We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

just to note for whatever reason residents of Northern Ireland aren't able to apply for the Nationwide BS Start to Save not sure why as I've had accounts with them in the past so the no Northern Ireland seem to be a recent thing?1

-

It's to do with Northern Ireland's gambling/lottery laws. I forget them now but I vaguely remember that accounts at other providers have fallen foul of this, too. Anyway, from the terms:donglemouse said:just to note for whatever reason residents of Northern Ireland aren't able to apply for the Nationwide BS Start to Save not sure why as I've had accounts with them in the past so the no Northern Ireland seem to be a recent thing?

"You can’t keep your Start to Save account if you live in Northern Ireland because of the law governing prize draws in that country. If that law changes, we may change this."3 -

Just open Nationwide BS Start to Save account. Slightly confused with how much I could put this account per month. Sorry I did not read the Terms at the start but saw the post in Page 1 saying that it allows £1000/month. When tried transfer £1000, it reported error and saying the maximum is £200. Then I transferred £200 and it is fine. However, when go to read the terms, it says maximum £100 per month. Slightly confused with how much I could put this Nationwide BS Start to Save account per month.

0 -

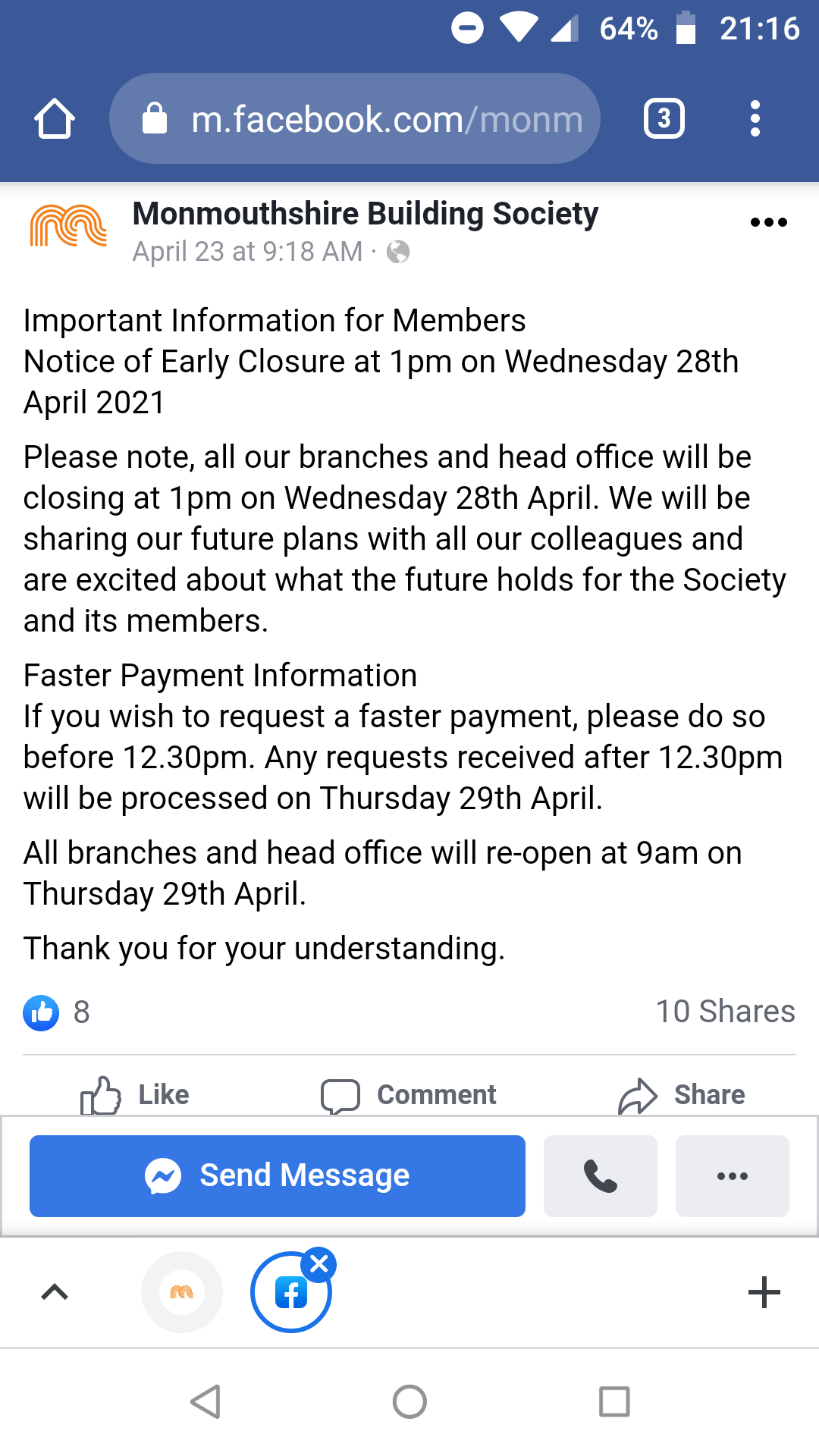

Good spotJamesRobinson48 said:I wonder what's going on at the Mon BS. Their website says they're closing at 13:00 on Wed 28th Apr because

"We will be sharing our future plans with all our colleagues and are excited about what the future holds for the Society and its members." 1

1 -

I remember a couple of years ago they were planning on launching a new Monzo-style current account product. It went a bit quiet after a few headiinesveryintrigued said:

Good spotJamesRobinson48 said:I wonder what's going on at the Mon BS. Their website says they're closing at 13:00 on Wed 28th Apr because

"We will be sharing our future plans with all our colleagues and are excited about what the future holds for the Society and its members."

https://www.mortgagefinancegazette.com/features/monmouthshire-gets-set-offer-current-accounts-04-02-2019/

https://www.thetimes.co.uk/article/150-year-old-mutual-takes-on-trendy-monzo-at-its-own-game-j0vgx0l29

0 -

wmb194 said:

It's to do with Northern Ireland's gambling/lottery laws. I forget them now but I vaguely remember that accounts at other providers have fallen foul of this, too. Anyway, from the terms:donglemouse said:just to note for whatever reason residents of Northern Ireland aren't able to apply for the Nationwide BS Start to Save not sure why as I've had accounts with them in the past so the no Northern Ireland seem to be a recent thing?

"You can’t keep your Start to Save account if you live in Northern Ireland because of the law governing prize draws in that country. If that law changes, we may change this."

yes you're right that's what it is more detail here if anyone is interested

https://www.belfasttelegraph.co.uk/business/northern-ireland/nationwide-account-with-a-prize-draw-cant-be-offered-in-northern-ireland-because-laws-wont-allow-it-38964853.html

0 -

justforlaugh said:Just open Nationwide BS Start to Save account. Slightly confused with how much I could put this account per month. Sorry I did not read the Terms at the start but saw the post in Page 1 saying that it allows £1000/month. When tried transfer £1000, it reported error and saying the maximum is £200. Then I transferred £200 and it is fine. However, when go to read the terms, it says maximum £100 per month. Slightly confused with how much I could put this Nationwide BS Start to Save account per month.

You are allowed to increase your balance by £100 each month whilst also having flexible withdrawals. If you start the month with £200 then withdraw it you can make a payment of £300 before the end of the month. Maybe what you have done is a bug or maybe the amount of overage will be retuned overnight?

1 -

Their systems do allow you to deposit more than £100, and seemingly less than £1,000, a month but if your balance increases by more than £100 (and less than £50) a month, they will exclude you from the prize draws,someone said:justforlaugh said:Just open Nationwide BS Start to Save account. Slightly confused with how much I could put this account per month. Sorry I did not read the Terms at the start but saw the post in Page 1 saying that it allows £1000/month. When tried transfer £1000, it reported error and saying the maximum is £200. Then I transferred £200 and it is fine. However, when go to read the terms, it says maximum £100 per month. Slightly confused with how much I could put this Nationwide BS Start to Save account per month.

You are allowed to increase your balance by £100 each month whilst also having flexible withdrawals. If you start the month with £200 then withdraw it you can make a payment of £300 before the end of the month. Maybe what you have done is a bug or maybe the amount of overage will be retuned overnight?0 -

Wonder if it's an impending merger. Their society year end date was 31 MarchJamesRobinson48 said:I wonder what's going on at the Mon BS. Their website says they're closing at 13:00 on Wed 28th Apr because

"We will be sharing our future plans with all our colleagues and are excited about what the future holds for the Society and its members."0 -

Good point, it's my interest that's 31 March, you are correct on year end, sorry.

I don't think other societies are interested in the branch footprint to get new customers like they used to especially with lockdowns and masks etc. Wouldn't surprise me if Principality took it over (sorry, merged).Closing all your branches to tell your staff stuff is quite extreme though unless it's something major.

Anyways. off topic and pure speculation so I'll stop there.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards