We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Easy Access Savings Discussion Area

Comments

-

YBS One Day Account -> 4.30% (only available to those under 21 and branch/post)If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

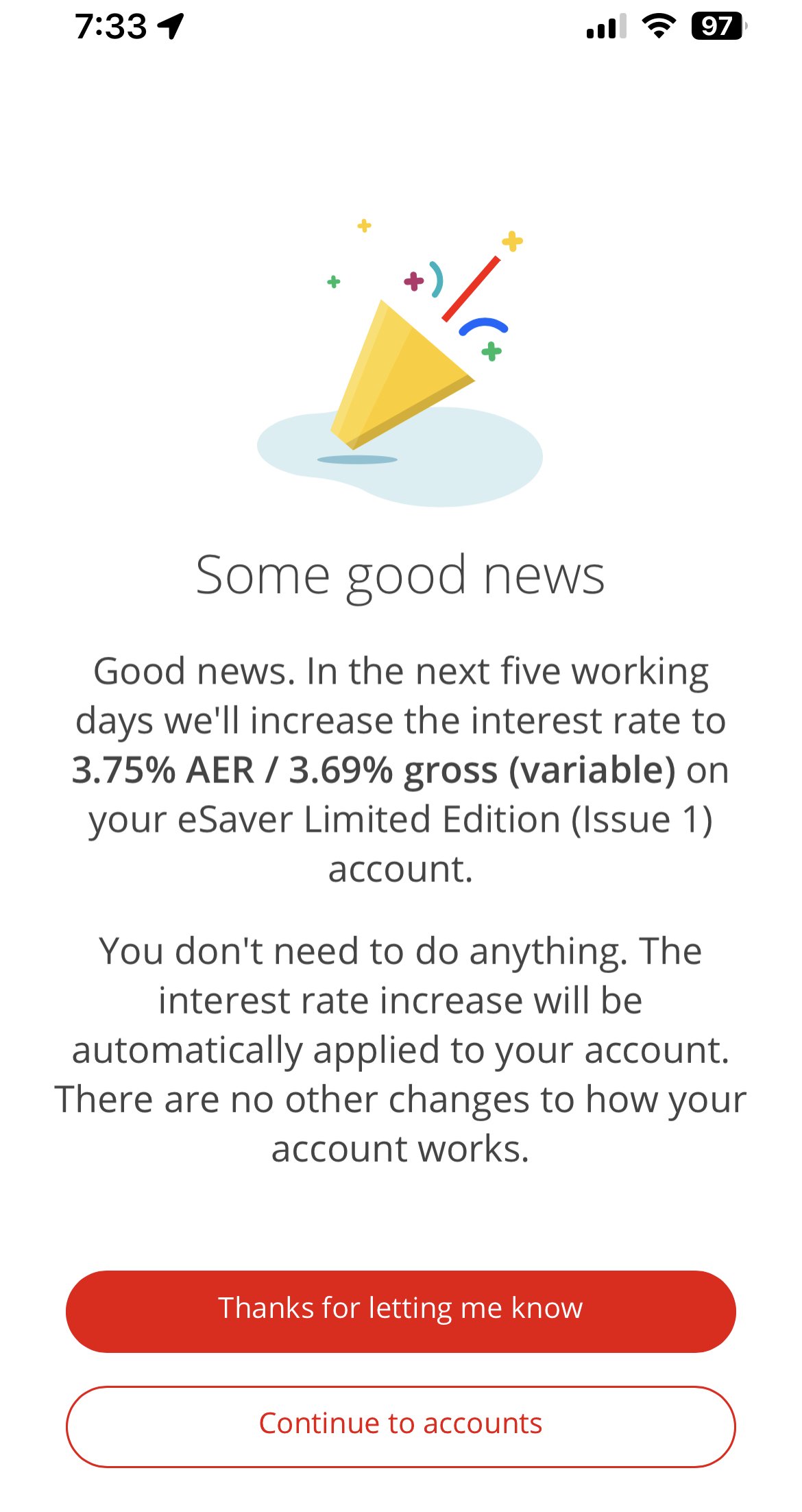

My Santander esaver now showing 3.75% up from 3.25%. Assume this updated overnight unless I missed it previously.8

-

I appreciate this won't be of much use to most people and apologies if it's already been mentioned on here before but for those who have a Leeds BS shared ownership mortgage it appears Leeds BS have launched a Shared Ownership Saver at 6% (£20k max, unlimited penalty free withdrawals).

https://www.leedsbuildingsociety.co.uk/savings/access-accounts/shared-ownership-saver/

2 -

I rang YBS yesterday to see if I could find out when and what rate increase will be for this account. The person I spoke to said the rates would increase by up to 0.50% and that it would happen on the 7th July. However, it looks like (from some posts above) that some rates have already changed.wiseonesomeofthetime said:

If it stays that way, I'll be emptying it for Newcastle's Tracker.Kazza242 said:I logged into YBS online banking and I can't see any interest rate change applied to their Loyalty Six Access E-Saver account (NLA). It is still displaying a rate of 4.00%1 -

When looking at my YBS online banking it seems to be that it's only savings accounts that are currently available to new customers that have updated. The ones that are NLA are yet to change so I imagine the NLA accounts will change on 7/7/23, the rest have been updated sooner.10_66 said:

I rang YBS yesterday to see if I could find out when and what rate increase will be for this account. The person I spoke to said the rates would increase by up to 0.50% and that it would happen on the 7th July. However, it looks like (from some posts above) that some rates have already changed.wiseonesomeofthetime said:

If it stays that way, I'll be emptying it for Newcastle's Tracker.Kazza242 said:I logged into YBS online banking and I can't see any interest rate change applied to their Loyalty Six Access E-Saver account (NLA). It is still displaying a rate of 4.00%4 -

I shall sit on my hands until 7 July then, but likelihood I will move my funds anyway, if not at least 0.40% rise, as would prefer unrestricted access and monthly interest over my current restricted access, annual interest, arrangement with this YBS account.10_66 said:

I rang YBS yesterday to see if I could find out when and what rate increase will be for this account. The person I spoke to said the rates would increase by up to 0.50% and that it would happen on the 7th July. However, it looks like (from some posts above) that some rates have already changed.wiseonesomeofthetime said:

If it stays that way, I'll be emptying it for Newcastle's Tracker.Kazza242 said:I logged into YBS online banking and I can't see any interest rate change applied to their Loyalty Six Access E-Saver account (NLA). It is still displaying a rate of 4.00%0 -

Yes, same here. Just received this message in the app this morning:tg99 said:My Santander esaver now showing 3.75% up from 3.25%. Assume this updated overnight unless I missed it previously.

3 -

https://www.ybs.co.uk/documents/productdata/YBM1607RC.pdf shows the upcoming changes to YBS now

generally only available to open accounts got the update today, the no longer available accounts getting them 6th July

(edit not 7th July)

5 -

https://www.coventrybuildingsociety.co.uk/content/dam/cbs/member/pdfs/savings/rate-change-notice-savings.pdf

Highlights include the Four Access Saver to 4.5% and First Home Saver to 5.45%

They took a while but not bad!15 -

though worth updating your no chat comment to say from 7th Julydlevene said:https://www.coventrybuildingsociety.co.uk/content/dam/cbs/member/pdfs/savings/rate-change-notice-savings.pdf

Highlights include the Four Access Saver to 4.5% and First Home Saver to 5.45%

They took a while but not bad!1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards