We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Chase UK discussion

Comments

-

The Roundup account was slways going to get emptied after 12 months.Deru said:I've just had a notification from the Chase telling me my Roundup Savings balance will be moved out in 90 days so had to nominate an account. i.e. Current acc or Savings, then I'll have to start again. That's annoying as I've built up a nice balance there that I was hoping to leave rolling.

By then, there's no more 1% on spending so doubt I'll bother. You're better off doing a Lloyds Regular Saver which lets you save £400 PM at 5.25%

The Lloyds Regular Saver, and neatly all other Regular Savers, doesn’t do roundups. Natwest/RBS do, and they won’t empty your account after 12 months. No cashback from them though0 -

I like using Chase, and standing orders direct from savings is very useful, but the one thing that irritates me is you can't see or edit any detail other than amount, date or frequency once standing orders have been set up. I have quite a few current accounts and various regular savers (all for the same amount) going out on different days, and as they are grouped under one payee i.e. me they all say Mr. PloughmansLunch. It would be great if we were able to see account / sort code for the SO payee or even add notes.1

-

Is this the same issue that was discussed herePloughmansLunch said:I like using Chase, and standing orders direct from savings is very useful, but the one thing that irritates me is you can't see or edit any detail other than amount, date or frequency once standing orders have been set up. I have quite a few current accounts and various regular savers (all for the same amount) going out on different days, and as they are grouped under one payee i.e. me they all say Mr. PloughmansLunch. It would be great if we were able to see account / sort code for the SO payee or even add notes.

https://forums.moneysavingexpert.com/discussion/comment/79776308/#Comment_797763080 -

No, not quite, although that post was very helpful as originally the accounts were set up as individual payees. Now I have them listed under one payee and all accounts are clearly listed once you click on my name. You can even edit and rename each once set up avoid having 3 x HSBC UK Bank plc listed.flaneurs_lobster said:

Is this the same issue that was discussed herePloughmansLunch said:I like using Chase, and standing orders direct from savings is very useful, but the one thing that irritates me is you can't see or edit any detail other than amount, date or frequency once standing orders have been set up. I have quite a few current accounts and various regular savers (all for the same amount) going out on different days, and as they are grouped under one payee i.e. me they all say Mr. PloughmansLunch. It would be great if we were able to see account / sort code for the SO payee or even add notes.

https://forums.moneysavingexpert.com/discussion/comment/79776308/#Comment_79776308

My problem is once a SO is arranged and added to the list they all have just the same payee name and no details, despite going to totally different accounts. If I go back to check a few days or weeks later I have no idea which one of my accounts/savers the £250 to going to go. References don't help me here as some are bounced through accounts once or twice before hitting savers to meet minimum pay-in requirements. If ever I'm in any doubt I end up deleting them and setting up again just to make sure which is a faff.

EDIT: AmityNeon's post further down hits the nail on the head0 -

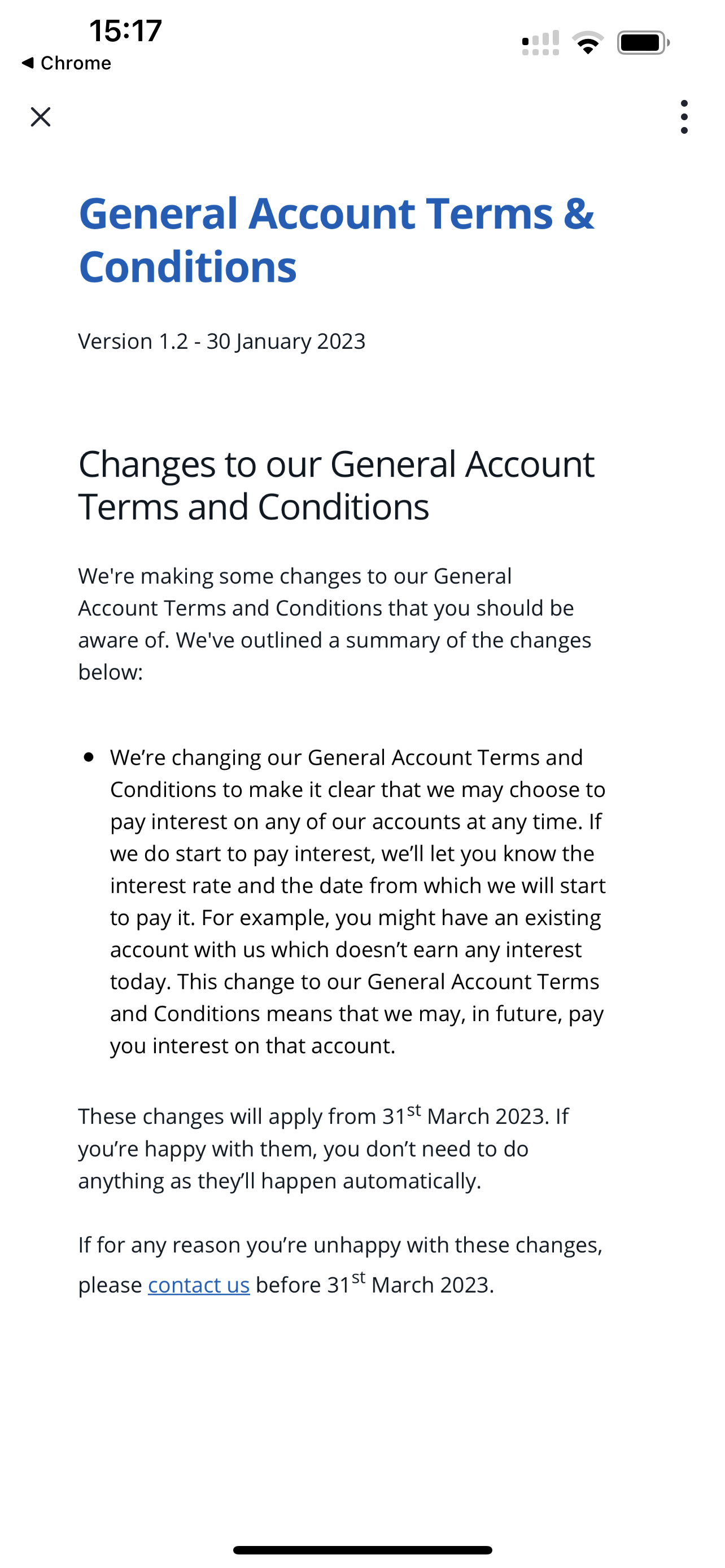

Email from Chase today to say they are changing their Ts and Cs to make it clear "that we may choose to pay interest on any of your accounts at any time".

This is intriguing. Anyone know what lies behind this? Maybe a plan to start offering interest on the current account, in order to soften the blow when early adopters reach the end of first year, so the 1% cash back expires?koru3 -

They are saying that the new T&Cs take effect on March 31 2023. From that I take it that the existing interest arrangement will remain unchanged until then, bar perhaps a change in rate of the saver account..koru said:Email from Chase today to say they are changing their Ts and Cs to make it clear "that we may choose to pay interest on any of your accounts at any time".

This is intriguing. Anyone know what lies behind this? Maybe a plan to start offering interest on the current account, in order to soften the blow when early adopters reach the end of first year, so the 1% cash back expires?

0 -

koru said:Email from Chase today to say they are changing their Ts and Cs to make it clear "that we may choose to pay interest on any of your accounts at any time".

This is intriguing. Anyone know what lies behind this? Maybe a plan to start offering interest on the current account, in order to soften the blow when early adopters reach the end of first year, so the 1% cash back expires?

Those in the Chase community got surveys about different reward/interest paying current accounts which I assume will launch soon

Also not sure if mentioned they are in confirmation of payee system now when someone sends you money but not yet added option to check when you send out.1 -

What are the views of forumites regarding the email from Chase yesterday which included the following text?

- We’re making it clear that we may choose to pay interest on any of your accounts at any time. If we do start to pay interest, we’ll let you know the interest rate and the date from which we will start to pay it. For example, you might have an existing account with us which doesn’t earn any interest today. This change to our General Account Terms and Conditions means that we may, in future, pay you interest on that account.

These changes will apply from 31 March 2023.

0 -

They are trying to work out how to keep their product attractive, particularly if the 1% cashback stops. I doubt if anything has been decided yet, they are simply keeping options open.

I'm happy to wait and see what unfolds. If it works for me I'll use it, if it doesn't I wont.....0 -

It's a teaser.....

Maybe they'll start paying interest on the current a/c ? (Wishful thinking !)

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards