We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Suggestions for a speculative punt?

Comments

-

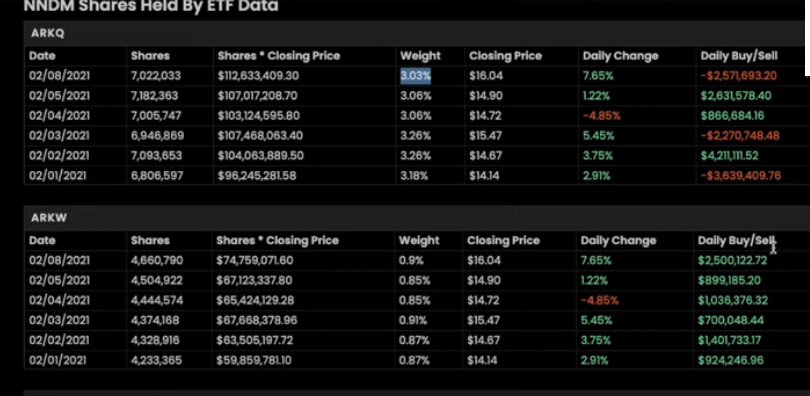

If you are holding NNDM (Nano Dimension) just be aware of they are making a huge share offering soon @ $13.70. This will bring a huge pressure on the share price and share dilution in the short term. For that reason, if you track it, ARK Invest has started selling/buying their position little by little since a few days ago. Share offering to grow a business is a very good for a business of a growth company. So highly likely it will be back to long time high again when making a dip later.

I need to make people aware of this share offering as I mentioned this stock in this forum a while ago when they were still a penny stock. This is one of my cast Iron stock as I have been buying it since there were still a penny stock. But what you do not want to see is your profit to plunge when you could actually use this opportunity to bag profit. IMO It is a very good chance you will have another entry point at a lower price when they are making a dip due to the impact of share offering. So to get the best of both world you might want to sell part of your position while the price is still high and buy back when they are making a dip later. Please do you own due diligence.

2 -

Block Chain. I mention this sector among other sectors such as Genome, EV/ESG, Cannabis/Marijuana, Gambling/Sport betiitng, Rare Earth Materials that will grow much faster compared to other sectors.

Tesla will accept bitcoin as a payment method. PayPal is already in forefront accepting Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. Some big business might follow.

If you do not want to invest in Crypto, the best way to catch this momentum is by investing in Block Chain. The current block chain currently mining bitcoin and on the spot is MARA, RIOT. Many of Blockchain stocks have been making a nice run. I am awaiting a good entry point for these stocks.

0 -

ARK Invest has been buying this stock PyroGenesis Canada Inc. (PYRNF).

I just have a look of it, It is the future of burning metal, build weapon with extreme higher temperature, replacing coal. As we all know coal wil be phased out.

I am waiting my broker to add this stock to be traded. As soon as it is available I will be looking for a good entry point.

https://uk.finance.yahoo.com/quote/PYRNF?p=PYRNF&.tsrc=fin-srch 4

https://www.otcmarkets.com/stock/PYRNF/overview 5It is an OTC penny stock for a reason, so please do your own DDs and be fully understand the risk/reward before throwing your money in it.

Those who are expecting to get the same level of risk with government bonds, Vanguard LifeStrategy funds (VLS), Vanguard Target retirement funds, S&P 500 index funds, or the like please stay away from this stock. Do not even touch it with a barge pole.

0 -

CCIV (Churchill Capital IV)

I mentioned this stock before and the potential Merger with Lucid Motors a Luxurious EV maker. When the merger with Lucid motors is confirmed, boom it is going to the Moon.

There is already evidenced in FOMO (fear of Missing Out)

CCIV (Churchill Capital IV) jumps 13% amid hopes it's nearing a deal to acquire Lucid Motors

Those who enter the game earlier Tail or Head either case you still win. Merger confirmed, it will increase your profitability, merger failed you still win as you will liquidate your position with a smaller profit. Playing a SPAC near NAV in sexy industry (E.g EV/ESG, FinTech, etc), good management team with big enterprise value is the name of the game. Keep in mind in SPAC stock before the merger date you are protected by the floor price of $10.

0 -

Surely the possible merger is built into the price now no?adindas said:CCIV (Churchill Capital IV)

I mentioned this stock before and the potential Merger with Lucid Motors a Luxurious EV maker. When the merger with Lucid motors is confirmed, boom it is going to the Moon.

There is already evidenced in FOMO (fear of Missing Out)

CCIV (Churchill Capital IV) jumps 13% amid hopes it's nearing a deal to acquire Lucid Motors

Those who enter the game earlier Tail or Head either case you still win. Merger confirmed, it will increase your profitability, merger failed you still win as you will liquidate your position with a smaller profit. Playing a SPAC near NAV in sexy industry (E.g EV/ESG, FinTech, etc), good management team with big enterprise value is the name of the game. Keep in mind in SPAC stock before the merger date you are protected by the floor price of $10.

0 -

Retireby40 said:

Surely the possible merger is built into the price now no?adindas said:CCIV (Churchill Capital IV)

I mentioned this stock before and the potential Merger with Lucid Motors a Luxurious EV maker. When the merger with Lucid motors is confirmed, boom it is going to the Moon.

There is already evidenced in FOMO (fear of Missing Out)

CCIV (Churchill Capital IV) jumps 13% amid hopes it's nearing a deal to acquire Lucid Motors

Those who enter the game earlier Tail or Head either case you still win. Merger confirmed, it will increase your profitability, merger failed you still win as you will liquidate your position with a smaller profit. Playing a SPAC near NAV in sexy industry (E.g EV/ESG, FinTech, etc), good management team with big enterprise value is the name of the game. Keep in mind in SPAC stock before the merger date you are protected by the floor price of $10.

I do not think so, but I might be wrong. But certainly is risky at the curent price. Lastweek volume was very big. You might want to wait until there is a pull back anf find a good entry point and sell it before the merger and reenter again later at a lower price when there is a good entry point.Alternatively wait until the merger gone through. Normally the price will drop after the merger date due to a lof of people are taking profitSome analysts predict Lucid Motor is one that could compete with Tesla. Although I myself think it might be only true the EV itself but not in technology. Telsa has built an ecosystem of EV.

0 -

Something happened around the 7th January. I'm assuming it was possibly the talk of a merger. It goes from around $10 to almost $40 in the space of just over a month. Thats not exactly normal and probably has the merger potential built in. If the merger happens may not increase much and if it doesn't go through the price will drop.adindas said:Retireby40 said:

Surely the possible merger is built into the price now no?adindas said:CCIV (Churchill Capital IV)

I mentioned this stock before and the potential Merger with Lucid Motors a Luxurious EV maker. When the merger with Lucid motors is confirmed, boom it is going to the Moon.

There is already evidenced in FOMO (fear of Missing Out)

CCIV (Churchill Capital IV) jumps 13% amid hopes it's nearing a deal to acquire Lucid Motors

Those who enter the game earlier Tail or Head either case you still win. Merger confirmed, it will increase your profitability, merger failed you still win as you will liquidate your position with a smaller profit. Playing a SPAC near NAV in sexy industry (E.g EV/ESG, FinTech, etc), good management team with big enterprise value is the name of the game. Keep in mind in SPAC stock before the merger date you are protected by the floor price of $10.

I do not think so, but I might be wrong. But certainly is risky at the curent price. Lastweek volume was very big. You might want to wait until there is a pull back anf find a good entry point and sell it before the merger and reenter again later at a lower price when there is a good entry point.Alternatively wait until the merger gone through. Normally the price will drop after the merger date due to a lof of people are taking profitSome analysts predict Lucid Motor is one that could compete with Tesla. Although I myself think it might be only true the EV itself but not in technology. Telsa has built an ecosystem of EV.0 -

Retireby40 said:

Something happened around the 7th January. I'm assuming it was possibly the talk of a merger. It goes from around $10 to almost $40 in the space of just over a month. Thats not exactly normal and probably has the merger potential built in. If the merger happens may not increase much and if it doesn't go through the price will drop.adindas said:Retireby40 said:

Surely the possible merger is built into the price now no?adindas said:CCIV (Churchill Capital IV)

I mentioned this stock before and the potential Merger with Lucid Motors a Luxurious EV maker. When the merger with Lucid motors is confirmed, boom it is going to the Moon.

There is already evidenced in FOMO (fear of Missing Out)

CCIV (Churchill Capital IV) jumps 13% amid hopes it's nearing a deal to acquire Lucid Motors

Those who enter the game earlier Tail or Head either case you still win. Merger confirmed, it will increase your profitability, merger failed you still win as you will liquidate your position with a smaller profit. Playing a SPAC near NAV in sexy industry (E.g EV/ESG, FinTech, etc), good management team with big enterprise value is the name of the game. Keep in mind in SPAC stock before the merger date you are protected by the floor price of $10.

I do not think so, but I might be wrong. But certainly is risky at the curent price. Lastweek volume was very big. You might want to wait until there is a pull back anf find a good entry point and sell it before the merger and reenter again later at a lower price when there is a good entry point.Alternatively wait until the merger gone through. Normally the price will drop after the merger date due to a lof of people are taking profitSome analysts predict Lucid Motor is one that could compete with Tesla. Although I myself think it might be only true the EV itself but not in technology. Telsa has built an ecosystem of EV.That is the time when the rumours come out and the news that Saudi Prince has a lot of stake in Lucid Motors. Whether the possible merger is built into the price now, yes to some extend but not fully realised. As any merger rumours in stock, a rumour is still a rumour. When there a DA that is where the real hike in the stock price will happen on that day and then will cool down moving sideways until the next catalysts.

I am a contrarian trader/investor, when I see the price spike on that day, I will sell part of my position and wait a few weeks to re-enter when the price has dropped and moved sideways and sell it again when close to merger date. If you observe it is almost the case for all of hype stocks.

But keep in mind I never suggest people to buy/hold/sell stock on this MSE, especially at this price level. So do it with your own risk. I bought it earlier at much lower price than the current price, so tail or head I still win although with much lower profit.

0 -

The urban myth that hold you back

There a lot of myths in this MSE forum and the news a myth that let you to believe that retailer investor like you is very hard to beat the market, S&P 500, FTSE100, VLS100% equity constantly.

I was in that league before. But after learning from various sources since a few months ago and see evidence from various sources, I do not believe that myth anylonger.

These three guys Dave Hanson, Chris Camillo & Jordan McClain are inspirational, documenting their journeys and will open your eyes.

https://www.youtube.com/watch?v=pa6N5DO7UfY&t=493s What Professional Wall Street "Insiders" Don't Want You To Know

https://www.youtube.com/c/DumbMoneyLIVE/videos

I do not follow their videos regularly but after watching a few of their videos I believe these guys are genuine and not a con / scammer. There are a lot of YouTubers, people in Investing sites producing the same videos, documents and later ask you to subscribe and pay for it. These guys do not make money asking people to buy their courses, selling spots on Patreon, to lure you to buy their funds, pump and dumb the stocks etc.. Certainly, they make small money monetizing from advertising. But keep in mind there are three of them, that advert money are too small for three of them compare to what they have made from their own investment.

0 -

Its not hard to find something that will increase over a short period of time. The problem most face is knowing when to buy and when to sell.adindas said:The urban myth that hold you back

There a lot of myths in this MSE forum and the news a myth that let you to believe that retailer investor like you is very hard to beat the market, S&P 500, FTSE100, VLS100% equity constantly.

I was in that league before. But after learning from previous sources since a few months ago and see evidence from various sources, I do not believe that myth any longer.

These three guys Dave Hanson, Chris Camillo & Jordan McClain are inspirational, documenting their journeys and will open your eyes.

https://www.youtube.com/watch?v=pa6N5DO7UfY&t=493s What Professional Wall Street "Insiders" Don't Want You To Know

https://www.youtube.com/c/DumbMoneyLIVE/videos

I do not follow their videos regularly but after watching a few of their videos I believe these guys are genuine and not a con / scammer. There are a lot of YouTubers, people in Investing sites producing the same videos, documents and later ask you to subscribe and pay for it. These guys do not make money asking people to buy their courses, selling spots on Patreon, to lure you to buy their funds, pump and dumb the stocks etc.. Certainly, they make small money monetizing from advertising. But keep in mind there are three of them, that advert money are too small for three of them compare to what they have made from their own investment.

With all the noise coming out of NIO and all the hype it seemed a perfect opportunity to invest. Which I did. I bought around $48 and added abit more around 53-54. On average my buy is about $51. That was before NIO day which after seen it rise to $65. Now I'm in it for the long term as I believe the idea is good and that there will be more electric cars and with China pushing EVs there's potential. U didn't sell but could have easily sold at $65 as everyone knew that after NIO day and the dust settled that it would go back down again.

I really should have sold at $65 and bought back at $52-53. Then watched it rise again to around $60. That said I'm not an expert and only learning but there's lot of opportunities to make a few quid. Likewise there's plenty to make a loss. You just have to do your homework.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards