We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Easy Access Savings Discussion Area

Comments

-

Interesting, and the main interest tier balance gone up from £5k to £10kBridlington1 said:@soulsaver

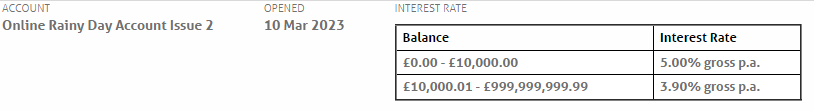

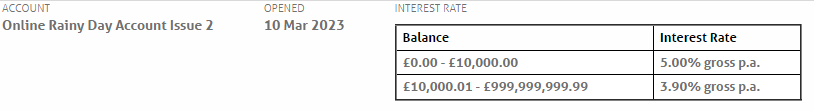

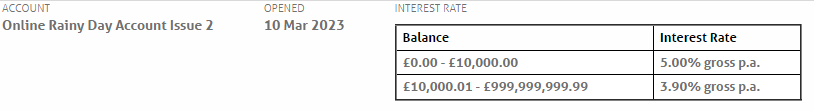

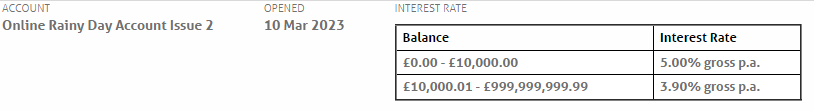

YBS Online Rainy Day Issue 2 now pays 5%. The new rate isn't showing on their website yet but is when logged into online banking.

It's showing on their interest rate PDF found on https://www.ybs.co.uk/boe-rate-change as a 14/09/2023 change (today).

No other YBS products appear to have changed. The no longer available Loyalty six access still 4.7%, but they were a 12 month product and should be downgraded soon to the six access saver soon.4 -

Must be updating website as no accounts are showing. Clicked compare accounts and none are there. Will try again later.AndyTh_2 said:

Interesting, and the main interest tier balance gone up from £5k to £10kBridlington1 said:@soulsaver

YBS Online Rainy Day Issue 2 now pays 5%. The new rate isn't showing on their website yet but is when logged into online banking.

It's showing on their interest rate PDF found on https://www.ybs.co.uk/boe-rate-change as a 14/09/2023 change (today).

No other YBS products appear to have changed. The no longer available Loyalty six access still 4.7%, but they were a 12 month product and should be downgraded soon to the six access saver soon.

Edit all on now0 -

Bridlington1 said:@soulsaver

YBS Online Rainy Day Issue 2 now pays 5%. The new rate isn't showing on their website yet but is when logged into online banking.

So 5% up to 10k now did it not used to be 5k

0 -

YBS Rainy Day Svr Iss2; 5.00% to £10K then 3.90% on balance over (14/09) On their webby now:

Product Details | Savings Product Finder | YBS Thnx @Bridlington1

2 -

I've only just closed this account. The main reason though, apart from the previously lower interest, was that the interest on this account is paid on 31/3/23 rather than in the next tax year.Bridlington1 said:@soulsaver

YBS Online Rainy Day Issue 2 now pays 5%. The new rate isn't showing on their website yet but is when logged into online banking. Not Rachmaninov

Not Rachmaninov

But Nyman

The heart asks for pleasure first

SPC 8 £1567.31 SPC 9 £1014.64 SPC 10 # £1164.13 SPC 11 £1598.15 SPC 12 # £994.67 SPC 13 £962.54 SPC 14 £1154.79 SPC15 £715.38 SPC16 £1071.81⭐⭐⭐⭐⭐⭐⭐⭐⭐Declutter thread - ⭐⭐🏅0 -

RedImp_2 said:

I presume Chip is in your partners name? Otherwise makes no senseZerforax said:Ugh made the mistake of quickly opening a Santander account without thinking. Did it in my name but in hindsight we need it in my partner's name as they're not a higher rate tax payer. Will probably just leave it in Chip for now.

Yes Chip is solely in partner name. Our main Santander account is a joint one but I didn't think it through when applying! Was just a couple of clicks for me.

0 -

Family Building Society Online Saver 6 paying 4.96%. Minimum deposit £100.

https://www.familybuildingsociety.co.uk/savings/bonds/product-detail/online-saver-(6)?_its=JTdCJTIydmlkJTIyJTNBJTIyZDg4MzIzNmMtMTFlZS00OGQzLWI4ODktOTI4MzFlMDM3MjBkJTIyJTJDJTIyc3RhdGUlMjIlM0ElMjJybHR%2BMTY5NDY4NjYwNH5sYW5kfjJfNTU5MV9kaXJlY3RfMDFkMWEzMzZlNmFiZmQyMDI4NjYxZDQ3YzFjNGEwZjUlMjIlN0Q%3D

@soulsaver

4 -

Clean link to the FBS Online Saver Issue 6...

2 -

Grabbed the 5.2% Santander account thanks to Martin's message. Currently have most of my savings in Chip. They were keen to keep competitive by increasing their rate regularly. That seems to have stopped at 4.84% - I kinda forgot about them. Are they likely to stay there now? Might move the balance over to Santander...0

-

Blandiblub said:Are they likely to stay there now?Who knows, they may not even know themselves yetMight move the balance over to Santander...I would have moved as soon as I opened the account

2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards