We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Easy Access Savings Discussion Area

Comments

-

The same here. I will ignore it. Some people on here said that they were running Edge for a long time without DDs and never had to pay a fee. I opened mine on 16th Aug, wasn't charged in September. I've put £3 in each of my accounts just in case, but it turned to be unnecessary so I reduced my balances to zero.n3ophyte said:Re: Santander Edge Current Account

I got the same message but will ignore it until I get charged.

Does anyone know if Santander sends text messages if you are overdrawn like some other banks do to give you a chance to top up before the overdraft fee is applied?0 -

Charter EA Issue 47 - 5.07% AER / 4.96% Gross5

-

Come on Ford - you know you want to...2

-

allegro120 said:

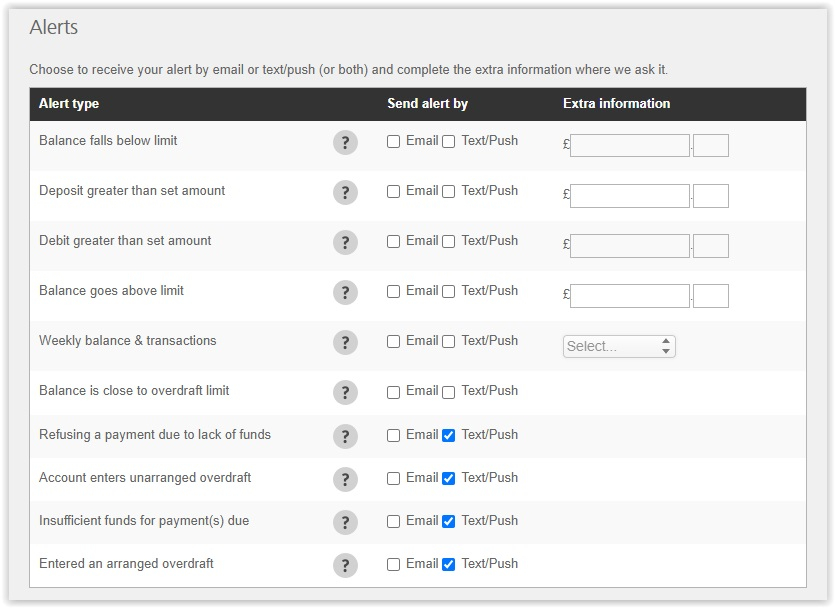

Does anyone know if Santander sends text messages if you are overdrawn like some other banks do to give you a chance to top up before the overdraft fee is applied?They do, it's an alert turned on by default. You can amend your alerts in online banking (not in the app).For overdrafts, they send a text around 08:30, and you then have until 20:15 to settle the overdraft or get get charged. 5

5 -

Yes it's just the faff of setting up direct debits and standing orders that put me off. I did it for Barclays as they had one of the best interest rates at the time so I'll probably do this too when i have time to set it all upflaneurs_lobster said:

I think the jury's still out on this one.Oh I didn't realise we could open the account without having to pay the fee, must have missed the posts but I'll definitely give it a try

In any case, 7% on £4K is about £23/month. Even with the £3 charge (and no cashback) probably still worth holding.

0 -

Can you help me recalculate the interest taking out another £2 per month please? So deducting £60 over 12months please?gussie5555 said:flaneurs_lobster said:

I think the jury's still out on this one.Oh I didn't realise we could open the account without having to pay the fee, must have missed the posts but I'll definitely give it a try

In any case, 7% on £4K is about £23/month. Even with the £3 charge (and no cashback) probably still worth holding.

Yes even deducting £36 you'll still earn 6.1% interest on your 4k holding after 12 months assuming Santander doesn't drop the rate.

And if its not too much trouble teach me the calculations please ☺️?0 -

pookey said:

Yes it's just the faff of setting up direct debits and standing orders that put me off. I did it for Barclays as they had one of the best interest rates at the time so I'll probably do this too when i have time to set it all upflaneurs_lobster said:

I think the jury's still out on this one.Oh I didn't realise we could open the account without having to pay the fee, must have missed the posts but I'll definitely give it a try

In any case, 7% on £4K is about £23/month. Even with the £3 charge (and no cashback) probably still worth holding.

it appears you do not need any DDs or SOs for this

1 -

It is just your net interest/amount * 100 where net interest is the interest you would have received normal minus fees/deductions. Mathematically,pookey said:

Can you help me recalculate the interest taking out another £2 per month please? So deducting £60 over 12months please?gussie5555 said:flaneurs_lobster said:

I think the jury's still out on this one.Oh I didn't realise we could open the account without having to pay the fee, must have missed the posts but I'll definitely give it a try

In any case, 7% on £4K is about £23/month. Even with the £3 charge (and no cashback) probably still worth holding.

Yes even deducting £36 you'll still earn 6.1% interest on your 4k holding after 12 months assuming Santander doesn't drop the rate.

And if its not too much trouble teach me the calculations please ☺️?

Effective interest rate (EIR) = ((interest rate * amount/100) - deductions)/amount * 100

So, for 7% interest on £4000 and deducting £60, you have:

EIR(%) = (7*4000/100 -60)/4000* 100 = (280-60)/4000*100=5.5%.

A simple way is to calculate the interest rate corresponding to the deductions and take that from the original interest rate. For £60 deductions for an amount of £4000, the interest rate = 60/4000*100 =1.5%.

If you take this from 7%, you also arrive at 5.5%.

Mathematically, can be derived from the first forumla, it is

Effective interest rate (EIR) = (interest rate - (deductions/amount * 100)) %

1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards