We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

The current terms and conditions for the Penrith 300 say "This account is available to Heartland residents or existing members of the Society and can be opened in branch or by post." I can confirm I had no trouble opening one as an existing member who lives nowhere near the Heartlands.Emily_Joy said:Emily_Joy said:Cambridge BS RS Reward ExtraThe entry on the 1st page says that it can be opened in branch, by post, or by phone. My Cambridge RS Reward (4% APR) matures in about a week's time and I was able to give maturity instructions online. One option was to open Reward Extra and to fund it using the funds from the maturing account, saving the hassle of posting the form.The maturity instruction form is very similar to Saffron's.It looks like it didn't work - I just logged in to discover all matured funds sitting in an easy access. Will try phoning them tomorrow. *sigh*The first page says Penrith BS regular saver 300 available to existing members, but at the moment it is for Heartlands residents only.

3 -

Can someone provide a link to the list of T's&C's for all the regular savings accounts please.1

-

https://forums.moneysavingexpert.com/discussion/6470420/an-archived-list-of-regular-saver-terms-and-conditions/p1chris_the_bee said:Can someone provide a link to the list of T's&C's for all the regular savings accounts please.

There is also a link to it on the first page of this thread.11 -

Not "best currently available" but for those with the accounts, Bucks BS are reducing their RS rates:

RS (open) -0.1% to 4.0%

RS Locals (closed) -0.1% to 4.5%

Source: Bucks BS email2 -

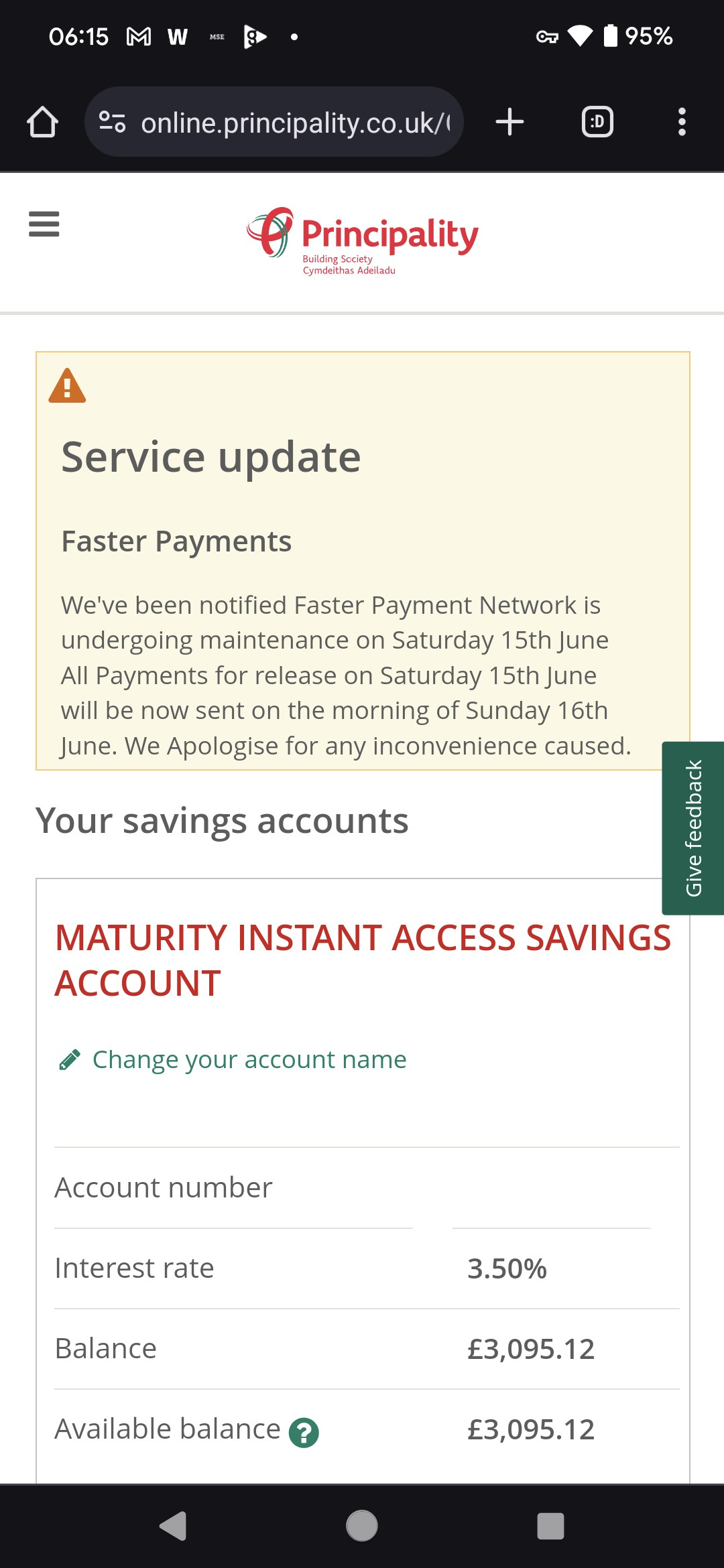

Got my money from Principality today (with an extra 60p added) got no regulars due to end until September now I thinkjameseonline said:My Principality 33 Regular matured today, requested closure of the new maturity account and funds to be transferred to my Virgin account.

£3095.12 total.

Wouldn't let me transfer the whole amount out which seems stupid so had to close it, like Principality know you going to get a few pence in interest so why make things more difficult than they need to be?, guess the only other option would be depositing £1(or amount to get it up to the next £1) or something then trying to get the few pence out?

Anyway what I did find strange when I logged in was it said faster payments are scheduled for maintenance on Saturday so be done on Sunday.

Does that mean Principality side or for everyone? 3

3 -

Think its a year since it became not worth opening Regular Savers. My next one to mature is Beehive at the end of July, then I have a load maturing in the autumn, the anniversary of interest rates shooting upjameseonline said:

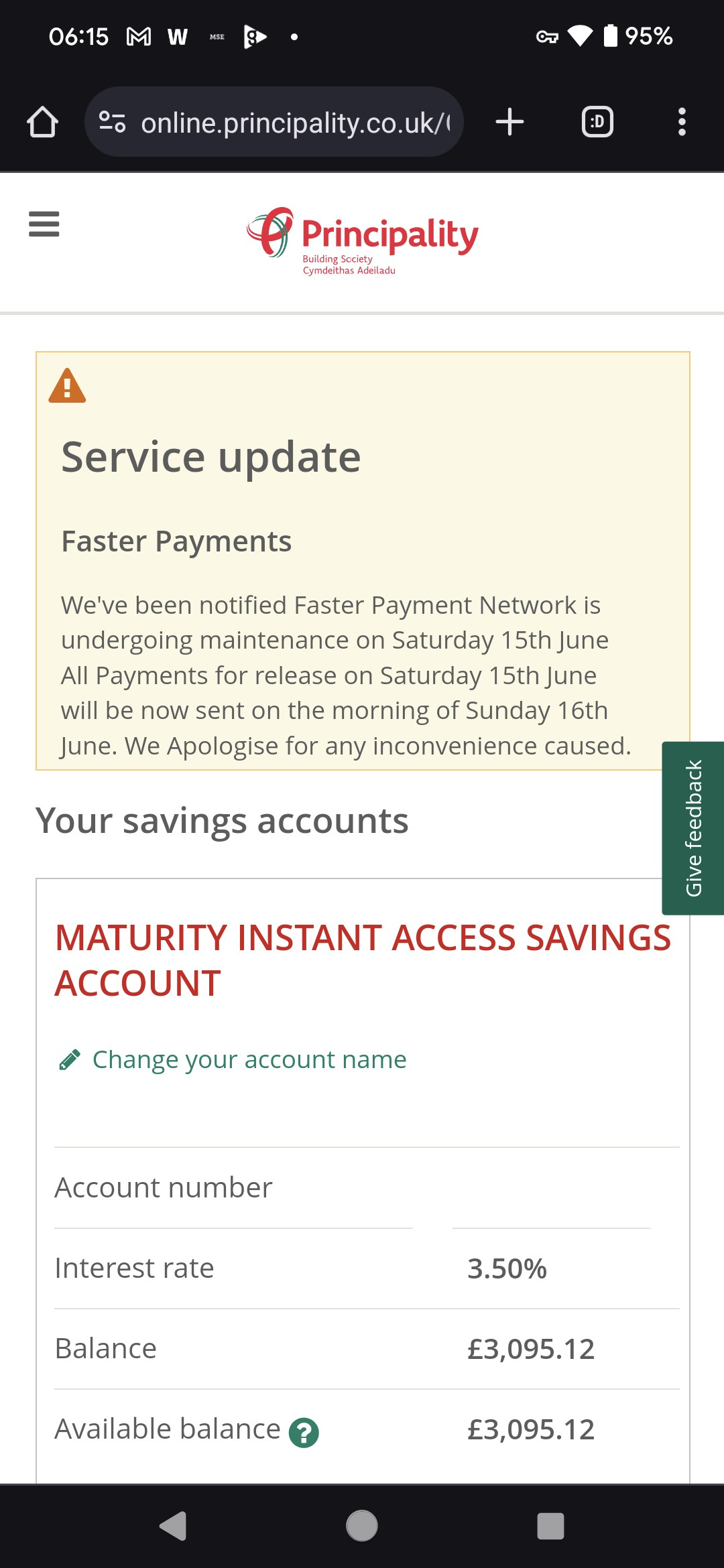

Got my money from Principality today (with an extra 60p added) got no regulars due to end until September now I thinkjameseonline said:My Principality 33 Regular matured today, requested closure of the new maturity account and funds to be transferred to my Virgin account.

£3095.12 total.

Wouldn't let me transfer the whole amount out which seems stupid so had to close it, like Principality know you going to get a few pence in interest so why make things more difficult than they need to be?, guess the only other option would be depositing £1(or amount to get it up to the next £1) or something then trying to get the few pence out?

Anyway what I did find strange when I logged in was it said faster payments are scheduled for maintenance on Saturday so be done on Sunday.

Does that mean Principality side or for everyone? I consider myself to be a male feminist. Is that allowed?1

I consider myself to be a male feminist. Is that allowed?1 -

Always worth opening them if you have funds, you not opened any in a year?.surreysaver said:

Think its a year since it became not worth opening Regular Savers. My next one to mature is Beehive at the end of July, then I have a load maturing in the autumn, the anniversary of interest rates shooting upjameseonline said:

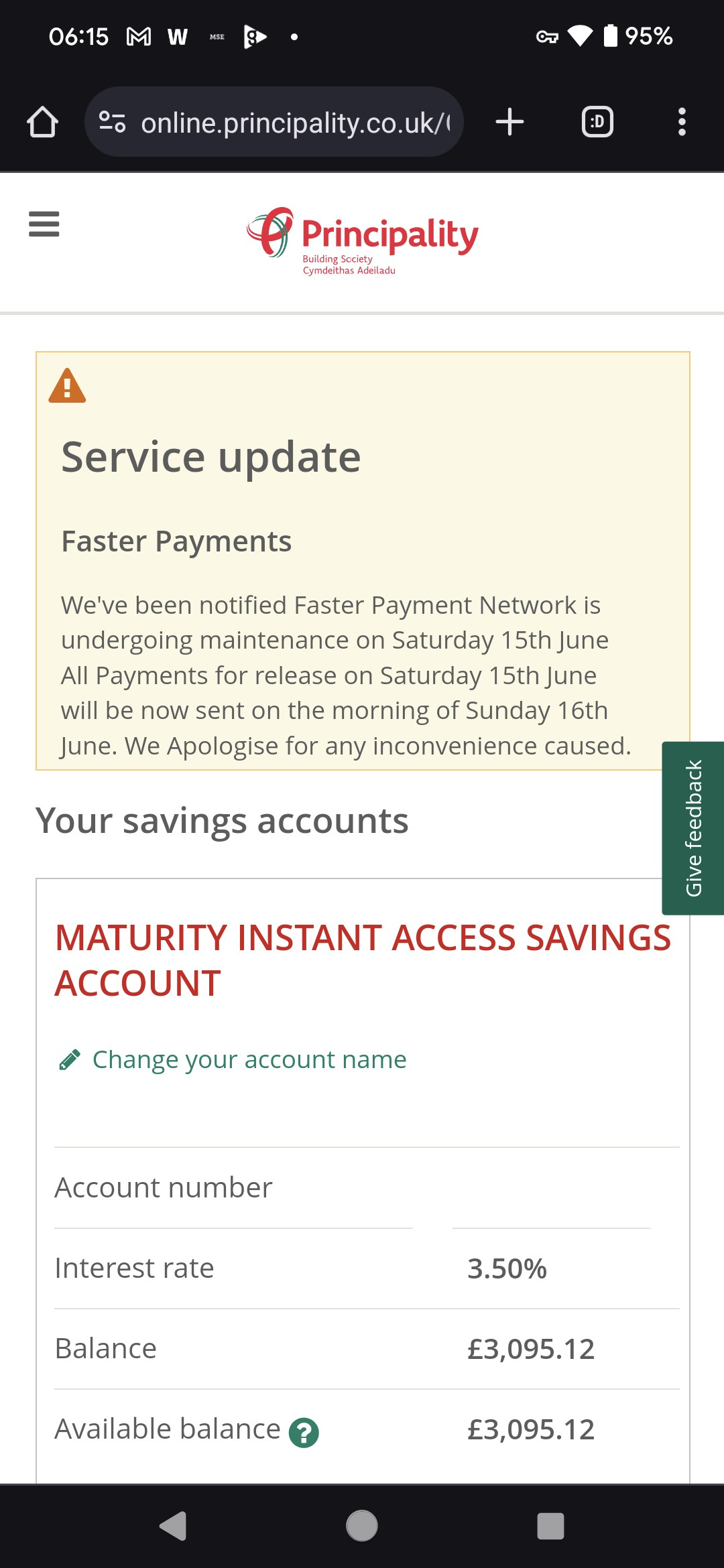

Got my money from Principality today (with an extra 60p added) got no regulars due to end until September now I thinkjameseonline said:My Principality 33 Regular matured today, requested closure of the new maturity account and funds to be transferred to my Virgin account.

£3095.12 total.

Wouldn't let me transfer the whole amount out which seems stupid so had to close it, like Principality know you going to get a few pence in interest so why make things more difficult than they need to be?, guess the only other option would be depositing £1(or amount to get it up to the next £1) or something then trying to get the few pence out?

Anyway what I did find strange when I logged in was it said faster payments are scheduled for maintenance on Saturday so be done on Sunday.

Does that mean Principality side or for everyone?

September is going to free up a lot of money for me, 7% YBS Loyalty Regular 2023 @ £500 a month then 2 days later my 8% Nationwide Flex Regular Saver Issue 2 @ £200 a month ends.

November just got YBS Xmas ending.

Jan I'll have maxed out NatWest and RBS digital.

Then several accounts ending in March if all goes well.3 -

Yes, got a load maturing in the autumn as my post saysjameseonline said:

Always worth opening them if you have funds, you not opened any in a year?.surreysaver said:

Think its a year since it became not worth opening Regular Savers. My next one to mature is Beehive at the end of July, then I have a load maturing in the autumn, the anniversary of interest rates shooting upjameseonline said:

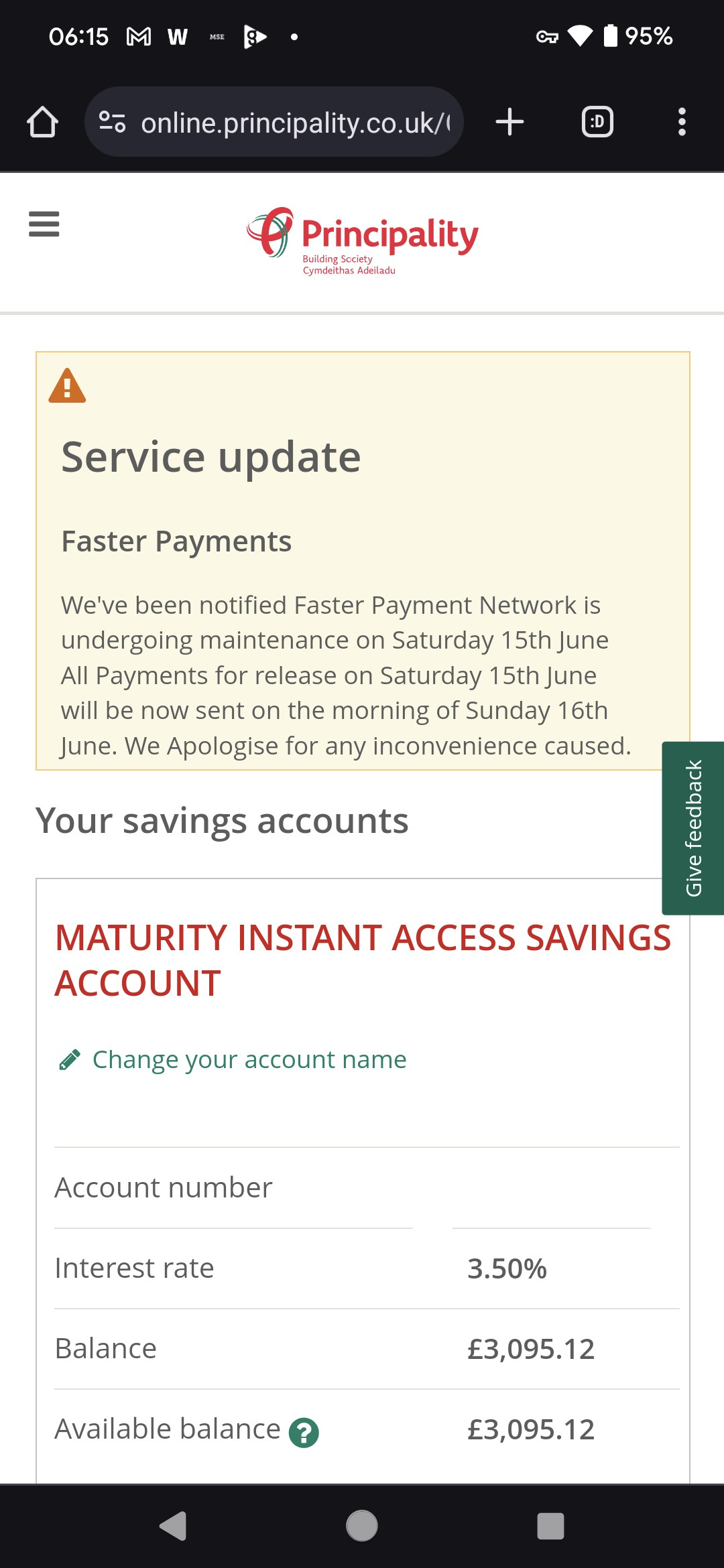

Got my money from Principality today (with an extra 60p added) got no regulars due to end until September now I thinkjameseonline said:My Principality 33 Regular matured today, requested closure of the new maturity account and funds to be transferred to my Virgin account.

£3095.12 total.

Wouldn't let me transfer the whole amount out which seems stupid so had to close it, like Principality know you going to get a few pence in interest so why make things more difficult than they need to be?, guess the only other option would be depositing £1(or amount to get it up to the next £1) or something then trying to get the few pence out?

Anyway what I did find strange when I logged in was it said faster payments are scheduled for maintenance on Saturday so be done on Sunday.

Does that mean Principality side or for everyone?

September is going to free up a lot of money for me, 7% YBS Loyalty Regular 2023 @ £500 a month then 2 days later my 8% Nationwide Flex Regular Saver Issue 2 @ £200 a month ends.

November just got YBS Xmas ending.

Jan I'll have maxed out NatWest and RBS digital.

Then several accounts ending in March if all goes well.I consider myself to be a male feminist. Is that allowed?1 -

Forgive me for being new here, but doesn't seem that worthwhile to drip feed 1 year regular savers. 2 hours wasted for £30 profit?

If I compare co-op 7% regular saver to a 5% easy access account:

Drip feed interest: (£250 * 6 * 0.07) + (£250 * 6 * 0.05) = £180

Non drip feed interest: £250 * 12 * 0.05 = £150

Difference: 180 - 150 = £30 profit

90 mins reading current account & regular saver terms and conditions(~22 page, ~4m per page), and 20 mins setting up account and standing orders is almost 2 hours spent.

0 -

Two hours to gain £30? That sounds like a reasonable return - it's above Minimum Wage.But I see you've not been on the MSE forum long - not long enough to realise that there are some on here that will happily spend two hours to gain 30pence!3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards