We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Comparing the biggest US companies to the biggest UK companies.

Comments

-

Diplodicus said:It’s a good question Chris..

ARM was the only U.K. company punching in big tech. . we sold it (the Leave vote helped as it made the shares 10% cheaper for nothing).

The pandemic has accelerated trends in business; the higher relative values of tech stocks are not going to “rebalance” as we get back to normal life. If you’re not invested now, you are late to the feast.

bowlhead’s response looks a bit testy: play the ball, not the man imho.

But "we" as in the UK did not sell it, the owners (shareholders) sold it. Some of those had no choice if they only had a very small holding but the UK did not own ARM it just happened to be based in Cambridge UK as opposed to Cambride US.

Some of the shareholders would not have even been UK based. Investors at the individual shareholding level (ignoring tracker funds) are buying companies that they believe will provide a good ROI either via future profits or via a sale.

So CCC - did you own shares in ARM and put your money where your mouth is to back a UK based tech company? What UK based tech companies are you invested in now?1 -

The main reason that there is not a big tech industry in the UK is that there is not sufficient demand for high tech output in the UK, the demand is in the US and far East and they are not easy markets to crack for small UK companies.

I worked for a couple of early stage tech companies in Cambridge in the early 2000s - getting traction in the US market was a real struggle. US companies tend to buy from US companies because they are familiar with the name and where they are based which provides comfort and trust, suprisingly parochial outlook in many cases, Not Invented Here alive and well.

Both companies ended up being sold to larger US organisations and the brightest guys (UK born and educated) from those startups are now working in SIlicon Valley for Microsoft, Google and the like with at least 2 in very senior positions in R&D setting the future direction for their products.

0 -

If you can't get into the World's biggest market then you're on a hiding to nothing. Given decent proportion of American exceptionlism is reliant upon a version of globalisation dominated by a protectionist US it's not an easy market to crack.

That's why they've got a chap sending rockets into space and we're celebrating a bloke who makes crap vacuum cleaners.0 -

The problem for me is I don't believe this is an isolated incident. I believe the tech boom was just the first in a series of future industries that we neglect to get involved in in a serious manner. There are 4 emerging industries on the horizon, AI, space travel / mining, bio-engineering and alternative energies and I don't see us stepping up creating these companies.AlanP_2 said:The main reason that there is not a big tech industry in the UK is that there is not sufficient demand for high tech output in the UK, the demand is in the US and far East and they are not easy markets to crack for small UK companies.

I worked for a couple of early stage tech companies in Cambridge in the early 2000s - getting traction in the US market was a real struggle. US companies tend to buy from US companies because they are familiar with the name and where they are based which provides comfort and trust, suprisingly parochial outlook in many cases, Not Invented Here alive and well.

Both companies ended up being sold to larger US organisations and the brightest guys (UK born and educated) from those startups are now working in SIlicon Valley for Microsoft, Google and the like with at least 2 in very senior positions in R&D setting the future direction for their products.

We don't even have the ability to launch a rocket let alone take people into space or mine asteroids...

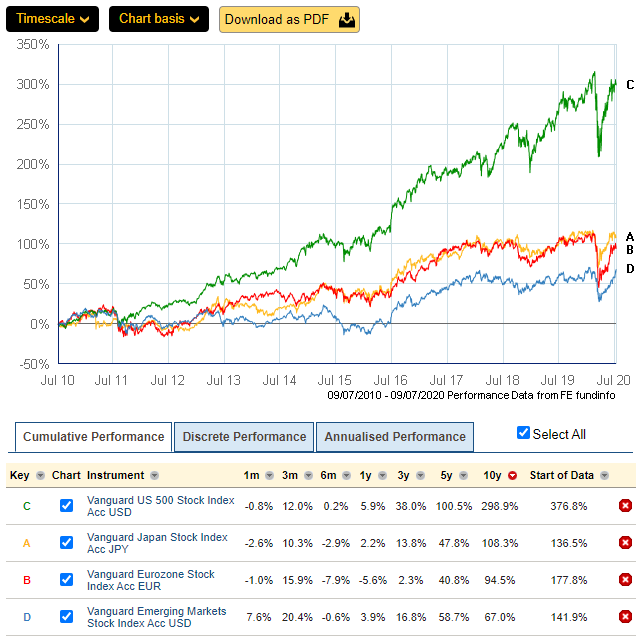

Look at this chart

That separation of the US from the rest of the world isn't a coincidence, it's not just some economic cycle. It's a result of them embracing technology and realising how critical it is to growing a country and its future tech based industries.0 -

If you were to remove just a small group of giant companies from that chart then the results would be quite different. I am not sure that the US market is actually growing much more than the rest of the world - just a few big tech names.3

-

The US has fallen from accounting for 21% of global GDP to around 15% in the past 20 years................2

-

CreditCardChris said:Where did we go wrong? Oh I know, we sat on the sidelines through the biggest revolution since the industrial revolution and ignored technology.No we didn't ignore it, in fact for a great deal of it we led it bringing out some of the biggest advancements there have been - Geim and Novosolov's work on graphene at Manchester University, arguably one of the most important discoveries there has been, won them the Nobel for Physics in 2010.Apple, the richest tech company in the world don't actually really invent that much, they innovate. They take existing technology and find better ways to use/implement it - hell even the new CPU they're designing is based on an ARM design.What did happen is that successful British companies got bought out by foreign companies who could do so simply because of the economies of scale and the fact the only thing shareholders care about is the money in their pocket. A perfect example of a world leading/beating tech company in it's field which was British and was bought out by a much wealthier foreign entity is the aforementioned ARM.

1 -

To be fair, SoftBank have been very smart not to compromise ARM’s reputation for neutrality; it does not discriminate between customers and that’s one reason why their chips are so widely used.

It’s not a question of any individual “putting his money where his mouth is”; if strategic companies are reckoned to help the national interest, it is for Govt rather to protect them.

0 -

UK investors have preferred property to direct ownership of companies for some years.Diplodicus said:

It’s not a question of any individual “putting his money where his mouth is”; if strategic companies are reckoned to help the national interest, it is for Govt rather to protect them.0 -

And this is a major problem for two reasons.Thrugelmir said:

UK investors have preferred property to direct ownership of companies for some years.Diplodicus said:

It’s not a question of any individual “putting his money where his mouth is”; if strategic companies are reckoned to help the national interest, it is for Govt rather to protect them.

1. It causes the price of houses to rise which does absolutely nothing but hinders the economy as people are forced to spend less as they need money to pay the extortionately high rents that home owners are charging.

2. It causes companies to stagnant as they have less profits to invest into other ventures.

Take Bezos for example, he has slowly been selling his Amazon shares over the years to fund new projects like Blue Origin, this would never be possible if the stock price remained at $30 forever. He still has 11% though so plenty of money to continue exploring more opportunities and can afford to take risks. UK companies cannot afford to take risks as one wrong investment and their fragile business collapses.

But what do we expect from boomers who bought their houses when they were 1/6th the price just 20 years ago. They are used to making fat gains on property so they're just going to stick to what they know. Meanwhile it's left to generation z to drag us out of this slump.

To be honest I think once all the boomers die and the oldest person alive was born in 1970, that'll probably be when we start shifting our focus from boomer investments (property, oil, banks, insurance etc) and into tech.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards