We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Has the dead cat finished bouncing?

Comments

-

I moved to 100% equities in March, which on this occasion thankfully worked out, maybe more luck than judgement, I've made plenty of similar calls wrong in the pastSailtheworld said:

Maybe 75% equities is appropriate for the level of risk you're willing to take and that you'll be less inclined to waste energy waiting for an opportunity to make itself known. Being 100% equities must be quite stressful.MaxiRobriguez said:

Despite that though I am still 75%+ equities, if anyone cares.Malthusian said:My view: Coronavirus unlikely to be going away anytime soon and people's behaviour will shift. More unemployment is coming, hoarding money rather than spending will become the norm, high streets will find it almost impossible to tradeThe problem with this view is not that it doesn't reflect reality but that it is exactly what everyone was saying in 2009.

The indices reflect the present value placed by the market on the next lifetime's worth of profits generated by listed businesses, not how long it will take people to venture out of their burrows over the next year.

People who try to use securities representing a lifetime's worth of earnings to place proxy bets on the performance of the economy over the next 12 months are destined to remain extremely confused when it doesn't work out the way they expected.

Really have little interest in bonds as they are currently valued, so its been interesting trying to find alternative assets which aren't too strongly correlated with equities.

The near term economic outlook is clearly going to be difficult, if everything goes well we can maybe get mass vaccination done in the UK by Q1 2021, but we are going to start bleeding a lot of jobs when the furlough ends. Ultimately I suspect worldwide govt is going to have to continue to provide stimulus for longer than it would like to1 -

I'd agree on bonds. There's still room for gold if you fancied it (no I'm really not the second coming of Ed!) or you could hedge within equities still - choose sectors on either side of the Coronavirus coin. If you're heavy on tech/stay at home stocks then hedge with beaten down travel for example.Filo25 said:

I moved to 100% equities in March, which on this occasion thankfully worked out, maybe more luck than judgement, I've made plenty of similar calls wrong in the pastSailtheworld said:

Maybe 75% equities is appropriate for the level of risk you're willing to take and that you'll be less inclined to waste energy waiting for an opportunity to make itself known. Being 100% equities must be quite stressful.MaxiRobriguez said:

Despite that though I am still 75%+ equities, if anyone cares.Malthusian said:My view: Coronavirus unlikely to be going away anytime soon and people's behaviour will shift. More unemployment is coming, hoarding money rather than spending will become the norm, high streets will find it almost impossible to tradeThe problem with this view is not that it doesn't reflect reality but that it is exactly what everyone was saying in 2009.

The indices reflect the present value placed by the market on the next lifetime's worth of profits generated by listed businesses, not how long it will take people to venture out of their burrows over the next year.

People who try to use securities representing a lifetime's worth of earnings to place proxy bets on the performance of the economy over the next 12 months are destined to remain extremely confused when it doesn't work out the way they expected.

Really have little interest in bonds as they are currently valued, so its been interesting trying to find alternative assets which aren't too strongly corelated with equities1 -

I have actually put a bit of my equity holdings into gold miners over the last couple of months, only about 5% or so but it does give some diversification.MaxiRobriguez said:

I'd agree on bonds. There's still room for gold if you fancied it (no I'm really not the second coming of Ed!) or you could hedge within equities still - choose sectors on either side of the Coronavirus coin. If you're heavy on tech/stay at home stocks then hedge with beaten down travel for example.Filo25 said:

I moved to 100% equities in March, which on this occasion thankfully worked out, maybe more luck than judgement, I've made plenty of similar calls wrong in the pastSailtheworld said:

Maybe 75% equities is appropriate for the level of risk you're willing to take and that you'll be less inclined to waste energy waiting for an opportunity to make itself known. Being 100% equities must be quite stressful.MaxiRobriguez said:

Despite that though I am still 75%+ equities, if anyone cares.Malthusian said:My view: Coronavirus unlikely to be going away anytime soon and people's behaviour will shift. More unemployment is coming, hoarding money rather than spending will become the norm, high streets will find it almost impossible to tradeThe problem with this view is not that it doesn't reflect reality but that it is exactly what everyone was saying in 2009.

The indices reflect the present value placed by the market on the next lifetime's worth of profits generated by listed businesses, not how long it will take people to venture out of their burrows over the next year.

People who try to use securities representing a lifetime's worth of earnings to place proxy bets on the performance of the economy over the next 12 months are destined to remain extremely confused when it doesn't work out the way they expected.

Really have little interest in bonds as they are currently valued, so its been interesting trying to find alternative assets which aren't too strongly corelated with equities

Its not generally an asset class I would touch either but I can see its attractions in the current climate, especially if governments do need to push stimulus further and longer.

I probably do need to pivot out of growth a bit towards value (or at least a better balance between the 2) but its always tough to do when it means selling your winners!

The whole COVID downturn has been interesting though in that its hit some of the areas in my portfolio which were supposedly defensive like infrastructure, while actually boosting riskier growth stocks, its been a very unusual market correction!0 -

Retired 1st July 2021.

This is not investment advice.

Your money may go "down and up and down and up and down and up and down ... down and up and down and up and down and up and down ... I got all tricked up and came up to this thing, lookin' so fire hot, a twenty out of ten..."2 -

Not overly greedy then. Unsurprising really, there's a lot of money being created, lots of people have cash on the sidlines, bonds/savings aren't particularly inspiring choices at the moment.quirkydeptless said:

TINA is real.0 -

1

-

Hasn't your furlough period finished yet? Though on second thoughts I can understand why it hasn't.Sailtheworld said:

If you've spent an adult life permanently befuddled by the fact markets are pricing in a more optimistic future out of line from your own pessimistic outlook you could get a little introspective and ponder why that is. Or, the easier option, continue to look down your nose blaming the meddling passive investors and those pesky retail investors.Thrugelmir said:

Passive investors do not buy companies on the basis of fundamentals but market capitisation. All investors by their own actions are part of the market. Not idle bystanders.Malthusian said:My view: Coronavirus unlikely to be going away anytime soon and people's behaviour will shift. More unemployment is coming, hoarding money rather than spending will become the norm, high streets will find it almost impossible to tradeThe indices reflect the present value placed by the market on the next lifetime's worth of profits generated by listed businesses, not how long it will take people to venture out of their burrows over the next year.

Markets tend to go up over time and there's no reason to think that 31st July 2020 is the date it all stopped. Therefore to make money from a bearish outlook you need to make it quick and then move on unless you really like pushing water uphill.

0 -

No furloughs at my place. It's going to be a record sales year this year with, hopefully, suitably adjusted bonuses to come. The gap between my earnings and spending has never been wider. Some of it is a happy accident but some is because I stopped trying to waste brain cells where I don't have an edge (investing) and put them to use where I do (my job).Thrugelmir said:

Hasn't your furlough period finished yet? Though on second thoughts I can understand why it hasn't.Sailtheworld said:

If you've spent an adult life permanently befuddled by the fact markets are pricing in a more optimistic future out of line from your own pessimistic outlook you could get a little introspective and ponder why that is. Or, the easier option, continue to look down your nose blaming the meddling passive investors and those pesky retail investors.Thrugelmir said:

Passive investors do not buy companies on the basis of fundamentals but market capitisation. All investors by their own actions are part of the market. Not idle bystanders.Malthusian said:My view: Coronavirus unlikely to be going away anytime soon and people's behaviour will shift. More unemployment is coming, hoarding money rather than spending will become the norm, high streets will find it almost impossible to tradeThe indices reflect the present value placed by the market on the next lifetime's worth of profits generated by listed businesses, not how long it will take people to venture out of their burrows over the next year.

Markets tend to go up over time and there's no reason to think that 31st July 2020 is the date it all stopped. Therefore to make money from a bearish outlook you need to make it quick and then move on unless you really like pushing water uphill.

Some people woefully underestimate just how many people are out there choosing to try and improve their situations. It's as if they expect people to watch News at Ten and just give up because of the futility of it all. They're doomed to a life of befuddlement.

1 -

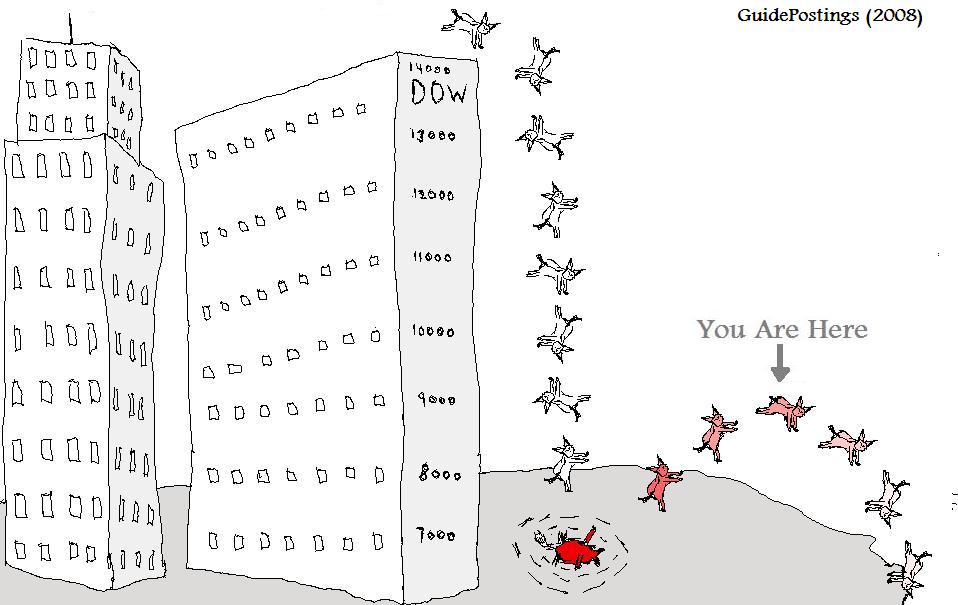

So apt. You do know that the Dow went straight up from the 'you are here' point - for more than a decade?quirkydeptless said:

2 -

Are you as objectionable at work. If your colleagues hold a different viewpoint to yourself ?Sailtheworld said:

No furloughs at my place. It's going to be a record sales year this year with, hopefully, suitably adjusted bonuses to come. The gap between my earnings and spending has never been wider. Some of it is a happy accident but some is because I stopped trying to waste brain cells where I don't have an edge (investing) and put them to use where I do (my job).Thrugelmir said:

Hasn't your furlough period finished yet? Though on second thoughts I can understand why it hasn't.Sailtheworld said:

If you've spent an adult life permanently befuddled by the fact markets are pricing in a more optimistic future out of line from your own pessimistic outlook you could get a little introspective and ponder why that is. Or, the easier option, continue to look down your nose blaming the meddling passive investors and those pesky retail investors.Thrugelmir said:

Passive investors do not buy companies on the basis of fundamentals but market capitisation. All investors by their own actions are part of the market. Not idle bystanders.Malthusian said:My view: Coronavirus unlikely to be going away anytime soon and people's behaviour will shift. More unemployment is coming, hoarding money rather than spending will become the norm, high streets will find it almost impossible to tradeThe indices reflect the present value placed by the market on the next lifetime's worth of profits generated by listed businesses, not how long it will take people to venture out of their burrows over the next year.

Markets tend to go up over time and there's no reason to think that 31st July 2020 is the date it all stopped. Therefore to make money from a bearish outlook you need to make it quick and then move on unless you really like pushing water uphill.

Some people woefully underestimate just how many people are out there choosing to try and improve their situations. It's as if they expect people to watch News at Ten and just give up because of the futility of it all. They're doomed to a life of befuddlement.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards