We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Assistance with improving my pension fund choices

Comments

-

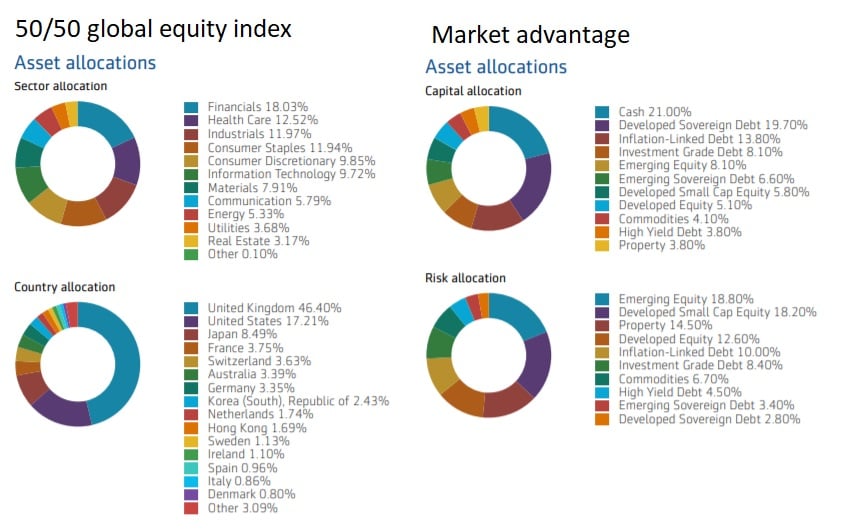

The ideal simple strategy would be to select a good single multi asset fund, much like the Blackrock Market Advantage fund, with an allocation to equities, bonds (debt) and property. That particular fund only has a very low allocation to equities and a high one to bonds so you would be looking for something the other way round - more equities and less bonds. You would need to decide on the split yourself but if it was me I would be looking at something between 60% and 80% equities. I am not sure that amongst your fund list there is a suitable multi asset fund like that.

Failing that you could create that split yourself by using one of the 100% equities fund mentioned earlier (ideally without the 50% UK allocation) and then maybe a gilt or bond fund. It would then be up to you to keep those two in balance as the equity fund would be expected to outpace the bond fund over time. Some people rebalance maybe once a year.0 -

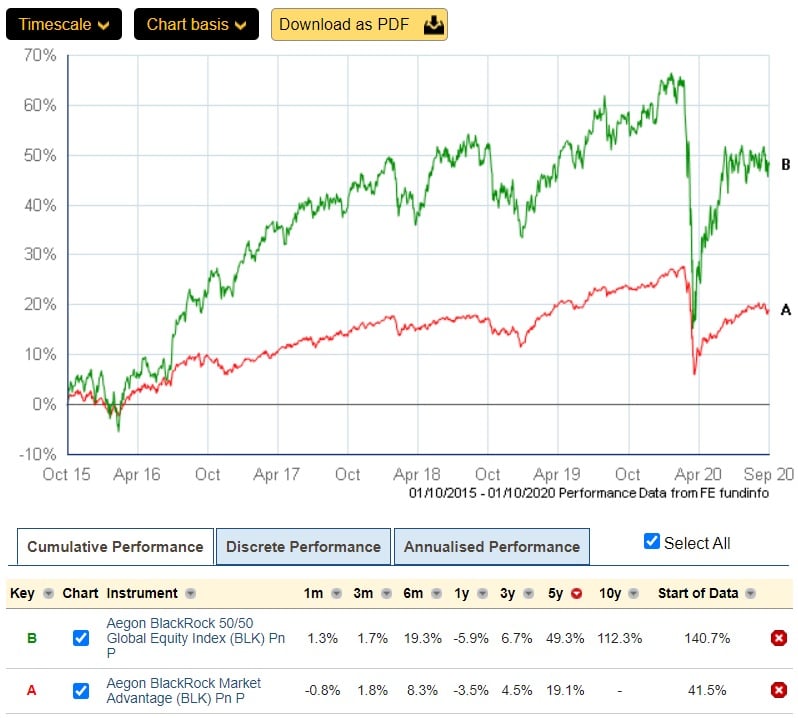

@Linton ok cheers. I can see how the charts work so that's fine. I've found my existing two funds on there (one only has five years data, the other has ten).

Ok so what do I know so far:

Here's my two existing funds:

And here is the mix within each one:

There is no information on the geographical mix for the fund on the right, its not in my PDF nor shown on the Morningstar site.

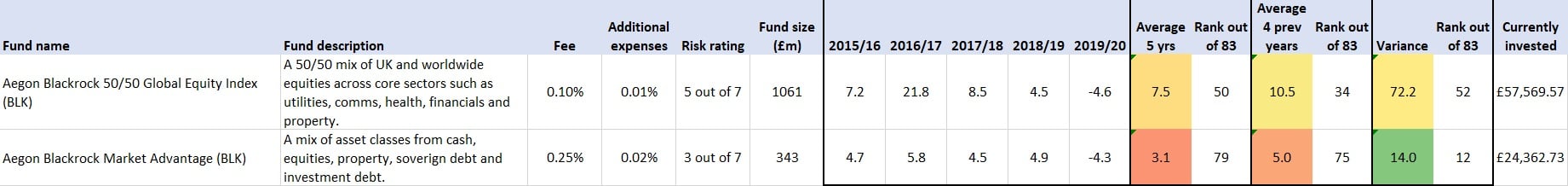

And here are the metrics I have compiled on my spreadsheet:

My headline issues right now are:- The market advantage fund is only returning an average of 3.1% a year (5% if you discount the last year) and is ranked nearly last out of all the funds I have available to me. One might think that its lower risk might mean its more stable? Nope, it still fell by 4.3% so far this year. This really jumps out as an underperforming fund to me, so what do I do about it?

- The 50/50 fund is 50% in UK equities, which might be too high? Alot of the funds with a higher global proportion have performed better over the past five years. What do I do about this?

Thanks for the help so far, I appreciate this is complex but I have to start somewhere.

0 -

If you look at the 'F' version of the fund (should be the same performance) you can get 10 yearsE = Aegon Blackrock 50/50 Global Equity Index Pn Fplotted again Ftse100, and Aggressive/ Balanced/ Cautious fundsDoesn't seem to bad to me.

0 -

The market advantage fund I am in has done poorly (ranked 79th out of 83 funds). You say that it contains a high proportion of bonds, but then why did it not perform more like some of the other bond funds I have available to me like for example these two:Prism said:The ideal simple strategy would be to select a good single multi asset fund, much like the Blackrock Market Advantage fund, with an allocation to equities, bonds (debt) and property. That particular fund only has a very low allocation to equities and a high one to bonds so you would be looking for something the other way round - more equities and less bonds. You would need to decide on the split yourself but if it was me I would be looking at something between 60% and 80% equities. I am not sure that amongst your fund list there is a suitable multi asset fund like that.

Failing that you could create that split yourself by using one of the 100% equities fund mentioned earlier (ideally without the 50% UK allocation) and then maybe a gilt or bond fund. It would then be up to you to keep those two in balance as the equity fund would be expected to outpace the bond fund over time. Some people rebalance maybe once a year.

Both of the above have performed twice as good as the market advantage fund I'm in, whilst still being low variance and low risk rating, and lower fee?

What's gone wrong with the market advantage fund?0 -

@Chickereeeee it was the market advantage fund I couldn't find 10 years data on.

However look what happens if I plot the Blackrock 50/50 against the HSBC Islamic Global Equity fund:

I know past performance is no guarantee of future performance but surely I am selling myself short by being only in the 50/50 fund, as the fund with far less UK equities in it has consistently outperformed it?

0 -

danlightbulb said:

The market advantage fund I am in has done poorly (ranked 79th out of 83 funds). You say that it contains a high proportion of bonds, but then why did it not perform more like some of the other bond funds I have available to me like for example these two:Prism said:The ideal simple strategy would be to select a good single multi asset fund, much like the Blackrock Market Advantage fund, with an allocation to equities, bonds (debt) and property. That particular fund only has a very low allocation to equities and a high one to bonds so you would be looking for something the other way round - more equities and less bonds. You would need to decide on the split yourself but if it was me I would be looking at something between 60% and 80% equities. I am not sure that amongst your fund list there is a suitable multi asset fund like that.

Failing that you could create that split yourself by using one of the 100% equities fund mentioned earlier (ideally without the 50% UK allocation) and then maybe a gilt or bond fund. It would then be up to you to keep those two in balance as the equity fund would be expected to outpace the bond fund over time. Some people rebalance maybe once a year.

Both of the above have performed twice as good as the market advantage fund I'm in, whilst still being low variance and low risk rating, and lower fee?

What's gone wrong with the market advantage fund?

Nothing has gone wrong with the Market Advanatage fund. If you look at what it invests in you will find a high % of lower return safer investments. It is a pretty cautious fund and appears to be doing what it is supposed to do - over the medium return providing a return of 3.5% above market interest rates. If for example you were within 5 years of retirement this could be an appropriate fund.danlightbulb said:

The market advantage fund I am in has done poorly (ranked 79th out of 83 funds). You say that it contains a high proportion of bonds, but then why did it not perform more like some of the other bond funds I have available to me like for example these two:Prism said:The ideal simple strategy would be to select a good single multi asset fund, much like the Blackrock Market Advantage fund, with an allocation to equities, bonds (debt) and property. That particular fund only has a very low allocation to equities and a high one to bonds so you would be looking for something the other way round - more equities and less bonds. You would need to decide on the split yourself but if it was me I would be looking at something between 60% and 80% equities. I am not sure that amongst your fund list there is a suitable multi asset fund like that.

Failing that you could create that split yourself by using one of the 100% equities fund mentioned earlier (ideally without the 50% UK allocation) and then maybe a gilt or bond fund. It would then be up to you to keep those two in balance as the equity fund would be expected to outpace the bond fund over time. Some people rebalance maybe once a year.

Both of the above have performed twice as good as the market advantage fund I'm in, whilst still being low variance and low risk rating, and lower fee?

What's gone wrong with the market advantage fund?

This is why you should not pick funds at random or on the basis of short term performance. You need to look under the bonnet - what does it invest in and what is the manager's objective. Only then can you see whether it is appropriate for your circumstances.0 -

Hi. I guess that's the crux isn't it - I didn't choose this fund. It was chosen for me and on the face of it now I don't consider it appropriate for me at this time. I don't know whether that is a right or wrong assertion?Linton said:

This is why you should not pick funds at random or on the basis of short term performance. You need to look under the bonnet - what does it invest in and what is the manager's objective. Only then can you see whether it is appropriate for your circumstances.

It's easy for me to look over the net, read various articles and say I should be (making figures up) 25% UK equities, 20% US, 25% bonds, 10% cash, 5% emerging market.... or whatever other figures I find but how do I decide what's right for me, at this point?

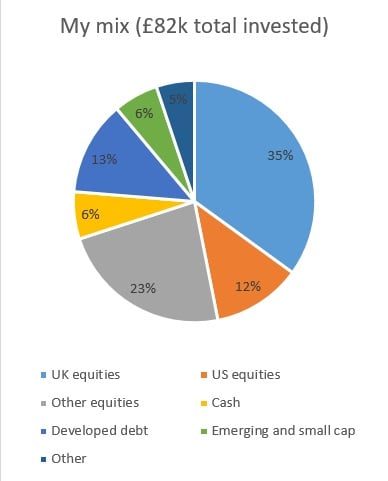

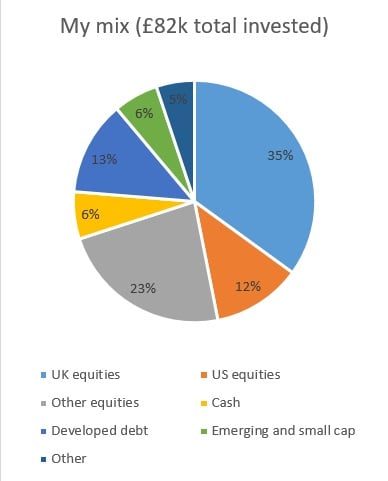

Using the information I could find for my two funds, I have tried to create a pie chart showing my current asset mix. I think its something like this:

0 -

The thing is there is no correct answer, just opinion. Which is why you find global equity funds with 60%, 50%, 40% Uk and then different splits of equities to bonds.danlightbulb said:

Hi. I guess that's the crux isn't it - I didn't choose this fund. It was chosen for me and on the face of it now I don't consider it appropriate for me at this time. I don't know whether that is a right or wrong assertion?Linton said:

This is why you should not pick funds at random or on the basis of short term performance. You need to look under the bonnet - what does it invest in and what is the manager's objective. Only then can you see whether it is appropriate for your circumstances.

It's easy for me to look over the net, read various articles and say I should be (making figures up) 25% UK equities, 20% US, 25% bonds, 10% cash, 5% emerging market.... or whatever other figures I find but how do I decide what's right for me, at this point?

Using the information I could find for my two funds, I have tried to create a pie chart showing my current asset mix. I think its something like this:

From you pie chart it looks like you have around 75% equites and 20% bonds/cash and about 5% other which is likely commodities and property. Honestly, that split looks pretty good.

I think your performance drag is the high UK allocation and the last 5 years. If we go back more than 5 years this allocation would have done just fine. So you could decide that the UK allocation is going to help going forwards as it is currently under valued. Or you could go more global with maybe the Islamic Global Equity Index. Or maybe a mix of the two?0 -

@Prism thanks.

Ok so I'm happy with retaining 75% equities I think. Its what I have now and I have no reason to want to change it. But as you say, its the mix within that, that I'm not too happy with. The reason being simply that I think I can get better performance. I don't particularly rate the UK's chances over the next ten years so I think I should reduce my allocation of UK equity.

Do I need to come up with a reason why or some sort of model, how do I decide what allocation I do want?

Or do I just make an incremental change, i.e I could move 10% from 50/50 equity into the HSBC global equity fund, and then let that play out for a few more months? (I assume I should make incremental changes, rather than (for example) moving my whole 70% from 50/50 global to something else all in one go)?

On the subject of the multi asset funds, I have 12 to choose from, some have done better than others but all are all in the lower half of the performance ranking over the past 5 years. I could, for example, move half of my 30% currently in the market advantage fund to another multi asset fund that has done better, and again, then see how that plays out for a while?

0 -

Is the size of the fund important?

All the following funds have around the same 65-70% allocation in US equities, I guess that's why they've all performed similarly, but the fund size varies quite alot from small to large. Is it better being in a bigger fund?

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards