We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

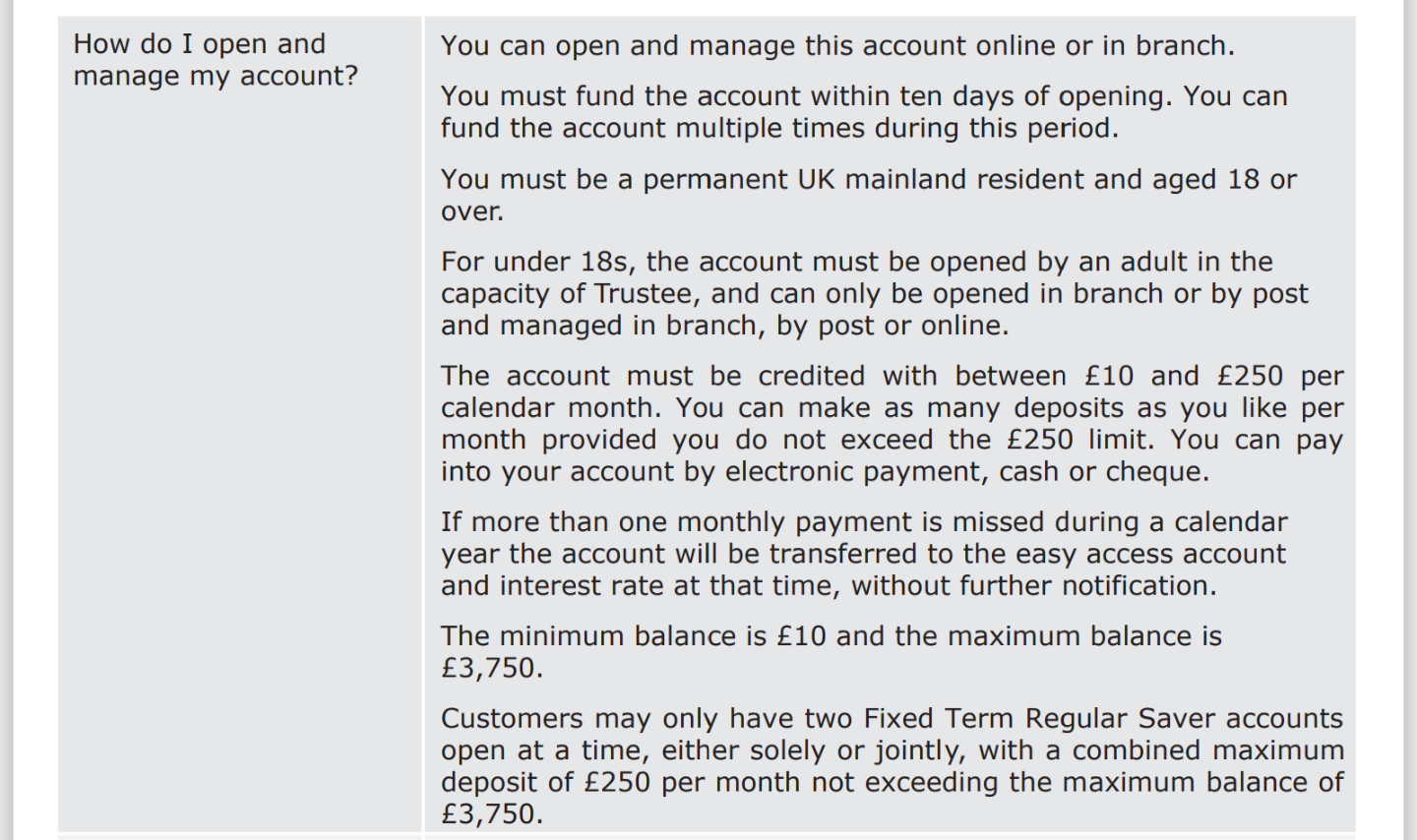

The maximum balance for Issue 1 was increased from £3k to £3.75k not long after it was launched IIRC.Bobblehat said:

This wasn't the case when I saved the T&C's during the application process on 26.09.2024 ... they were saved as I showed them earlier, with max as £3000! Does this affect the table I posted, I don't think so? I still think the maximum interest to be had by 31.03.2026 is achieved by the 10/240 split and paying in £250 to Iss 2 after Iss 1 has matured. I'm prepared to be proved wrong!qbadger said:

EDIT:

See below:

https://forums.moneysavingexpert.com/discussion/comment/81018871/#Comment_810188714 -

Bobblehat said:

This wasn't the case when I saved the T&C's during the application process on 26.09.2024 ... they were saved as I showed them earlier, with max as £3000! Does this affect the table I posted, I don't think so? I still think the maximum interest to be had by 31.03.2026 is achieved by the 10/240 split and paying in £250 to Iss 2 after Iss 1 has matured. I'm prepared to be proved wrong!qbadger said:The interest rate is the same, so prioritising the newer one will result in a higher carried balance when the other matures, and therefore more interest overall.If they varied the maximum balance while the original one was on sale, I'm surprised they didn't notify you of updated T&C.4 -

I've no memory of them notifying me ... but I've no excuse for missing the forum post by Kim_13 and signposted by Bridlington1. The forum is a more reliable source of such informationmasonic said:Bobblehat said:

This wasn't the case when I saved the T&C's during the application process on 26.09.2024 ... they were saved as I showed them earlier, with max as £3000! Does this affect the table I posted, I don't think so? I still think the maximum interest to be had by 31.03.2026 is achieved by the 10/240 split and paying in £250 to Iss 2 after Iss 1 has matured. I'm prepared to be proved wrong!qbadger said:The interest rate is the same, so prioritising the newer one will result in a higher carried balance when the other matures, and therefore more interest overall.If they varied the maximum balance while the original one was on sale, I'm surprised they didn't notify you of updated T&C. Compiler of the RS League Table.

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum3 -

There was a discussion somewhere on the forum - I think it was something like with the duration of the account in terms of months, and a £250 per month, you’d exceed £3000 and reach £3750. People reported this to MHBS who subsequently updated the ts and cs. I agree though that customers who opened on the old terms should’ve been sent the new terms - bad form, I only knew about this from being on the forum.

The thing I’m really curious about is if the systems enforce the whole deposit limit! I.e. if it will let you pay £250 in each regardless of terms, and doesn’t just void the interest at the end of the term.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

Mansfield BS Kick Start (7th issue) RS

I've just realised the bonus comes to an end in the next few days and overall interest rate drops to 4%. I'd like to withdraw funds - does anyone know if this can be done electronically via online secure message or any other quick way without sending passbook etc?

1 -

Mine matured on 21st and had already transferred to a new EA account when I logged in today and I was able to open a new RS and fund today.BestSeagull said:My Nationwide Flex RS has just matured. I tried to open the current one but the system tells me I can't because I already have a RS.

Any idea how long it will take to sort itself out?

1 -

Sadly not I'm afraid. If you wish to make withdrawals/close the account you'd need to produce the passbook, this must be done in branch or by post.granta said:Mansfield BS Kick Start (7th issue) RS

I've just realised the bonus comes to an end in the next few days and overall interest rate drops to 4%. I'd like to withdraw funds - does anyone know if this can be done electronically via online secure message or any other quick way without sending passbook etc?

2 -

Thanks. Kicking myself for not getting this sorted before Christmas!Bridlington1 said:

Sadly not I'm afraid. If you wish to make withdrawals/close the account you'd need to produce the passbook, this must be done in branch or by post.granta said:Mansfield BS Kick Start (7th issue) RS

I've just realised the bonus comes to an end in the next few days and overall interest rate drops to 4%. I'd like to withdraw funds - does anyone know if this can be done electronically via online secure message or any other quick way without sending passbook etc?1 -

Bridlington1 said:

I've fully funded the 1st issue and have just opened issue 2. I shall send £10 across to issue 2 tomorrow as an experiment so shall report back whether the £250 combined monthly deposit rule is actually enforced in practice.qbadger said:So if you've already funded the 1st issue in full this month, you'll need to wait until 02 Jan before funding the 2nd issue?I have 2 x Issue 1 which I credit the maximum of £250 in each RS each month and have done for the past 4 months. Interest for those 2 x Issue 1 RS has also been applied in December as per the T&C's.I have now opened Issue 2 which I have credited £250 and there are no system issues or returned payments if the max isn't exceeded each month in each RS account. This month I have paid the maximum allowed over 3 RS £750 with no monies returned.# No.2 Save 1p A Day Challenge 2026 £59.17 / £667.95 (1)# No.4 Save £12k in 2026 £2454.88 / £12,000 (1)# No.4 £2 Savers Club 2026 - 25/12 - 24/10 £30 / £200 (1)# No.8 Sealed Pot Challenge 19 - 2026 - 24/12 - 24/10 £50+ / £400 (1)# No.5 Fiver Friday Challenge 2026 £25/£230 (1)# Make £2026 in 2026 £787.42 / £2026 (1)8 -

Dizzycap said:Bridlington1 said:

I've fully funded the 1st issue and have just opened issue 2. I shall send £10 across to issue 2 tomorrow as an experiment so shall report back whether the £250 combined monthly deposit rule is actually enforced in practice.qbadger said:So if you've already funded the 1st issue in full this month, you'll need to wait until 02 Jan before funding the 2nd issue?I have 2 x Issue 1 which I credit the maximum of £250 in each RS each month and have done for the past 4 months. Interest for those 2 x Issue 1 RS has also been applied in December as per the T&C's.I have now opened Issue 2 which I have credited £250 and there are no system issues or returned payments if the max isn't exceeded each month in each RS account. This month I have paid the maximum allowed over 3 RS £750 with no monies returned.Well, that’s going to put the cat amongst the pigeons

I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards