We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Top Fixed Interest Savings Discussion Area

Comments

-

Ford Money have just increased their 1 year fix to 2.45%

1 -

You also have 14 days to make your first deposit and if they raise the rate in the interim, you would get the higher rate.bertsilver said:Ford Money have just increased their 1 year fix to 2.45%1 -

Hi. does anyone know if Ford money is linked to any other bank?bertsilver said:Ford Money have just increased their 1 year fix to 2.45%0 -

No, they are stand alone, part of Ford Credit Europe.vickyholly said:

Hi. does anyone know if Ford money is linked to any other bank?bertsilver said:Ford Money have just increased their 1 year fix to 2.45%

1 -

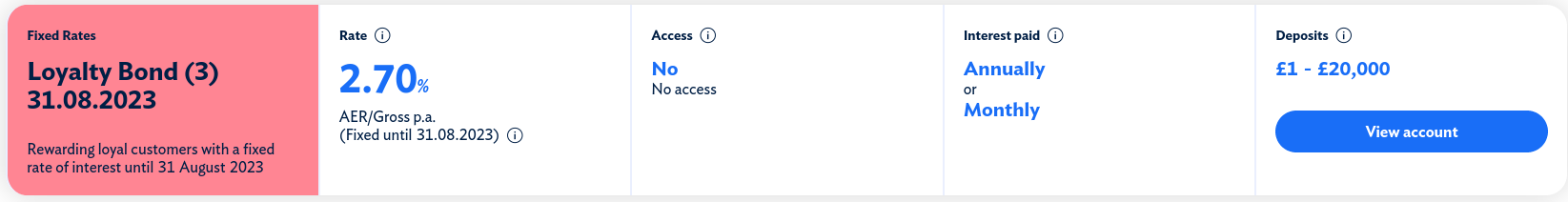

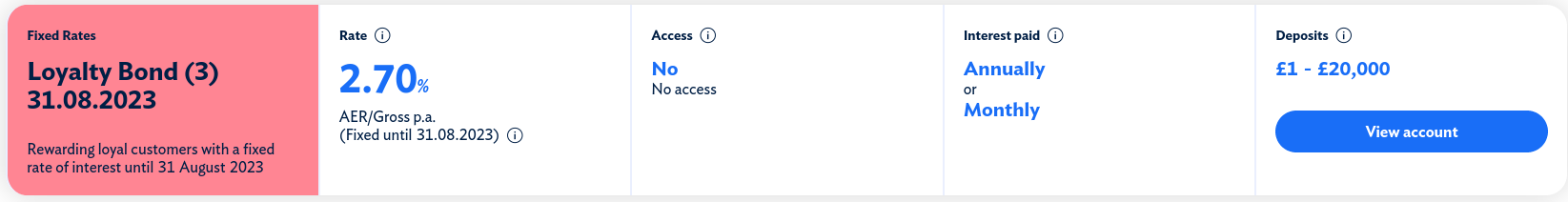

Not sure if this has been mentioned already, but:

For existing CBS memebers who 'have held or been linked to a savings or mortgage account with Coventry Building Society, ITL or Godiva continuously since 1 January 2022 or earlier.'5

For existing CBS memebers who 'have held or been linked to a savings or mortgage account with Coventry Building Society, ITL or Godiva continuously since 1 January 2022 or earlier.'5 -

Interesting that I have just sent a transfer request form to move my CBS fixed rate ISA 1% to Virgin 2:06% . Reason being I am fed up with CBS offering paltry fixed ISA rates for their existing customers on maturity date , knowing full well that interest rates will increase in a few weeks time. If they'd offered 2% instead of 1% , I would have stayed with them but they mess around with interest rates to suit borrowers rather than savers.SJMALBA said:Not sure if this has been mentioned already, but: For existing CBS memebers who 'have held or been linked to a savings or mortgage account with Coventry Building Society, ITL or Godiva continuously since 1 January 2022 or earlier.'

For existing CBS memebers who 'have held or been linked to a savings or mortgage account with Coventry Building Society, ITL or Godiva continuously since 1 January 2022 or earlier.'

I'm assuming they've now realised (in the previous absence of offering any loyalty rates for several years) that many of their existing 'loyal' customers are prepared to take the 'penalty hit' for early closure and move their savings to other providers with superior interest rates.

I can also imagine that they've done their homework about how high interest rates will increase before offering this loyalty bond. Maybe they've worked out that in a few months time that other provider interest rates will be offered higher than the 2.7% they've offered now (and for more than their limited £20k max deposit).

I remember a high inflation economy many years ago and it will take years to get it down (probably 5-10 years). Savings rates were averaging quite high maybe 6-8% while I also nearly lost my property when my mortgage rate at Chelsea BS reached 18%. I had made provision for a 2% increase in mortgage interest rates but not 10% and, in the end, had to depend on my parents for food as all my salary was going to pay off the mortgage. Those were dark days indeed!

Austerity might end up to be a permanent part of our lives

1 -

Personally, I don't worry too much about default rates at maturity - the funds are not likely to be there very long, bearing in mind that transfer times, these days, are only a day or two in many cases.

Warning: In the kingdom of the blind, the one-eyed man is king.

0

Warning: In the kingdom of the blind, the one-eyed man is king.

0 -

Allica Bank now match Atom with a 12 month "bond" at 2.60% if you don't want app/mobile only for that rate.

(is also desktop)2 -

Tandem Bank 1 year fixed saver also at 2.60%

open Online or mobile.

Manage by phone or mobile.0 -

Kent reliance 1 year bond now 2.61%2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards