We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

DJDools said:

Yes. Me and my (slightly) better half have a joint bank a/c, and two separate sole regular savings as well as a joint regular saver.etienneg said:If two people have a joint current account with Co-operative Bank, can each of them have a sole regular savings account, or can they only have one joint regular savings account?

That's interesting. This is from their own web site:- You can only have one Regular Saver account of the same issue at any one time – if you have a joint Regular Saver, you cannot open one on your own

1 -

I think they were referring to this bit.DJDools said:

Yes. Me and my (slightly) better half have a joint bank a/c, and two separate sole regular savings as well as a joint regular saver.etienneg said:If two people have a joint current account with Co-operative Bank, can each of them have a sole regular savings account, or can they only have one joint regular savings account?

Which contradicts the terms.1 -

So sorry, I should have noted the early hour of the day (after midnight) when I responded; I was mistaken and thinking of the Nationwide. It has been a VERY long and hard months so far, so I shall refrain from answering questions if I find myself in such a situation again. Many apologies.kaMelo said:I think they were referring to this bit.DJDools said:

Yes. Me and my (slightly) better half have a joint bank a/c, and two separate sole regular savings as well as a joint regular saver.etienneg said:If two people have a joint current account with Co-operative Bank, can each of them have a sole regular savings account, or can they only have one joint regular savings account?

Which contradicts the terms.5 -

If you have a joint regular saver, you can't also open a sole one.I see nothing to prevent both joint current account holders each opening sole regular savers tho.1

-

Im with Chase banking and they recently sent an email to say that their saver account interest rate is going up to 5.1% easy access account and you get cashback for the first year with just a normal account too.1

-

bridie925 said:Im with Chase banking and they recently sent an email to say that their saver account interest rate is going up to 5.1% easy access account and you get cashback for the first year with just a normal account too.There's a thread about it here: https://forums.moneysavingexpert.com/discussion/6519410/chase-5-1-saver-account-1-boost-until-january-updatedTo bring back around to relevance to this thread, the Chase savings account is one of the few I've found that let you set up scheduled repeatable payments (i.e. Standing Orders, but paid 365 days a year rather than working days only). It's a great choice for drip-feeding.

6 -

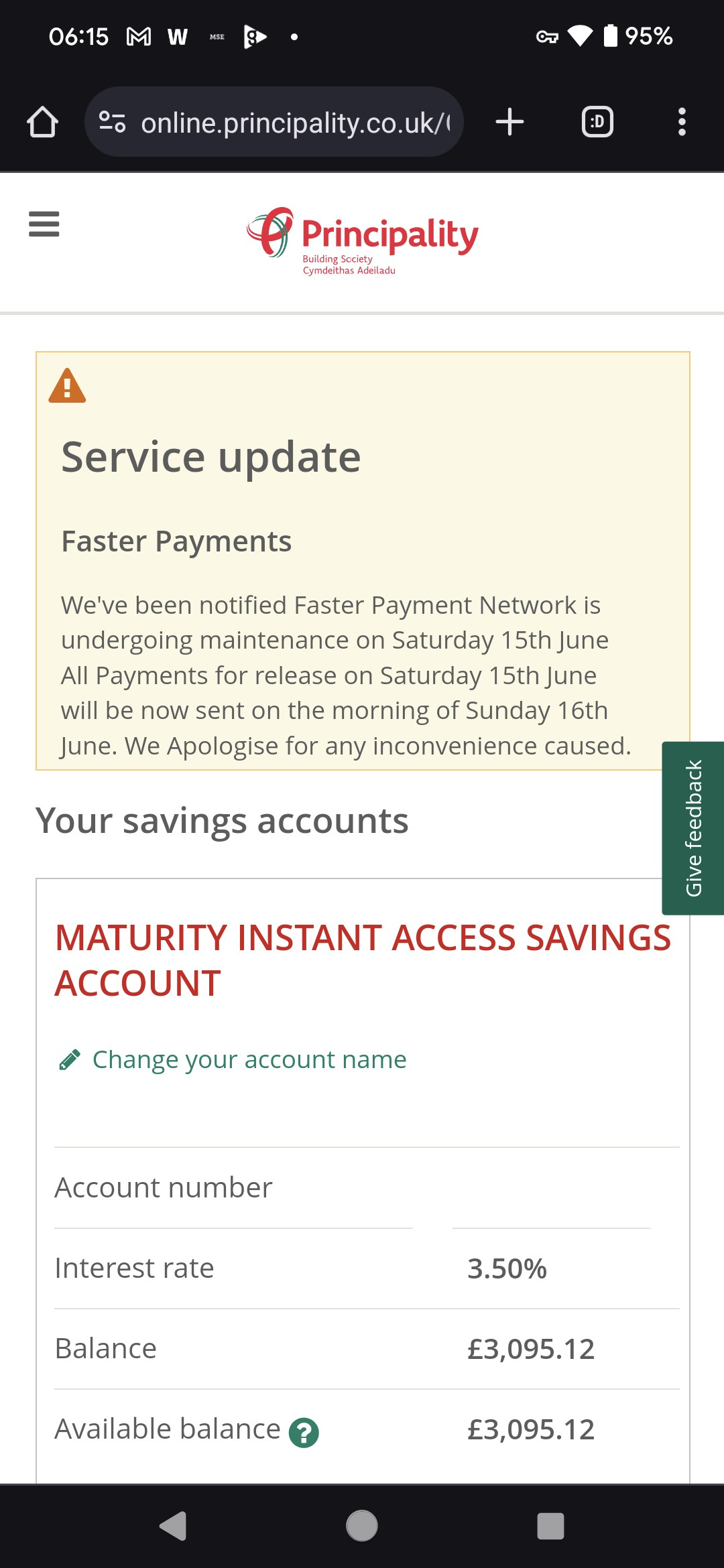

My Principality 33 Regular matured today, requested closure of the new maturity account and funds to be transferred to my Virgin account.

£3095.12 total.

Wouldn't let me transfer the whole amount out which seems stupid so had to close it, like Principality know you going to get a few pence in interest so why make things more difficult than they need to be?, guess the only other option would be depositing £1(or amount to get it up to the next £1) or something then trying to get the few pence out?

Anyway what I did find strange when I logged in was it said faster payments are scheduled for maintenance on Saturday so be done on Sunday.

Does that mean Principality side or for everyone? 1

1 -

If you already requested closure & transfer of the balance to your Virgin account why are you trying to transfer the money yourself ? I don't understand.1

-

I tried to transfer the money out 1st THEN opted for closing the maturity accountsubjecttocontract said:If you already requested closure & transfer of the balance to your Virgin account why are you trying to transfer the money yourself ? I don't understand.1 -

My Principality 33 was due to mature today too and have the above FP message, but I now only have the £50 p/m HH saver and £125 Xmas saver left in my accounts list (~£1k total) as I’d already submitted maturity instructions. I’m sure it’s sat waiting to go out somewhere so not worried.I only needed a small slice of it today anyway to feed my Coventry Loyalty RS, but can’t remember if weekend payments to Coventry are deposited there and then or will be counted as being received on Monday - does anyone know if I should raid another account today to make the contribution or just wait til next working day?1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards