We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Suggestions for a speculative punt?

Comments

-

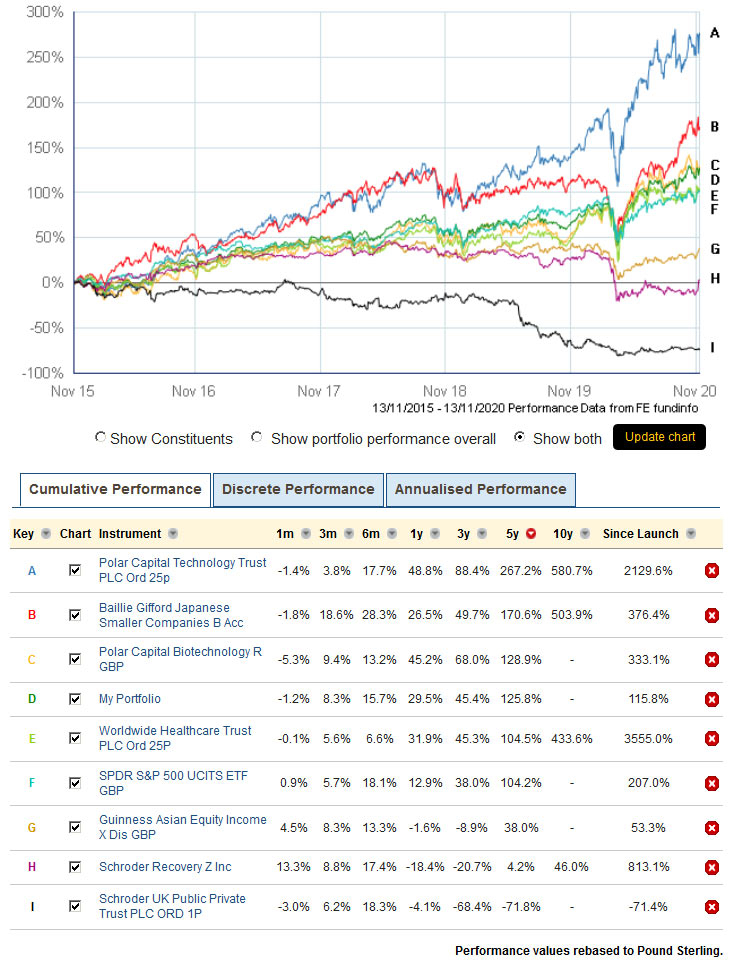

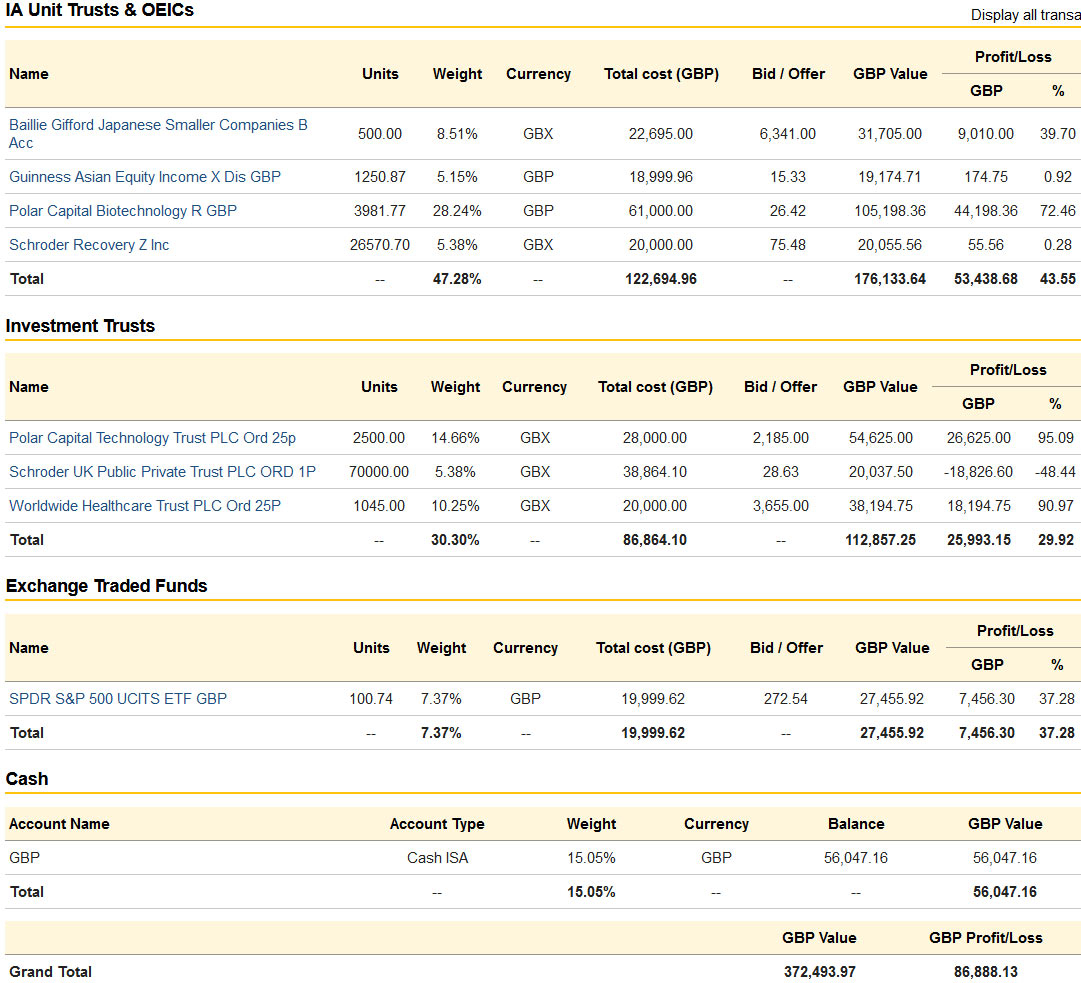

You say that you are easily beating the market with your chosen stocks but the final graph you posted suggests otherwise. Your portfolio is running level with the two healthcare trusts on the graph and the other funds cannot be compared with them. Well done for keeping up with the experts though. Personally, I would never assume that I have any kind of edge on them. Too many unknown unknowns.BrockStoker said:adindas said:The statistics show that in the long run it is only less rthan 10% of fund managers could beat the market "consistantly". I wonder is there anyone here could manage to beat the market from composing a balance portfolio (divesifying in different sectors, market, geograpics, etc)?. But the history has shown even with a balance portfoio, in the market crash you will still get effected.I hae seen many people beat the market significanly by taking the risk "buy low sell high" all the time.But keep remember the capital preservation rule. Never sell at lossWarren Buffett capital preservation rule in invesment: “Rule No. 1: Never lose money. Rule No. 2: Don’t forget rule No. 1”.As you already know, I'm easily beating the market with my portfolio of (mostly biotech stocks). I'm not sure I'd be able to beat the market with a basket of very diversified stocks, primarily because I don't have a good understanding of all sectors/stocks, so I stick mostly to what I know (understanding what you invest in is crucial). Also, in my short time investing in stocks, I have found that it's futile trying to recreate a fund containing many stocks. I simply don't have the resources/time to find/keep an eye on many stocks, so I just concentrate on my "best ideas".That said, I have a more diverse portfolio of funds (although it is still VERY overweight biotech/tech), that also easily beats the market:

The key is understanding the risks. While there are some risks with biotech/tech (the same risks that exist with all other investments - Eg. newbie sees it crashing and makes the mistake of exiting, thereby crystallizing a loss), I don't see most funds like tech/biotech as risky, since people will always need these things. So providing you are confident in your fund manager, have a long enough investing time horizon, and understand the pitfalls/psychology of investing, there is very little risk IMHO. Certainly much less so with funds than stocks.You don't really need a deep understanding of tech (or biotech) to make money in it if you use funds. All you need to know is that people/society will always need tech/biotech. "Risk" is easily mitigated (partially at least) by holding some cash, and taking advantage of dips/crashes. Again, it comes down to psychology. When everyone else is panicking, you can be having a whale of a time, and look forward to a nice crash

The key is understanding the risks. While there are some risks with biotech/tech (the same risks that exist with all other investments - Eg. newbie sees it crashing and makes the mistake of exiting, thereby crystallizing a loss), I don't see most funds like tech/biotech as risky, since people will always need these things. So providing you are confident in your fund manager, have a long enough investing time horizon, and understand the pitfalls/psychology of investing, there is very little risk IMHO. Certainly much less so with funds than stocks.You don't really need a deep understanding of tech (or biotech) to make money in it if you use funds. All you need to know is that people/society will always need tech/biotech. "Risk" is easily mitigated (partially at least) by holding some cash, and taking advantage of dips/crashes. Again, it comes down to psychology. When everyone else is panicking, you can be having a whale of a time, and look forward to a nice crash As for "rule number 1" - of course TRY not to loose money, but in order to beat, you do need to take some "risk". That "risk" is often overblown though, as I eluded to in my words above.The fascists of the future will call themselves anti-fascists.1

As for "rule number 1" - of course TRY not to loose money, but in order to beat, you do need to take some "risk". That "risk" is often overblown though, as I eluded to in my words above.The fascists of the future will call themselves anti-fascists.1 -

You say that you are easily beating the market with your chosen stocks but the final graph you posted suggests otherwise.I should have noted that the chart does not take into account when I bought. For example, Schroder UK Public Private Trust was bought earlier this year, twice, while it was falling. That is my worst performer currently, never the less.Also, the bottom 3 (GHI) make up a relatively small part of my portfolio.Further more, the S&P 500 ETF was bought 12 March.Here is the breakdown:

0 -

Brock, your one-year graph is indeed interesting and shows that your portfolio is performing well. However, I am confused by the three- and five-year versions. If my recollection of your earlier posts is correct, you only started your biotech portfolio at the beginning of Nov '19, so are your longer time-series graphs are based on a back-analysis on what it would have looked like if you had bought these stocks earlier? While an interesting exercise, that would potentially give a false sense of success.

I've been watching SMT for a number of years and always baulked at buying at current prices (big mistake!) but if I was to buy it tonight and then tomorrow back-analyse my current portfolio, I would be a star performer! 1

1 -

Apodemus,I think you are confusing my stocks/shares (started at the end of October last year) with my fund portfolio (above charts) which has been going close to it's current form for 4-5 years.My Japan, recovery, and healthcare funds have all been held longer than 5 years.There is some back-analysis in the 5 year chart/s above, but it's not too far off. Eg. I first bought Polar Capital Biotechnology on Nov 4 2016, and the technology fund was first bought around that time too.Try plugging that date in here:

1 -

"Alibaba (BABA)" is currentlyhaving a dip. Many analysts have recommended a buy signal for this stock. A lot of upside potential. This is just one example.But please do your own due diligence "you take the gain, you take the pain (loss)"I have been keep adding my position on this stock and will sell it back when they are going back to the all time high. The mega cap stock like this could easily go back to the all time high.0

-

My apologies! Sorry to have misconstrued!BrockStoker said:Apodemus,I think you are confusing my stocks/shares (started at the end of October last year) with my fund portfolio (above charts) which has been going close to it's current form for 4-5 years.My Japan, recovery, and healthcare funds have all been held longer than 5 years.There is some back-analysis in the 5 year chart/s above, but it's not too far off. Eg. I first bought Polar Capital Biotechnology on Nov 4 2016, and the technology fund was first bought around that time too.Try plugging that date in here: 2

2 -

The flagship listing of Ant Group was pulled at the last minute in both Hong Kong and China due to regulatory concerns. Seems that Jack Ma has been pulled back into line. A timely reminder as to who runs China, and that it remains far removed from being an open democracy. Alibaba holds a sizable interest in Ant Group.adindas said:"Alibaba (BABA)" is currentlyhaving a dip. Many analysts have recommended a buy signal for this stock. A lot of upside potential. This is just one example.

Political risk needs to be factored in when investing. Just like all the other kinds, of which there are many.3 -

This might be another jump for Tesla.S&P Dow Jones Indices announced on Monday that Tesla will join the S&P 500 effective prior to trading on Monday, Dec. 21.

0 -

Thrugelmir said:

The flagship listing of Ant Group was pulled at the last minute in both Hong Kong and China due to regulatory concerns. Seems that Jack Ma has been pulled back into line. A timely reminder as to who runs China, and that it remains far removed from being an open democracy. Alibaba holds a sizable interest in Ant Group.adindas said:"Alibaba (BABA)" is currentlyhaving a dip. Many analysts have recommended a buy signal for this stock. A lot of upside potential. This is just one example.

Political risk needs to be factored in when investing. Just like all the other kinds, of which there are many.Yes that is a concern, Indeed political risk need to be factored. I am fully aware of the Ant group connection with Alibaba and the delay of IPO listing.Ant group is also the stock I have been watching.But for Alibaba I am taking that risk considering that a vast majority of analysts have sent a buy signal.Analysts must have taken this political risk before making that judgement.With the current price, they are also undervalued based on analysis estimated price.They are megacap companies so the risk to go under administration is considerably low.0 -

Analysts will report what they have been told, and paid, to.adindas said:Thrugelmir said:

The flagship listing of Ant Group was pulled at the last minute in both Hong Kong and China due to regulatory concerns. Seems that Jack Ma has been pulled back into line. A timely reminder as to who runs China, and that it remains far removed from being an open democracy. Alibaba holds a sizable interest in Ant Group.adindas said:"Alibaba (BABA)" is currentlyhaving a dip. Many analysts have recommended a buy signal for this stock. A lot of upside potential. This is just one example.

Political risk needs to be factored in when investing. Just like all the other kinds, of which there are many.Yes that is a concern, Indeed political risk need to be factored. I am fully aware of the Ant group connection with Alibaba and the delay of IPO listing.Ant group is also the stock I have been watching.But for Alibaba I am taking that risk considering that a vast majority of analysts have sent a buy signal.Analysts must have taken this political risk before making that judgement.With the current price, they are also undervalued based on analysis estimated price.They are megacap companies so the risk to go under administration is considerably low.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards