We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Easy Access Savings Discussion Area

Comments

-

Interesting, I guess "life long savings" is my answer but how you you prove that?I have had this request: "As part of our regulatory responsibilities we need to perform source of wealth checks for some of our customers, and you've been selected for one as someone who has cumulatively deposited over £100,000 in Chip over 12 months. These checks help keep Chip safe and secure for everyone, but we appreciate this is inconvenient for you. So, we’ll aim to complete this check as quickly as possible. You’ll likely be familiar with the procedure from other financial products and services, such as mortgages, investments, and international money transfers. "

As I am keeping records, I had no issues providing them with the relevant information, and they confirmed within a few days "We have now completed the Source of Wealth check. We do not require anything further from you". I was able to continue to use my Chip account throughout the investigation, there was no block on my account ever.

I always leave some headroom for interest, unless I skim off the interest monthly. At 3.81%, I would deposit less than £82k.snappyfish said:So put 85k in the chip easy access 3.82% now.

Yes, I would skim off interest I guess and keep it at 85k or just less.1 -

Breaking news from Virgin Money.

Breaking news! We’re boosting our M Plus Saver rate to 3.03% AER3 (variable) and Easy Access Cash ISA Exclusive to 3.75% AER/tax-free (variable) from 1 June 2023. For new and existing current account customers (exclusions and terms apply).

It is the ISA that is more impressive but the non ISA account is still okay.

I have also posted on the ISA savings sub-board.

https://forums.moneysavingexpert.com/discussion/6449558/virgin-money-exclusive-isa-increasing-from-3-to-3-75-on-1st-june/p1?new=1

https://uk.virginmoney.com/current-accounts/pca/

12 -

Still atrocious then.RG2015 said:Breaking news from Virgin Money.

Breaking news! We’re boosting our M Plus Saver rate to 3.03% AER3 (variable) and Easy Access Cash ISA Exclusive to 3.75% AER/tax-free (variable) from 1 June 2023. For new and existing current account customers (exclusions and terms apply).

It is the ISA that is more impressive but the non ISA account is still okay.

I have also posted on the ISA savings sub-board.

https://forums.moneysavingexpert.com/discussion/6449558/virgin-money-exclusive-isa-increasing-from-3-to-3-75-on-1st-june/p1?new=1

https://uk.virginmoney.com/current-accounts/pca/2 -

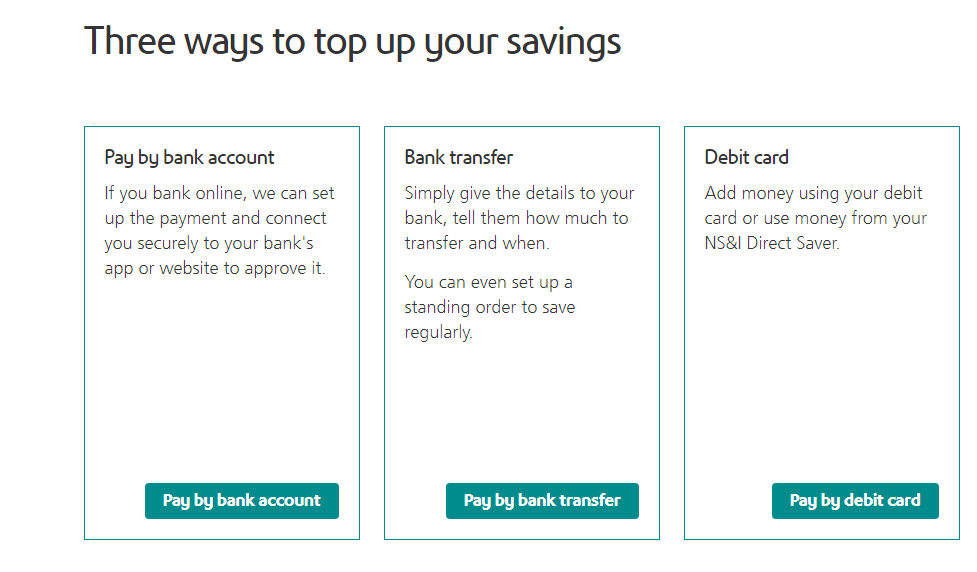

I can't seem to see it mentioned anywhere but it appears you can now deposit into the NS&I direct saver using open banking as well as using bank transfer and debit card as before.

I don't know if it's the same for any of their other accounts though.3 -

3.75% on a flexible cash ISA is very good if you are earning enough interest to breach the savings allowance. The fact it's flexible means you can operate it like an easy-access account, just paying careful attention when it's coming up to a new tax year (i.e. when April 6 is approaching, make sure you've put back everything you've taken out in the previous 12 months)jaypers said:

Still atrocious then.RG2015 said:Breaking news from Virgin Money.

Breaking news! We’re boosting our M Plus Saver rate to 3.03% AER3 (variable) and Easy Access Cash ISA Exclusive to 3.75% AER/tax-free (variable) from 1 June 2023. For new and existing current account customers (exclusions and terms apply).

It is the ISA that is more impressive but the non ISA account is still okay.

I have also posted on the ISA savings sub-board.

https://forums.moneysavingexpert.com/discussion/6449558/virgin-money-exclusive-isa-increasing-from-3-to-3-75-on-1st-june/p1?new=1

https://uk.virginmoney.com/current-accounts/pca/

Here's what you'd need a "normal" account to pay, in order to beat this ISA, for various tax brackets (assuming, as I mentioned above, you already breach the savings allowance):Tax Bracket Interest Rate needed for "normal" account to beat the 3.75% flexible ISA Basic rate 4.69 Higher rate 6.25 Basic rate with outstanding student loan 5.28 Higher rate with outstanding student loan 7.35 2 -

NNNNNNOOOOOO!!!!!!RG2015 said:Breaking news from Virgin Money.

Breaking news! We’re boosting our M Plus Saver rate to 3.03% AER3 (variable) and Easy Access Cash ISA Exclusive to 3.75% AER/tax-free (variable) from 1 June 2023. For new and existing current account customers (exclusions and terms apply).

It is the ISA that is more impressive but the non ISA account is still okay.

I have also posted on the ISA savings sub-board.

https://forums.moneysavingexpert.com/discussion/6449558/virgin-money-exclusive-isa-increasing-from-3-to-3-75-on-1st-june/p1?new=1

https://uk.virginmoney.com/current-accounts/pca/

Having waited and waited for the 3.0% ISA rate to improve I am in the process of transferring it to Chorley 3.55%!!!!!!

Best get on the phone pronto. Also means I will be able to make more use of the Chorley EA 3.7%.0 -

This comparison excludes tax payers in Scotland where rates are different.Mr._H_2 said:

3.75% on a flexible cash ISA is very good if you are earning enough interest to breach the savings allowance. The fact it's flexible means you can operate it like an easy-access account, just paying careful attention when it's coming up to a new tax year (i.e. when April 6 is approaching, make sure you've put back everything you've taken out in the previous 12 months)jaypers said:

Still atrocious then.RG2015 said:Breaking news from Virgin Money.

Breaking news! We’re boosting our M Plus Saver rate to 3.03% AER3 (variable) and Easy Access Cash ISA Exclusive to 3.75% AER/tax-free (variable) from 1 June 2023. For new and existing current account customers (exclusions and terms apply).

It is the ISA that is more impressive but the non ISA account is still okay.

I have also posted on the ISA savings sub-board.

https://forums.moneysavingexpert.com/discussion/6449558/virgin-money-exclusive-isa-increasing-from-3-to-3-75-on-1st-june/p1?new=1

https://uk.virginmoney.com/current-accounts/pca/

Here's what you'd need a "normal" account to pay, in order to beat this ISA, for various tax brackets (assuming, as I mentioned above, you already breach the savings allowance):Tax Bracket Interest Rate needed for "normal" account to beat the 3.75% flexible ISA Basic rate 4.69 Higher rate 6.25 Basic rate with outstanding student loan 5.28 Higher rate with outstanding student loan 7.35

1 -

Fairly sure taxpayers in Scotland are treated the same as the rest of the UK when it comes to savings interest.0

-

The OP states "Basic" and "Higher" rates but Scotland has four rates of Income Tax against two in the rest of the UK (they have not referred to the Top rate in any case), and the rates are different in three out of four cases. Therefore, their calculations of implied returns do not apply to the whole of the UK.Eirambler said:Fairly sure taxpayers in Scotland are treated the same as the rest of the UK when it comes to savings interest.

1 -

On the Virgin ISA rate change to 3.75% - does this apply to ALL of their existing easy access cash ISAs? I have one with Virgin but it is called an "Exclusive Flexi ISA2". Has been at 3% for a while now. Is this one changing too?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards