We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

That is correct, and that is why I said "The new terms would not override the maximum balance of the older account, but probably do signify a relaxation of the aggregate maximum balance". The new terms do not change how much you are allowed to pay into the older account.chris_the_bee said:

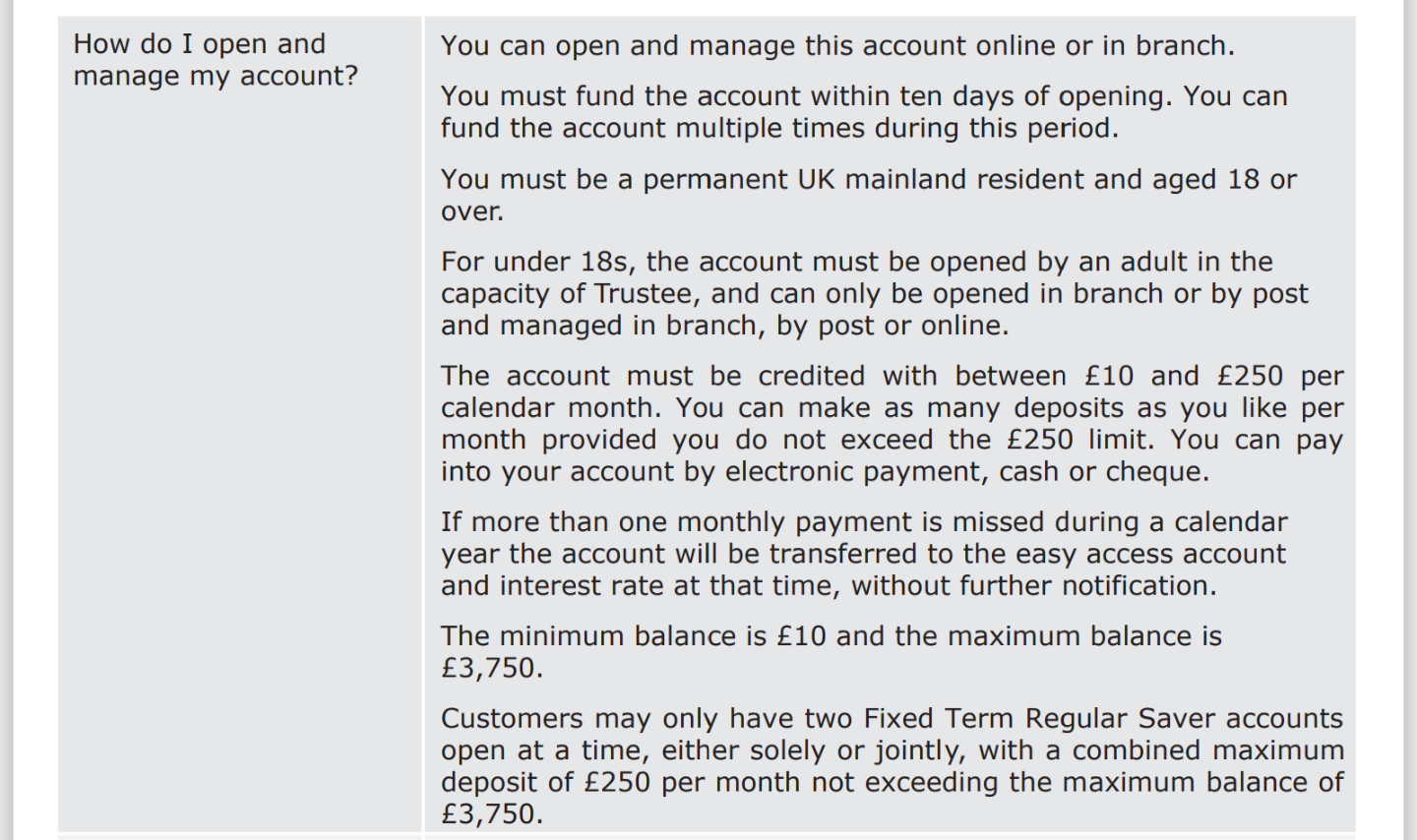

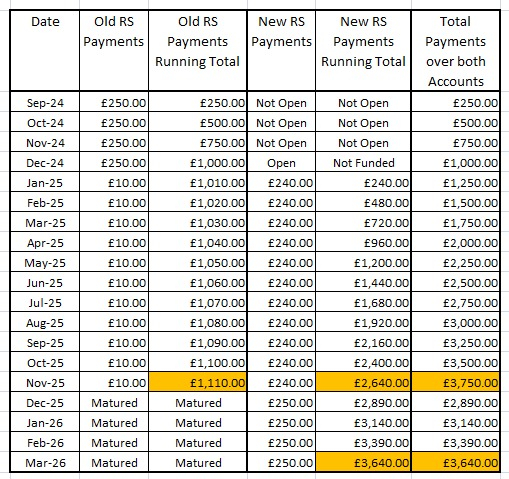

Market Harboroughmasonic said:Bobblehat said:1) Do you think that the new T&C's over-ride the old T&C's for the old RS?2) How will this affect the potential pay-in to both? If you've already funded the old one with £1000 by December 2024 and start funding in Jan 2025 with £240 in the new and £10 in the old?

Struggling to get my head around when (if at all) I'd fall foul of any of the above funding restrictions before one or the other RS matures? I assume that the interim interest payments (i.e. paid on 30.11.24 for the older RS and the equivalent for the new RS [31.03.2025?] don't count).My interpretation would be that you can distribute up to £3,750 between the two, but can only have a maximum of £3,600 in the first. The new terms would not override the maximum balance of the older account, but probably do signify a relaxation of the aggregate maximum balance.The restriction as written refers to money deposited by you, so interest above this limit should be ok.

I think the £3750 limit across two accounts if you open the RS (31.03.2026) supersedes the £3000 stipulation for RS (30.11.2025)The new terms override the old as the new clearly state you can have £3750 across the two accounts.

2 -

I guess that if I were to open the new one, fund it with £240pm and fund the old one with £10pm from Jan 25 on, then I won't anyway near exceed the £3000 limit on the old RS! So no problem there!masonic said:

That is correct, and that is why I said "The new terms would not override the maximum balance of the older account, but probably do signify a relaxation of the aggregate maximum balance". The new terms do not change how much you are allowed to pay into the older account.chris_the_bee said:

Market Harboroughmasonic said:Bobblehat said:1) Do you think that the new T&C's over-ride the old T&C's for the old RS?2) How will this affect the potential pay-in to both? If you've already funded the old one with £1000 by December 2024 and start funding in Jan 2025 with £240 in the new and £10 in the old?

Struggling to get my head around when (if at all) I'd fall foul of any of the above funding restrictions before one or the other RS matures? I assume that the interim interest payments (i.e. paid on 30.11.24 for the older RS and the equivalent for the new RS [31.03.2025?] don't count).My interpretation would be that you can distribute up to £3,750 between the two, but can only have a maximum of £3,600 in the first. The new terms would not override the maximum balance of the older account, but probably do signify a relaxation of the aggregate maximum balance.The restriction as written refers to money deposited by you, so interest above this limit should be ok.

I think the £3750 limit across two accounts if you open the RS (31.03.2026) supersedes the £3000 stipulation for RS (30.11.2025)The new terms override the old as the new clearly state you can have £3750 across the two accounts.

It looks like, if I've done the maths correctly, that I would reach exactly £3750 in total over the two accounts on 3rd November 2025 (1st is a Saturday). Come the end of November the first RS matures and from then on I can actually fund the newer RS with £250pm and not break the £3750 limit right up to maturity in 31.03.26 with £3640 in there!

If anyone spots an error below or flaw in my thinking, please let me know!

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum19 -

Not an error/flaw, more an observation, but why open the 2nd one this month, just leave it until the 1st or 2nd Jan? It's vaguely possible that if opened in Dec and not funded you may fall foul of the min £10 monthly deposit even though you have 10 days to fund. Those two rules rather contradict one another, however I'm sure the latter rule would override the minimum

Also, if requiring extra funds ready in time for Xmas 25 you could adjust the split from 10/240 at some point to whatever you think you'll need.

For those who worry about CoP.- Please note Confirmation of Payee (CoP) will not work for 24 hours after you initially set up your account, for details of the scheme please see our CoP webpage

3 -

3

-

Also perhaps worth noting that according to the Issue 2 Terms, an account opened this month "...must be credited with between £10 and £250 per calendar month". This condition can not seemingly be met if you have already fully funded Issue 1 this month and the combined monthly deposit rule is enforced in practice.

https://mhbs.co.uk/document/1YR02/2 -

Though that term makes no difference for this month anyway.qbadger said:Also perhaps worth noting that according to the Issue 2 Terms, an account opened this month "...must be credited with between £10 and £250 per calendar month". This condition can not seemingly be met if you have already fully funded Issue 1 this month and the combined monthly deposit rule is enforced in practice.

https://mhbs.co.uk/document/1YR02/

If you miss more than one payment in a calendar year the account is transferred into an EA account, but it is currently the final month of the calendar year anyway, if you open the account in December it is not possible to miss more than one payment this calendar year so if you miss this payment nothing happens and the year resets in January leaving you in the same position as you would be had you opened the account in January so far as meeting that term is concerned.

If you have a fully funded Issue 1 the only real difference by opening in December vs January is that assuming they enforce the rule about only being able to deposit £250 between them is that your funding window for making your initial deposit is reduced if you open it in December.3 -

If it's still available on 1st/2nd Jan, that would be fine to open and fund it then.exel1966 said:Not an error/flaw, more an observation, but why open the 2nd one this month, just leave it until the 1st or 2nd Jan? It's vaguely possible that if opened in Dec and not funded you may fall foul of the min £10 monthly deposit even though you have 10 days to fund. Those two rules rather contradict one another, however I'm sure the latter rule would override the minimum

Also, if requiring extra funds ready in time for Xmas 25 you could adjust the split from 10/240 at some point to whatever you think you'll need.

For those who worry about CoP.- Please note Confirmation of Payee (CoP) will not work for 24 hours after you initially set up your account, for details of the scheme please see our CoP webpage

I assumed that by putting it in December, it would be a good example for those that wanted to "grab it quick", (or already grabbed it!). Those that are prepared to take a chance would see that the number crunching above would still be valid if it were opened in early January. The sweet spot might be to open it early on 24th December and even the harshest interpretation of "10 days" would certainly fall on a bank working day straight after the New Year break! That's what I'm going for. It also gives me the certainty that if the account is open on the 24th, I should be well in time to alter my pending January SO (to the older RS) to £10 instead of its current value of £250. The first payment to the new RS I'll do manually, and set up a 2nd SO for £240 to start in February.

The main purpose of trying such a table was to see if a certain combination of factors would breach the £3750 rule, I couldn't do it in my head, so played around and eventually came up with this version as the best one I could come up with to test out on the forum who are far quicker than me to see various possibilities (or problems)

I did try a few "different splits" but as I don't have a current reason to maximise the maturity value of the older RS, I went for the maximum overall payments without breaking the max rule which is the 10/240 split with £250pm in the new one after the older RS matures. I think this could maximise the overall total of interest over the two RS's.Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum3 -

I would imagine that most people would want to fund them on the 2nd January, to maximise the interest potential, so it wouldn’t make any difference to them, whenever they open them.Bridlington1 said:

Though that term makes no difference for this month anyway.qbadger said:Also perhaps worth noting that according to the Issue 2 Terms, an account opened this month "...must be credited with between £10 and £250 per calendar month". This condition can not seemingly be met if you have already fully funded Issue 1 this month and the combined monthly deposit rule is enforced in practice.

https://mhbs.co.uk/document/1YR02/

If you miss more than one payment in a calendar year the account is transferred into an EA account, but it is currently the final month of the calendar year anyway, if you open the account in December it is not possible to miss more than one payment this calendar year so if you miss this payment nothing happens and the year resets in January leaving you in the same position as you would be had you opened the account in January so far as meeting that term is concerned.

If you have a fully funded Issue 1 the only real difference by opening in December vs January is that assuming they enforce the rule about only being able to deposit £250 between them is that your funding window for making your initial deposit is reduced if you open it in December.2 -

Apologies, my post was badly worded. I should've put in practice you've a shorter timeframe that you are able to make your initial deposit.Stargunner said:

The funding window will be exactly the same, whatever month you open it.Bridlington1 said:

Though that term makes no difference for this month anyway.qbadger said:Also perhaps worth noting that according to the Issue 2 Terms, an account opened this month "...must be credited with between £10 and £250 per calendar month". This condition can not seemingly be met if you have already fully funded Issue 1 this month and the combined monthly deposit rule is enforced in practice.

https://mhbs.co.uk/document/1YR02/

If you miss more than one payment in a calendar year the account is transferred into an EA account, but it is currently the final month of the calendar year anyway, if you open the account in December it is not possible to miss more than one payment this calendar year so if you miss this payment nothing happens and the year resets in January leaving you in the same position as you would be had you opened the account in January so far as meeting that term is concerned.

If you have a fully funded Issue 1 the only real difference by opening in December vs January is that assuming they enforce the rule about only being able to deposit £250 between them is that your funding window for making your initial deposit is reduced if you open it in December.

The point I was attempting to make was that if you've fully funded Issue 1 and you open issue 2 in December and they enforce the term regarding only being able to deposit £250 between the two accounts, you'd be unable to make your initial deposit for Issue 2 in December but the 10 calendar day funding window remains so in practice the number of days you can actually make your initial deposit into the account without the payment getting bounced. E.g. if you opened the account tomorrow (23/12/24), the 10 calendar days would start from then but you wouldn't in practice be able to make your deposit till 1/1/25 so your funding window in practice would be restricted to the first couple of days of January only.4 -

This wasn't the case when I saved the T&C's during the application process on 26.09.2024 ... they were saved as I showed them earlier, with max as £3000! Does this affect the table I posted, I don't think so? I still think the maximum interest to be had by 31.03.2026 is achieved by the 10/240 split and paying in £250 to Iss 2 after Iss 1 has matured. I'm prepared to be proved wrong!qbadger said:Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards