We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Comparing the biggest US companies to the biggest UK companies.

Comments

-

Doesn't sound as if you ever been involved in either the funding of and raising capital for early stage companies. More angels than you might imagine who commit 6 figure sums.CreditCardChris said:

Take Bezos for example, he has slowly been selling his Amazon shares over the years to fund new projects like Blue Origin, this would never be possible if the stock price remained at $30 forever. He still has 11% though so plenty of money to continue exploring more opportunities and can afford to take risks. UK companies cannot afford to take risks as one wrong investment and their fragile business collapses.Thrugelmir said:

UK investors have preferred property to direct ownership of companies for some years.Diplodicus said:

It’s not a question of any individual “putting his money where his mouth is”; if strategic companies are reckoned to help the national interest, it is for Govt rather to protect them.0 -

Let's not forget the fact that the Federal Reserve has been pumping Trillions of Dollars into the US financial system, which has inevitably found its way into the equity values of the S&P 500. Yes the UK has been doing this to, but not to the same sheer scale.0

-

The world looking on in disbelief at the unbreakable strength of the nasdaq.

I guess technology is profitable huh, who would have ever guessed.0 -

This book gives some explanation, and IMHO things have only got worse since it was published:

https://link.springer.com/book/10.1007/978-1-349-06381-9

0 -

But surely there are baby boomers in the US, also?CreditCardChris said:

And this is a major problem for two reasons.Thrugelmir said:

UK investors have preferred property to direct ownership of companies for some years.Diplodicus said:

It’s not a question of any individual “putting his money where his mouth is”; if strategic companies are reckoned to help the national interest, it is for Govt rather to protect them.

1. It causes the price of houses to rise which does absolutely nothing but hinders the economy as people are forced to spend less as they need money to pay the extortionately high rents that home owners are charging.

2. It causes companies to stagnant as they have less profits to invest into other ventures.

Take Bezos for example, he has slowly been selling his Amazon shares over the years to fund new projects like Blue Origin, this would never be possible if the stock price remained at $30 forever. He still has 11% though so plenty of money to continue exploring more opportunities and can afford to take risks. UK companies cannot afford to take risks as one wrong investment and their fragile business collapses.

But what do we expect from boomers who bought their houses when they were 1/6th the price just 20 years ago. They are used to making fat gains on property so they're just going to stick to what they know. Meanwhile it's left to generation z to drag us out of this slump.

To be honest I think once all the boomers die and the oldest person alive was born in 1970, that'll probably be when we start shifting our focus from boomer investments (property, oil, banks, insurance etc) and into tech.

As a "boomer" myself, who does not fit your characterisation at all, I find your explanation simplistic (especially the portrayal of Generation Z as the saviours of the stock market). A big difference between the UK and US is the much larger number of defined contribution pensions in the UK. US employees have to learn to be investment-savvy. UK employees are only now having to learn these lessons, as defined benefits pensions transition out of the scene.

I'm minded of Mark Twain's comment that when he was 14, his father was so stupid he hated to have him around. By the time he reached 21, he was astonished at how much his father had learned.(Nearly) dunroving0 -

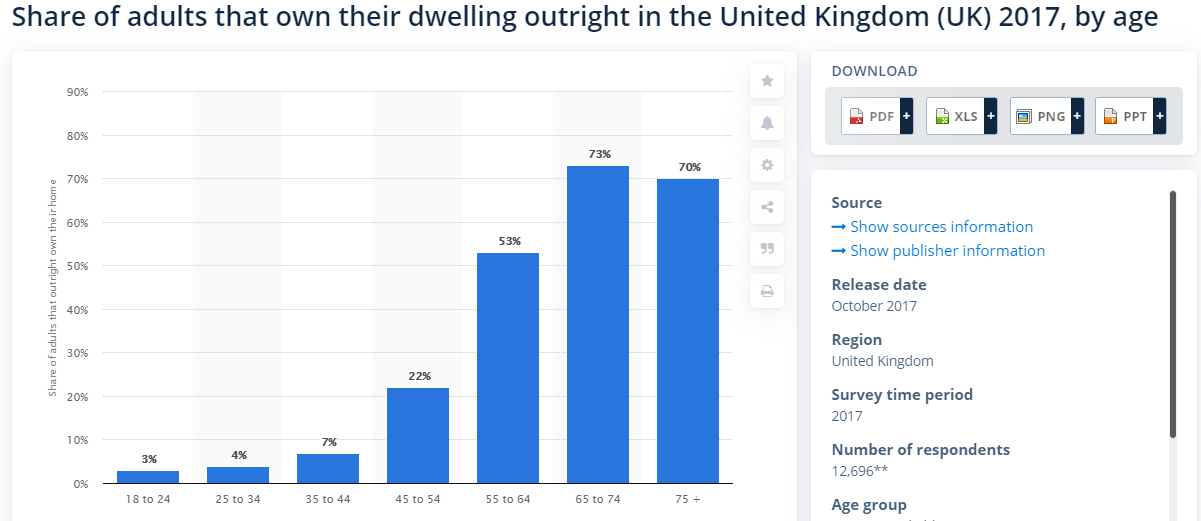

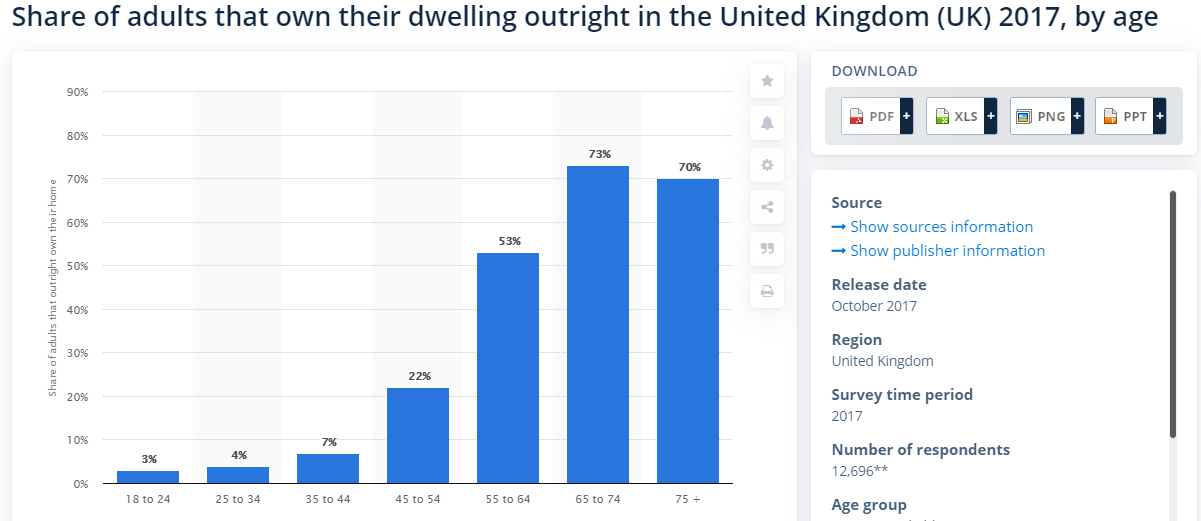

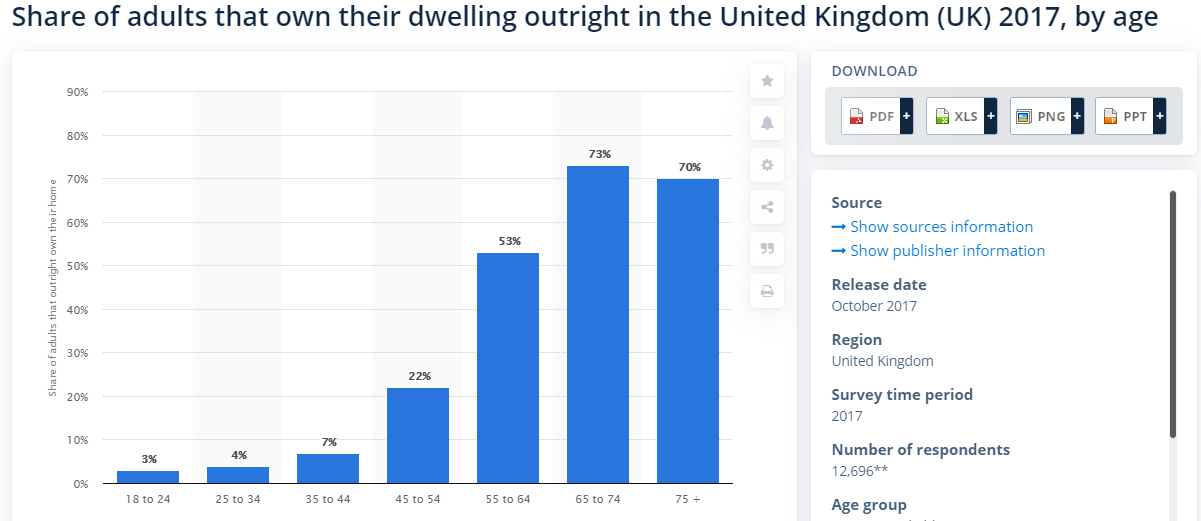

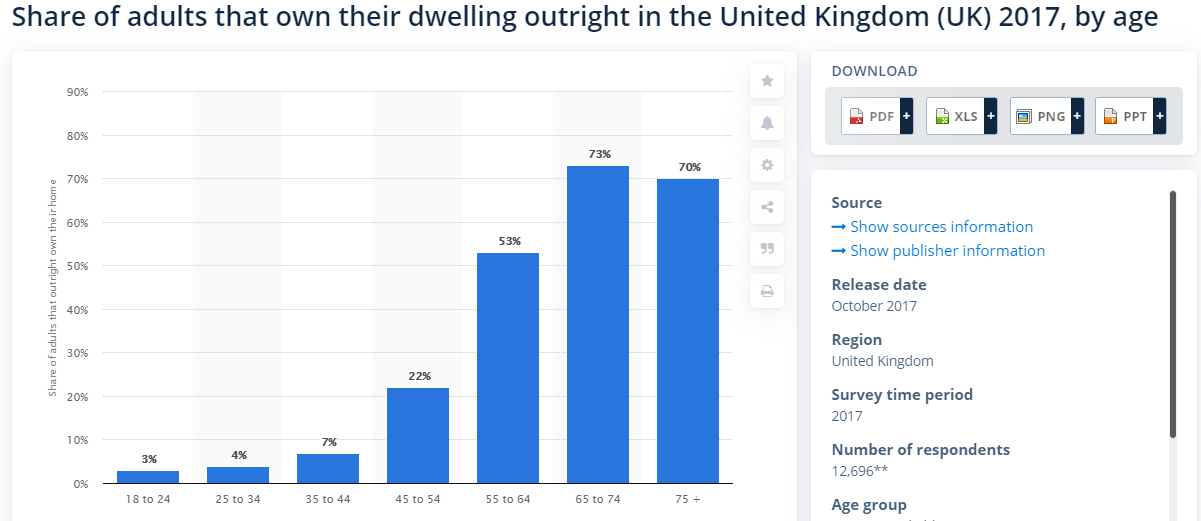

The difference between the UK and the US is the US population invests heavily in businesses while the UK population invests heavily in real estate. The former creates jobs, business ventures, innovation and competition which are all healthy for an economy. The latter creates a highly inflated housing market which diverts money that would otherwise be spent or invested in the markets to home owners and 73% of home owners are aged between 65 and 74.dunroving said:

But surely there are baby boomers in the US, also?CreditCardChris said:

And this is a major problem for two reasons.Thrugelmir said:

UK investors have preferred property to direct ownership of companies for some years.Diplodicus said:

It’s not a question of any individual “putting his money where his mouth is”; if strategic companies are reckoned to help the national interest, it is for Govt rather to protect them.

1. It causes the price of houses to rise which does absolutely nothing but hinders the economy as people are forced to spend less as they need money to pay the extortionately high rents that home owners are charging.

2. It causes companies to stagnant as they have less profits to invest into other ventures.

Take Bezos for example, he has slowly been selling his Amazon shares over the years to fund new projects like Blue Origin, this would never be possible if the stock price remained at $30 forever. He still has 11% though so plenty of money to continue exploring more opportunities and can afford to take risks. UK companies cannot afford to take risks as one wrong investment and their fragile business collapses.

But what do we expect from boomers who bought their houses when they were 1/6th the price just 20 years ago. They are used to making fat gains on property so they're just going to stick to what they know. Meanwhile it's left to generation z to drag us out of this slump.

To be honest I think once all the boomers die and the oldest person alive was born in 1970, that'll probably be when we start shifting our focus from boomer investments (property, oil, banks, insurance etc) and into tech.

As a "boomer" myself, who does not fit your characterisation at all, I find your explanation simplistic (especially the portrayal of Generation Z as the saviours of the stock market). A big difference between the UK and US is the much larger number of defined contribution pensions in the UK. US employees have to learn to be investment-savvy. UK employees are only now having to learn these lessons, as defined benefits pensions transition out of the scene.

I'm minded of Mark Twain's comment that when he was 14, his father was so stupid he hated to have him around. By the time he reached 21, he was astonished at how much his father had learned.

I'm not making this up...

So to all the boomers who invested in property creating an inflated housing market and a depressing stock market which has affected young people beyond measure, I just want to say cheers!

Maybe one day when we stop putting more value on property than we do on businesses we'll be able to get this country back on track.0 -

Hmmm, I don't think this disagrees from my post. I suggested a reason WHY in the UK there has been a greater focus on "investing in property" (your term), which from your explanation I take to mean "paying off the mortgage". In the US, people invest more in businesses ("stocks and bonds"; equities) because they are more familiar with them, by necessity, because in general that's the sort of pension they have over there. It's this, rather than a boomer generation phenomenon, that explains the difference. Perhaps it makes you feel better to blame the people rather than the financial context.CreditCardChris said:

The difference between the UK and the US is the UK population invests heavily in businesses while the UK population invests heavily in real estate. The former creates jobs, business ventures, innovation and competition which are all healthy for an economy. The latter creates a highly inflated housing market which diverts money that would otherwise be spent or invested in the markets to home owners and 73% of home owners are aged between 65 and 74.dunroving said:

But surely there are baby boomers in the US, also?CreditCardChris said:

And this is a major problem for two reasons.Thrugelmir said:

UK investors have preferred property to direct ownership of companies for some years.Diplodicus said:

It’s not a question of any individual “putting his money where his mouth is”; if strategic companies are reckoned to help the national interest, it is for Govt rather to protect them.

1. It causes the price of houses to rise which does absolutely nothing but hinders the economy as people are forced to spend less as they need money to pay the extortionately high rents that home owners are charging.

2. It causes companies to stagnant as they have less profits to invest into other ventures.

Take Bezos for example, he has slowly been selling his Amazon shares over the years to fund new projects like Blue Origin, this would never be possible if the stock price remained at $30 forever. He still has 11% though so plenty of money to continue exploring more opportunities and can afford to take risks. UK companies cannot afford to take risks as one wrong investment and their fragile business collapses.

But what do we expect from boomers who bought their houses when they were 1/6th the price just 20 years ago. They are used to making fat gains on property so they're just going to stick to what they know. Meanwhile it's left to generation z to drag us out of this slump.

To be honest I think once all the boomers die and the oldest person alive was born in 1970, that'll probably be when we start shifting our focus from boomer investments (property, oil, banks, insurance etc) and into tech.

As a "boomer" myself, who does not fit your characterisation at all, I find your explanation simplistic (especially the portrayal of Generation Z as the saviours of the stock market). A big difference between the UK and US is the much larger number of defined contribution pensions in the UK. US employees have to learn to be investment-savvy. UK employees are only now having to learn these lessons, as defined benefits pensions transition out of the scene.

I'm minded of Mark Twain's comment that when he was 14, his father was so stupid he hated to have him around. By the time he reached 21, he was astonished at how much his father had learned.

I'm not making this up...

So to all the boomers who invested in property creating an inflated housing market and a depressing stock market which has affected young people beyond measure, I just want to say cheers!

Maybe one day when we stop putting more value on property than we do on businesses we'll be able to get this country back on track.

All you have done is repeat your statement THAT in the UK there has been a greater focus on "investing in property" and continue blaming boomers for the mess that Generation X, Y, and Z ride in on on their white horses and rescue.

(BTW, I think you meant to say, "the US population invests heavily in businesses ..." in your first sentence.(Nearly) dunroving0 -

Yeah it was a typo, I've corrected it now.dunroving said:

Hmmm, I don't think this disagrees from my post. I suggested a reason WHY in the UK there has been a greater focus on "investing in property" (your term), which from your explanation I take to mean "paying off the mortgage". In the US, people invest more in businesses ("stocks and bonds"; equities) because they are more familiar with them, by necessity, because in general that's the sort of pension they have over there. It's this, rather than a boomer generation phenomenon, that explains the difference. Perhaps it makes you feel better to blame the people rather than the financial context.CreditCardChris said:

The difference between the UK and the US is the UK population invests heavily in businesses while the UK population invests heavily in real estate. The former creates jobs, business ventures, innovation and competition which are all healthy for an economy. The latter creates a highly inflated housing market which diverts money that would otherwise be spent or invested in the markets to home owners and 73% of home owners are aged between 65 and 74.dunroving said:

But surely there are baby boomers in the US, also?CreditCardChris said:

And this is a major problem for two reasons.Thrugelmir said:

UK investors have preferred property to direct ownership of companies for some years.Diplodicus said:

It’s not a question of any individual “putting his money where his mouth is”; if strategic companies are reckoned to help the national interest, it is for Govt rather to protect them.

1. It causes the price of houses to rise which does absolutely nothing but hinders the economy as people are forced to spend less as they need money to pay the extortionately high rents that home owners are charging.

2. It causes companies to stagnant as they have less profits to invest into other ventures.

Take Bezos for example, he has slowly been selling his Amazon shares over the years to fund new projects like Blue Origin, this would never be possible if the stock price remained at $30 forever. He still has 11% though so plenty of money to continue exploring more opportunities and can afford to take risks. UK companies cannot afford to take risks as one wrong investment and their fragile business collapses.

But what do we expect from boomers who bought their houses when they were 1/6th the price just 20 years ago. They are used to making fat gains on property so they're just going to stick to what they know. Meanwhile it's left to generation z to drag us out of this slump.

To be honest I think once all the boomers die and the oldest person alive was born in 1970, that'll probably be when we start shifting our focus from boomer investments (property, oil, banks, insurance etc) and into tech.

As a "boomer" myself, who does not fit your characterisation at all, I find your explanation simplistic (especially the portrayal of Generation Z as the saviours of the stock market). A big difference between the UK and US is the much larger number of defined contribution pensions in the UK. US employees have to learn to be investment-savvy. UK employees are only now having to learn these lessons, as defined benefits pensions transition out of the scene.

I'm minded of Mark Twain's comment that when he was 14, his father was so stupid he hated to have him around. By the time he reached 21, he was astonished at how much his father had learned.

I'm not making this up...

So to all the boomers who invested in property creating an inflated housing market and a depressing stock market which has affected young people beyond measure, I just want to say cheers!

Maybe one day when we stop putting more value on property than we do on businesses we'll be able to get this country back on track.

All you have done is repeat your statement THAT in the UK there has been a greater focus on "investing in property" and continue blaming boomers for the mess that Generation X, Y, and Z ride in on on their white horses and rescue.

(BTW, I think you meant to say, "the US population invests heavily in businesses ..." in your first sentence.

We don't have to fix it, we can just keep piling on and take over from where you guys left off. That's to say forget investing in UK businesses and just keep buying the hell out of property. However property returns less than the stock market (when people actually invest in it) so I'd prefer to see a shift away from housing and back to stocks.

And paying off your mortgage is fine, it's expected... However what's not expected is going to the bank, taking out a £250,000 loan secured against your now fully paid off house and getting 5 buy to let mortgages and renting them out. I understand why people do it because it generates a guaranteed income which is very important to boomers as they retire. But this then takes those 5 houses off the market to young people who actually want to buy a house but can't afford them because boomers snapped them all up.

Forcing us to rent for often significantly above average prices. Not all of us have parents who own homes we can live in, or spouses to split the rent with. Maybe I am repeating myself and I don't know the fundamental reason why the UK population is obsessed with property instead of stocks but what I do know is favouring investing in property over businesses is detrimental to the UK economy in almost every way.

1 -

You see, there you go again with the "you guys" did this and that, "forcing us" to do that, "not all of us have" this and that. The only part of your post I find makes sense is when you say, "Maybe I am repeating myself"CreditCardChris said:

Yeah it was a typo, I've corrected it now.dunroving said:

Hmmm, I don't think this disagrees from my post. I suggested a reason WHY in the UK there has been a greater focus on "investing in property" (your term), which from your explanation I take to mean "paying off the mortgage". In the US, people invest more in businesses ("stocks and bonds"; equities) because they are more familiar with them, by necessity, because in general that's the sort of pension they have over there. It's this, rather than a boomer generation phenomenon, that explains the difference. Perhaps it makes you feel better to blame the people rather than the financial context.CreditCardChris said:

The difference between the UK and the US is the UK population invests heavily in businesses while the UK population invests heavily in real estate. The former creates jobs, business ventures, innovation and competition which are all healthy for an economy. The latter creates a highly inflated housing market which diverts money that would otherwise be spent or invested in the markets to home owners and 73% of home owners are aged between 65 and 74.dunroving said:

But surely there are baby boomers in the US, also?CreditCardChris said:

And this is a major problem for two reasons.Thrugelmir said:

UK investors have preferred property to direct ownership of companies for some years.Diplodicus said:

It’s not a question of any individual “putting his money where his mouth is”; if strategic companies are reckoned to help the national interest, it is for Govt rather to protect them.

1. It causes the price of houses to rise which does absolutely nothing but hinders the economy as people are forced to spend less as they need money to pay the extortionately high rents that home owners are charging.

2. It causes companies to stagnant as they have less profits to invest into other ventures.

Take Bezos for example, he has slowly been selling his Amazon shares over the years to fund new projects like Blue Origin, this would never be possible if the stock price remained at $30 forever. He still has 11% though so plenty of money to continue exploring more opportunities and can afford to take risks. UK companies cannot afford to take risks as one wrong investment and their fragile business collapses.

But what do we expect from boomers who bought their houses when they were 1/6th the price just 20 years ago. They are used to making fat gains on property so they're just going to stick to what they know. Meanwhile it's left to generation z to drag us out of this slump.

To be honest I think once all the boomers die and the oldest person alive was born in 1970, that'll probably be when we start shifting our focus from boomer investments (property, oil, banks, insurance etc) and into tech.

As a "boomer" myself, who does not fit your characterisation at all, I find your explanation simplistic (especially the portrayal of Generation Z as the saviours of the stock market). A big difference between the UK and US is the much larger number of defined contribution pensions in the UK. US employees have to learn to be investment-savvy. UK employees are only now having to learn these lessons, as defined benefits pensions transition out of the scene.

I'm minded of Mark Twain's comment that when he was 14, his father was so stupid he hated to have him around. By the time he reached 21, he was astonished at how much his father had learned.

I'm not making this up...

So to all the boomers who invested in property creating an inflated housing market and a depressing stock market which has affected young people beyond measure, I just want to say cheers!

Maybe one day when we stop putting more value on property than we do on businesses we'll be able to get this country back on track.

All you have done is repeat your statement THAT in the UK there has been a greater focus on "investing in property" and continue blaming boomers for the mess that Generation X, Y, and Z ride in on on their white horses and rescue.

(BTW, I think you meant to say, "the US population invests heavily in businesses ..." in your first sentence.

We don't have to fix it, we can just keep piling on and take over from where you guys left off. That's to say forget investing in UK businesses and just keep buying the hell out of property. However property returns less than the stock market (when people actually invest in it) so I'd prefer to see a shift away from housing and back to stocks.

And paying off your mortgage is fine, it's expected... However what's not expected is going to the bank, taking out a £250,000 loan secured against your now fully paid off house and getting 5 buy to let mortgages and renting them out. I understand why people do it because it generates a guaranteed income which is very important to boomers as they retire. But this then takes those 5 houses off the market to young people who actually want to buy a house but can't afford them because boomers snapped them all up.

Forcing us to rent for often significantly above average prices. Not all of us have parents who own homes we can live in, or spouses to split the rent with. Maybe I am repeating myself and I don't know the fundamental reason why the UK population is obsessed with property instead of stocks but what I do know is favouring investing in property over businesses is detrimental to the UK economy in almost every way.

I'm what you would label as "a boomer", but couldn't be more different than your portrayal. Stop lumping people together. You come across as being very bitter towards the older generation and about your own country. It's exhausting.(Nearly) dunroving2 -

Your analysis misses a few things:CreditCardChris said:The difference between the UK and the US is the US population invests heavily in businesses while the UK population invests heavily in real estate. The former creates jobs, business ventures, innovation and competition which are all healthy for an economy. The latter creates a highly inflated housing market which diverts money that would otherwise be spent or invested in the markets to home owners and 73% of home owners are aged between 65 and 74.

Firstly, the people in the UK who own property almost invariably have pension funds, generally worth rather more than their properties. To a great extent these pension savings are invested in businesses, generally through stock markets;

Secondly, people who are buying with a mortgage need some way of paying off that mortgage. Although repayment mortgages are fashionable now, until a decade ago large numbers of home-buyers would have used an 'Endowment': they would have been paying into an investment product that again used equities and was intended to mature at the point when the mortgage needed repaying.

Thirdly, Americans are also very interested in buying property. If you think London is expensive, try San Francisco! Or even New York.

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards