We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The Top Easy Access Savings Discussion Area

Comments

-

If one of the app based accounts I have increases this week to match NBS then I might was well keep my funds with them given the quicker withdrawals, and then review next month after the next BOE meeting. I have a feeling I'll be bouncing funds between the two for the rest of the year at least.0

-

Yes I read the T&C's and yes I know NBS is the same, but why dont they come up to the current standards like everyone else? also Shawbrook is very random on paying interest, normally its paid for me on the 16th and I wont get the credit for another two days after that, everything with them is snail2010 said:

jaceyboy, must have read the T&C or just ticked the box saying they had been read, otherwise you can`t apply for the account.nic_c said:

They state they don't use faster payments but standard paymentsjaceyboy said:So it seems NBS are another Shawbrook where they hold your funds for a day before giving them to you, cant be dealing with that again after having Chip/Tandem etc, thats so backwards...Do you offer a faster payment facility?Unfortunately we don’t. We offer a Standard Payment facility for withdrawals; this will ensure your funds will reach your nominated bank account within two working days of leaving the Society. This came into effect as of the Payment Service Directive January 2012.

So it shouldn`t come as a surprise that NBS is not instant withdrawals.

I can live with waiting a day, getting a good rate that`s going to go up the full amount of any future increase.1 -

Current standards is open banking, but still plenty of places not signed up for that.jaceyboy said:

Yes I read the T&C's and yes I know NBS is the same, but why dont they come up to the current standards like everyone else? also Shawbrook is very random on paying interest, normally its paid for me on the 16th and I wont get the credit for another two days after that, everything with them is snail2010 said:

jaceyboy, must have read the T&C or just ticked the box saying they had been read, otherwise you can`t apply for the account.nic_c said:

They state they don't use faster payments but standard paymentsjaceyboy said:So it seems NBS are another Shawbrook where they hold your funds for a day before giving them to you, cant be dealing with that again after having Chip/Tandem etc, thats so backwards...Do you offer a faster payment facility?Unfortunately we don’t. We offer a Standard Payment facility for withdrawals; this will ensure your funds will reach your nominated bank account within two working days of leaving the Society. This came into effect as of the Payment Service Directive January 2012.

So it shouldn`t come as a surprise that NBS is not instant withdrawals.

I can live with waiting a day, getting a good rate that`s going to go up the full amount of any future increase.

The answer probably is to do with the cost of upgrading systems to allow it, and they probably get more business offering a competitive rate than offering a lower rate but offering faster payments.1 -

Maybe if they didn’t send so many physical letters in the post, they could afford to implement faster paymentsnic_c said:

Current standards is open banking, but still plenty of places not signed up for that.jaceyboy said:

Yes I read the T&C's and yes I know NBS is the same, but why dont they come up to the current standards like everyone else? also Shawbrook is very random on paying interest, normally its paid for me on the 16th and I wont get the credit for another two days after that, everything with them is snail2010 said:

jaceyboy, must have read the T&C or just ticked the box saying they had been read, otherwise you can`t apply for the account.nic_c said:

They state they don't use faster payments but standard paymentsjaceyboy said:So it seems NBS are another Shawbrook where they hold your funds for a day before giving them to you, cant be dealing with that again after having Chip/Tandem etc, thats so backwards...Do you offer a faster payment facility?Unfortunately we don’t. We offer a Standard Payment facility for withdrawals; this will ensure your funds will reach your nominated bank account within two working days of leaving the Society. This came into effect as of the Payment Service Directive January 2012.

So it shouldn`t come as a surprise that NBS is not instant withdrawals.

I can live with waiting a day, getting a good rate that`s going to go up the full amount of any future increase.

The answer probably is to do with the cost of upgrading systems to allow it, and they probably get more business offering a competitive rate than offering a lower rate but offering faster payments.1 -

Apologies for another question re: Newcastle Tracker A/C.

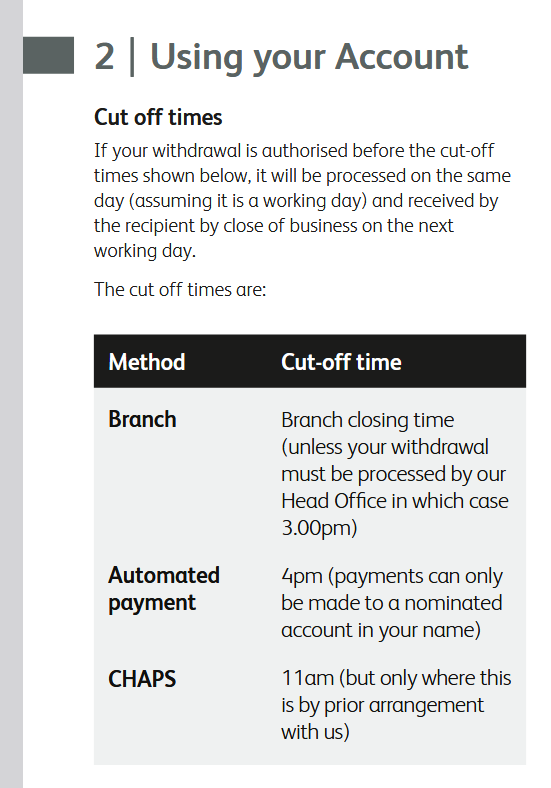

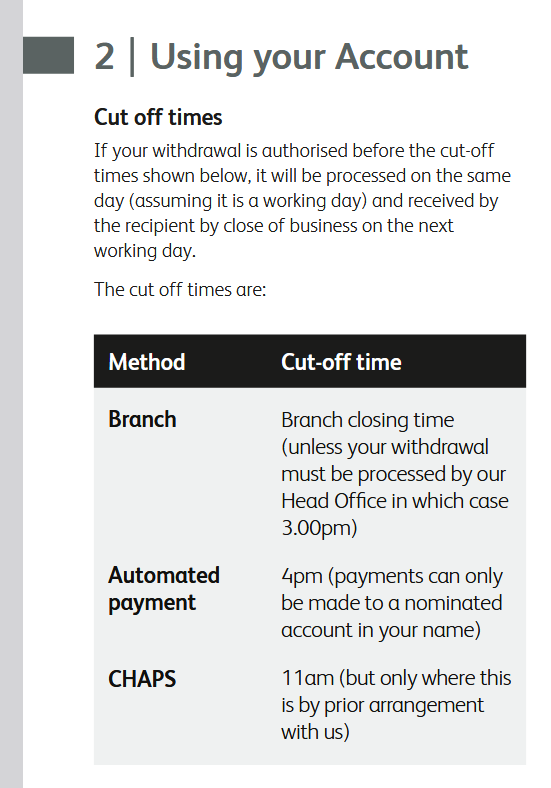

Have looked on their site but can't find the answer - trying to find out what the cut off time is for transferring funds in so that they are credited on same day?

Thanks in advance for any help.

0 -

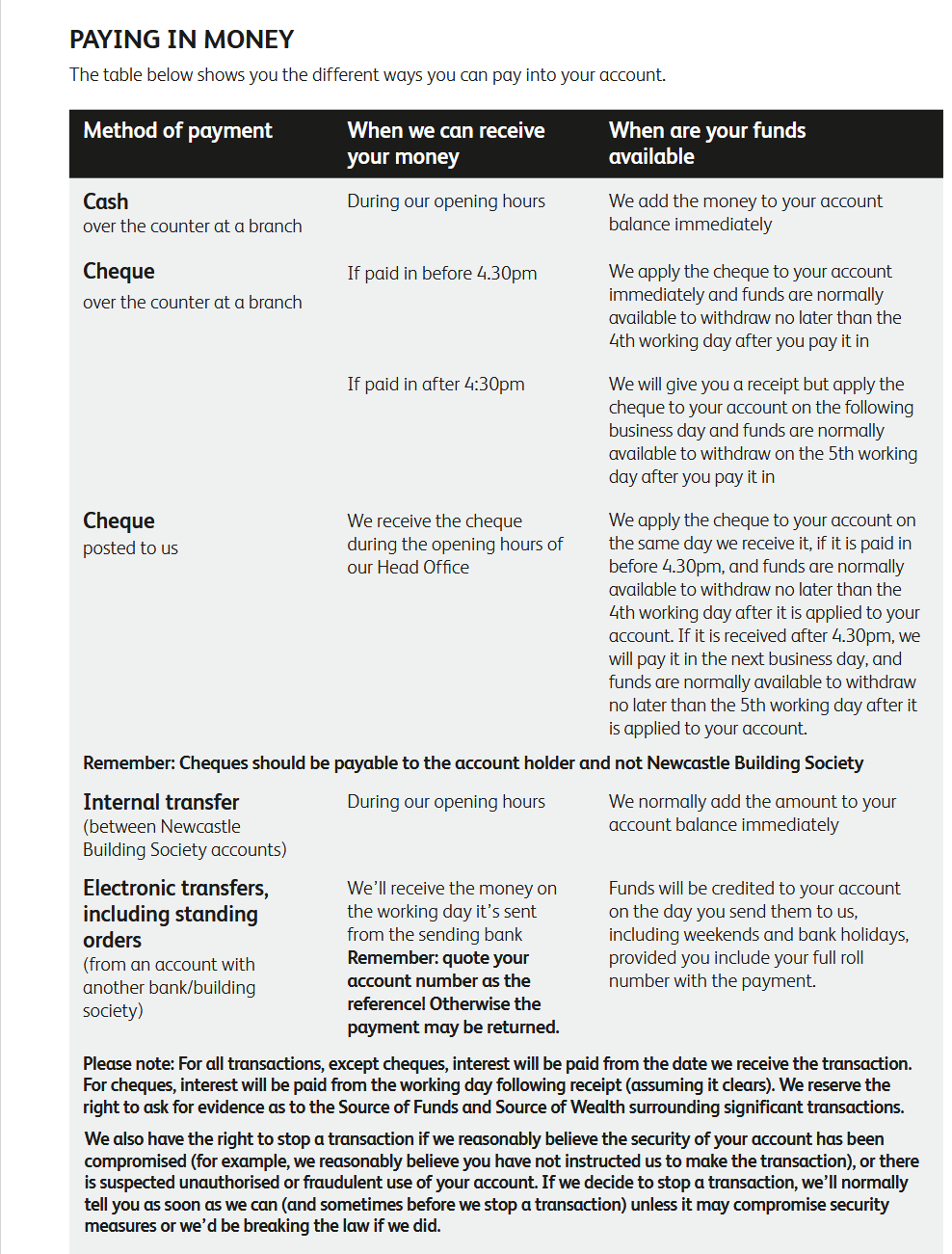

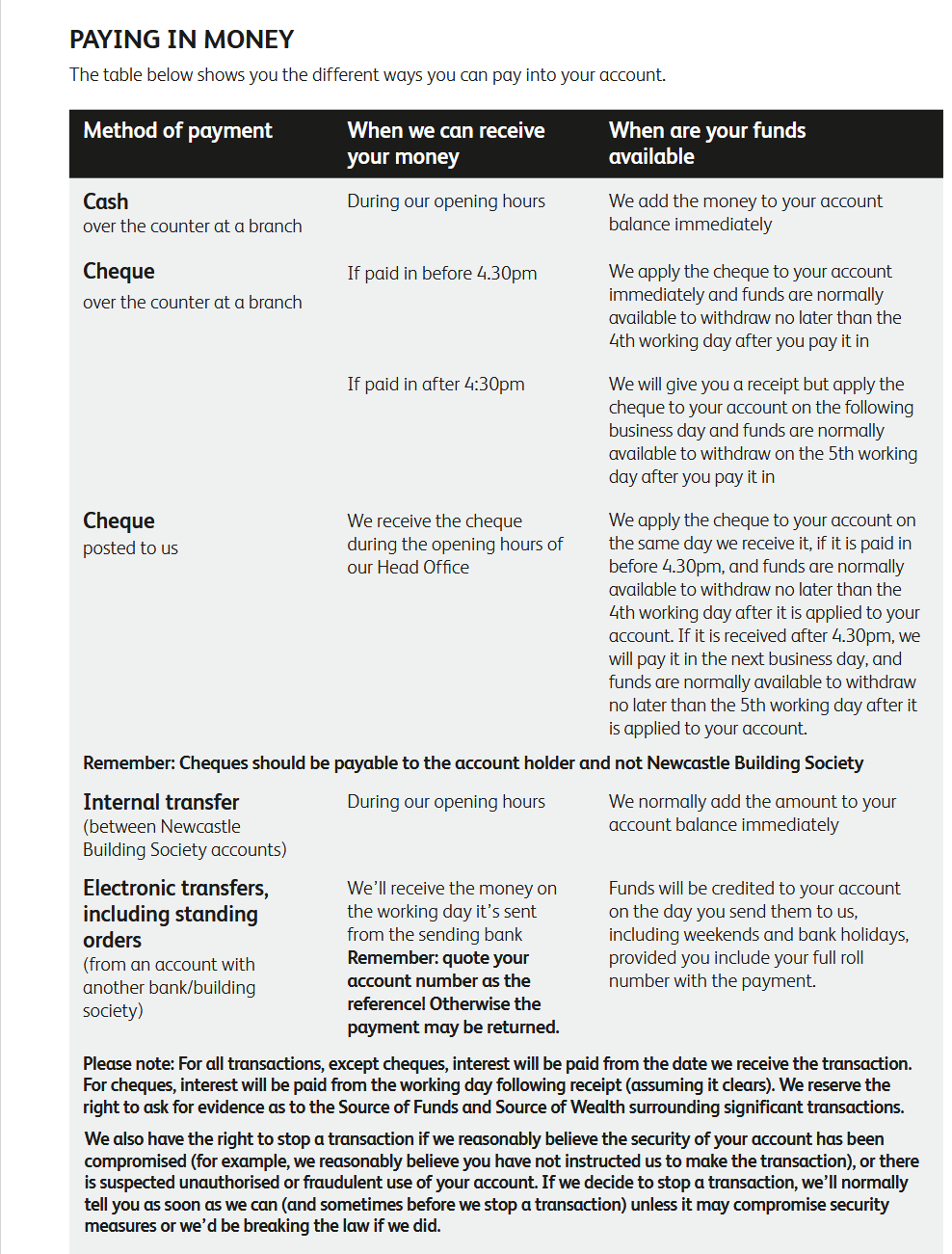

In The Savings General Terms and Conditions

5

5 -

That’s interesting - they told me there was a 4pm cut off - wonder what that was all aboutpokemaster said:In The Savings General Terms and Conditions If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.2 -

Withdrawals maybe?

Withdrawals maybe?

3 -

Perhaps they got mixed up with the withdrawals and deposits.pokemaster said: Withdrawals maybe?

Withdrawals maybe?

They said:

“Any payment made to us before 4pm on a business day, will credit the account on the same day.”

Perhaps if it is made after 4pm it appears on the next working day, but is backdated to the day it was made.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.2 -

YBS Internet Saver Plus Issue 13 -> 4.25%

Source ~ MoneyFactsIf you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.6

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards