We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Barclays let you scan in cheques up to £5,000.2

-

There is another alternative which perhaps I should have mentioned. Some or all of the maturity funds into an account entitled Fixed Rate Bond 31/10/25 at 4.05% variable (though the summary box says fixed).

Minimum balance £1000 and more funds can be added within a window to 14 November (branch or post)

And a 35 day notice account at 4.51% (4.70% on £10K+)

Again I assume withdrawals by cheque.

Once I'm out of this archaic establishment I ain't going back!

1 -

I was going to leave £1 in for membership purposes. Can I specify £1 into the default and withdraw the remainder, or easily get the rest out if I let it default? Worried about doing anything with the options in the app given they’ve been there for weeks with no information to accompany them.Not too disappointed with a cheque, as my nominated account is the only current account I actively use that doesn’t have a minimum pay in requirement - so it makes sense for the proceeds to go somewhere else.0

-

What about if you live close by? No change?schiff said:Tipton

Maturity pack arrived by post today. Closing the account means a cheque! No alternative offered.

If you don't send instructions in the franked envelope provided the proceeds go into a 3.60% EA (limited) account. Not very interesting. Presumably withdrawals also by cheque.

So - a reminder please of which banks would take a cheque deposit of £3500+ by photo?1 -

schiff said:TiptonIf you don't send instructions in the franked envelope provided the proceeds go into a 3.60% EA (limited) account. Not very interesting. Presumably withdrawals also by cheque.

———————————————————————

How is the EA account Limited?Surely on maturity they would offer an Easy Access account and then process Faster Payments from it on request to your nominated Bank Account.Otherwise, why have a nominated bank account?I’ve heard nothing yet from Tipton.I think I’ll just get out of it ASAP.Digital Payback

The National Lottery : A tax on those who aren’t good at maths.0 -

same here... Hanley Econ..."we don't operate faster payments...should bethere by the endof theweek" !0

-

Definitely. "We do not permit withdrawals to be made by direct debit, standing order, or by electronic/Faster Payment." https://www.thetipton.co.uk/media/3552/tipton-terms-and-conditions.pdfschiff said:Tipton

Maturity pack arrived by post today. Closing the account means a cheque! No alternative offered.

If you don't send instructions in the franked envelope provided the proceeds go into a 3.60% EA (limited) account. Not very interesting. Presumably withdrawals also by cheque.

So - a reminder please of which banks would take a cheque deposit of £3500+ by photo?

So presumably the cash drag timeline is:

Matures on Thursday, cheque sent on Friday, arrives on Monday and (from memory with Lloyds by photo) takes one or two days to be cashed. 6-7 days of £3500+interest earning nothing, but the rate is good enough to compensate for the delay.

Strange that they could "modernise" to offering app account, but still live in the "cheque/cash only" world.

2 -

https://forums.moneysavingexpert.com/discussion/6552075/list-of-bank-building-society-app-cheque-deposit-limits/p1schiff said:Tipton

So - a reminder please of which banks would take a cheque deposit of £3500+ by photo?3 -

re Tipton

I would expect to be able to withdraw to my nominated account.

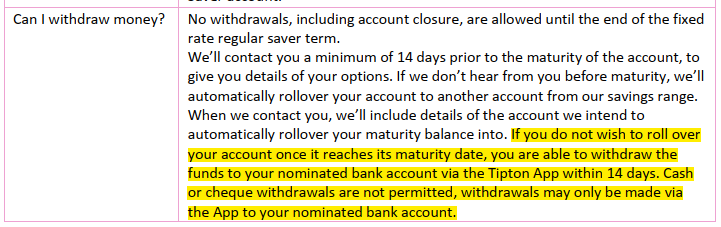

According to the account Summary box I saved during application:

5 -

allegro120 said:

Definitely. "We do not permit withdrawals to be made by direct debit, standing order, or by electronic/Faster Payment." https://www.thetipton.co.uk/media/3552/tipton-terms-and-conditions.pdfschiff said:Tipton

Maturity pack arrived by post today. Closing the account means a cheque! No alternative offered.

If you don't send instructions in the franked envelope provided the proceeds go into a 3.60% EA (limited) account. Not very interesting. Presumably withdrawals also by cheque.

So - a reminder please of which banks would take a cheque deposit of £3500+ by photo?

So presumably the cash drag timeline is:

Matures on Thursday, cheque sent on Friday, arrives on Monday and (from memory with Lloyds by photo) takes one or two days to be cashed. 6-7 days of £3500+interest earning nothing, but the rate is good enough to compensate for the delay.

Strange that they could "modernise" to offering app account, but still live in the "cheque/cash only" world.I don’t understand.

when I closed my last Tipton RS on maturity they did it via bank transfer.

is this perhaps the difference between variants opened by app and by post? Has anyone who opened in the app been offered cheque only?

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards