We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

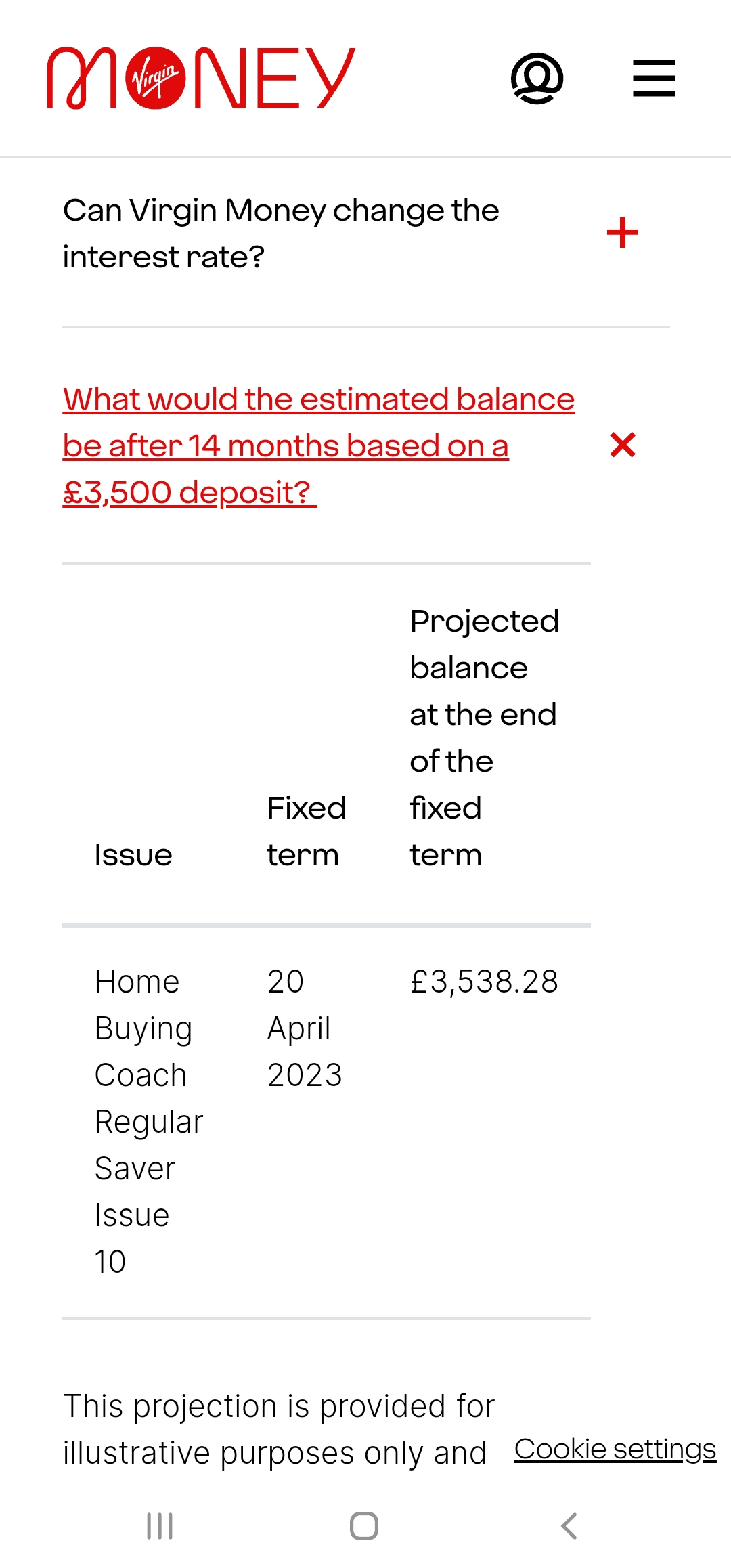

Home Buying Coach Regular Saver 10

Does this follow the same pattern of maturing two months after the last one (so by my calculation 20 Apr 23)? - I can't see anything on the webpage apart from various mentions of 14 months.

0 -

Coventry Regular Savings Account (formerly Stroud & Swindon Regular Saver Plus Issue 2)

Does anybody have any information on the current terms on this account please? When it was a Stroud & Swindon account, my notes say that a monthly deposit of between £10 and £250 was required, and no more than one withdrawal per account year was permitted. Otherwise, the 2.5% bonus interest would be lost.

Following the merger takeover by Coventry, there isn't any bonus interest. So my question is, do the minimum monthly deposit and withdrawal restrictions effectively no longer apply, as there is now no bonus to lose? What happens if you break either the monthly deposit or withdrawal conditions?

The rate is now only 1.15% (rising to 1.25% on 1 May 2022), which for the first time is lower than the best available instant access account (Chase @ 1.5%).

I'm just trying to weigh up whether to keep the money in (but possibly reduce the monthly payments), withdraw most of the funds but leave it open, or just close it completely and move it all to Chase.

I've built up over £40k in this account over 12 years, so I'm slightly reluctant just to take it all out, in case it comes good again in the future. There aren't many RS accounts around which continue indefinitely. I think when we have the next base rate increase, it is perhaps unlikely that Chase will increase their rate accordingly, as they are already some way ahead of the competition. So this account could close the gap on Chase. However, with Coventry's dismal interest rate record on this account over the last few years, I don't have much confidence that this account would catch up with Chase even when base rates next increase again.0 -

Coventry Regular SaverI believe the only change in terms was back in January 2015 when the bonus was interest stopped and no longer a maximum balance. I agree with your thoughts regarding this account and will probably move some money to Chase but keep the account open to keep my options open.1

-

I have a First Direct regular saver due to mature on 16 April (Easter Saturday). The account has disappeared from my online record (as expected] but the maturity proceeds have not yet appeared in the basic savings account into which they are to be transferred on maturity. Does anyone know what happens if the maturity date is not a banking day? If I have to wait until the next banking day, that won't be until Tuesday,0

-

According to their site frequently asked questions regular saver maturity process can take up to 5 daysDeleted_User said:I have a First Direct regular saver due to mature on 16 April (Easter Saturday). The account has disappeared from my online record (as expected] but the maturity proceeds have not yet appeared in the basic savings account into which they are to be transferred on maturity. Does anyone know what happens if the maturity date is not a banking day? If I have to wait until the next banking day, that won't be until Tuesday,"Look after your pennies and your pounds will look after themselves"2 -

I think based on experience Coventry are unlikely to reward those of us who've held this account for a long time. As we've all seen they have keenly reduced the rate from market-leading and are not increasing it much. I am going to use it towards a deposit on a property. Subsequently, I think I will keep it open and make small payments, in case the situation changes or they do decide to offer rewards to members. I am glad of the substantial interest payments it has made in the past but the value of this account is coming to its conclusion.spider42 said:Coventry Regular Savings Account (formerly Stroud & Swindon Regular Saver Plus Issue 2)

Does anybody have any information on the current terms on this account please? When it was a Stroud & Swindon account, my notes say that a monthly deposit of between £10 and £250 was required, and no more than one withdrawal per account year was permitted. Otherwise, the 2.5% bonus interest would be lost.

Following the merger takeover by Coventry, there isn't any bonus interest. So my question is, do the minimum monthly deposit and withdrawal restrictions effectively no longer apply, as there is now no bonus to lose? What happens if you break either the monthly deposit or withdrawal conditions?

The rate is now only 1.15% (rising to 1.25% on 1 May 2022), which for the first time is lower than the best available instant access account (Chase @ 1.5%).

I'm just trying to weigh up whether to keep the money in (but possibly reduce the monthly payments), withdraw most of the funds but leave it open, or just close it completely and move it all to Chase.

I've built up over £40k in this account over 12 years, so I'm slightly reluctant just to take it all out, in case it comes good again in the future. There aren't many RS accounts around which continue indefinitely. I think when we have the next base rate increase, it is perhaps unlikely that Chase will increase their rate accordingly, as they are already some way ahead of the competition. So this account could close the gap on Chase. However, with Coventry's dismal interest rate record on this account over the last few years, I don't have much confidence that this account would catch up with Chase even when base rates next increase again.1 -

I've given up on the Coventry Reg (formerly Stroud & Swindon) when they announced they are increasing the rate to 1.25% in May.

Transferred everything apart from £100 to the Chase account for the time being.

Also reduced my monthly payments to £10.1 -

Special_Saver2 said:

Interest rate: 2.5% gross p.a. fixed

Monthly payment: £1-£200 (the month is calculated by the date that you open your Regular eSaver, e.g. you open the Regular eSaver on the 16th of a month, your month will run from 16th of one month to the 15th of the next month and standing orders are only processed Monday to Friday; if your standing order falls on a weekend or bank holiday your payment will be made on the next working day, and if this is the last day of the month your payment won’t reach this account until the following month)

Miss any payments: Yes, as many as you want but any missed payments cannot be made up at a later date

Penalty-free withdrawals: Yes, as many as you like

Age of applicant: Age 16 years old or older

How to open account: Branch or online

Special conditions: You must have a Santander 123 current account or be part of Santander Select or Private Banking, you must fund the account with a standing order from a Santander current account and you must be signed up for online or mobile banking.- At the end of 12 months, Santander will automatically renew your Regular eSaver for another 12 months at the interest rate and on the Terms and Conditions applicable at that time

and transfer the final balance at the end of the term (including interest earned) to your Santander current account from which the standing order was paid, including if your current account is in joint names.This question is likely to be answered already, but the thread is too long to find the answer.I just discovered that my "MONTHLY SAVER" is paying me pathetic 0.5% interest, not 2.5%.The good news is that it was renewed recently. The bad news is that it seems to be the same 0.5% the previous 12 months and, possibly even deeper in the past.Not a huge loss, bun how could this happen?!And, to add insult to injury, they don't allow me to open a new "Regular eSaver" because I allegedly already have one. And to close it I have to call them because I cannot do it online and their robotic chat cannot close it either despite apparently being able to close other types of accounts.

0 -

grumbler said:Special_Saver2 said:

Interest rate: 2.5% gross p.a. fixed

Monthly payment: £1-£200 (the month is calculated by the date that you open your Regular eSaver, e.g. you open the Regular eSaver on the 16th of a month, your month will run from 16th of one month to the 15th of the next month and standing orders are only processed Monday to Friday; if your standing order falls on a weekend or bank holiday your payment will be made on the next working day, and if this is the last day of the month your payment won’t reach this account until the following month)

Miss any payments: Yes, as many as you want but any missed payments cannot be made up at a later date

Penalty-free withdrawals: Yes, as many as you like

Age of applicant: Age 16 years old or older

How to open account: Branch or online

Special conditions: You must have a Santander 123 current account or be part of Santander Select or Private Banking, you must fund the account with a standing order from a Santander current account and you must be signed up for online or mobile banking.- At the end of 12 months, Santander will automatically renew your Regular eSaver for another 12 months at the interest rate and on the Terms and Conditions applicable at that time

and transfer the final balance at the end of the term (including interest earned) to your Santander current account from which the standing order was paid, including if your current account is in joint names.This question is likely to be answered already, but the thread is too long to find the answer.I just discovered that my "MONTHLY SAVER" is paying me pathetic 0.5% interest, not 2.5%.The good news is that it was renewed recently. The bad news is that it seems to be the same 0.5% the previous 12 months and, possibly even deeper in the past.Not a huge loss, bun how could this happen?!And, to add insult to injury, they don't allow me to open a new "Regular eSaver" because I allegedly already have one. And to close it I have to call them because I cannot do it online and their robotic chat cannot close it either despite apparently being able to close other types of accounts.The Santander RS renews at the end of the 12 month period at the interest rate prevailing at the time of renewal. The rate only increased to 2.5% fairly recently so odds are yours renewed just before the rate increase.You can close your existing RS by calling them or getting through to an agent on live chat (you have to get past the robot first, but that's fairly easy to do). Once it's closed (which might take a few days) you can then open a new one at the current rate.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

Yes same as others.

Yes same as others.