We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Can only be withdrawn by closing the account which most of us wouldn't wish to. So it's income of tax year 2025/26.solartom said:For anyone with an Principality 2 Year Health Habit RS they added annual interest to my account on its 1 year anniversary3 -

Surely the tax liability doesn't depend on whether it's something you wish to do or not but, wether you can access the funds......and you can access them in 24/25 tax year if you want to.schiff said:

Can only be withdrawn by closing the account which most of us wouldn't wish to. So it's income of tax year 2025/26.solartom said:For anyone with an Principality 2 Year Health Habit RS they added annual interest to my account on its 1 year anniversary3 -

If they have added the interest to your account then you have received it. That money is in your name. And presumably the interest is compounded so you are benefitting from it. It will be part of this year's income.subjecttocontract said:

Surely the tax liability doesn't depend on whether it's something you wish to do or not but, wether you can access the funds......and you can access them in 24/25 tax year if you want to.schiff said:

Can only be withdrawn by closing the account which most of us wouldn't wish to. So it's income of tax year 2025/26.solartom said:For anyone with an Principality 2 Year Health Habit RS they added annual interest to my account on its 1 year anniversary6 -

I've been trying to get my head around the comments about opening the new Market Harborough Fixed term RS (31.03.2026) in conjunction with already having the (30.11.2025) RS.

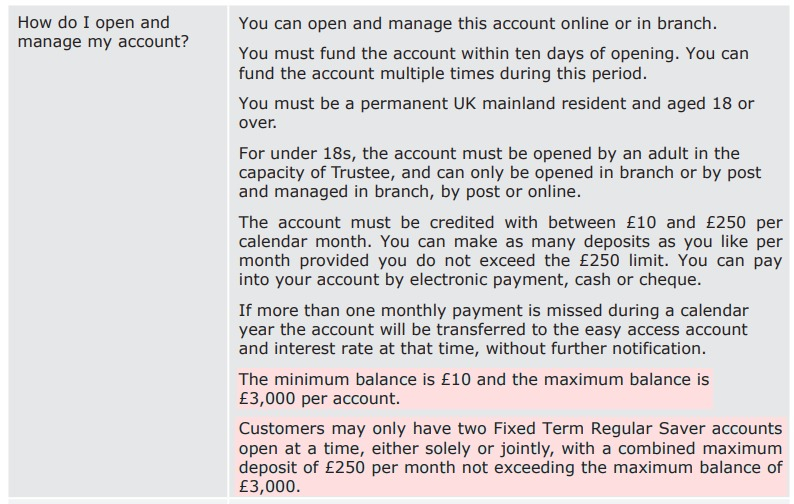

I've just looked at the T&C's for the older one and noticed that there is a section about having two fixed term RS's ....

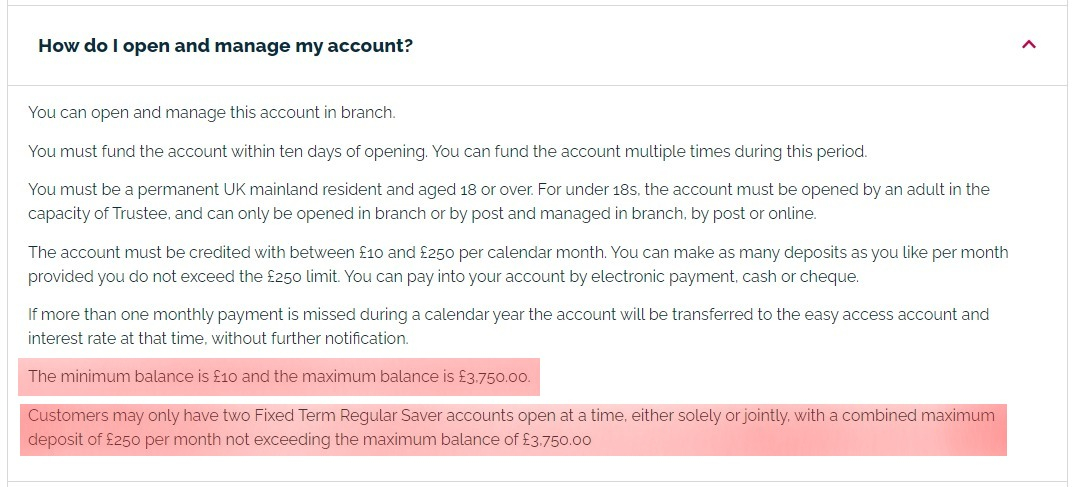

and a similar section in the new RS T&C's .....

My questions are ....

1) Do you think that the new T&C's over-ride the old T&C's for the old RS?

2) How will this affect the potential pay-in to both? If you've already funded the old one with £1000 by December 2024 and start funding in Jan 2025 with £240 in the new and £10 in the old?

Struggling to get my head around when (if at all) I'd fall foul of any of the above funding restrictions before one or the other RS matures? I assume that the interim interest payments (i.e. paid on 30.11.24 for the older RS and the equivalent for the new RS [31.03.2025?] don't count).

I'd appreciate your thoughts especially if you feel I'm over thinking this!

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum3 -

What matters is whether or not you can access it (including with a penalty). Since the account can be closed before the end of the term, the interest arises for tax when credited. Had the account not permitted early access or closure, then it would have arisen at maturity.Nick_C said:

If they have added the interest to your account then you have received it. That money is in your name. And presumably the interest is compounded so you are benefitting from it. It will be part of this year's income.subjecttocontract said:

Surely the tax liability doesn't depend on whether it's something you wish to do or not but, wether you can access the funds......and you can access them in 24/25 tax year if you want to.schiff said:

Can only be withdrawn by closing the account which most of us wouldn't wish to. So it's income of tax year 2025/26.solartom said:For anyone with an Principality 2 Year Health Habit RS they added annual interest to my account on its 1 year anniversary

5 -

Bobblehat said:1) Do you think that the new T&C's over-ride the old T&C's for the old RS?2) How will this affect the potential pay-in to both? If you've already funded the old one with £1000 by December 2024 and start funding in Jan 2025 with £240 in the new and £10 in the old?

Struggling to get my head around when (if at all) I'd fall foul of any of the above funding restrictions before one or the other RS matures? I assume that the interim interest payments (i.e. paid on 30.11.24 for the older RS and the equivalent for the new RS [31.03.2025?] don't count).My interpretation would be that you can distribute up to £3,750 between the two, but can only have a maximum of £3,600 in the first. The new terms would not override the maximum balance of the older account, but probably do signify a relaxation of the aggregate maximum balance.The restriction as written refers to money deposited by you, so interest above this limit should be ok.5 -

Re: Principality 2 Year Health Habit RS — interestmasonic said:

What matters is whether or not you can access it (including with a penalty). Since the account can be closed before the end of the term, the interest arises for tax when credited. Had the account not permitted early access or closure, then it would have arisen at maturity.Nick_C said:

If they have added the interest to your account then you have received it. That money is in your name. And presumably the interest is compounded so you are benefitting from it. It will be part of this year's income.subjecttocontract said:

Surely the tax liability doesn't depend on whether it's something you wish to do or not but, wether you can access the funds......and you can access them in 24/25 tax year if you want to.schiff said:

Can only be withdrawn by closing the account which most of us wouldn't wish to. So it's income of tax year 2025/26.solartom said:For anyone with an Principality 2 Year Health Habit RS they added annual interest to my account on its 1 year anniversaryThank you for this. It clarifies things, to a degree, but isn't it simply a case where the interest arises for tax when withdrawn (for example, if I opted to close this account and gain access to said interest before the year end), rather than if it can in theory be withdrawn?1 -

No sadly not, interest is counted in the tax year you can access it.DJDools said:

Re: Principality 2 Year Health Habit RS — interestmasonic said:

What matters is whether or not you can access it (including with a penalty). Since the account can be closed before the end of the term, the interest arises for tax when credited. Had the account not permitted early access or closure, then it would have arisen at maturity.Nick_C said:

If they have added the interest to your account then you have received it. That money is in your name. And presumably the interest is compounded so you are benefitting from it. It will be part of this year's income.subjecttocontract said:

Surely the tax liability doesn't depend on whether it's something you wish to do or not but, wether you can access the funds......and you can access them in 24/25 tax year if you want to.schiff said:

Can only be withdrawn by closing the account which most of us wouldn't wish to. So it's income of tax year 2025/26.solartom said:For anyone with an Principality 2 Year Health Habit RS they added annual interest to my account on its 1 year anniversaryThank you for this. It clarifies things, to a degree, but isn't it simply a case where the interest arises for tax when withdrawn (for example, if I opted to close this account and gain access to said interest before the year end), rather than if it can in theory be withdrawn?4 -

Market Harboroughmasonic said:Bobblehat said:1) Do you think that the new T&C's over-ride the old T&C's for the old RS?2) How will this affect the potential pay-in to both? If you've already funded the old one with £1000 by December 2024 and start funding in Jan 2025 with £240 in the new and £10 in the old?

Struggling to get my head around when (if at all) I'd fall foul of any of the above funding restrictions before one or the other RS matures? I assume that the interim interest payments (i.e. paid on 30.11.24 for the older RS and the equivalent for the new RS [31.03.2025?] don't count).My interpretation would be that you can distribute up to £3,750 between the two, but can only have a maximum of £3,600 in the first. The new terms would not override the maximum balance of the older account, but probably do signify a relaxation of the aggregate maximum balance.The restriction as written refers to money deposited by you, so interest above this limit should be ok.

I think the £3750 limit across two accounts if you open the RS (31.03.2026) supersedes the £3000 stipulation for RS (30.11.2025)The new terms override the old as the new clearly state you can have £3750 across the two accounts.2 -

DJDools said:

Re: Principality 2 Year Health Habit RS — interestmasonic said:

What matters is whether or not you can access it (including with a penalty). Since the account can be closed before the end of the term, the interest arises for tax when credited. Had the account not permitted early access or closure, then it would have arisen at maturity.Nick_C said:

If they have added the interest to your account then you have received it. That money is in your name. And presumably the interest is compounded so you are benefitting from it. It will be part of this year's income.subjecttocontract said:

Surely the tax liability doesn't depend on whether it's something you wish to do or not but, wether you can access the funds......and you can access them in 24/25 tax year if you want to.schiff said:

Can only be withdrawn by closing the account which most of us wouldn't wish to. So it's income of tax year 2025/26.solartom said:For anyone with an Principality 2 Year Health Habit RS they added annual interest to my account on its 1 year anniversaryThank you for this. It clarifies things, to a degree, but isn't it simply a case where the interest arises for tax when withdrawn (for example, if I opted to close this account and gain access to said interest before the year end), rather than if it can in theory be withdrawn?No it isn't. Otherwise we could go on accumulating interest in savings accounts without it being taxable (rather like how capital gains tax works). Clearly interest doesn't work like this.Unless the T&Cs of the account prohibit you from accessing the interest, then it is taxable when it is credited. In the instance that you are prevented from accessing the interest, it is considered that it hasn't actually been made available to you.If you are free to withdraw the interest without penalty, or if you can withdraw the interest subject to a penalty, or if you can close the account early to access the interest, then in all of these cases it is taxable when credited.6

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards