We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Suggestions for a speculative punt?

Comments

-

Good luck with that approach to investing.adindas said:Thrugelmir said:You didn't actually answer my question. Dot Com boom all over again. Detachment from reality. Revenue is not profit.What is more important for you as an investor, the company makes profit or you make profit ? Each to their own but to me I choose the latter. 2

2 -

See Tesla has quietly reduced the upgrade cost of its infotainment upgrade by 40%. Following the request by the NHTSA to recall 159,000 older cars due to defective touchscreens. Tesla's treatment of it's customers with regards to warranty issues appear as abrasive as Musk himself sometimes, hard work.NottinghamKnight said:

Not sure where you get those numbers from (made up?), anecdotally on these forums batteries are reported as losing maybe 1-2% a year or so, can't see a battery being replaced in most circumstances more than once a decade, by which time it is questionable whether is economic - the consensus on the motoring forum is that 14 years is the typical lifespan of a car by the way.BrockStoker said:If I were to buy a used EV then:Initial purchase: 5kReplacement battery after 4 years: 8k?Replacement battery after a further 8 years: 7k?So about 20K for 20 years. The numbers would probably be worse if I bought a new EV to begin with.I think I can get about 20 years out of my current car for 5K, and since I do not drive all the time, fuel costs probably would not add more than another 1 or 2K over that time I would guess.The difference is significant. Having said that, if my investments do well, then I could probably stomach the cost of an EV in 5-10 years time.

You haven't stated you mileage again but it must be miniscule, far fewer parts on an EV to go wrong and maintenance of an older ICE car can get very expensive/ uneconomic. A timing belt change is required every what 5-7 years at a cost of maybe £500, clutches need replacing over the timespan you suggest, brakes far more frequently. Do some per mile costs and it might be of use, you are just guessing as it is. Diesel and petrol costs will continue to rise but maybe electricity may become taxed as EVs become more common too.

I thought I was a cynic about EV but guess I'm just a realist.0 -

Thrugelmir said:

Good luck with that approach to investing.adindas said:Thrugelmir said:You didn't actually answer my question. Dot Com boom all over again. Detachment from reality. Revenue is not profit.What is more important for you as an investor, the company makes profit or you make profit ? Each to their own but to me I choose the latter.

Thanks for wish me luck. What you probably do not realise is that what I and many other investors have been doing focusing more on growth companies rather than profitability have been tested for many years by many fund managers.

The debate between investing for growth in disruptive innovation vs Value investing has been going on and on. Each approach offer advantages and disadvatages. What is insane is that there are still some people as you see from some comments on these thread keep doing the same thing again and again but expecting to get a different result.

Most people focusing on growth in disruptive innovation are also doing Value investing with a very mature well-established companies for stability and especially for dividend, but expect a much lower return.

The bubble burst could come anytime but when it comes it will be entirely different to what you saw with dot.com bubble in 1995. Nowadays important information about the stock market in real time is easily accessible. When it comes (if it ever happened) it will not happen in one day, you will always have time to prepare for it or to quit entirely. Also there are a lot of tools avalaible to prevent to wipe out your entire gain such as to set up a stop loss.

0 -

Thrugelmir said:

Good luck with that approach to investing.adindas said:Thrugelmir said:You didn't actually answer my question. Dot Com boom all over again. Detachment from reality. Revenue is not profit.What is more important for you as an investor, the company makes profit or you make profit ? Each to their own but to me I choose the latter.

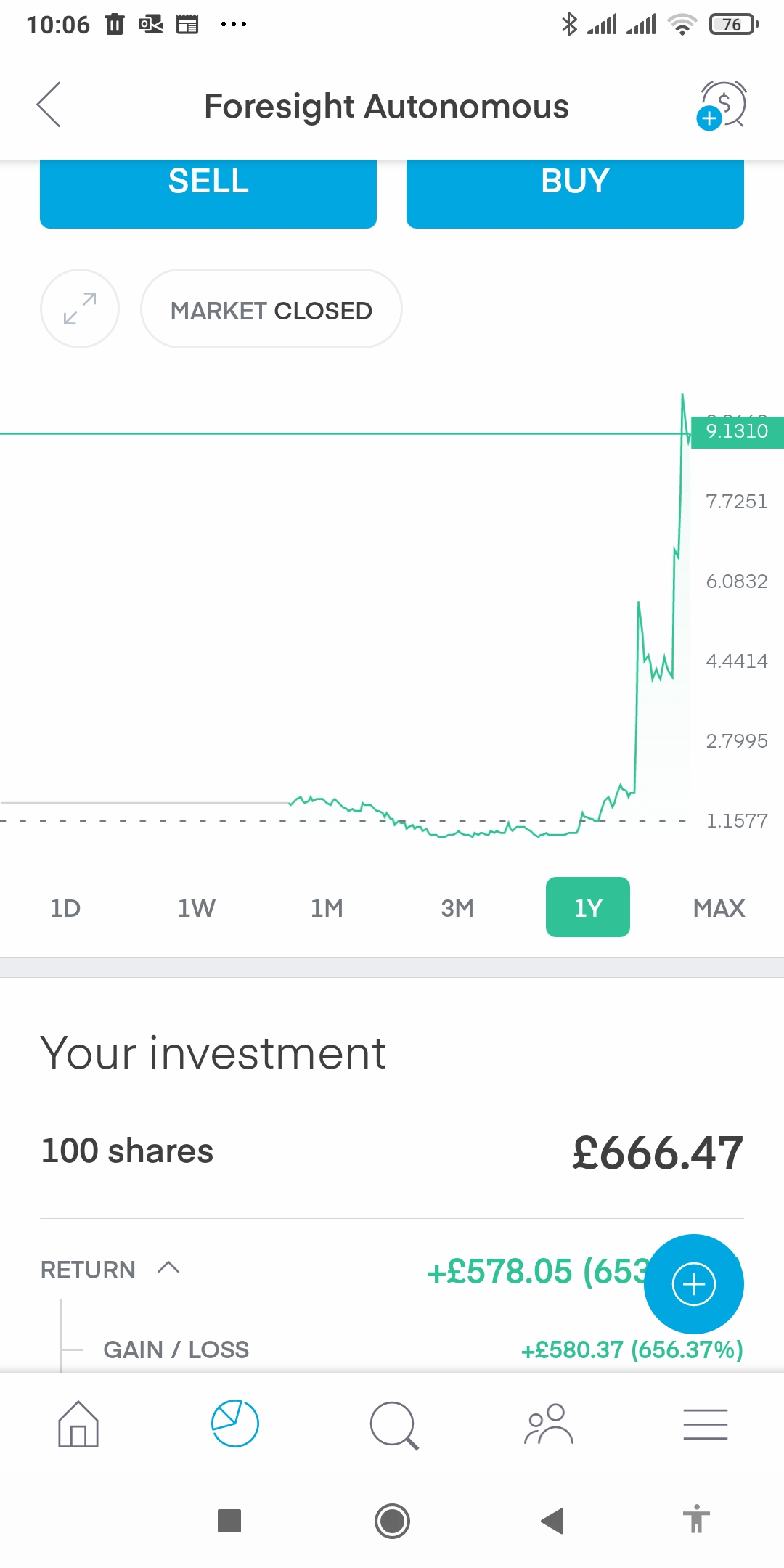

Example of the power of investing for Growth in Disruptive innovation rather than Value investing

This is one example from my own print screen, Foresight Autonomous (FRSX) the stock I bought back on Dec 1, 2020 and now 653.75%. Could you ever get that by focusing only on Value investing?

I also already mentioned this stock on my previous posting.

Unlike Biotech stock, in many cases the technology stock which was a penny stock will keep growing once they have taken of, especially when they keep offering a share to grow the business. You have seen a lot of examples the current monster in technology used to be a penny stock.

One of the technological developments that you might want to keep your eye on in the next few years is Israeli technology. There are a lot of innovations and inventions.

Some of Israeli technology (with cautious and carefully picked) are hot stocks. ARK invest has formed an ETF dedicated to this area, ARK Israel Innovative Technology ETF (IZRL). Most of these companies have not made profits because they keep using the money to expand and to grow the business. Please do your own due dilligenece if you want to invest in this stock. You take your own gain you take your own loss.

0 -

Most likely the combination of the taxpayer, and companies that can make a profit charging people to refuel their cars. I was simply pointing out one example that is already making use of the fact that electricity is already distributed nationally.Thrugelmir said:

Who is going to fund the infrastructure required? Street lights are only going to provide a limited number of on street parking bays.kinger101 said:

street lighting can be retrofitted to provide charging points.benbay001 said:Can i just clarify on the points i made above about electric cars, that im not saying electric doesnt have a future.

Im merely saying that IMHO we dont have the infrastructure built, nor are we planning to build the infrastructure to support a meaning % of cars running on electric.

Personally i feel the future will leap over electric and go straight to hydrogen, with hybrid cars being a very efficient compromise for the short term.

https://www.fleeteurope.com/en/new-energies/europe/analysis/1300-street-lights-converted-ev-chargers-london?a=JMA06&t[0]=Siemens&t[1]=Ubitricity&t[2]=electric vehicle&t[3]=charging infrastructure&t[4]=London&curl=1

Anyone who can park their car at home can already get a charging point installed for around £500.

https://www.edfenergy.com/electric-cars/home-charger

Cars spend most of their life parked. Parked a short distance from a copper wire."Real knowledge is to know the extent of one's ignorance" - Confucius0 -

Thrugelmir said:

Good luck with that approach to investing.adindas said:Thrugelmir said:You didn't actually answer my question. Dot Com boom all over again. Detachment from reality. Revenue is not profit.What is more important for you as an investor, the company makes profit or you make profit ? Each to their own but to me I choose the latter.

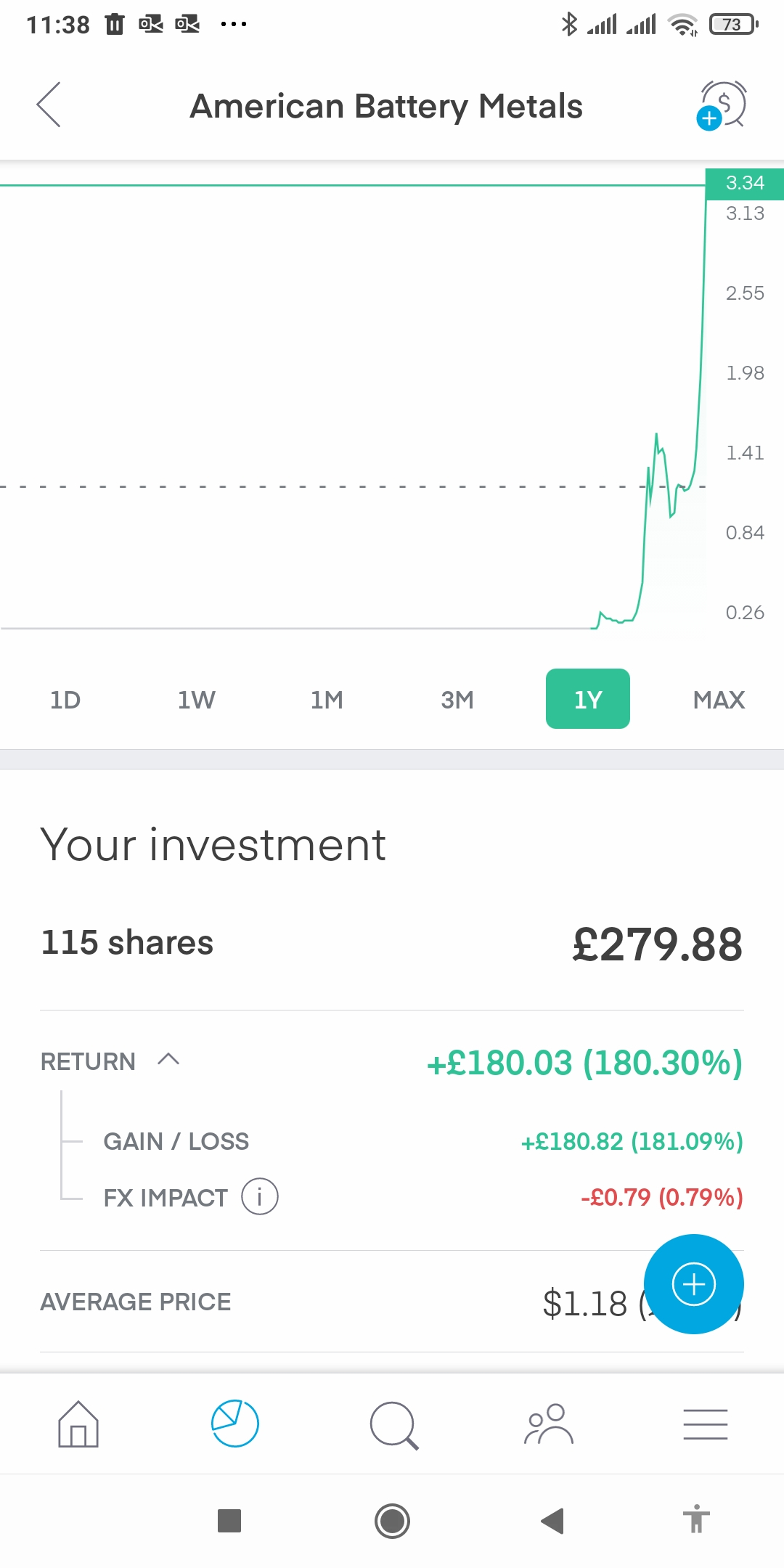

Another example the power of investing in disruptive innovation, directly from my print screen.

American Battery Metals (ABML). I bought this share on January 11, 2021, up 181.09% in just two weeks. You will not be surprised if you could notice that they are currently in demand and not many companies are doing what they are doing.

I have also mentioned a few stock related to space traveling and satelite technologies such as $SPCE, $SRAC, $NPA (will merge w AST & Science). Have a look how they perform.Do not expect these companies will make profit for a few years to come.

Please do your own due dilligence if you want to invest in this stock. You take your own gain you take your own loss.

0 -

Yes, well "guestimates". Feel free to plug in some more realistic numbers.NottinghamKnight said:

Not sure where you get those numbers from (made up?)BrockStoker said:If I were to buy a used EV then:Initial purchase: 5kReplacement battery after 4 years: 8k?Replacement battery after a further 8 years: 7k?So about 20K for 20 years. The numbers would probably be worse if I bought a new EV to begin with.I think I can get about 20 years out of my current car for 5K, and since I do not drive all the time, fuel costs probably would not add more than another 1 or 2K over that time I would guess.The difference is significant. Having said that, if my investments do well, then I could probably stomach the cost of an EV in 5-10 years time.

0 -

I have done based on responses in the motoring forum which mostly relates to Renault/ Nissan rather than Tesla, plenty of data from both sides there, I don't think your guesstimates are even that. You would need to work out your actual costs and that likely for an EV either on an annual or per mile basis and go from there. We'll pretty much all be driving EV in a couple of decades but I see no reason to be a fairly early adopter, better to wait and see but that approach has to be based on the best available information and your own situation.BrockStoker said:

Yes, well "guestimates". Feel free to plug in some more realistic numbers.NottinghamKnight said:

Not sure where you get those numbers from (made up?)BrockStoker said:If I were to buy a used EV then:Initial purchase: 5kReplacement battery after 4 years: 8k?Replacement battery after a further 8 years: 7k?So about 20K for 20 years. The numbers would probably be worse if I bought a new EV to begin with.I think I can get about 20 years out of my current car for 5K, and since I do not drive all the time, fuel costs probably would not add more than another 1 or 2K over that time I would guess.The difference is significant. Having said that, if my investments do well, then I could probably stomach the cost of an EV in 5-10 years time.0 -

Adinas, how many companies do you have in total?

Its all very good showing a company that is up 180% and another that is up 600%, but if you own 20 or more stocks its all rather moot.

On top of this, what possible metric are you using to decide if these companies are buys or sells?

Every stock, no matter how good the company, has to have a price which if it reached it today, it would become a sell.

If you cant tell me what that price would be, and how you came to that figure then you are simply speculator IMHO.Im A Budding Neil Woodford.0 -

benbay001 said:Adinas, how many companies do you have in total?

Its all very good showing a company that is up 180% and another that is up 600%, but if you own 20 or more stocks its all rather moot.

On top of this, what possible metric are you using to decide if these companies are buys or sells?

Every stock, no matter how good the company, has to have a price which if it reached it today, it would become a sell.

If you cant tell me what that price would be, and how you came to that figure then you are simply speculator IMHO.Many of my stock’s picks are in this thread you could have a look how they perform now. How I find the company, simple, research.

I also explain my strategy in this thread. Any investment will involve some level of speculation. Even it is a well-diversified well-known index or Mutual fund it is still a speculative and it is not immune to market crash. The only one I will consider not a speculative is saving account or government bond. The thing you will need to consider is the risk/reward, upside/downside. if you are happy with saving (Government Bond) Risk=No risk/reward=1%PA nothing wrong with it. It is your money you are investing anyway.

As I explain in my previous message, I was like many peole here on this MSE a few months ago, before the lock down last year 2020. I kept chasing the RSAs. In the past there was no incentive to look for another alternative as you could easily get return 5% pa in RSA no risk at all. Also I was relying on my passive investment, a well known index/mutual fund in SIIP.

The one I was showing were penny stocks for a long holding as they have taken off; it might turn to become a monster, so I am not going to sell it. I put a stop loss if the fall 50% (or the like) and I will re-enter again if possible. If not, I will look for another opportunity. About a few months ago I put my Printscreen of my stocks pick on thin thread. But it keep changing as I am also trading it.How to decide, buy/hold/sell, simple I am using a technical analysis to enter and to exit. I already explain in this thread. I can’t tell anyone at what price to enter or to exit as I am not a financial adviser. I am also using the fundamental analysis.

For SPACs stock I sell if before the merger date in many cases. Many of them are making me 50%+ in just a few months. A few of them are 200%+. I also already explain my strategy for SPAC stock in this thread.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards