We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Regular Savings Accounts: The Best Currently Available List!

Comments

-

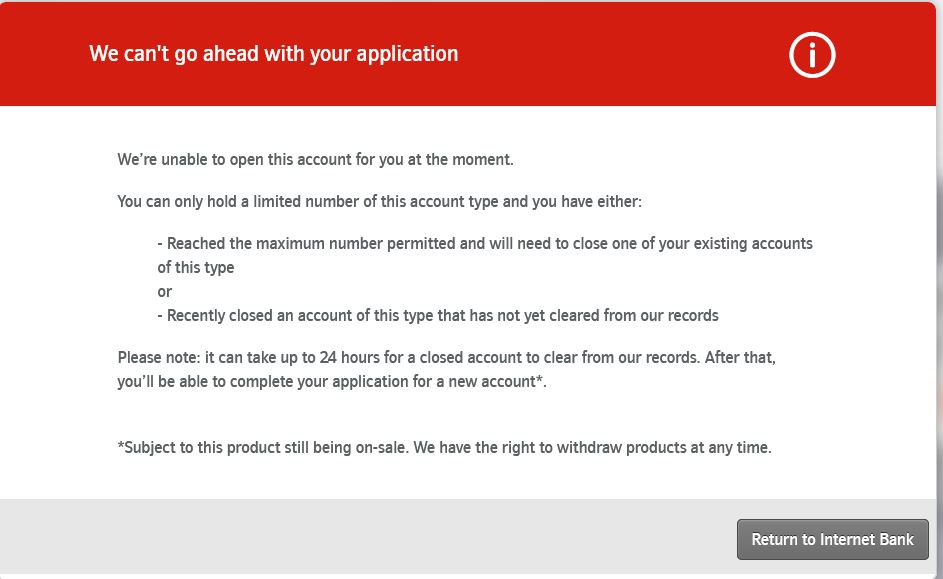

What method other people use to get the second Nationwide Flex RS 8%?I tried it today this is what I get ...

1

1 -

If only it were a massage :-)adindas said:YBS Loyalty Regular eSaver 2023 7.0%Apply today using existing login. It took me less than five minutes and it already shows on my List of account with AC no already shown. I got this massage on the account"We're still setting up your account. Please come back tomorrow to make a deposit or change your account options. Withdrawals will be available in 14 days."

I had the same message when I set up mine the other day. The account was showing and I was happily able to transfer across funds from YBS Six Access eSaver that same day.0 -

People will be ending up with multiple RS accounts unintentionally, due to repeated attempts following various error messages experienced during the application process today. The extra accounts will get closed down eventually.adindas said:What method other people use to get the second Nationwide Flex RS 8%?0 -

Does the massage have a happy ending,?mebu60 said:

If only it were a massage :-)adindas said:YBS Loyalty Regular eSaver 2023 7.0%Apply today using existing login. It took me less than five minutes and it already shows on my List of account with AC no already shown. I got this massage on the account"We're still setting up your account. Please come back tomorrow to make a deposit or change your account options. Withdrawals will be available in 14 days."

I had the same message when I set up mine the other day. The account was showing and I was happily able to transfer across funds from YBS Six Access eSaver that same day.I consider myself to be a male feminist. Is that allowed?3 -

If I remember correctly, NW is good at spotting offenders nowadays. At least it is based on my personal experience in the past and recently.refluxer said:

People will be ending up with multiple RS accounts unintentionally, due to repeated attempts following various error messages experienced during the application process today. The extra accounts will get closed down eventually.adindas said:What method other people use to get the second Nationwide Flex RS 8%?

1 -

I opened my RS with Nationwide no problem but my wife has had the technical error message as well. Will wait to see if hers appear like people say it should.0

-

Indeed. The quote isrefluxer said:

People will be ending up with multiple RS accounts unintentionally, due to repeated attempts following various error messages experienced during the application process today. The extra accounts will get closed down eventually.adindas said:What method other people use to get the second Nationwide Flex RS 8%?https://www.nationwide.co.uk/savings/flex-regular-saver/You can only have one Flex Regular Saver Issue 2 account in your name at any time. You can't open this account in trust for the benefit of another person.

0 -

ForumUser7 said:

Were you able to get past the income and employment section into the nominated bank account for withdrawals section please? Or did you get the error message before it reached that page?csw5780 said:Re: Nationwide RS2. Applied, error message, no email, account appeared in app after a few minutes.

I didn't see any question about employment, just income. I specified Retired as occupation.

0 -

Did she receive the welcome email ? If so, it's not uncommon for Nationwide accounts to take a while to show up in online banking - this can be as long as next-day in my experience, although this does depend on the type of account (these regular savers do seem to appear straight away though).poshrule_uk said:I opened my RS with Nationwide no problem but my wife has had the technical error message as well. Will wait to see if hers appear like people say it should.

If she didn't receive the email and you've waited for at least an hour or so, I would try again.

I applied late this morning and, as I hadn't received the email by mid-afternoon (and the account hadn't appeared in online banking), I applied again and was immediately successful, receiving the email within minutes..0 -

Very tempted by the Nationwide switch offer and RS.

I'm assuming First Direct needs an open current account to keep their regular saver?

Edit - having reread the T&Cs, looks like I need to keep a current account with FD, but the current account has no minimum direct debits etc so I can just keep it open to feed the existing RS, right?1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards