We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

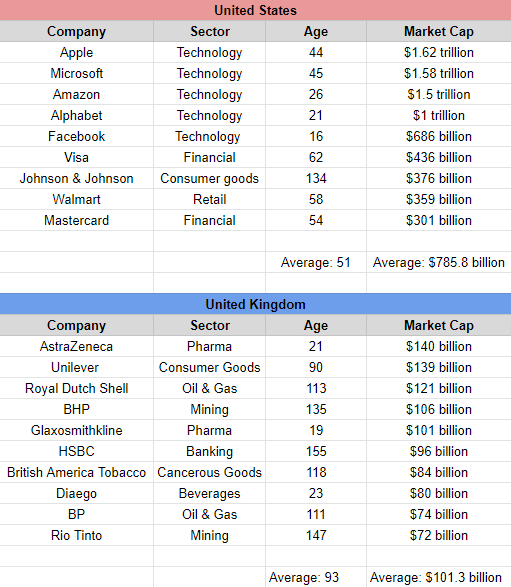

Comparing the biggest US companies to the biggest UK companies.

CreditCardChris

Posts: 344 Forumite

Where did we go wrong? Oh I know, we sat on the sidelines through the biggest revolution since the industrial revolution and ignored technology.

Our top 10 companies are nearly twice as old and worth 1/7th as much. Last week Apple's market cap gained $135billion, nearly the entire market cap of our richest company... in 1 week!

It's hard to pin point why the UK failed to get in on the tech boom but one things absolutely certain, the UK cannot rely on dinosaur industries to prop up our economy anymore. There has to come a time when we realise this and start pushing out technology of our own? Boris wants to "build build build" infrastructure, well maybe he should do something to incentivise people to create technology companies? Maybe reduce the cost of computer science degrees by 50%. Maybe give tech startups (subject to approval of course) a 0% interest loan which is forgivable if the company goes bankrupt. Maybe slash the corporate tax rate for existing and new tech companies from 18% to 5% to encourage more people to create tech companies.

I dunno I'm just spit balling but the world is becoming more and more digital, more and more tech orientated and if we don't get in on it soon we're going to be royally f'ed. There are 4 new industries on the horizon and those are AI, bio-engineering, space mining and alternative energies, all require a solid tech foundation which we don't have. You know the saying about companies that fail to evolve end up failing to exist? Well that can happen to countries too you know, not cease to exist in the literal sense, but cease to exist on the world stage.

2

Comments

-

Yes, you are almost up to 70 threads of spitballing now, and in quite a few of them you've been 'spitballing' the same points about how terrible the UK 'dinosaurs' are, to whoever would listen and generally disregarding any responses that don't accord with your world view.CreditCardChris saidI dunno I'm just spit balling

Back in your 'finally opened a S&S ISA' thread in February your opening two posts included:I decided to go with a US 500 index tracker as the UK market has been a complete shambles for with old (oil, banking and insurance) dinosaur companies at the helm for far too long.Why on Earth would I invest in this country when it has absolutely no drive to create powerhouse companies anymore?In April you had your "Why do people discourage investing only in the US markets" thread where you couldn't believe that people would really want to put their money anywhere other than the US, believing it to be the best and only place worth investing in.

Then by June on the 'Is my portfolio too risky' thread you were askingCurrently I'm investing in the Vanguard Global All Cap Index which is weighted 59.8% America, 17% Europe, 12.5% Pacific, 10.1% Emerging and 0.6% other.You got a variety of answers, but maybe not as many as you'd have had if you didn't keep coming back to repetitive themes so more people were interested in getting involved in the discussion.

But now I'm thinking this is too risky and I should play it safer and go with the Vanguard S&P500 index fund instead? I feel very uneasy investing in countries which have lagged behind the US for the last 100 years.

The world just isn't capable of keeping up with the US

And now one month on you want to set up another thread talking about how the US is so great and how the UK could never create a high growth company, and presumably still won't listen to any answers that don't pat you on the back and say wow this Credit Card Chris has been right all along.

So, another month, another CCC thread about why you should only invest in the US because it's the only place that has AI and space mining on the public markets and every other part of the world including the UK is doomed.

Not sure I have the energy to keep participating but I expect someone will pick up the baton.

13 -

Actually this thread isn't about "why you should invest in the US", but more as a discussion of where it all went horribly wrong for the UK? From the mighty British Empire to a mid tier country with a sub par economy. To be honest if it can happen to us then perhaps you're right and in 40 years the US economy could fall off the perch and India, China and Brazil take over and rule the world. Our with old in with the new kinda thing.bowlhead99 said:

Yes, you are almost up to 70 threads of spitballing now, and in quite a few of them you've been 'spitballing' the same points about how terrible the UK 'dinosaurs' are, to whoever would listen and generally disregarding any responses that don't accord with your world view.CreditCardChris saidI dunno I'm just spit balling

Back in your 'finally opened a S&S ISA' thread in February your opening two posts included:I decided to go with a US 500 index tracker as the UK market has been a complete shambles for with old (oil, banking and insurance) dinosaur companies at the helm for far too long.Why on Earth would I invest in this country when it has absolutely no drive to create powerhouse companies anymore?In April you had your "Why do people discourage investing only in the US markets" thread where you couldn't believe that people would really want to put their money anywhere other than the US, believing it to be the best and only place worth investing in.

Then by June on the 'Is my portfolio too risky' thread you were askingCurrently I'm investing in the Vanguard Global All Cap Index which is weighted 59.8% America, 17% Europe, 12.5% Pacific, 10.1% Emerging and 0.6% other.You got a variety of answers, but maybe not as many as you'd have had if you didn't keep coming back to repetitive themes so more people were interested in getting involved in the discussion.

But now I'm thinking this is too risky and I should play it safer and go with the Vanguard S&P500 index fund instead? I feel very uneasy investing in countries which have lagged behind the US for the last 100 years.

The world just isn't capable of keeping up with the US

And now one month on you want to set up another thread talking about how the US is so great and how the UK could never create a high growth company, and presumably still won't listen to any answers that don't pat you on the back and say wow this Credit Card Chris has been right all along.

So, another month, another CCC thread about why you should only invest in the US because it's the only place that has AI and space mining on the public markets and every other part of the world including the UK is doomed.

Not sure I have the energy to keep participating but I expect someone will pick up the baton.

Who knows... I guess it's just the natural cycle of things. There's only a certain amount of time you can remain dominant for, British Empire, Roman Empire, Persian Empire etc. They all ended up falling.0 -

It’s a good question Chris..

ARM was the only U.K. company punching in big tech. . we sold it (the Leave vote helped as it made the shares 10% cheaper for nothing).

The pandemic has accelerated trends in business; the higher relative values of tech stocks are not going to “rebalance” as we get back to normal life. If you’re not invested now, you are late to the feast.

bowlhead’s response looks a bit testy: play the ball, not the man imho.0 -

I am invested, I have been since February just as the market started to crash, my first buy was like -12% from the highs and I've been buying every month.Diplodicus said:It’s a good question Chris..

ARM was the only U.K. company punching in big tech. . we sold it (the Leave vote helped as it made the shares 10% cheaper for nothing).

The pandemic has accelerated trends in business; the higher relative values of tech stocks are not going to “rebalance” as we get back to normal life. If you’re not invested now, you are late to the feast.

bowlhead’s response looks a bit testy: play the ball, not the man imho.

He seems a bit testy because in all fairness I have made a lot of threads bashing the UK economy and he and many others have replied to them and are probably getting a bit frustrated with me by now but still I feel like it's important to find the root cause of why the UK refused to get involved (apart from 1 company) in the biggest revolution since the industrial revolution. If we can sit on the sidelines for the tech revolution, will we also sit on the sidelines for the AI, space and bioengineering revolutions too? That is a truly frighting prospect.

Imagine we're still plodding along with oil, banks, insurance and earth mining while the US is fusing brains with silicon chips, harvesting rare materials from planets and asteroids in space and created ground breaking AI / robotics that can perform brain surgery.-1 -

What a pointless thread. Akin to a kid looking at the Football League tables, then choosing to follow and support Liverpool. Rather than their home town of Scunthorpe.

7 -

Speak for yourself. Personally I’m still hoping my investments in Amphoras will be back up any day now.CreditCardChris said:

Actually this thread isn't about "why you should invest in the US", but more as a discussion of where it all went horribly wrong for the UK? From the mighty British Empire to a mid tier country with a sub par economy. To be honest if it can happen to us then perhaps you're right and in 40 years the US economy could fall off the perch and India, China and Brazil take over and rule the world. Our with old in with the new kinda thing.bowlhead99 said:

Yes, you are almost up to 70 threads of spitballing now, and in quite a few of them you've been 'spitballing' the same points about how terrible the UK 'dinosaurs' are, to whoever would listen and generally disregarding any responses that don't accord with your world view.CreditCardChris saidI dunno I'm just spit balling

Back in your 'finally opened a S&S ISA' thread in February your opening two posts included:I decided to go with a US 500 index tracker as the UK market has been a complete shambles for with old (oil, banking and insurance) dinosaur companies at the helm for far too long.Why on Earth would I invest in this country when it has absolutely no drive to create powerhouse companies anymore?In April you had your "Why do people discourage investing only in the US markets" thread where you couldn't believe that people would really want to put their money anywhere other than the US, believing it to be the best and only place worth investing in.

Then by June on the 'Is my portfolio too risky' thread you were askingCurrently I'm investing in the Vanguard Global All Cap Index which is weighted 59.8% America, 17% Europe, 12.5% Pacific, 10.1% Emerging and 0.6% other.You got a variety of answers, but maybe not as many as you'd have had if you didn't keep coming back to repetitive themes so more people were interested in getting involved in the discussion.

But now I'm thinking this is too risky and I should play it safer and go with the Vanguard S&P500 index fund instead? I feel very uneasy investing in countries which have lagged behind the US for the last 100 years.

The world just isn't capable of keeping up with the US

And now one month on you want to set up another thread talking about how the US is so great and how the UK could never create a high growth company, and presumably still won't listen to any answers that don't pat you on the back and say wow this Credit Card Chris has been right all along.

So, another month, another CCC thread about why you should only invest in the US because it's the only place that has AI and space mining on the public markets and every other part of the world including the UK is doomed.

Not sure I have the energy to keep participating but I expect someone will pick up the baton.

Who knows... I guess it's just the natural cycle of things. There's only a certain amount of time you can remain dominant for, British Empire, Roman Empire, Persian Empire etc. They all ended up falling.

0 -

So you've just confirmed your own bias then. You support the UK's failing economy because it's your country, instead of being honest and realising its pitfalls? Typical boomer, buries his head in the sand and pretends the UK economy isn't a complete dumpster fire because he's getting his little 4% a year retirement dividend instead of 12% a year from the S&P.Thrugelmir said:What a pointless thread. Akin to a kid looking at the Football League tables, then choosing to follow and support Liverpool. Rather than their home town of Scunthorpe.

Perhaps if we don't talk about it nobody will realise 🤫0 -

Never make assumptions as an investor. Cardinal sin.CreditCardChris said:

So you've just confirmed your own bias then. You support the UK's failing economy because it's your country, instead of being honest and realising its pitfalls? Typical boomer, buries his head in the sand and pretends the UK economy isn't a complete dumpster fire because he's getting his little 4% a year retirement dividend instead of 12% a year from the S&P.Thrugelmir said:What a pointless thread. Akin to a kid looking at the Football League tables, then choosing to follow and support Liverpool. Rather than their home town of Scunthorpe.

Perhaps if we don't talk about it nobody will realise 🤫4 -

Thrugelmir said:What a pointless thread. Akin to a kid looking at the Football League tables, then choosing to follow and support Liverpool. Rather than their home town of Scunthorpe.CreditCardChris said:

So you've just confirmed your own bias then. You support the UK's failing economy because it's your country, instead of being honest and realising its pitfalls? Typical boomer, buries his head in the sand and pretends the UK economy isn't a complete dumpster fire because he's getting his little 4% a year retirement dividend instead of 12% a year from the S&P.

Perhaps if we don't talk about it nobody will realise 🤫If you live in Scunthorpe you can get a season ticket for you and your sons to go and watch the local team at the stadium down the road with 4000 fellow local fans for under £400 a year. Or you can instead look at the league table and see that Liverpool must be the very best team to support, and commit to spending 3x the amount of money on your season tickets, and packing the kids up in the car for a 240 mile round trip every other weekend, oh and a multi-decade long waiting list to actually get your season ticket (if they ever re-open the list) by which time your kids have grown up and moved out.If you do the latter, and someone points out that the 3x price, the 240 mile round trip and the 20 year waiting list to actually get the season ticket are probably not going to combine to help you enjoy those Saturdays any more than if you had supported your local team, and they note that unlike the other 91 clubs in the EFL and Premiership, Liverpool's position in the league table is unlikely to rise next year... you can just shout back at them, "ok, boomer", because you clearly have it all figured out. You can start a thread online about how you are a fan of Liverpool and how it's better to be a fan of Liverpool than any other team, and that it always will be, because everything else is a dumpster fire.5 -

CreditCardChris said:

So you've just confirmed your own bias then. You support the UK's failing economy because it's your country, instead of being honest and realising its pitfalls? Typical boomer, buries his head in the sand and pretends the UK economy isn't a complete dumpster fire because he's getting his little 4% a year retirement dividend instead of 12% a year from the S&P.Thrugelmir said:What a pointless thread. Akin to a kid looking at the Football League tables, then choosing to follow and support Liverpool. Rather than their home town of Scunthorpe.

Perhaps if we don't talk about it nobody will realise 🤫Well don’t worry you’ll get your 12% so you are fine.As seems to be a common theme for your threads when someone doesn’t agree with you you get weirdly aggressive.No one is actually disagreeing with your point on the US vs the UK. However you seem to act as though the world economy is made up of the US and the UK - since these are the only countries mentioned in your numerous threads.No one is suggesting that investing more in the US than the UK is a bad idea, in fact you would find many many threads where people who propose just investing in the FTSE100 and are told this is a bad idea.What you don’t seem to understand is investing in solely the US (or more precisely 500 US companies) is more risky than investing in ~50% US and ~50% rest of world. That has been explained multiple times so I’m not going to bother.The question I have is - over the last 10 years the S and P 500 has some good performers and some less good performers - since you believe only the US is the future - why not just invest in Apple and the other ‘top performers’ - why dilute them with the other remaining companies?4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards