We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Asked a few times before and lately just 2 pages back. All of the above is unnecessary, just stop the S/O and move the interest.schiff said:Probably been asked before. If I withdraw £150 plus the accumulated excess over £850 from my RBoS digital saver and then deposit £150 and do that every following month, does that maximise the benefit from both the increased interest rate and the monthly deposit limit?1 -

I thought that, but on what planet does a four word description become a 3 letter acronym?schiff said:

On theother hand.RG2015 said:

"OTH" ?Daliah said:

Last year, you could easily have got 3% for some of your money. @Special_Saver2 puts in a considerable effort to make it easy for us to pick the most appropriate offers. The Santander RS dropped from the top 10 in March 2018. 2.5%, OTH, is now in joint 2nd for adult Regular Savers.grumbler said:Thank you all for the replies. I was a little busy last year to be on top of everything, but even last year I'd expect a little more than 0.5% from a regular savings account. And even with recent rise in the rates this 2%(!) hike doesn't look right. They sort of admit that 0.5% was pathetic.

I always get caught out by acronyms but even Google had no answer for this.

BAM

Bloodystupidifyou Ask Me3 -

Daliah said:

Last year, you could easily have got 3% for some of your money. @Special_Saver2 puts in a considerable effort to make it easy for us to pick the most appropriate offers. The Santander RS dropped from the top 10 in March 2018. 2.5%, OTH, is now in joint 2nd for adult Regular Savers.grumbler said:Thank you all for the replies. I was a little busy last year to be on top of everything, but even last year I'd expect a little more than 0.5% from a regular savings account. And even with recent rise in the rates this 2%(!) hike doesn't look right. They sort of admit that 0.5% was pathetic.IanManc said:

It doesn't. The abbreviation for "on the other hand" is OTOH. 😉RG2015 said:

I thought that, but on what planet does a four word description become a 3 letter acronym?schiff said:

On theother hand.RG2015 said:

"OTH" ?Daliah said:

Last year, you could easily have got 3% for some of your money. @Special_Saver2 puts in a considerable effort to make it easy for us to pick the most appropriate offers. The Santander RS dropped from the top 10 in March 2018. 2.5%, OTH, is now in joint 2nd for adult Regular Savers.grumbler said:Thank you all for the replies. I was a little busy last year to be on top of everything, but even last year I'd expect a little more than 0.5% from a regular savings account. And even with recent rise in the rates this 2%(!) hike doesn't look right. They sort of admit that 0.5% was pathetic.

I always get caught out by acronyms but even Google had no answer for this.

BAM

Bloodystupidifyou Ask Me

OTOH (abbreviation) definition and synonyms | Macmillan Dictionary

Ah thanks, I see.schiff said:

On theother hand.RG2015 said:

"OTH" ?Daliah said:

Last year, you could easily have got 3% for some of your money. @Special_Saver2 puts in a considerable effort to make it easy for us to pick the most appropriate offers. The Santander RS dropped from the top 10 in March 2018. 2.5%, OTH, is now in joint 2nd for adult Regular Savers.grumbler said:Thank you all for the replies. I was a little busy last year to be on top of everything, but even last year I'd expect a little more than 0.5% from a regular savings account. And even with recent rise in the rates this 2%(!) hike doesn't look right. They sort of admit that 0.5% was pathetic.

I always get caught out by acronyms but even Google had no answer for this.

@Daliah made a mistake and @schiff failed to mention this in their response.0 -

schiff said:Probably been asked before. If I withdraw £150 plus the accumulated excess over £850 from my RBoS digital saver and then deposit £150 and do that every following month, does that maximise the benefit from both the increased interest rate and the monthly deposit limit?

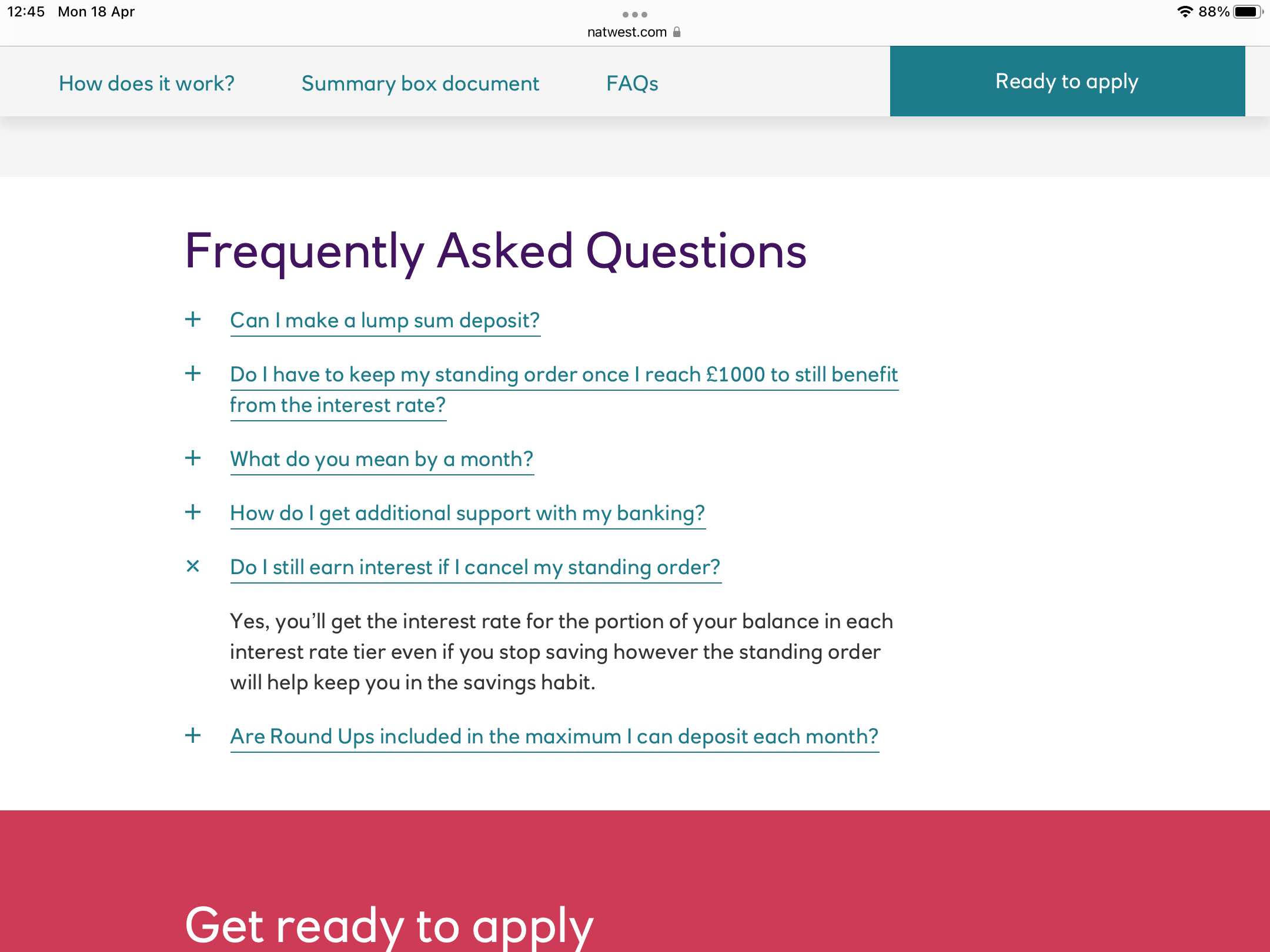

As @Wheres_My_Cashback says - no need to complicate things. The terms for both NatWest and RBS digital savers seem to say that once you reach £1k you can cancel your SO, so there's no need to do anything further except skim off the interest each month

0 -

For RBS you don't need to keep the SO going. I have cancelled mine after first payment of £1 went in. Now just transfer as much as I want when I want up to £1500

-

They do say this.PRAISETHESUN said:schiff said:Probably been asked before. If I withdraw £150 plus the accumulated excess over £850 from my RBoS digital saver and then deposit £150 and do that every following month, does that maximise the benefit from both the increased interest rate and the monthly deposit limit?

As @Wheres_My_Cashback says - no need to complicate things. The terms for both NatWest and RBS digital savers seem to say that once you reach £1k you can cancel your SO, so there's no need to do anything further except skim off the interest each month

1 -

TUO - two unforgiveable offencesRG2015 said:Daliah said:

Last year, you could easily have got 3% for some of your money. @Special_Saver2 puts in a considerable effort to make it easy for us to pick the most appropriate offers. The Santander RS dropped from the top 10 in March 2018. 2.5%, OTH, is now in joint 2nd for adult Regular Savers.grumbler said:Thank you all for the replies. I was a little busy last year to be on top of everything, but even last year I'd expect a little more than 0.5% from a regular savings account. And even with recent rise in the rates this 2%(!) hike doesn't look right. They sort of admit that 0.5% was pathetic.IanManc said:

It doesn't. The abbreviation for "on the other hand" is OTOH. 😉RG2015 said:

I thought that, but on what planet does a four word description become a 3 letter acronym?schiff said:

On theother hand.RG2015 said:

"OTH" ?Daliah said:

Last year, you could easily have got 3% for some of your money. @Special_Saver2 puts in a considerable effort to make it easy for us to pick the most appropriate offers. The Santander RS dropped from the top 10 in March 2018. 2.5%, OTH, is now in joint 2nd for adult Regular Savers.grumbler said:Thank you all for the replies. I was a little busy last year to be on top of everything, but even last year I'd expect a little more than 0.5% from a regular savings account. And even with recent rise in the rates this 2%(!) hike doesn't look right. They sort of admit that 0.5% was pathetic.

I always get caught out by acronyms but even Google had no answer for this.

BAM

Bloodystupidifyou Ask Me

OTOH (abbreviation) definition and synonyms | Macmillan Dictionary

Ah thanks, I see.schiff said:

On theother hand.RG2015 said:

"OTH" ?Daliah said:

Last year, you could easily have got 3% for some of your money. @Special_Saver2 puts in a considerable effort to make it easy for us to pick the most appropriate offers. The Santander RS dropped from the top 10 in March 2018. 2.5%, OTH, is now in joint 2nd for adult Regular Savers.grumbler said:Thank you all for the replies. I was a little busy last year to be on top of everything, but even last year I'd expect a little more than 0.5% from a regular savings account. And even with recent rise in the rates this 2%(!) hike doesn't look right. They sort of admit that 0.5% was pathetic.

I always get caught out by acronyms but even Google had no answer for this.

@Daliah made a mistake and @schiff failed to mention this in their response.0 -

Why can't people just say what they mean? I'm out of this.Daliah said:

TUO - two unforgiveable offencesRG2015 said:Daliah said:

Last year, you could easily have got 3% for some of your money. @Special_Saver2 puts in a considerable effort to make it easy for us to pick the most appropriate offers. The Santander RS dropped from the top 10 in March 2018. 2.5%, OTH, is now in joint 2nd for adult Regular Savers.grumbler said:Thank you all for the replies. I was a little busy last year to be on top of everything, but even last year I'd expect a little more than 0.5% from a regular savings account. And even with recent rise in the rates this 2%(!) hike doesn't look right. They sort of admit that 0.5% was pathetic.IanManc said:

It doesn't. The abbreviation for "on the other hand" is OTOH. 😉RG2015 said:

I thought that, but on what planet does a four word description become a 3 letter acronym?schiff said:

On theother hand.RG2015 said:

"OTH" ?Daliah said:

Last year, you could easily have got 3% for some of your money. @Special_Saver2 puts in a considerable effort to make it easy for us to pick the most appropriate offers. The Santander RS dropped from the top 10 in March 2018. 2.5%, OTH, is now in joint 2nd for adult Regular Savers.grumbler said:Thank you all for the replies. I was a little busy last year to be on top of everything, but even last year I'd expect a little more than 0.5% from a regular savings account. And even with recent rise in the rates this 2%(!) hike doesn't look right. They sort of admit that 0.5% was pathetic.

I always get caught out by acronyms but even Google had no answer for this.

BAM

Bloodystupidifyou Ask Me

OTOH (abbreviation) definition and synonyms | Macmillan Dictionary

Ah thanks, I see.schiff said:

On theother hand.RG2015 said:

"OTH" ?Daliah said:

Last year, you could easily have got 3% for some of your money. @Special_Saver2 puts in a considerable effort to make it easy for us to pick the most appropriate offers. The Santander RS dropped from the top 10 in March 2018. 2.5%, OTH, is now in joint 2nd for adult Regular Savers.grumbler said:Thank you all for the replies. I was a little busy last year to be on top of everything, but even last year I'd expect a little more than 0.5% from a regular savings account. And even with recent rise in the rates this 2%(!) hike doesn't look right. They sort of admit that 0.5% was pathetic.

I always get caught out by acronyms but even Google had no answer for this.

@Daliah made a mistake and @schiff failed to mention this in their response.0 -

Be thankful that you don't know an organisation that has acronyms within acronyms !

Otherwise known as a Backronym.

1 -

S N A F U0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards