We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Assistance with improving my pension fund choices

Comments

-

Ok so I'm happy with retaining 75% equities I think. Its what I have now and I have no reason to want to change it. But as you say, its the mix within that, that I'm not too happy with. The reason being simply that I think I can get better performance. I don't particularly rate the UK's chances over the next ten years so I think I should reduce my allocation of UK equity.

Yes I think Prism's comments are pretty spot on, and some reduction in the UK equities % in favour of a more even global split is probably a good move . This has not a lot to do with the 'UK chances over the next ten years ' but is a reflection of the balance and type of companies that occupy the FTSE 100 . Most are pretty global anyway but are largely in unexciting sectors like oil and banks.

Traditionally the large pension funds ( not just Aegon) contain a high % UK as this is what the customers liked . Preferring this to foreign investments . Most global funds contain only 5% UK as this approx. represents our % in the global financial world.

On the other hand global funds are dominated by the US ( between 50 and 65% usually ) and not everybody is so comfortable with that either.

So not everyone is convinced about this low UK % being a good thing, as it also exposes you more to currency risk and some advocate a middle way with say 15/20% UK . Maybe with more % UK for the fixed income securities ( bonds, gilts etc ) part of a portfolio and less for the equity investments ..

However as said before a lot of it is about opinion rather than hard facts, and you will just have to make a decision at some point as nobody can make it for you . Unless of course you pay for an IFA .

2 -

@Albermarle thanks.

So lets say I wanted to reduce my UK equities and increase my global equities. There are several ways I could do this:

* Move everything from the current 50/50 fund to a single alternative fund i.e a 70/30 world/uk

* Move an amount from the current 50/50 fund into a global ex-UK fund, and retain some of the 50/50 fund for the UK element

* Invest directly in regional funds, i.e specific US, Japan, Pacific Basin, Europe and UK funds, in the proportions I wanted.

Does any of these options have any advantage over another?

For example I could choose from several funds dedicated to US equities, or another bunch of funds for global (ex-UK) equities, or another bunch of funds with a fixed split i.e 60/40 or 70/30.

0 -

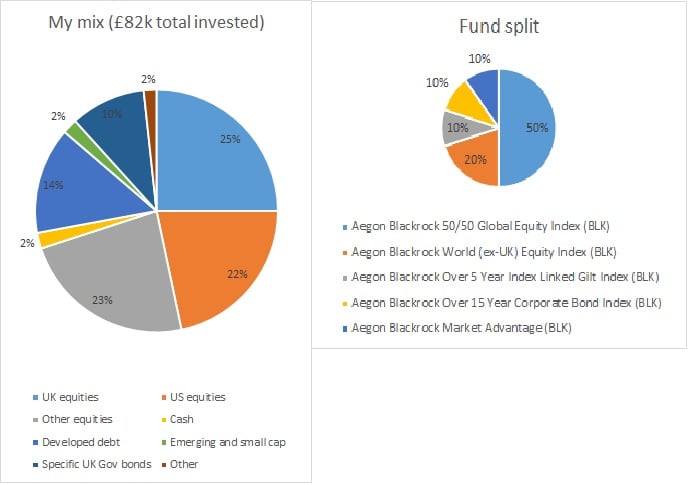

Right I've come up with a portfolio which moves some of my equities away from the UK by splitting the equity investment between two funds - my existing 50/50 fund and a new global (ex-UK) fund which is 60% US.

At the same time, I have split the existing multi asset fund into three and kept 10% in, moving 10% into a specific UK government index linked bonds fund and the other 10% into a corporate bond fund.

The fund mix and asset mix would be as follows:

Over the past 5 years, this new mix would have given me an average return of 8.7% per year, compared to the 6.2% per year of my current funds.

Using the 1 to 7 risk rating scale that Aegon gives me for each of the funds, the new mix would give me an average of 4.5 score against 4.4 of the current funds. So this is slightly higher based on their categories, but in terms of actual variance over the past five years the new mix shows as a little lower than the current funds.

So how do I judge this scenario now? Does anyone have a view?1 -

Rather than fiddle around with several funds each making up for faults with another I think you should go directly to the simplest configuration that provides the allocation you want. In your case where you want to control the UK allocation, if there isnt a suitable single fund available I would use a global Ex-UK fund together with a separate UK one. Then changing the UK allocation in the future is easy.danlightbulb said:@Albermarle thanks.

So lets say I wanted to reduce my UK equities and increase my global equities. There are several ways I could do this:

* Move everything from the current 50/50 fund to a single alternative fund i.e a 70/30 world/uk

* Move an amount from the current 50/50 fund into a global ex-UK fund, and retain some of the 50/50 fund for the UK element

* Invest directly in regional funds, i.e specific US, Japan, Pacific Basin, Europe and UK funds, in the proportions I wanted.

Does any of these options have any advantage over another?

For example I could choose from several funds dedicated to US equities, or another bunch of funds for global (ex-UK) equities, or another bunch of funds with a fixed split i.e 60/40 or 70/30.

How you arrange the funds is partially dependent on the size of your pot. WIth a small pot it doesnt matter much anyway. Eg with £10K in a global ex UK fund putting £500 in a UK fund to get the right proportions is pretty irrelevent in absolute terms. On the other hand with a very large pot you may wish to have separate funds for each geographic area particularly for small companies where local knowledge may be important. Generally with developed world large companies, because of globalisation, geography is less important than industrial sector. It's the industrial sector split that is the biggest problem with the FTSE100 more than any particular issue with the UK.

2 -

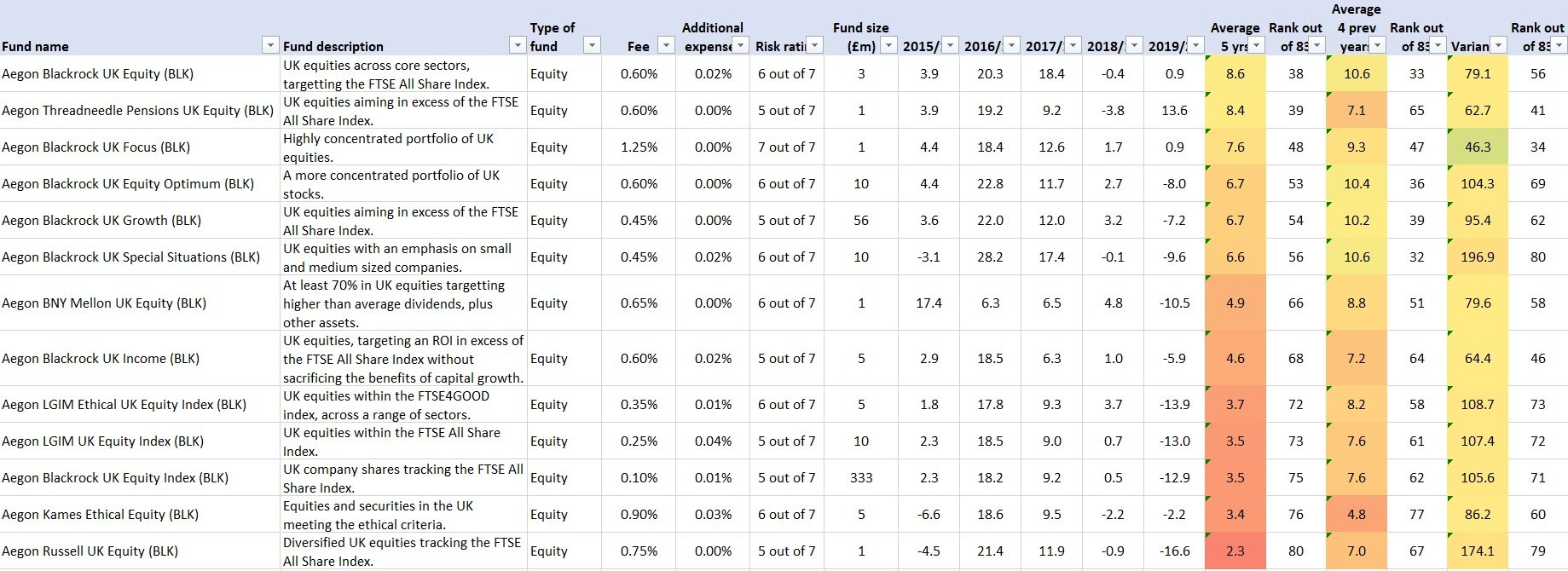

@Linton thanks. Ive just looked through the available UK only funds and they appear to be very small funds? Here are the UK only ones I can choose from:

The biggest one is £333m, which has not performed very well. The upper half of the list isn't too bad, but the funds are tiny? I think I might have to use a mixed fund and then an ex-UK fund to compensate, because of the limitations of what funds I have available to pick from.0 -

And conversely when the market rose you'd have had less of a rise. And in any case mathematically the overall change will be what you'd have got if you just went with the One fund that had the mix you ended up with.danlightbulb said:@ColdIron hmm. So just looking at some recent performance, the 50/50 fund Im in has -4.6% for the most recent year, but the 60/40 fund only has -0.9%. Being in only one of those funds means I have taken the full hit of -4.6% whereas if I was in both funds equally I'd have taken only a hit of approximately half way between the two?

So i get your point about the diversity but it still seems beneficial to be in more than one fund even if they are similar in makeup?There's three issues with your cunning plan.-The first, as said, is that you are just making your own Frankenfund with no real extra diversification. Better IMO to have a core of indexes and then specialise with a few "satellite" funds that focus on particular areas rather than just more of the same. That woudl give more true diversification. For example a smaller companies fund. Or in an upcoming area like say health or renewables.-The second is what's called "worseification". That is, if these are active funds then by buying many of them, you most likely end up with the performance of an index but management costs of active. Whereas if you decide that (say) 60/40 works for you then you can choose the one 60/40 with lowest costs or management style that suits you. Be that index or he type of active management you prefer.-Third, you are now setting yourself up for having to rebalance these funds every year because they will get out of the balance you wanted to achieve your perfect (Say) 60/40 split. Could you stomach selling some of your better performing 60/40 to buy more of the badly performing 30/70?0 -

Goodness. Are you sure?danlightbulb said:@Prism there are several different ones but yes where they have used a convention like 60/40 or 50/50 they seem to be always referring to UK vs overseas equity splits.

For example there is;

* Aegon Blackrock 60/40 Global Growth (BLK)

* Aegon Blackrock 60/40 Global Equity Index (BLK)

* Aegon Blackrock 40/60 Global Equity Index (BLK)

* Aegon Blackrock World (ex-UK) Equity Index (BLK)

* Aegon BNY Mellon Real Return (BLK)

* Aegon HSBC Islamic Global Equity Index (BLK)

There's more, I haven't finished cataloguing them all yet.

All of the above funds have a similar mix yet have performed slightly differently. Why wouldn't I diversify across them? Why stick to just one?

On my spreadsheet (when completed) I will be able to sort by average returns and variance, with the aim of looking for a) good returns but also b) consistency.

Also the last one on that list, the Islamic (Sharia compatible) fund, has done very well compared to the other global equity funds. But I wouldn't want to make it my sole equity fund would I?

Normally when people refer to 60/40 or 30/70 etc they are referring to equities vs bonds. Not global vs U.K for 100% equities.My comments above are in the light of equities/bonds split not global vs U.K and thats what most people will be thinking of when you mention 60/40 . If you really are looking at such high proportions of UK, thats poor strategy. Why pick the UK out of all the other countries just because you happen to live here? Especially since UK doenst really mean Uk anyway.To explain that more, you have to dig into what "UK"means. It just means "HQ happens to be located in the UK"So recently for example, Unilever toyed with the idea of moving its HQ from UK to Netherlands. So if that happened, and you held a UK fund, then all of a sudden, effectively on a whim, you'd have lost Unilever (which BTW is just a large multinational that does most of its business outside the UK).Id rather have a fund that decided to invest in unilever for reasons of it being a good company and stuck with it througha HQ move. And then also if you look at what you end up with if you just invest in the "UK" you end up with a lot of multinational companies that are highly skewed towards oil and finance.YOu had better make very sure when you look at these 50/50 60/40 etc funds you are looking consistently at what that allocation refers to, UK or bonds.And I'd suggest very strongly you discard from consideration any fund that has a fixed UK allocation above the "natural" 5% or so. Fine if its an active fund that for whatever reasons happens to have more than that in teh UK, not fine if it has a rigid x% UK.1 -

It sounds like you haven't seen many workplace pensions - they are full of these kind of funds that nobody else would choose. Little of the stuff that you would want to build up an easy allocation is available and most of the multi asset funds have heavy weightings to the UK FTSE. So in the end danlightbulb has to make the best of a very limited and odd collection with Aegon. Its the same situation with Scottish Widows.AnotherJoe said:

Goodness. Are you sure?danlightbulb said:@Prism there are several different ones but yes where they have used a convention like 60/40 or 50/50 they seem to be always referring to UK vs overseas equity splits.

For example there is;

* Aegon Blackrock 60/40 Global Growth (BLK)

* Aegon Blackrock 60/40 Global Equity Index (BLK)

* Aegon Blackrock 40/60 Global Equity Index (BLK)

* Aegon Blackrock World (ex-UK) Equity Index (BLK)

* Aegon BNY Mellon Real Return (BLK)

* Aegon HSBC Islamic Global Equity Index (BLK)

There's more, I haven't finished cataloguing them all yet.

All of the above funds have a similar mix yet have performed slightly differently. Why wouldn't I diversify across them? Why stick to just one?

On my spreadsheet (when completed) I will be able to sort by average returns and variance, with the aim of looking for a) good returns but also b) consistency.

Also the last one on that list, the Islamic (Sharia compatible) fund, has done very well compared to the other global equity funds. But I wouldn't want to make it my sole equity fund would I?YOu had better make very sure when you look at these 50/50 60/40 etc funds you are looking consistently at what that allocation refers to, UK or bonds.And I'd suggest very strongly you discard from consideration any fund that has a fixed UK allocation above the "natural" 5% or so. Fine if its an active fund that for whatever reasons happens to have more than that in teh UK, not fine if it has a rigid x% UK.

It can be made to work but you usually need to combine a few funds to get the right allocation0 -

Prism is correct on the workplace pensions stuff

One of mine was a 60 40 fund with the 60 being the U.K. equity percentage, quite alarming1 -

@AnotherJoe

Ive examined all 83 funds I can select from, and what I have said above (which the chaps above have confirmed) is true.

All the x%/y% labelled funds refer to the uk/global mix.

I cant select any specific sector funds except for gold. There isnt one for health for example.

I do have options to select more active funds vs passive funds and ive noticed the performance is no better, and that many articles suggest active funds are not worth the premium, so Im happy to stick to passive.

Almost all of the funds with UK stocks in them have a relatively high proportion, between 40 to 70% UK. There are a couple with only a low UK percentage but these have very high US percentage. I can choose from some regional funds (or ex-Uk funds) but would then have to specify my own proportions to get the mix I want.

Currently Im 35% UK equities, that was chosen for me when the scheme was set up.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards