We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

BITCOIN

Comments

-

Could have compared vs 2012 and then gold would be basically flat.darren232002 said:

Hilarious.Michael121 said:You forgot dividends in both comparisons vs gold and FTSE100, also picked FTSE100 over all share, i wonder why that is.

FTSE 100 since 2000: 11%

SPY since 2000: 200%

FTSE all Share since 2000: 35%

Oh gosh. Yes, that is a great counter point which is completely terminal to the point I raised. Clearly I was misrepresenting the facts in order to present a biased argument. For gods sake, do you guys even know what intellectual honesty & integrity is?

Gold is up like 500% or something ridiculous, so even with your compounded dividends you're not outperforming it.

And I need to point out here that I don't think gold is better than the indices or is a better investment. I just think its hilarious when something as moronic as gold can outperform the markets over that period of time, particularly when many would say that the last two decades have been pretty damn awesome economically. It really speaks volumes about the quality of equities.

I wonder at what point do we just accept that the S&P is a ponzi because everybody has been blindly buying the index for the last 3 decades. The stock market is meant to function as an efficient capital allocator, but its been broken for some time.0 -

If the Fed owns the stock then the interest paid is simply an accounting book entry.darren232002 said:That was an exceptional event which has yet to run it's course. The great unwinding is yet to follow.

Interest payments on US debt currently stand at $420BN per year on a 0.25% interest rate. US GDP is twenty odd trillion, but federal tax receipts are $4T per year. 0

0 -

Quite a good article on the climate problem around Bitcoin.

https://www.theguardian.com/technology/2022/jan/30/how-do-we-solve-bitcoins-carbon-problem

Quite balanced I thought. (sorry for bringing it up but it is quite important to some of us who don't want our kids to cook to a crisp).

Highest rated comment:Quantum computing might sort it all out within a few days, first by mining the 3000 or so remaining Bitcoins, then by stealing the largest wallets of those who don't have quantum computers. I expect it'll all be worthless within hours of the first theft.

Next highest rated comment

Appears to be awfully expensive to keep the idiots happy.Edible geranium0 -

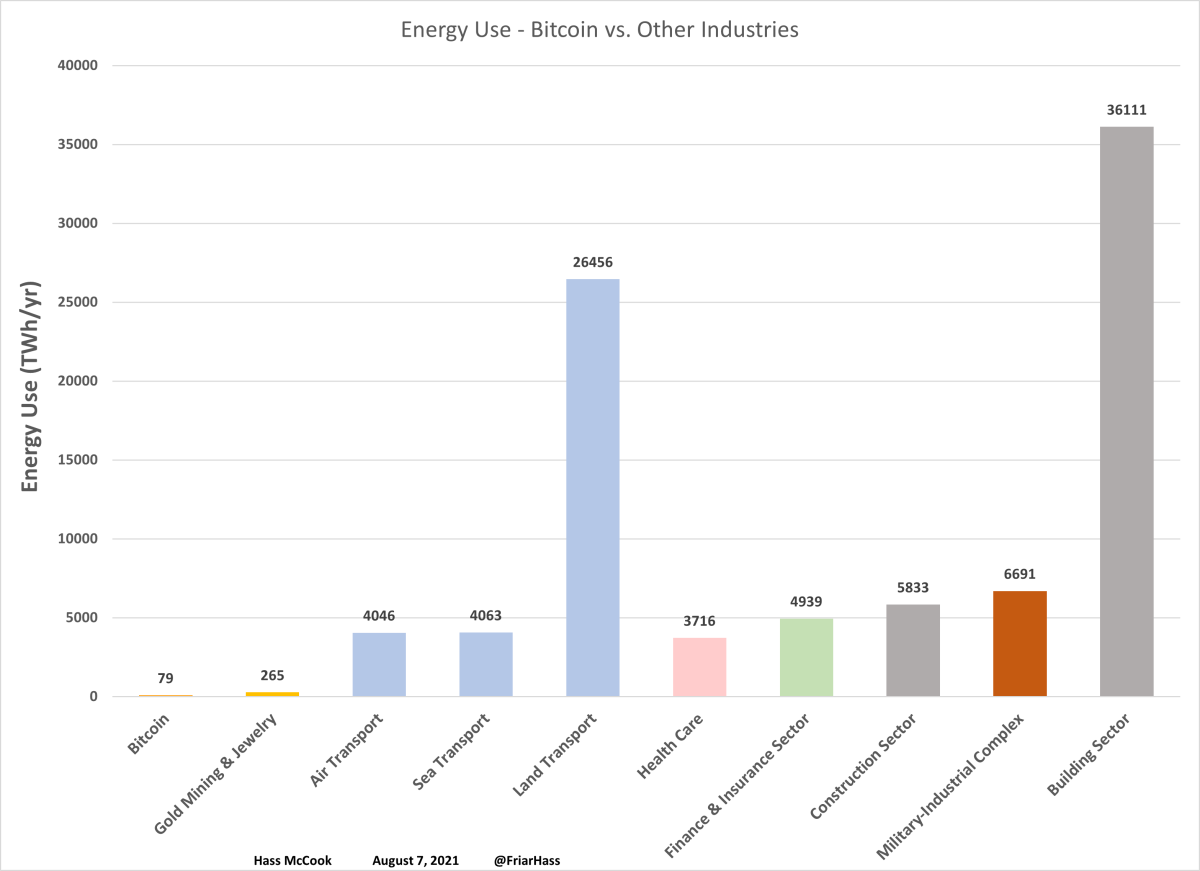

I would be looking at other industries before worrying about Bitcoin burning your kids.bugbyte_2 said:Quite a good article on the climate problem around Bitcoin.

https://www.theguardian.com/technology/2022/jan/30/how-do-we-solve-bitcoins-carbon-problem

Quite balanced I thought. (sorry for bringing it up but it is quite important to some of us who don't want our kids to cook to a crisp).

Highest rated comment:Quantum computing might sort it all out within a few days, first by mining the 3000 or so remaining Bitcoins, then by stealing the largest wallets of those who don't have quantum computers. I expect it'll all be worthless within hours of the first theft.

Next highest rated comment

Appears to be awfully expensive to keep the idiots happy.

To put Bitcoin's energy usage into context see the below, and also be aware that your concerns have already been acknowledged by the industry and could be at zero (possibly negative) within 10 years...you can't say that about the other industry's shownFigure 11: Bitcoin versus other industries — yearly energy use, in TWh

1 -

"At 0.08 % of global CO2e emissions, removing the entire mining network from global demand would not amount to anything more than a rounding error"

"Currently emissions are created by Bitcoin mining, but this needn't to persist. Bitcoin will be 100% renewable when power generation is 100% renewable. The focus should be on building out renewable power generation, not on stifling the development of monetary technology."

"By re-directing the conversation from sources of energy to uses of energy, you are cherry picking where to focus environmental policy based on political bias."

But sure, keep ignoring the facts and listening to those 'highest rated comments' that don't even know how many bitcoins are left to mine, couldn't explain what a qubit was if it hit them in the face, how many qubits would actually be needed to hack the BTC network and why the current level is orders of magnitude off where it needs to be to do so, plus the fact that quantum resistant algorithms are gonna be easier to develop than quantum computing is.1 -

I wonder why gold is flat since 2012... Hmm, if only I'd thought about that before perhaps...Could have compared vs 2012 and then gold would be basically flat.

True. But fiat is about belief and some actions will shake that belief beyond repair.If the Fed owns the stock then the interest paid is simply an accounting book entry.

0 -

bugbyte_2 said:Quite a good article on the climate problem around Bitcoin.

https://www.theguardian.com/technology/2022/jan/30/how-do-we-solve-bitcoins-carbon-problem

Quite balanced I thought. (sorry for bringing it up but it is quite important to some of us who don't want our kids to cook to a crisp).

Highest rated comment:Quantum computing might sort it all out within a few days, first by mining the 3000 or so remaining Bitcoins, then by stealing the largest wallets of those who don't have quantum computers. I expect it'll all be worthless within hours of the first theft.

Next highest rated comment

Appears to be awfully expensive to keep the idiots happy.

Literally stupid comments by Guardian readers. If Quantum computers do somehow hack Bitcoin's network - the strongest computing network ever created, it will already have hacked every bank, every government website, etc.

Also if quantum computing does get remotely close to being a realistic threat, bitcoin's encryption can be updated well in advance..

It's an incredibly silly argument by people who haven't got a clue what they are talking about. Its the same parroted rubbish people blurt out that they heard some idiot say down the pub once....

"BlOcKChAiN NoT BiTCoIN"

The only thing half decent about that article is that they actually accept that Bitcoin only uses 0.1% of global energy consumption... but that doesn't make such a scary headline, does it?2 -

If I was playing Bitcoin Forum bingo where you have to get a response from all of the main protagonists I think I won.

Go me!

All I need for a full house is for someone to mention flat earth something about being deaf MATT DAMON!!! Fortune favors the stupid, etc.Edible geranium-1 -

Yawn, again….bugbyte_2 said:

Really couldn't have put it better myself.

But but but people can live in houses! Blockchain solves nothing and nobody can live there, derp

Go on then - just for banter - what value does Bitcoin add to society? (Real value that normal people would benefit from, not some hypothetical at some point in the future collapse of fiat or pretending your average Nigerian is eternally grateful to Bitcoins existence).

The hardest form of money ever created. An inflation hedge and store of value. A way to transact with zero reliance on a 3rd party middleman.

It’s cool if you don’t it, it doesn’t seem like you want to now anyway. I’ll buy you a little house in the metaverse if you want, just say the word0 -

Fascinating view from a crypto skeptic. It's called "The problem with NFTs", but it directly addresses Bitcoin and Ethereum.

I am a Chartered Financial Planner

Anything I say on the forum is for discussion purposes only and should not be construed as personal financial advice. It is vitally important to do your own research before acting on information gathered from any users on this forum.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

https://www.youtube.com/watch?v=YQ_xWvX1n9g

https://www.youtube.com/watch?v=YQ_xWvX1n9g