We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Comparing the biggest US companies to the biggest UK companies.

Comments

-

But Americans don't neglect the stock market for housing whereas we do for some reason. Also America is large enough where you can have some pockets like San Francisco or Beverly Hills with expensive housing but the UK is freaking tiny, we don't have the land for people to drive up markets.Voyager2002 said:

Your analysis misses a few things:CreditCardChris said:The difference between the UK and the US is the US population invests heavily in businesses while the UK population invests heavily in real estate. The former creates jobs, business ventures, innovation and competition which are all healthy for an economy. The latter creates a highly inflated housing market which diverts money that would otherwise be spent or invested in the markets to home owners and 73% of home owners are aged between 65 and 74.

Firstly, the people in the UK who own property almost invariably have pension funds, generally worth rather more than their properties. To a great extent these pension savings are invested in businesses, generally through stock markets;

Secondly, people who are buying with a mortgage need some way of paying off that mortgage. Although repayment mortgages are fashionable now, until a decade ago large numbers of home-buyers would have used an 'Endowment': they would have been paying into an investment product that again used equities and was intended to mature at the point when the mortgage needed repaying.

Thirdly, Americans are also very interested in buying property. If you think London is expensive, try San Francisco! Or even New York.

And before you say it's just London, no it's not, pretty much everywhere south of Leicester (with the exception of wales) is off limits to most sole mortgage buyers. That's 1/3 of the entire country!

0 -

From the data I could find, there seems to be very little difference between home ownership, rental, and private rental, between the US and UK. So I'm not sure where the idea of the UK's obsession about investing in property comes from.(Nearly) dunroving3

-

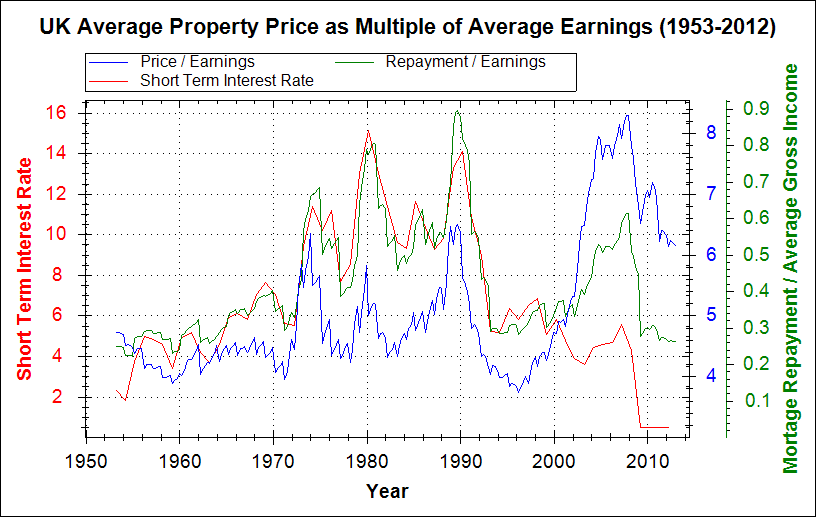

CreditCardChris said:But what do we expect from boomers who bought their houses when they were 1/6th the price just 20 years ago.Oh you're one of those morons. Generation X were the ones who were buying 20 years ago.I think you mean when they bought their houses in the 70s and 80s only to see interest rates hit double digits and mortgage repayments be more than a month's take home pay? Rent and mortgage payments are at a fairly historic low currently, being around 30% average of gross monthly pay.

3 -

For all the stats can be misread and misinterpreted, FWIW I think the OP is on the right track.

If investments show better returns from sitting on your hands, it beats working; or thinking.

Politics trumps economics, and falling house prices are to be avoided, at any cost by any Govt, but especially the Party Of Landlords: Conservatives.

Hence this week’s Stamp Duty boost.1 -

Must demur from dunroving’s last claim also; pretty sure rent in Tumbleweed, Wyoming is not governed by LHA.

And LHA - by whichever formula it is arrived at-

is the foundation of the housing Mkt in the U.K.

If the meanest hovel can be rented out at £500 pm, that underpins the whole market. Because the meanest hovel is a x of that £500pm.

Better than working or thinking.0 -

I'm struggling a bit to understand what you mean, but from owning and renting in the US, the relationship between cost of renting and cost of "owning" (paying mortgage) is pretty similar to the UK. I lived in what you would characterise as Podunk USA, and "cheap" rents there compared to rent in cheap areas of the UK (proportional to salary, and proportional to mortgage on the same property).Diplodicus said:Must demur from dunroving’s last claim also; pretty sure rent in Tumbleweed, Wyoming is not governed by LHA.

And LHA - by whichever formula it is arrived at-

is the foundation of the housing Mkt in the U.K.

If the meanest hovel can be rented out at £500 pm, that underpins the whole market. Because the meanest hovel is a x of that £500pm.

Better than working or thinking.

But the thread is straying from the original topic, related to company investment in the UK vs US. I stick by my original main comment, that in the US, investing in companies has been the norm because most pensions are defined contribution. It's not a Baby Boomer vs Generation whatever issue. I only delved into the property side of things because the OP seems to think this explains why the UK boomers don't invest in companies.(Nearly) dunroving0 -

Dunroving, you’ve lived in locales many inhabit only in daydreams! I bow to your first-hand experience; I lazily assumed that, because there is much less welfare in the USA, there would be no “floor” equivalent to LHA which props up the base of the property market in the U.K. Hence, many more affordable rental properties in America. Sadly not, from your report.

Yes, housing is an abstraction from the thread title but CCC s point, that a country fixated on the price of its property loses something in the way of opportunity and innovation, rings true to me.

That seems to be changing here. A people obsessed with the value of their houses now seem to have become obsessed with the value of their pensions. Go figure.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards