussion/6396218/we-will-get-this-debt-d£own-the-savings-up1 -

I had to google Sunny Hunny @Sun_Addict as I was a bit clueless for a minute 😂. It's so lovely there, but my poor trainers didn't agree as when I was walking on the beach I misjudged some of the sand depth and so I got brown sandy marks on my trainers which I really need to try and wipe off properly. I had a nap as soon as we got back to my friends house and then I vaguely remembered yesterday and just remembered again now... 🤦🏾♀️.

Work is definitely a means to an end @AntoMac, and I will use it as a way for me to do what I will enjoy in life. The stable income from my boring job will allow me to build up an emergency fund and pay down my debt. Going back to work puts me in a stronger financial position even if I'm not happy there.

Budget wise, I've increased my standing order for the emergency fund from £50 a month to £100 a month starting from March 2024. I've also budgeted £400 a month set aside for debt repayments. I'll reach my £2,000 emergency fund by December 2024 and I'll be down to £5,700 debt with Barclaycard by December 2024, and will need one final 0% money transfer to see me through to the debt free finish line by December 2025.

So once I've cleared my debt to my mum in April 2024, I'll snowball that £100 standing order into the emergency fund, so that I will be able to save £200 a month. That will give me with £1,900 by December 2024 and through surveys, cashback and Chase round ups, I'll be able to accumulate the remaining £100 and hit the £2,000 goal by the end of December 2024.

I'll be leaving Barclaycard at £300 a month throughout 2024. Then from January 2025, as I would have hit my £2,000 emergency fund goal, I will increase my Barlcaycard direct debit to £400 a month and reduce the savings back to £100 a month. That way, by December 2025, I will be debt free and have £3,000 as my emergency fund. Then from 2026 onward, I can start working on getting a proper month ahead on my bills and living expenses.

I've accepted that I won't have much disposable income for the next two years, but rather than putting all my focus on debts, I'll have savings. And a more or less stable budget whilst I'm doing that, so whatever spare money I do have, is spent on living life rather than trying to save quicker or get out of debt quicker. It seems like the kindest way to manage it all.Debt Free Diary:- The Mental Debt Struggle

(Original Debt on 15/07/2016 was £33,056.76) 🙈 but Debt Free on 09/02/2025 🎉

Career Loan £150/£3,000 (5% repaid)4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards