We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Economy crash =/= stock market crash?

Comments

-

There's a difference between timing the markets and understanding the markets. Look ahead and make your own judgement calls. No one drives by using their rear view mirror. Though plenty of investors adopt a similar style. No need to race either. Patience can be a virtue.0

-

Not a good start to the year for the Nasdaqlozzy1965 said:

OK this HAD to be my first post of the year.tranquility1 said:

Yes I stand by my view that a crash will happen this year. Before the end of this month is the most likely time. And I will come on here admit I got the timing wrong if it hasn't happened by January.

But even if it doesn't happen this year, this financial system has reached the end of it's life and a crash and new financial system is absolutely coming. They may kick it down the road until the CBDCs are ready. That would probably be their preference because that would neatly replace the current rapidly-worthless currencies. But their hand may be forced by world events. Notably China, which is in big trouble and the contagion from that could collapse the global economy at any point now.

China's economy and the global economy are primed for collapse. The only question is how controlled the collapse is. But I think the powers that be want the collapse to be messy and painful because they then have an excuse to use the tools they want to use (CBDC and UBI) for the "greater good". The collapse will only be painful and messy for us. They won't feel a pinch. They will enrich themselves even further. They and we are not playing the same game.

Just checking, have I missed the collapse of the current world financial system over the last few days? January is mentioned, so maybe we have another four weeks or so to go still - Or maybe THEY managed to kick it down the road!

Happy New Year EVERYONE

EDIT: Ah, just checked, and apparently tranquility1 might be now living in their underground bunker having 'invested' in tins of beans as the only viable currency going forward:Last Active: 28 October 2021 at 8:40PMSo no correction of the definite views they expressed is likely to be forthcoming.

There were two other doom mongers though, can't remember their names. I wonder if they have the same world view now?1 -

Maybe you are referring to me as a "doom monger"? Last summer I talked about various long term cycles including the great war cycle. I was ridiculed for my views, someone even suggested I try reading tea leaves instead.lozzy1965 said:

OK this HAD to be my first post of the year.tranquility1 said:

Yes I stand by my view that a crash will happen this year. Before the end of this month is the most likely time. And I will come on here admit I got the timing wrong if it hasn't happened by January.

But even if it doesn't happen this year, this financial system has reached the end of it's life and a crash and new financial system is absolutely coming. They may kick it down the road until the CBDCs are ready. That would probably be their preference because that would neatly replace the current rapidly-worthless currencies. But their hand may be forced by world events. Notably China, which is in big trouble and the contagion from that could collapse the global economy at any point now.

China's economy and the global economy are primed for collapse. The only question is how controlled the collapse is. But I think the powers that be want the collapse to be messy and painful because they then have an excuse to use the tools they want to use (CBDC and UBI) for the "greater good". The collapse will only be painful and messy for us. They won't feel a pinch. They will enrich themselves even further. They and we are not playing the same game.

Just checking, have I missed the collapse of the current world financial system over the last few days? January is mentioned, so maybe we have another four weeks or so to go still - Or maybe THEY managed to kick it down the road!

Happy New Year EVERYONE

EDIT: Ah, just checked, and apparently tranquility1 might be now living in their underground bunker having 'invested' in tins of beans as the only viable currency going forward:Last Active: 28 October 2021 at 8:40PMSo no correction of the definite views they expressed is likely to be forthcoming.

There were two other doom mongers though, can't remember their names. I wonder if they have the same world view now?

Seven months later we find ourselves on the brink of WWIII. Read what I said back then if you are interested or ridicule me, it makes no difference to me.

I also talked about inflation last summer and how I was noticing it in my weekly shopping bill. Inflation around the world is definitely out of control. Commodity prices are spiralling, petrol, diesel, gas, electricity, building materials, food and so on. When people cannot afford to buy food you can expect to see civil unrest.

0 -

What happened to the other thread?0

-

We all got bored and it self deleted0

-

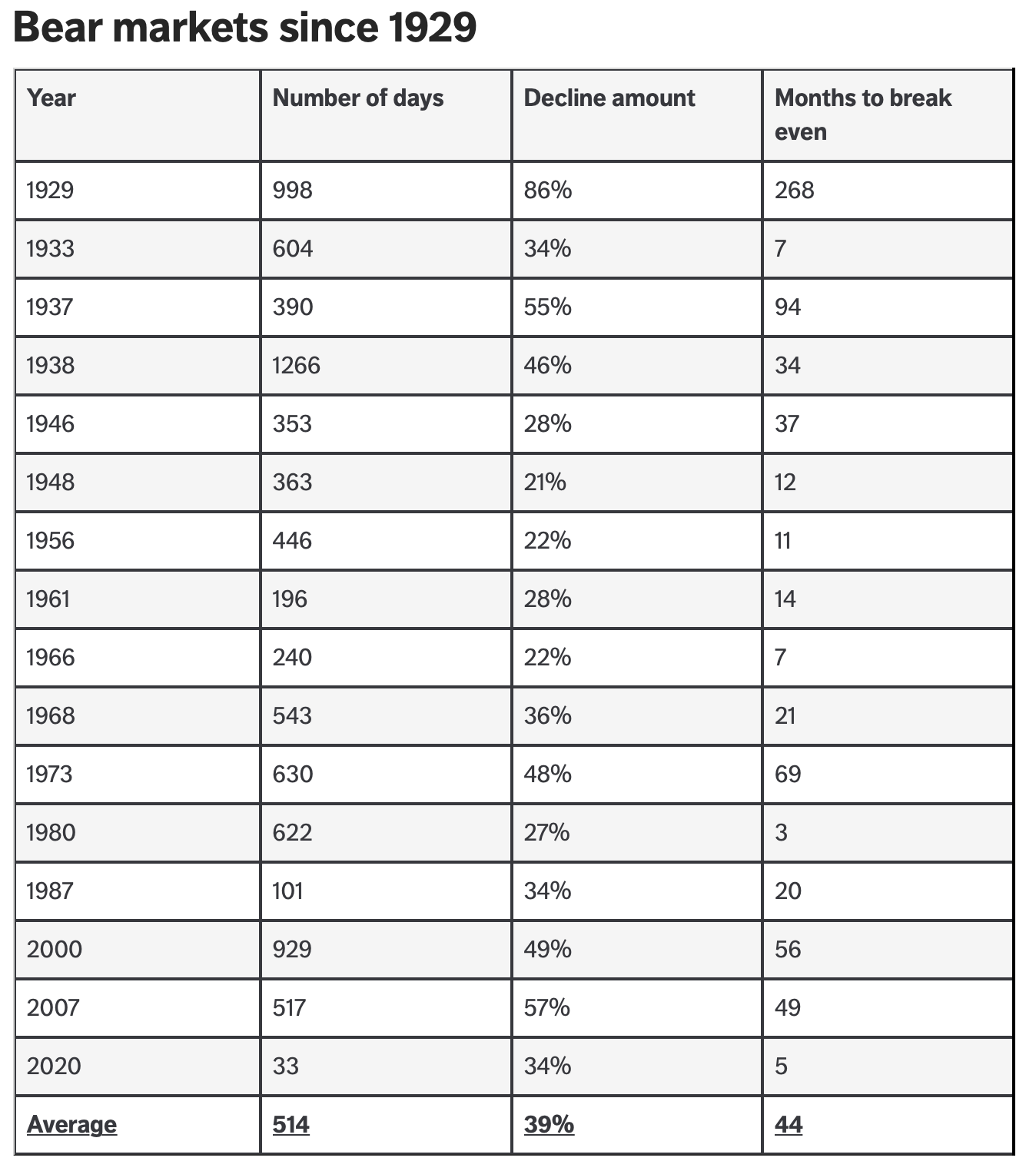

Can someone repost the table of all the bear market recovery times since the 1920s? I just went looking and the threads gone!!

I "think" it was posted on that thread?

ThanksHow's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0 -

The 2 Types of Bear Markets (awealthofcommonsense.com)Sea_Shell said:Can someone repost the table of all the bear market recovery times since the 1920s? I just went looking and the threads gone!!

I "think" it was posted on that thread?

Thanks

Profiling S&P 500 Drawdowns Since 1871 And How They Compare To Today | Investing.com

1 -

I guess the mods are trying to tell you somethingType_45 said:What happened to the other thread? 3

3 -

Here you go @Sea_ShellSea_Shell said:Can someone repost the table of all the bear market recovery times since the 1920s? I just went looking and the threads gone!!

I "think" it was posted on that thread?

Thanks

It's from this article:

https://www.aarp.org/money/investing/info-2022/bear-market-field-guide.html

4 -

While the current focus seems to be on inflationary risks, over leveraged economies and financial assets coupled with dropping consumer sentiment and negative money supply growth points to deflationary risks rising and could well become the big problem later in the year and 2023. This is a contrarian view ofcourse but one worth keeping an eye on over the coming months.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards