We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Has anyone had any luck opening it without a mortgage or has it just not gone through please? ThanksKazza242 said:According to Moneyfacts, Coventry Building Society are launching a new regular saver, called 'Loyalty Mortgage Saver', paying 6.00% (variable).

The account is available to existing members of the Society and you must hold an eligible mortgage account with Coventry Building Society, Godiva Mortgages Limited or ITL Mortgages Limited (eligibility criteria applies). If opening a joint account only one customer will need to be eligible.

- Maximum monthly deposit £1,000 (per calendar month)

- Maximum total investment is £13,000

- The account runs for one year (the interest is paid on the anniversary of account opening)

- After the 14 day 'cooling off period', you can withdraw money or close your account, but this will incur a charge equal to 30 calendar days' interest on the amount withdrawn on each occasion.

The account is already available to apply for if you login to Coventry BS online banking (you must meet the eligibility criteria required to open the account).

Edit: The account has now been added to the Coventry BS website, here.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

Hattie627 said:

Hope this isn't the start of a new trend of limiting loyalty or preferential savings products to mortgage holders with the institution. Very restrictive.Kazza242 said:According to Moneyfacts, Coventry Building Society are launching a new regular saver, called 'Loyalty Mortgage Saver', paying 6.00% (variable).

The account is available to existing members of the Society and you must hold an eligible mortgage account with Coventry Building Society, Godiva Mortgages Limited or ITL Mortgages Limited (eligibility criteria applies). If opening a joint account only one customer will need to be eligible.

- Maximum monthly deposit £1,000 (per calendar month)

- Maximum total investment is £13,000

- The account runs for one year (the interest is paid on the anniversary of account opening)

- After the 14 day 'cooling off period', you can withdraw money or close your account, but this will incur a charge equal to 30 calendar days' interest on the amount withdrawn on each occasion.

The account is already available to apply for if you login to Coventry BS online banking (you must meet the eligibility criteria required to open the account).

Edit: The account has now been added to the Coventry BS website, here.

It's clearly a different sort of product to most of their regular savers, with a good but not wonderful rate but a much higher than usual deposit limit. I wouldn't be too concerned.

0 -

Nope. Tried earlier.ForumUser7 said:

Has anyone had any luck opening it without a mortgage or has it just not gone through please? ThanksKazza242 said:According to Moneyfacts, Coventry Building Society are launching a new regular saver, called 'Loyalty Mortgage Saver', paying 6.00% (variable).

The account is available to existing members of the Society and you must hold an eligible mortgage account with Coventry Building Society, Godiva Mortgages Limited or ITL Mortgages Limited (eligibility criteria applies). If opening a joint account only one customer will need to be eligible.

- Maximum monthly deposit £1,000 (per calendar month)

- Maximum total investment is £13,000

- The account runs for one year (the interest is paid on the anniversary of account opening)

- After the 14 day 'cooling off period', you can withdraw money or close your account, but this will incur a charge equal to 30 calendar days' interest on the amount withdrawn on each occasion.

The account is already available to apply for if you login to Coventry BS online banking (you must meet the eligibility criteria required to open the account).

Edit: The account has now been added to the Coventry BS website, here.1 -

Quick question...do First Direct standing orders to fund the RS come out on a Saturday? I know Sunday ones go to Monday, but not sure about Saturdays.0

-

t1redmonkey said:Quick question...do First Direct standing orders to fund the RS come out on a Saturday? I know Sunday ones go to Monday, but not sure about Saturdays.

No, next working day.1 -

Coventry Loyalty Mortgage Saver

A "nice" way to reward existing mortgage holders - perhaps Nationwide could take note for next years fairer share rewards...

Although I'm not sure it's quite enough to encourage someone to take out a mortgage with Coventry, just to get this account!0 -

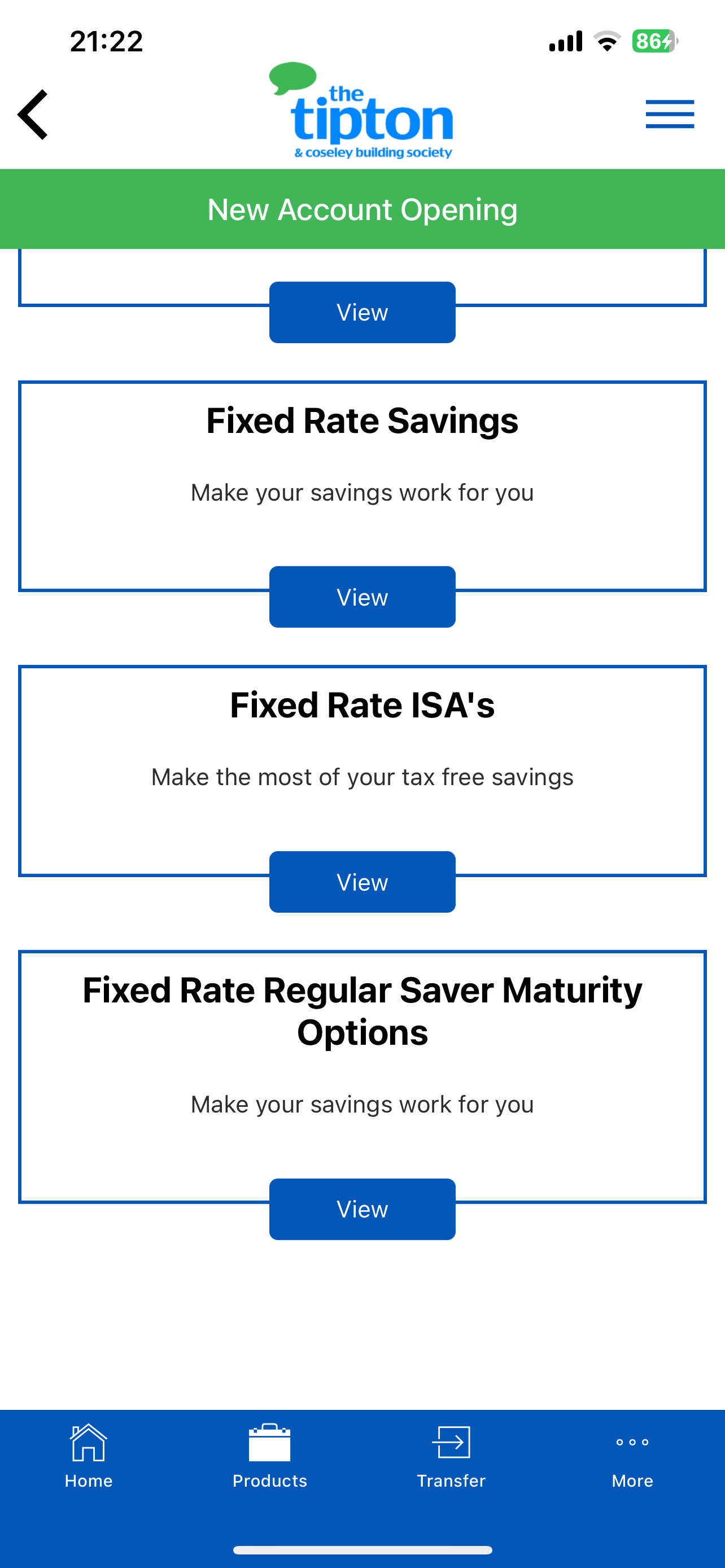

Have you updated the Tipton App? There were a few issues a couple of weeks ago and they did an update with a fresh APP download.schiff said:"If you want your money to go back to your nominated account then select that option on your homepage in the App. There should be a link along the bottom of the Regular Saver box. Once you've confirmed, it should say: Thank you for selecting your maturity option, and the link will disappear."

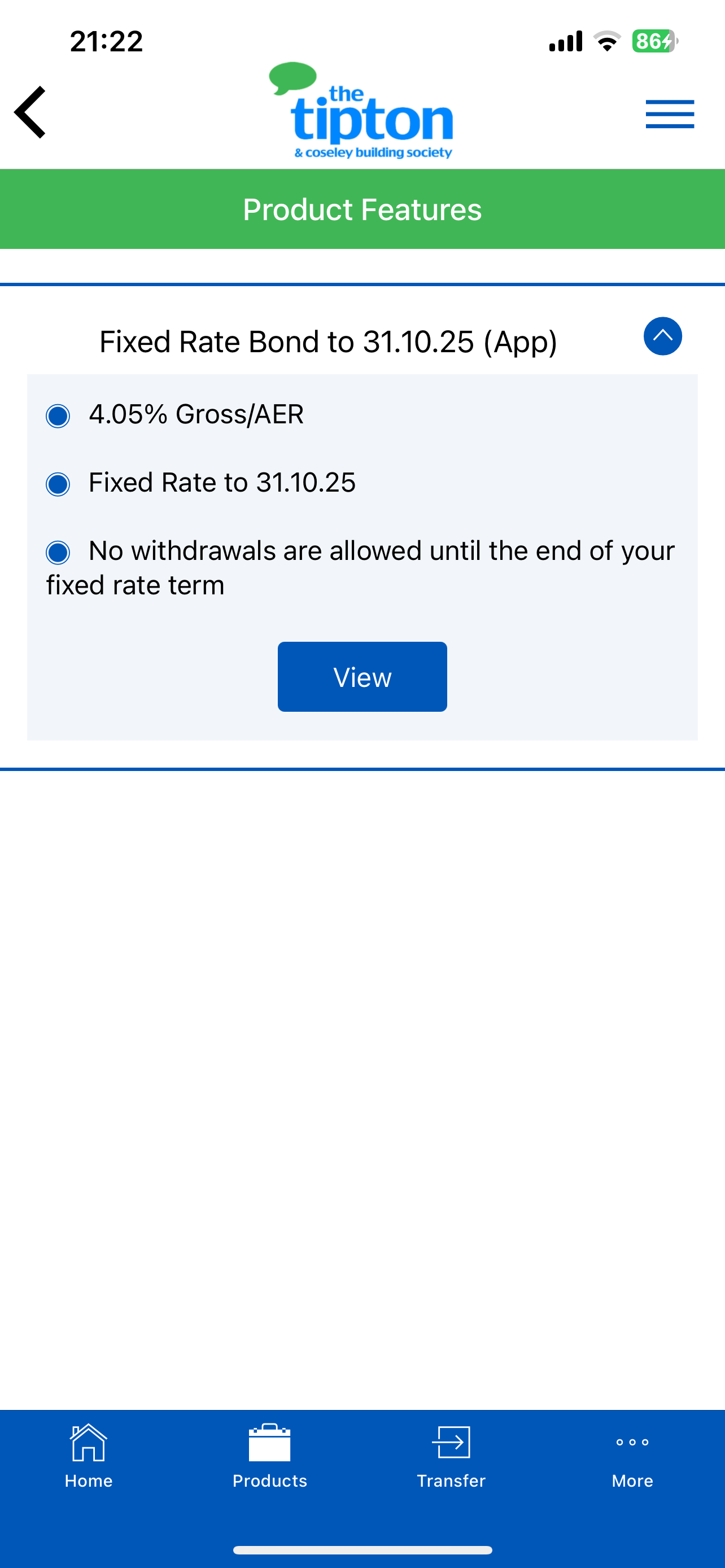

I've tried everything but no joy. The link isn't there - for me anyway. I'll try again in a day or so. There's plenty of time.This is the rollover option I have in the most recent Tipton App - Under products: When I click View I get this Fixed Rate Bond @ 4.05% for my maturing Regular Saver:

When I click View I get this Fixed Rate Bond @ 4.05% for my maturing Regular Saver: It seems we're all getting different offers?

It seems we're all getting different offers? # No.2 Save 1p A Day Challenge 2026 £118.34 / £667.95 (2)# No.4 Save £12k in 2026 £3635.93 / £12,000 (2)# No.4 £2 Savers Club 2026 - (25/12 - 24/10) £50 / £200 (2)# No.8 Sealed Pot Challenge 19 - 2026 - 24/12 - 24/10 £50+ / £400 (2)# No.5 Fiver Friday Challenge 2026 £40/£230 (2)# Make £2026 in 2026 £1033.98 / £2026 (2)0

# No.2 Save 1p A Day Challenge 2026 £118.34 / £667.95 (2)# No.4 Save £12k in 2026 £3635.93 / £12,000 (2)# No.4 £2 Savers Club 2026 - (25/12 - 24/10) £50 / £200 (2)# No.8 Sealed Pot Challenge 19 - 2026 - 24/12 - 24/10 £50+ / £400 (2)# No.5 Fiver Friday Challenge 2026 £40/£230 (2)# Make £2026 in 2026 £1033.98 / £2026 (2)0 -

I think the aim is to encourage the existing mortgage customers to stay.dcs34 said:Coventry Loyalty Mortgage Saver

A "nice" way to reward existing mortgage holders - perhaps Nationwide could take note for next years fairer share rewards...

Although I'm not sure it's quite enough to encourage someone to take out a mortgage with Coventry, just to get this account!0 -

allegro120 said:

I think the aim is to encourage the existing mortgage customers to stay.dcs34 said:Coventry Loyalty Mortgage Saver

A "nice" way to reward existing mortgage holders - perhaps Nationwide could take note for next years fairer share rewards...

Although I'm not sure it's quite enough to encourage someone to take out a mortgage with Coventry, just to get this account!So do I. Other than the Rainy Day Regular Saver (NLA) the rest of the savings rates are a little on the anemic side.Looks like The Mortgage Saver is replacing the Loyalty Regular Saver, for now anyway............Shame, as their Standard Regular Saver @ 4.75% is non-competative :/in the RS market.# No.2 Save 1p A Day Challenge 2026 £118.34 / £667.95 (2)# No.4 Save £12k in 2026 £3635.93 / £12,000 (2)# No.4 £2 Savers Club 2026 - (25/12 - 24/10) £50 / £200 (2)# No.8 Sealed Pot Challenge 19 - 2026 - 24/12 - 24/10 £50+ / £400 (2)# No.5 Fiver Friday Challenge 2026 £40/£230 (2)# Make £2026 in 2026 £1033.98 / £2026 (2)0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards