We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Possible £100 Halifax switch offer starting 4/8/20

Comments

-

It can be done after the account is opened. Some have had the option at the end of the application while others have not.Mosler said:When an application is made for a Reward account, at what point can you apply to switch an account to it, or do you do it after the account is opened?

0 -

I did mine within the application. Worked fine. But I did it on a laptop on Chrome.0

-

It gives you the option after the application is complete.

0 -

I've got a Club Lloyds account, but none of the Lifestyle benefits really suit me anymore.

I previously had an account with Halifax and received a switch offer back in 2016, so would still qualify. Quite tempted to switch back and take advantage of this now!0 -

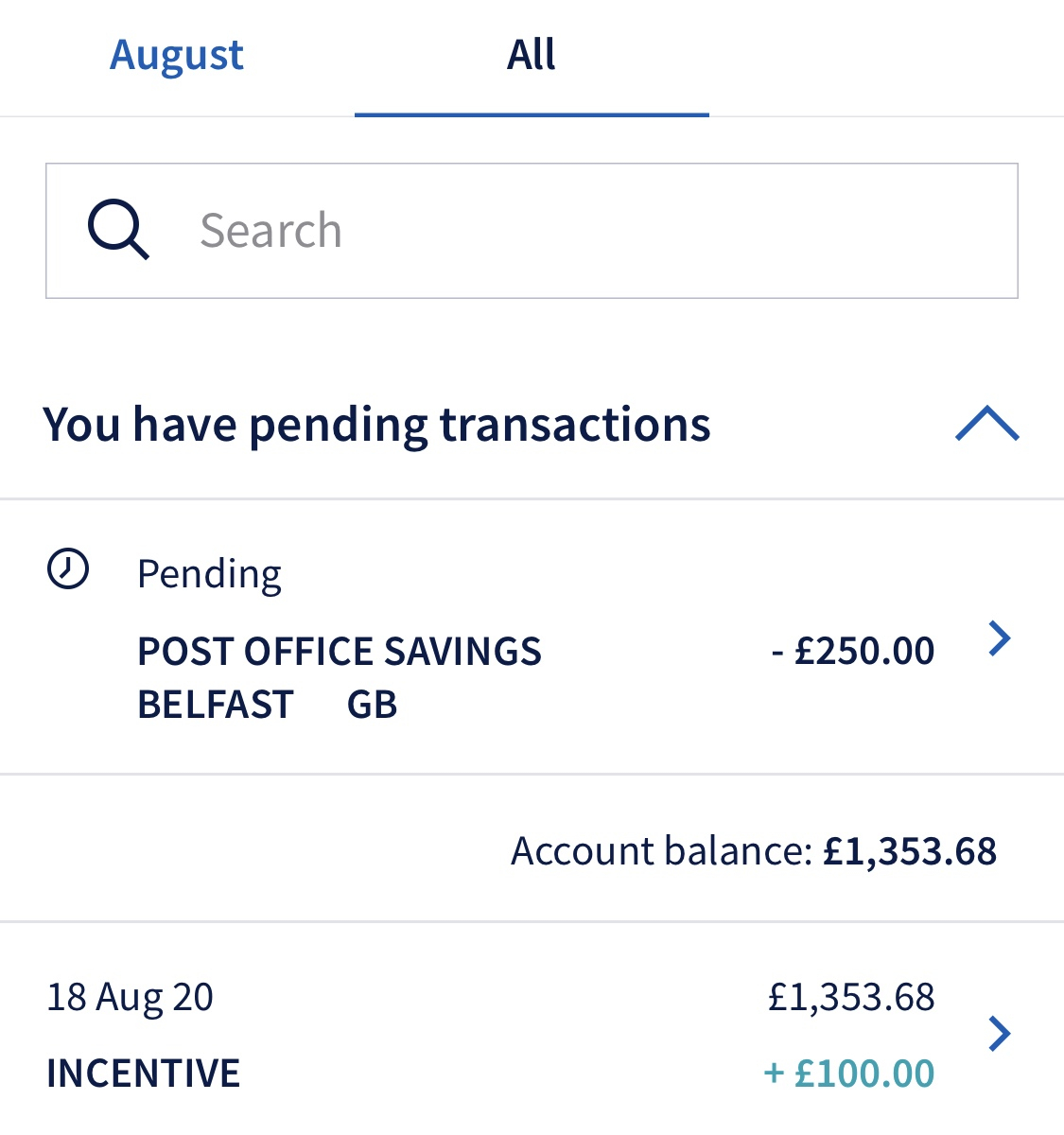

That'll likely be working. Failures before were at 'there's been a problem...' and back to log in. Try again same, and again, same, so unlikely to get to the pending stage in Halifax, having failed to process with PO.funkycredit said:

To be fair I'm doing 2 x £250 transfers. I've tested one but it's still pending. I've heard the PO is locked for first 8 days which is fine so for now I'll leave it with the tester £250 I sent Monday when I opened the PO account.soulsaver said:

Many of us can't get the PO to work... It'll work with Hfax, I'm sure, but getting the PO accounts to accept DC payment of £500 mostly has proved too much for PO systems in my and many others experience. Good if you do.funkycredit said:

I have..... what do you mean?soulsaver said:

I bet you haven't done that yet...funkycredit said:

Can't you have two? I thought it says you can't open if you already hold 2? (I read that as meaning if I've only 1 then I can open a second but if I've got two then I'm ineligible). I was thinking of opening a second for the £5 reward as I'm just moving the debit card spend between post office savings back into other accounts.badger09 said:

A sole Reward accountfunkycredit said:badger09 said:

It was meant in jest.funkycredit said:

Who mentioned every 30 seconds? I've looked twice this week!badger09 said:

I also keep getting the 'something went wrong' message when I try to apply for a new account via app. I'll try via website.colsten said:I just helped a friend with his switch request.

He logged in online and clicked on switch your account. Got "Something went wrong. We had to log you out". So he logged in once more. This time, he didn't get logged out but did not manage to get past the second screen because Halifax did not recognise their own sort code and account number. We double and triple checked - both, the sort code and account number entered were definitely correct.

He then logged into the app and could complete the switch request without problems.

Weird. At least he didn't have to phone them, though.

Wish all you lot who are compulsively checking every 30 seconds to see if your switch incentive has landed, would give it a rest

Anyway, decided against applying for the Ultimate Reward account as it involved me telling blatant lies.

Do you already hold reward accounts?It's trial & error for now in my case. I'll update when I know what's going on and I move the second £250 over.See below. Still hanging in pending.

Not tried it lately as I have a couple of other options but I may waste a few more minutes to see if it's somehow become viable.1 -

Like have your cake and eat it - so NSI debit card gets £5 reward + 1.15% interest.PRAISETHESUN said:

Or you could whack the £5k in a savings account and get some interest as well as the £5 reward for the debit card spend... a have your cake and eat it too kind of thingvixen1500 said:

Should work out to more than £6,25?

Saves messing about having to reclaim tax

PLUS money available to spend if needed

Yes, sounds like the way to goTypically confused and asking for advice1 -

Sorry if previously asked but would transferring £1500 from a Lloyds bank account count towards refunding the monthly fee? I know Coop don't count transfers from (their) Smile bank, for example...0

-

Yes, even transfers from your own Halifax accounts works.1

-

Switch completed yesterday; bonus paid today.

£500 paid via DC to NS&I, cleared today but not as yet updated on tracker.

My partner received her bonus yesterday and was paid three times but Halifax took the extra back later in the day.

It all sounds a bit hit and miss to me.

I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.0 -

My partner has now received the £100 but does not want the benefits. Would there be an issue if my partners account was downgraded to a fee free one. What I'm asking is could they then take the bonus back.

Off subject. I just noticed I was able to post a message without even being signed in to my account.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards