We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Coventry Loyalty Seasonal Saver - I prefer to fund it on the 20th of each month because I need a very large sum to fund the many RS`s I currently have which are funded on the 1st of the month by SO. I can use my weekly pension payments for the funding of the few non 1st of the month RS SO`s thus helping with cash flow. I fund using SO`s as opposed to doing manual payments so having SO dates not on the 1st of each month is not an issue.I noticed there is are no withdrawals and no option to close this account and realise the interest accrued without penalty. I presume if they dropped the interest rate we would be able to close the account without penalty.Many seasonal thanks to Bridlington and others who post these new RS offerings.I wrongly assumed new RS accounts with high interest rates would become less frequent in the present climate but the merry go round continues unabated!6

-

If that's a question then I think the answer is no - if the interest rate is decreased then the withdrawal penalty remains (loss of 30 day's interest) albeit at a lower rate.where_are_we said:Coventry Loyalty Seasonal Saver .... I presume if they dropped the interest rate we would be able to close the account without penalty.0 -

My interpretation would be yes.flaneurs_lobster said:

If that's a question then I think the answer is no - if the interest rate is decreased then the withdrawal penalty remains (loss of 30 day's interest) albeit at a lower rate.where_are_we said:Coventry Loyalty Seasonal Saver .... I presume if they dropped the interest rate we would be able to close the account without penalty.

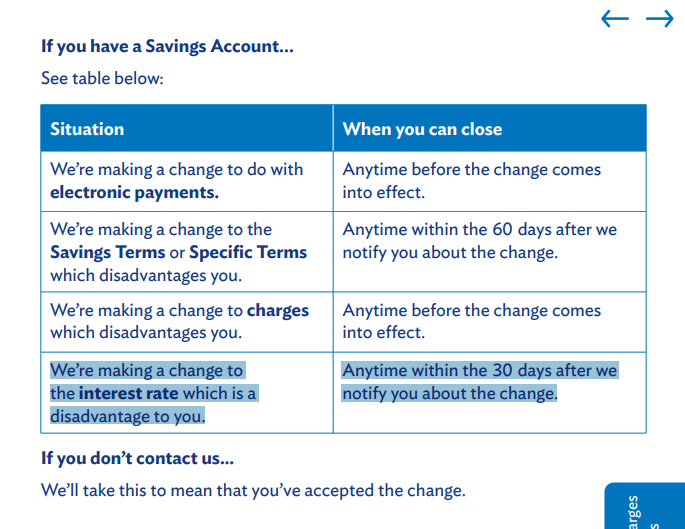

The General Ts&Cs state:

Thus if the interest rate was reduced you'd be able to close the account without penalty within 30 days of being notified of the decrease.17 -

By "no" I did, of course, mean "yes"..My interpretation would be yes.

.

Thus if the interest rate was reduced you'd be able to close the account without penalty within 30 days of being notified of the decrease.

Missed the override clause in the General T&Cs. Thanks @Bridlington1.7 -

No is the new Yes, Ha Haflaneurs_lobster said:

By "no" I did, of course, mean "yes"..My interpretation would be yes.

.

Thus if the interest rate was reduced you'd be able to close the account without penalty within 30 days of being notified of the decrease.

Missed the override clause in the General T&Cs. Thanks @Bridlington1.I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.1 -

My Nationwide Flex RS has just matured. I tried to open the current one but the system tells me I can't because I already have a RS.

Any idea how long it will take to sort itself out?0 -

Apologies if this has been announced already. It's the same RS that a lot of us opened in September (ending 30/11/2025), but with a new ending date, same interest (6%) fixed

Market Harborough B.S.

Fixed Term Regular Saver (31.03.2026)

6.00% Gross*/AER** fixed

Minimum balance – £10

Maximum balance – £250 (per month)

Annual interest paid at maturityIt is possible to hold 2 RS but not deposit more than a total of £250 a month

7 -

Seems it can only be opened in branch, unlike the September offeringfrancoghezzi said:Apologies if this has been announced already. It's the same RS that a lot of us opened in September (ending 30/11/2025), but with a new ending date, same interest (6%) fixedMarket Harborough B.S.

Fixed Term Regular Saver (31.03.2026)

6.00% Gross*/AER** fixed

Minimum balance – £10

Maximum balance – £250 (per month)

Annual interest paid at maturityIt is possible to hold 2 RS but not deposit more than a total of £250 a month

Learn from the mistakes of others - you won't live long enough to make them all yourself.0 -

According to their website the RS must be opened in branch, yes, at least for now. It is worth keeping an eye, anyway, because it is still a good fixed 6% lasting 15 monthscheckly said:

Seems it can only be opened in branch, unlike the September offeringfrancoghezzi said:Apologies if this has been announced already. It's the same RS that a lot of us opened in September (ending 30/11/2025), but with a new ending date, same interest (6%) fixedMarket Harborough B.S.

Fixed Term Regular Saver (31.03.2026)

6.00% Gross*/AER** fixed

Minimum balance – £10

Maximum balance – £250 (per month)

Annual interest paid at maturityIt is possible to hold 2 RS but not deposit more than a total of £250 a month

1 -

BestSeagull said:My Nationwide Flex RS has just matured. I tried to open the current one but the system tells me I can't because I already have a RS.

Any idea how long it will take to sort itself out?

You should be able to open a new RS tomorrow

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards