We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

BITCOIN

Comments

-

darren232002 said:I'm not completely au fait with the bonds but I believe the original stipulation was that El Salvador would share half of any profit on the Bitcoin with the investors. Which would seem to render your argument here void and, of course, wouldn't be the first time you've made assumptions that aren't factually correct.Citation needed. I looked at a few reports, and there is no indication that El Salvador will pay investors a share of any profit on the Bitcoin it holds. What may have confused you is that El Salvador has committed to using half the money raised to buy Bitcoin and the other half to invest in its volcano brodome. It plans to start selling that Bitcoin after five years to pay the previously agreed coupon (6.5%). No part of that involves sharing the profits with bondholders.Even if you're correct and El Salvador is paying 6.5% plus half the gains on the Bitcoin held (which, as half the money is going to Bitcoin, would mean 25% of the rise in Bitcoin * amount invested * % discount or premium over the issue price), it still doesn't answer the question of why you would lend money to El Salvador and let them have half the upside instead of buying Bitcoins yourself and taking all the upside.6.5%pa for lending money to a country whose bonds trade at yields of 24%+ certainly isn't a good reason.El Salvador has 1800 or so BTC acquired for about $80M I believe (above what they would trade for right now). Do you really think a country with a GDP of $25B is dependent on an investment or lump sum of $80M to pay its soldiers and civil servants?No. They're dependent on the IMF not cutting up their credit card. Unless Bitcoin goes to the mewn or they can persuade enough bros to pay $100,000 for an El Salvadorean passport. This is the fundamental issue with El Brosidente's Operation You Only Live Twice.2

-

Bitcoin down over 10% ($) today. Are the cracks finally appearing and herd is beginning to stampede for the exits......0

-

Haha

S&P500 Pre-Pandemic (March 2020): 3400

S&P500 Now: 4000

+17%

FTSE 250 Pre-Pandemic (March 2020): 21800

FTSE 250 Now: 19300

-12%

Bitcoin Pre-Pandemic (March 2020): £6800

Bitcoin Now: £25000

+267%

Its like you guys don't have access to a calculator.

1 -

Well done for plucking some suitable dates out of the air and not responding to the specific -10% in the last message which doesn’t even need a calculatordarren232002 said:Haha

S&P500 Pre-Pandemic (March 2020): 3400

S&P500 Now: 4000

+17%

FTSE 250 Pre-Pandemic (March 2020): 21800

FTSE 250 Now: 19300

-12%

Bitcoin Pre-Pandemic (March 2020): £6800

Bitcoin Now: £25000

+267%

Its like you guys don't have access to a calculator.0 -

Interval entertainment!The pretend gold rush overwhelmed the Ethereum bLoCkChAiN, which meant that another bro spent $3,300 in transaction fees to buy this 8-bit clip art picture of a goat in a bowl of soup, priced at $25.The future of money!Yes, I know, "the thread title says Bitcoin, what's this got to do with Bitcoin". Simple. Every $ that goes into trying and failing to buy 8-bit clip art pictures is a $ that can't go into Bitcoin to be cashed out by the disenfranchised. The proliferation and fragmetation of crypto money games helps to explain why Bitcoin is in a 53% dump, despite the turmoil on real asset markets and the headlines about nuclear war and the cost of living crisis, which in theory makes this the ideal time for a pump.2

-

Wish I had some more fiat to take advantage of Terra giving away free money!

For those who don't know UST is a algorithmic stablecoin pegged to the USD, which has dropped in value due to a glitch. Currently you can buy it at 90cents, although it has been under 70cents. Even though its guaranteed to be redeemable for a dollar.

This is the crypto equivalent of buying a £10 note for £5. Now just to decide whether to spend these sweet gains on SFM or ETC.0 -

Haha - "Suitable dates." Bitcoin outperforms the markets from basically any date outside the past 16 months. You're welcome to check this. As this thread ages, its going to be great to point out to all the posters who are so vehemently against it what they could have achieved if they had bought some on the time stamp.Well done for plucking some suitable dates out of the air and not responding to the specific -10% in the last message which doesn’t even need a calculator

Would you prefer the asset that 10x's and then collapses by 50% (Bitcoin) or the asset that 2x's and then declines by 20%?

0 -

A guarantee is only as good as its backer. There are plenty of stories about people losing investments that were 'guaranteed'.mooneysaver said:Wish I had some more fiat to take advantage of Terra giving away free money!

For those who don't know UST is a algorithmic stablecoin pegged to the USD, which has dropped in value due to a glitch. Currently you can buy it at 90cents, although it has been under 70cents. Even though its guaranteed to be redeemable for a dollar.

This is the crypto equivalent of buying a £10 note for £5. Now just to decide whether to spend these sweet gains on SFM or ETC.

What's stopping you churning your money now? Buy at 90 and redeem for 100. Repeat.1 -

Nothing! Like I said, literally free money!lozzy1965 said:

What's stopping you churning your money now? Buy at 90 and redeem for 100. Repeat.0 -

Ah, you love a Malthusian post that completely ignores the previous discussion because he has, again, been shown to be comprehensively incorrect (y'know, about the terms of the Bitcoin bond that he knew didn't share profits with investors).

My inkling is that, like quantum cryptography and risk free hedging strategies, you actually have no clue how the bond market works and the difference between yield and interest. Probably explains why you ignored me pointing it out twice.

Do you think this is going to rile me or in some way makes you correct? You do realise that many of us have been telling you that Bitcoin will collapse by 50, 60 or 70% again after its 10x'd and we have been saying that since the beginning of this thread. This isn't an unexpected dip or unexpected behaviour.Malthusian said:53% dump lol.

Malthusian said:The funny thing about the "Well obviously El Salvador and Central African Republic would be the ones adopting Bitcoin, because they've been disenfranchised by the current monetary system" shtick, is that it's essentially the reason why crypto holders consist predominantly of the low-skilled middle class, embittered divorcees and people who buy things because they were advertised in a football stadium, but with the zoom level changed from the micro level of individuals to the macro level of countries.

Skint people want to get rich quick so they buy crypto. Skint countries want to get Dubai quick so they adopt crypto as legal tender, build volcano brodomes and wait for the crypto wealth to start rolling in.Meanwhile while they are trading points between each other and trying to fend off the IMF, wealth continues to flow to those who own the means of production (Marx wasn't wrong about everything). El Salvador is not skint because it's being oppressed by a global economic conspiracy. It is skint because its income consists mainly of selling cheap clothing and remittances from expats who made it to the USA. "Bitcoin to $400,000" isn't a solution, it's a lottery ticket.

That's a whole lot of sweeping generalisations you're making there, leading you in to a narrow world view all predicated on top of each assumption. The caricature you have is completely false.

Of everyone I know in my social circle that owns Bitcoin, none of them are divorced or low-skilled employees. I, and many of those I know in this industry, are not skint people trying to get rich. I'm sorry for banging on about my degrees again, but you have to know that the fiat system is very lucrative for someone who has a fistful of STEM qualifications. I'm in my mid thirties and I'll almost certainly be able to retire before I get to 45. My lifestyle will not change even if Bitcoin 10x's from here. The sheer number of people leaving TradFi to come over to crypto probably don't fit that stereotype either and the fact that the talent pipeline from universities has shifted from banking to crypto speaks volumes.Telly not knowy not telly derp. March 2020 was the height of the pandemic (at least from a market perspective), not pre-pandemic.

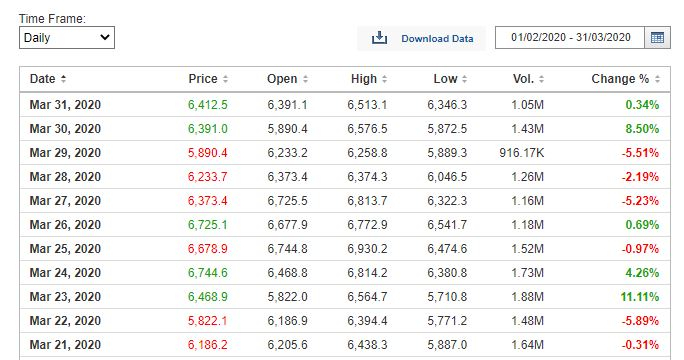

The real crash happened towards the end of March with the S&P bottoming on the 23rd March. By 'March' I was using the prices immediately prior to everything falling off a cliff, which should have been really obvious because the S&P wasn't at 3400 at ANY point in March. So much for provoking you in to doing actual research...

But hey, you're welcome to pick any date in February or March and run the numbers and you'll get the same result with BTC returns being an order of magnitude higher.Your £6,800 figure for Bitcoin is from near the bottom of the market (either halfway down the flash crash of around 10 March, or around 26 March in the recovery)

Incorrect. Bitcoin bottomed on March 13th at approximately £3000, way below the figure I quoted. On both of the dates you cite Bitcoin was trading considerably below £6800. The absolute highest value of BTC throughout all of Feb & March 2020 was £8500. My £6800 figure is more than twice as close to the absolute top in that time period than it is to the bottom.

Lets not pretend that I'm cherry picking a bottom for BTC here - I picked the price immediately before it started to dive off a cliff (same as I did with the S&P) because coherent data actually matters to me. If you want to run the numbers for the absolute bottom of both to current levels, Bitcoin still wins.Let's go with 26 March. Since that date an investment in the FTSE 250 is up 36%, and for the S&P 500 59%. You can easily verify this on Morningstar. This is of course still below the 267% return someone who bought Bitcoin at the same time and sold it today would make (despite the current dump). Which would be great if anybody did.

Amazing that you can recalculate the S&P figures but aren't interested in re-calculating the Bitcoin figures...

On March 26th, Bitcoin was trading at $6700 and its currently trading at $31600 for a comfy return of 372% (or, in bro speak, a 4.72x).But yes, keep banging on about a 53% drawdown as if I care...

Needs Improvement. C+See, it can be dangerous to provoke people into doing actual research.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

But yes, keep banging on about a 53% drawdown as if I care...

But yes, keep banging on about a 53% drawdown as if I care...