We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

BITCOIN

Comments

-

As Bitcoin continues to get hodled, sure a smaller proportion of overall supply gets traded on a regular basis but its incorrect to imply from this that the pool of buyers and sellers active are also going to be small. Further, a larger proportion of bitcoin ends up being hodled only as a consequence of the distribution spreading around such that fewer participants have outsize positions that can crash a market if dumped.Frequentlyhere said:There is a growing base of holders for whom there is a clear intention to use Bitcoin as an alternate store of value and allocate permanently..The pumps during bull cycles will continue because of speculators who get tempted by quick gains but the dumps only go down to levels much higher than previous dumps because of the rising hodler base.

Just wanted to pick out this specific bit from @aaj123 's comment.

This quote seems to suggest that the spot price of Bitcoin is able to naturally build as 'hodlers' increasingly outweigh speculators. If we accept there are an increasing number of 'hodlers' (frankly, I've no idea) is that true?

Under my current understanding, the people holding bitcoin and neither buying nor selling aren't actually relevant to the price. The price is determined only by the balance between those actively selling or buying. Do I have it wrong?

My understanding is that this mechanism is the reason that often very large BTC buy/sells are done away from the spot market, because they could quite easily crash the price.

If I do have it right, wouldn't a smaller pool of people actively buying/selling actually make it more volatile as liquidity thins?

As for flight to safety during banking scares, no one is suggesting that anyone puts all their eggs into Bitcoin. They just choose Bitcoin as one key allocation to hedge themselves. Even if this is a small proportion of people, its no different to may financial instruments not having a wide base among retail. Or one could say that the catchment will increase over time.0 -

Posted 11th October 2022;darren232002 said:

Sold nothing. Bought more and will continue to do so. What new information? The thesis is literally playing out right in front of your eyes...

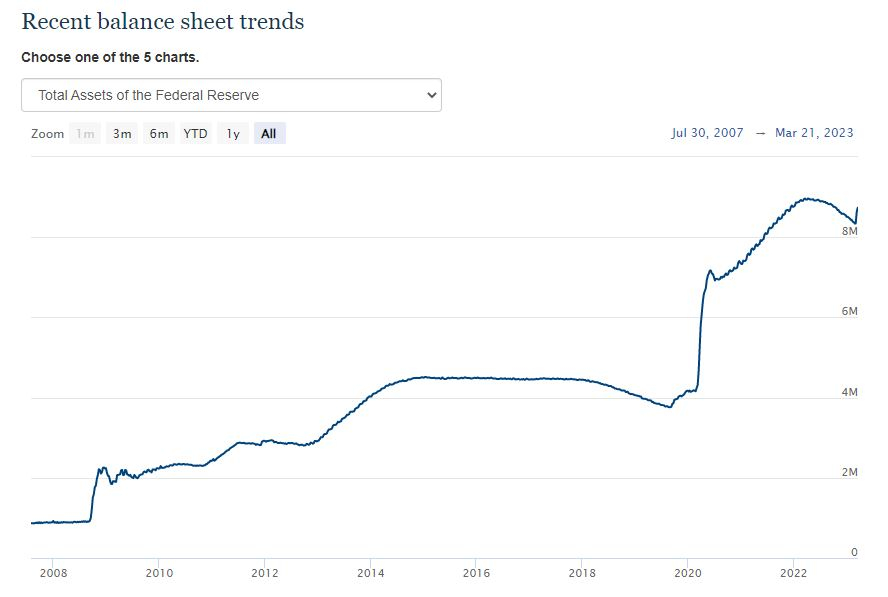

When push comes to shove, the printer will always be turned on. This all ends up one way, with YCC and fiat currencies being printed to cover obligations. Bitcoin is sitting very pretty.

Posted 28th November 2022;Frequentlyhere said:

Risk-off currenices going up.Stocks going up, bonds going up too. Crypto economy on the precipice of falling into the abyss. Bitcoin specifically - who knows.

Everything not currently tanking, but bitcoin still is, as prophesised. Not sure if that represents a winning prediction. <shrugs>

S&P500 then 3963; S&P500 now 3970 (+0%)

FTSE100 then 7500; FTSE100 now 7400 (-1.3%)

Bitcoin then $16200; Bitcoin price now $27500 (+70%)

Bonds went down so bad they caused entire banks to fail.

"As prophesised"Frequentlyhere said:

"2. Bitcoin liquidity is lowBitcoin liquidity was never high, but after the collapse of FTX it tanked, and has remained quite low ever since. This exacerbates Bitcoin’s price volatility, causing trades to have outsized impact on price. This may be supported by data from CoinShares, which showed substantial Bitcoin outflows"

(1) Define low please. Numerically. Because you have a habit of attempting to use qualitative terms to discuss quantitative topics.

(2) Bitcoin trades several hundred thousand BTC per day on Binance alone, which as a share of its market cap or total supply is 2 to 3 times more than the amount traded in the first few S&P500 stocks I checked (AAPL, META & MSFT). The reason Bitcoin crashed in Jan 2020 is precisely because it is a liquid instrument; In a crisis, you sell what you can, not what you want.

(3) Volume is shown in the bars along the bottom. The FTX collapse began on Nov 2 2022 (highlighted). Please can you point to this 'tanking' of liquidity and its 'remaining quite low ever since.' On the contrary, it would appear that liquidity has recovered and grown in 2023.Frequentlyhere said:Just also to highlight one other random bit, that I can certain empathise with. This is her describing how the current bank scares do not really feed into price appreciation of Bitcoin:

"Most people who have the thought “wow, this bank stuff is scaring me” don’t leap right to “so I should withdraw my cash and put it into Bitcoin”. If you are brain-poisoned by crypto Twitter like I am, it’s sometimes easy to forget that this is a really fringe position. If people are afraid about their money, they usually take actions to try to “flee to safety”, and buying Bitcoin is not typically one of those actions"

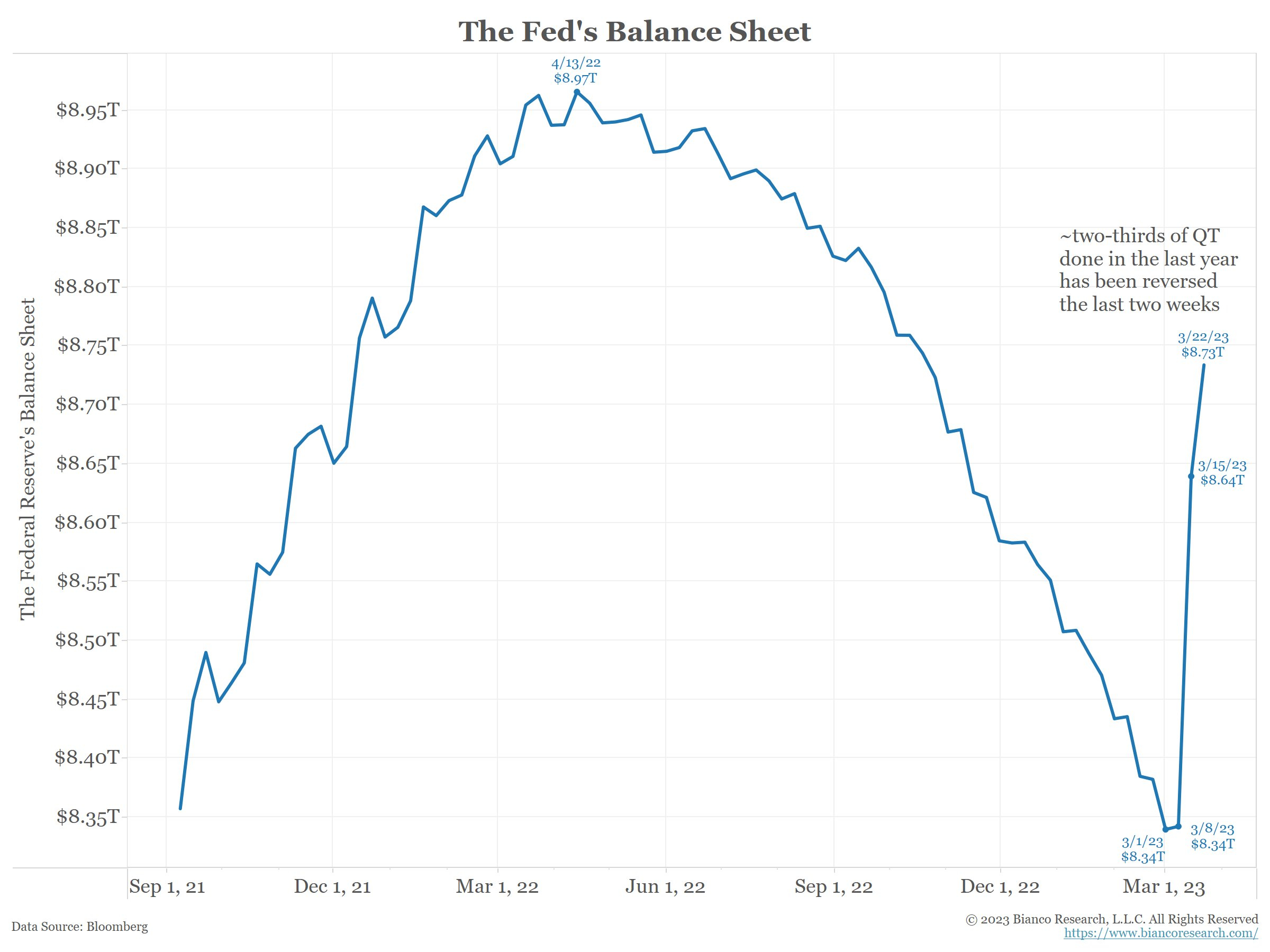

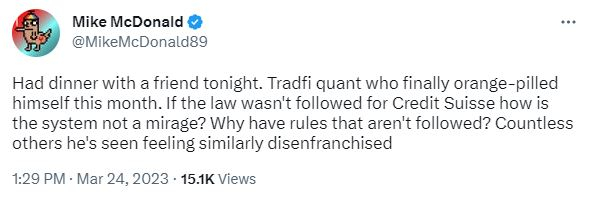

In a two week period where serious concerns about the banking system have surfaced, Gold is up 10% and Bitcoin is up 40%. Its a bold assertion to claim that these are merely unrelated events. Bitcoin price is behaving like the safe haven asset should.

I'm not Jon Stewart's biggest fan, but this caught my attention; https://youtu.be/tU3rGFyN5uQ

https://youtu.be/tU3rGFyN5uQ

Data is showing that demand and wage inflation are not the main drivers of inflation and people are, rightly, starting to question the fairness of a system that continually bails out businesses ahead of consumers and employees.

At 0:50 Summers goes on a strawman tirade about sicknesses and side effects. At 1:30 he tries to bring Stewart's credibility in to question by using 'you and me' to point out to an audience that Stewart is rich (repeated several times throughout the interview). Stewart makes the point that post 2008, the stock market reversed all its losses within 4 years, but the job market took twice as long to do that (and that's just in raw employment terms, because real terms wage growth went nowhere over that time). The argument that the workers should take the pain in the current economy is starting to be questioned.

At 6:20 is the bit that can apply to every public sector strike in the UK right now;

"You're saying to me, 'John, market forces are market forces, and if demand goes up, are you suggesting that Apple should charge less than they could charge?' Let me flip that on you; when there's a tightness in the labor market, what you're saying is the workers shouldn't do the same. That the workers, just following the same capitalistic principles that allow Apple to charge more for their phones, shouldn't charge more because wage inflation is driving inflation."

When people begin to question the fairness of the current financial system, they will look for alternatives. A finite monetary system rewards labor over those that control the money printer because, by definition, the printer allows people to print away the value of labor previously rendered.

3 -

"When people begin to question the fairness of the current financial system, they will look for alternatives"

And yet here we are in exactly the sort of forum which you'd expect to be at the vanguard of such a revolution if that were true, and there's only about 20 of us here talking about bitcoin and perhaps only 3 or 4 of those who actually still think it's a good idea.

It has the reverse of any sort of traction. People were open-minded and gave it lots of leeway with the run up in price, but it's been many years, people lost lots of money, they found no good use for it, and the jig is up.4 -

Frequentlyhere said:"When people begin to question the fairness of the current financial system, they will look for alternatives"

And yet here we are in exactly the sort of forum which you'd expect to be at the vanguard of such a revolution if that were true.

That is quite possibly the most back to front statement I have read on this forum.

I purposely have stopped trying to debate the pro's and con's of Bitcoin here as I find it to be the most closed minded forum I have come across in regard to anything Bitcoin related.4 -

Can you show me another personal finance forum or any sort of grouping that is still showing widespread interest in bitcoin that isn't either hinging off a bitcoin website or a forum about bitcoin?That is quite possibly the most back to front statement I have read on this forum.

I purposely have stopped trying to debate the pro's and con's of Bitcoin here as I find it to be the most closed minded forum I have come across in regard to anything Bitcoin related.

0 -

You need to realise these are precisely the conditions where it pays to enter into exposure to bitcoin.Frequentlyhere said:

Can you show me another personal finance forum or any sort of grouping that is still showing widespread interest in bitcoin that isn't either hinging off a bitcoin website or a forum about bitcoin?That is quite possibly the most back to front statement I have read on this forum.

I purposely have stopped trying to debate the pro's and con's of Bitcoin here as I find it to be the most closed minded forum I have come across in regard to anything Bitcoin related.

Else people complain after buying at near tops when all and sundry talk about it.0 -

Now you are just making stuff up.Frequentlyhere said:

It has the reverse of any sort of traction. People were open-minded and gave it lots of leeway with the run up in price, but it's been many years, people lost lots of money, they found no good use for it, and the jig is up.

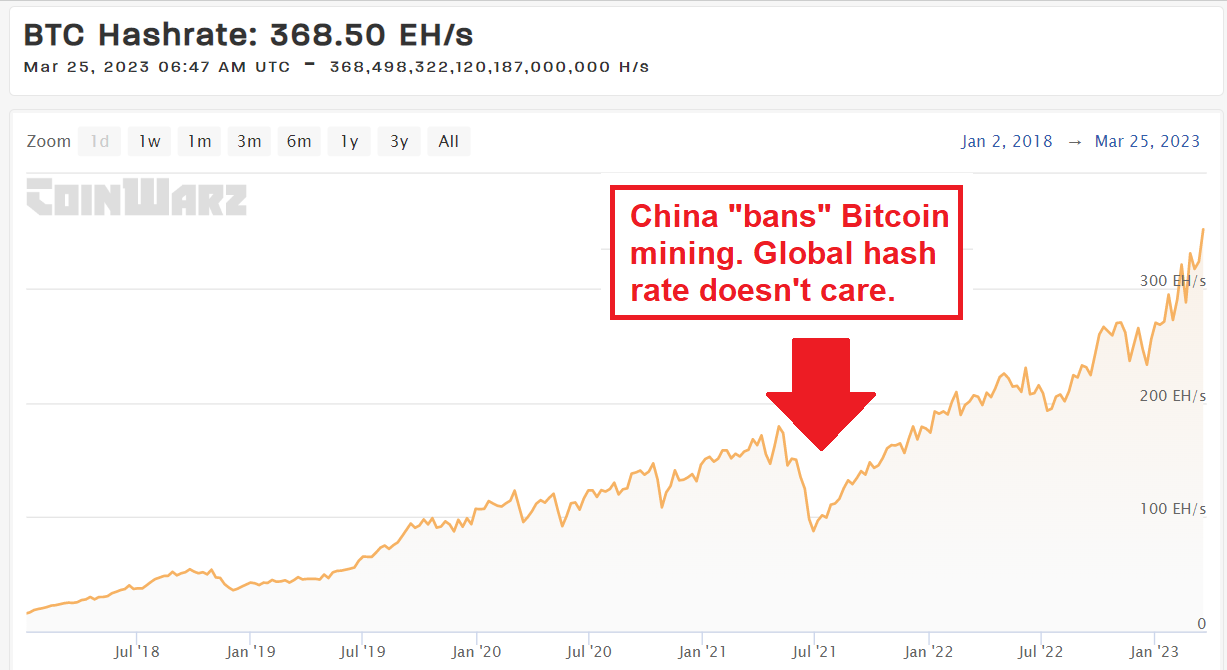

Hash rate up. Active addresses up. Institution use up. What evidence do you have that 'it has the reverse of any sort of traction'?

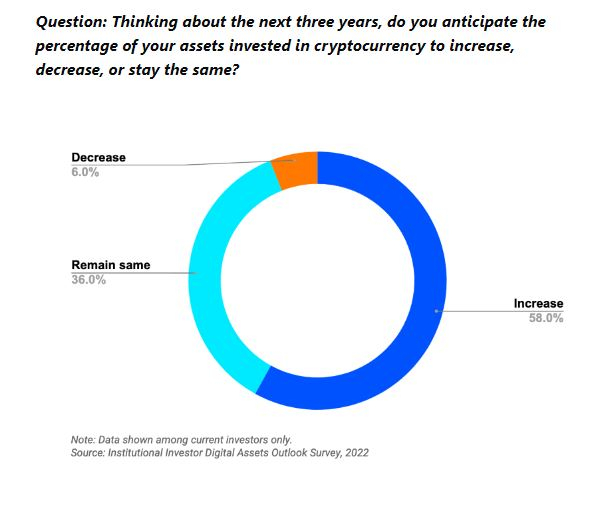

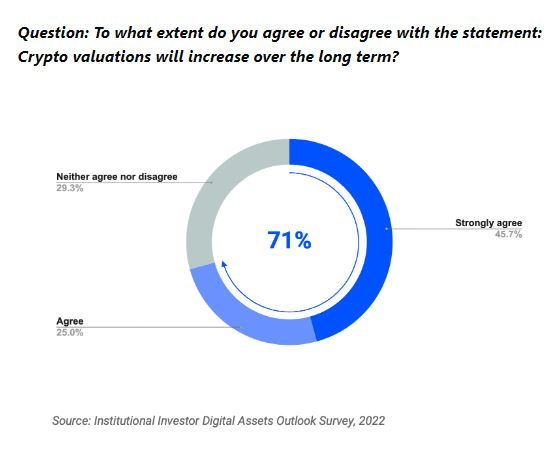

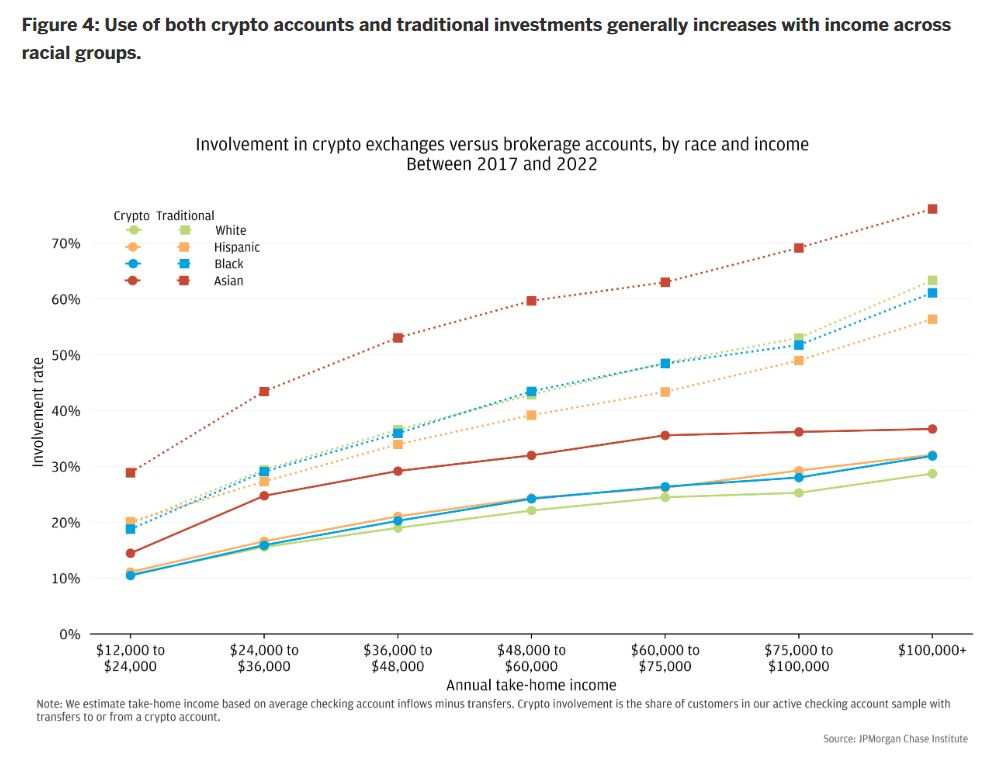

A recent JPM report found that the use of crypto currencies amongst younger generations was pushing 20%. That the amount of money invested in crypto, as a percentage of net worth / salary, increased with average income and education. A recent CB survey of fund managers with $2.6T under management found that the overwhelming majority expected crypto to be here to stay, expected prices to increase and expected to increase allocations in the future.

2 -

It would be pretty difficult for the vast majority of institutional investors to decrease allocation to cryptocurrency, given that for over 99.9% of the investment funds and pension schemes in the world, their allocation to cryptocurrency is zero, and any allocation to magic Internet money would be in violation of their fund's objective.

(Unless we're talking funds having a small percentage in Tesla or MicroStrategy which in turn gives them a microscopic allocation to BTC... which let's face it we probably are, given all that "BlackRock is on teh blockchain!" excitement a few dozen pages back which turned out to mean that BlackRock was passively investing in blockchain companies in proportion to the index.)

If the bros could figure out a way to off-ramp an opinion poll they'd all have Made It by now. Ask a silly question, get a silly answer.

1 -

Malthusian said:It would be pretty difficult for the vast majority of institutional investors to decrease allocation to cryptocurrency, given that for over 99.9% of the investment funds and pension schemes in the world, their allocation to cryptocurrency is zero

Thats the most bullish thing I have heard you say about Bitcoin bro

2

2 -

Which is why the image I posted, that you are referring to, contains this caption underneath; "data shown among current investors only."Malthusian said:It would be pretty difficult for the vast majority of institutional investors to decrease allocation to cryptocurrency, given that for over 99.9% of the investment funds and pension schemes in the world, their allocation to cryptocurrency is zero, and any allocation to magic Internet money would be in violation of their fund's objective.

Congratulations for, yet again, demonstrating your ability to post before engaging some critical thinking.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards