We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Easy Access Savings Discussion Area

Comments

-

Zopa apply increased rates to all accounts. Instant access is currently 2.15%. Obviously way behind the top account. I'd dump chase tonight, although transfer in to use the 1% cashback.homi said:I know it is hard to say but what bank consistently offers one of the higher interest rates without the need to keep upgrading and just applies the new rate to the current product.

Got sick of Tescos / postoffice who increase their rates but made you apply for a new product to get the higher rate ( ended up with 5 saving accounts with tescos within 18 months).

Currently hold quite a bit in Chase at 1.5% and do not mind swapping banks but keep upgrading the accounts within the same bank does my head in.0 -

One thing I like about the Santander and Barclays top savings accounts is that you can view them through open banking.1

-

Having both a big and smaller bank jumping to 2.75% is pretty significant - and well before the next BoE meeting too.

Apart from when Chase offered 1.5% as part of its marketing theyve all been raising by around 0.3% a time and just matching each other. Now the gap is so large that even people determined to stay with Chase are finally moving and its made the other easy access look pretty uncompetitive.

Even fairly recent fixed rates that seemed reasonable as part of a ladder now make those saying wait look like they did have a point.1 -

In these top 10, do any allow planned multiple withdrawals? I’m currently sticking with Zopa and still kept Tandem open but I find myself having to set reminders in my calendar to withdraw the money ahead of payment to CC’s.

In previous times I’d use the Sainsburys eSaver Special, deposit majority of my salary monthly on top of savings and then set up multiple withdrawals across the month to ensure money was ready in my current account to pay bills. Seems like most higher interest easy access accounts do not offer such a service?If you believe you can, you will. If you believe you can't, you won't.

Secured/Unsecured loans x 1

Credit Cards x 8 (total limit £55,050)

Creation FS Retail Account x 1

Creation Credit Sale 0% x 1 = £112.50pm x 20 mths

0% Overdraft x 1 (£0 / £250)

Mortgage Outstanding - £137,707.00 (Payment 13/360)

Total Debt = £7,400 (0%APR) @ £100pm - Stoozing0 -

Santander Esaver allows standing orders and direct debits and scheduled payments. You could pay some of your bills from the Esaver directly without shuffling money around.1

-

Most easy access savings accounts allow you to specify a withdrawal date, and unlimited numbers of withdrawals. The Santander esaver certainly does, to any UK account you like, and it even allows you to set up SOs and DDs. The latter two being rather unusual, and previously only seen at Chase AFAIK (and may be at previous Santander esavers - - even though I am a longstanding Santander customer, I have never used these before as their savings rates have always been dire until now)MrFrugalFever said:In these top 10, do any allow planned multiple withdrawals? I’m currently sticking with Zopa and still kept Tandem open but I find myself having to set reminders in my calendar to withdraw the money ahead of payment to CC’s.

In previous times I’d use the Sainsburys eSaver Special, deposit majority of my salary monthly on top of savings and then set up multiple withdrawals across the month to ensure money was ready in my current account to pay bills. Seems like most higher interest easy access accounts do not offer such a service?

EDIT: I take this back. Even though it looks as if you can set up SOs on the Santander esaver, you can't actually do it. I suspect they also won't let you do DDs, but I'll give it a try

Cynergy, OTOH, is somewhat dinosaurish when it comes to withdrawals. You can still make as many withdrawals as you like but you can't specify a withdrawal date, and withdrawals go to your nominated current account, or another Cynergy account, only.

Other accounts are somewhere in between these two extremes though withdrawals to a nominated account only are quite common.

Note that many people like the withdrawal to a nominated account only as it is another security step to deter any hackers / fraudsters. Whether you value this or see it as a limitation is down to yourself.2 -

crumpet_man said:Santander Esaver allows standing orders and direct debits and scheduled payments. You could pay some of your bills from the Esaver directly without shuffling money around.

How do you do that then? It only lists my Santander current account as an option to make a standing order from online. If I can't make a standing order from the Santander esaver, I would expect direct debits to be rejected too.

Whilst the mobile app opens to a standing order page for the esaver, trying to add a standing order says that standing orders can't be set up on the account.1 -

My mistake, cannot setup SO on the Santander ESaver. I have requested a DD to pay a credit card but it's too early for it to show on the account. Earlier in the thread I think that Daliah commented that a Santander agent had stated that direct debits are allowed.

You can setup future/scheduled payments which is a workaround for SO.1 -

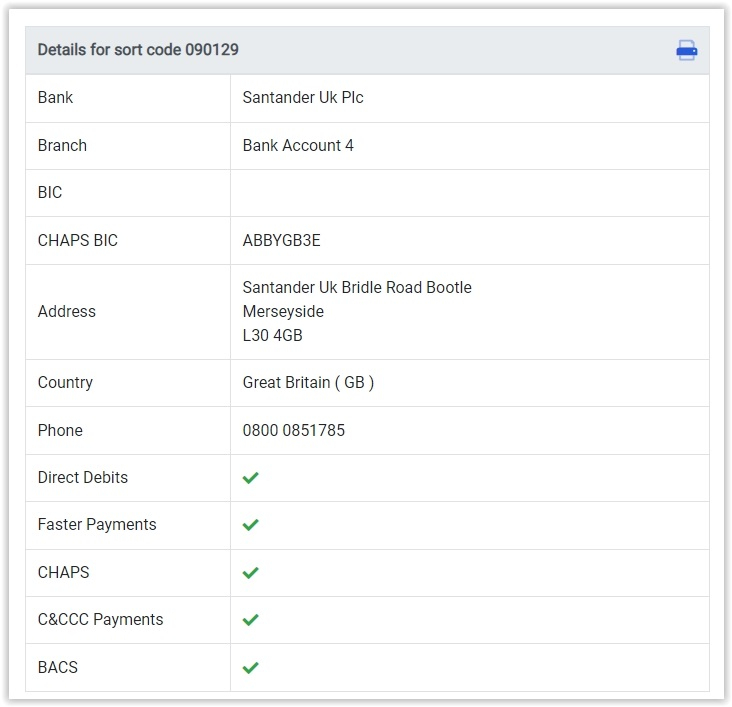

I may have stated they allow DDs but I didn't get the info from a Santander agent. I was just going by what I could see in the app, and on sort code checkercrumpet_man said:My mistake, cannot setup SO on the Santander ESaver. I have requested a DD to pay a credit card but it's too early for it to show on the account. Earlier in the thread I think that Daliah commented that a Santander agent had stated that direct debits are allowed.

You can setup future/scheduled payments which is a workaround for SO.

We have now figured out that SOs definitely cannot be set up, contrary to what it looks like. Great shame. I think Santander are missing a trick there.

The jury is out on DDs - I have also set up a DD mandate but I won't know for another week or two whether it would work.2 -

I'm keeping Chase as a feeder account. One manual scheduled transfer from Santander to Chase on the last working day of the month. Multiple scheduled payments from Chase on the first.MrFrugalFever said:In these top 10, do any allow planned multiple withdrawals? I’m currently sticking with Zopa and still kept Tandem open but I find myself having to set reminders in my calendar to withdraw the money ahead of payment to CC’s.

In previous times I’d use the Sainsburys eSaver Special, deposit majority of my salary monthly on top of savings and then set up multiple withdrawals across the month to ensure money was ready in my current account to pay bills. Seems like most higher interest easy access accounts do not offer such a service?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards