We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Bluestone Mortgages

Comments

-

Obviously paying any default is best but you should use it as bargaining with them first. Get them to confirm when default was and to rectify your file a.s.a.p. Joleen23 said:Thankyou for your reply. Even though the actual default was from last year. I will pay it straight away. I’m just worried bluestone wont accept now!

Joleen23 said:Thankyou for your reply. Even though the actual default was from last year. I will pay it straight away. I’m just worried bluestone wont accept now!

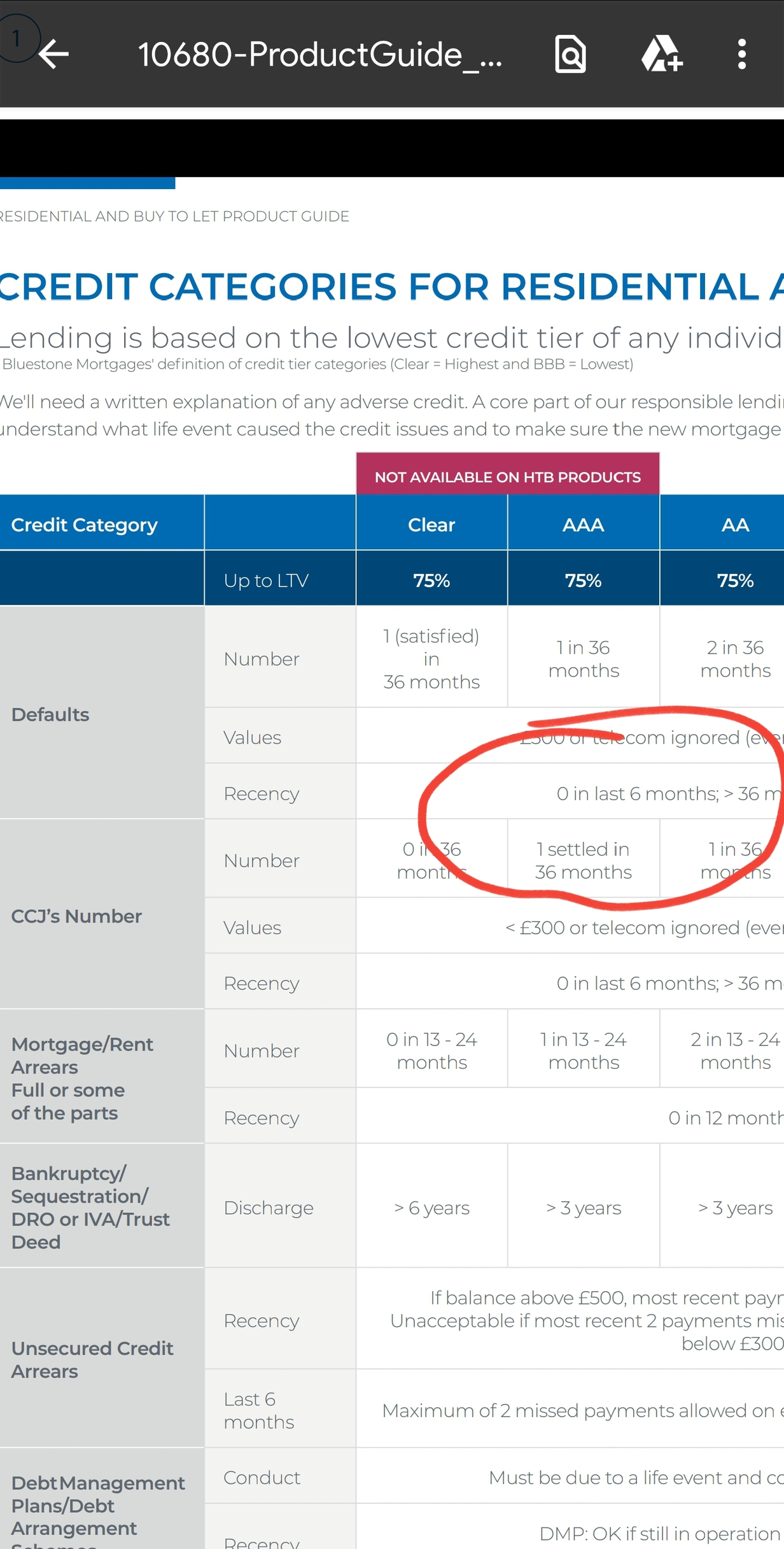

Paid or not bluestone do not accept defaults that occurred in last 6 months0 -

Remain positive. If default is incorrectly dated you can get this back on track but don't expect it to solve itself. Try not to worry because that's just wasted energy, focus on getting it fixed.Joleen23 said:

Also what credit file are you checking? Does it say last updated or date of default?

The update date doesn't change the original default date so it's really important to know what it says. It if says date of default then you need to get it put right as I already said.1 -

Hello again, it’s with Experian.. here’s what it says-

0 -

Thankyou again, it’s with Experian. Hers what it says mortgagetakingages said:

mortgagetakingages said:

Remain positive. If default is incorrectly dated you can get this back on track but don't expect it to solve itself. Try not to worry because that's just wasted energy, focus on getting it fixed.Joleen23 said:

Also what credit file are you checking? Does it say last updated or date of default?

The update date doesn't change the original default date so it's really important to know what it says. It if says date of default then you need to get it put right as I already said.0 -

That's good news. You can see the default date is August 2019. That's the date that matters and is over a year ago so meets their criteria.

0 -

Thankyou so much for your advice. It’s really helped. Should I still ring Lowell and pay it in full or won’t it matter to my full mortgage application now?mortgagetakingages said:That's good news. You can see the default date is August 2019. That's the date that matters and is over a year ago so meets their criteria.0 -

I wouldn't pay it but it may be a requirement for the mortgage offer. See what comes back.Joleen23 said:

Thankyou so much for your advice. It’s really helped. Should I still ring Lowell and pay it in full or won’t it matter to my full mortgage application now?mortgagetakingages said:That's good news. You can see the default date is August 2019. That's the date that matters and is over a year ago so meets their criteria.

If you do look to settle I would look to offer 50% of the amount too.0 -

Oh right ok, I will do, will paying 50% affect a full offer? Thanks again ☺️0

-

I'm not a mortgage advisor so this is just my view. Bluestone don't expect defaults to be settled so a partial settlement that saves you money makes sense to me1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards