We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

the snap general election thread

Comments

-

Out,_Vile_Jelly wrote: »Yes, I was the only voter first thing this morning and there was a disapproving silence when it became obvious from the squeaky pencil that I was writing something more than X. I just put NONE OF THE ABOVE. Not a decision made lightly btw.

How could you tell the silence was not a silent ringing endorsement?I am just thinking out loud - nothing I say should be relied upon!

I do however reserve the right to be correct by accident.0 -

The Tories have borrowed more in the last 7 years than Labour governments have borrowed ever. The debt binge doesn't seem to have led to increasing mortgage costs or gilt yields.

BOE has been buying the debt. 25% of total debt issuance sits with the Treasury. The electorate has been screened from the impact. US Treasury intends unwinding it's $4.5 trillion holding of bonds shortly. Get your surf board ready as there'll be waves.0 -

During the last Labour government, who were said to have gone a debt binge, my mortgage (and yours?) got cheaper - not just towards the GFC end of their tenure but trended down from the start and rates were already trending down before that.

Banks discovered debt securitisation. In 1971 banks balance sheets were more or less at par. By the peak of the GFC. Banks such as Barclays had leveraged up to 72 times their core capital base. Even with Basle III which has been pushed further and further back. Balance sheets will still be leveraged up 33 times. There's some way to go in deflating the balloon of cheap debt yet.0 -

it was a different time back then. nowadays we live in a debt based world. why buy a house for cash if you can borrow at a ridiculous low interest rate and then diversify your portfolio in 5 or 10 houses.

People buy cars on finance instead of cash as its cheaper to take the finance deal and cancel after a week then pay straight out cash.0 -

During the last Labour government, who were said to have gone a debt binge, my mortgage (and yours?) got cheaper - not just towards the GFC end of their tenure but trended down from the start and rates were already trending down before that.

That's the theory. I suspect it's a theory that'll be tested no matter who wins the election thinking about it.

Interest rates were lowered globally after 9/11 - this is widely regarded now as a mistake - they were too low for too long and that led to the US housing crisis of 2007 - which led to the GFC of 2008.

Google Greenspan and the financial crash.0 -

Thrugelmir wrote: »BOE has been buying the debt. 25% of total debt issuance sits with the Treasury. The electorate has been screened from the impact. US Treasury intends unwinding it's $4.5 trillion holding of bonds shortly. Get your surf board ready as there'll be waves.Thrugelmir wrote: »Banks discovered debt securitisation. In 1971 banks balance sheets were more or less at par. By the peak of the GFC. Banks such as Barclays had leveraged up to 72 times their core capital base. Even with Basle III which has been pushed further and further back. Balance sheets will still be leveraged up 33 times. There's some way to go in deflating the balloon of cheap debt yet.

Which supports my premise that there's not necessarily a strong correlation between interest rates and the size of government debt.0 -

A spoilt ballot for me. Makes no odds - if the Labour incumbent doesn't win I'll eat my hat.

The polling centre was as quiet as morgue and I had the world's noisiest pencil so it was obvious to the invigilators that I was writing more than an 'x'. Was going for 'none of the above' but stopped at 'none'. Felt like an insurgent.

You're entirely entitled to spoil your vote should you wish, however I just read that between 1979 and now, the number of spoilt papers have always been between 0.28% and 0.38%.

I'm not aware of earlier years.

It's therefor simply not newsworthy across the whole of the UK, but can be prominent in individual constituencies:wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0 -

setmefree2 wrote: »Interest rates were lowered globally after 9/11 - this is widely regarded now as a mistake - they were too low for too long and that led to the US housing crisis of 2007 - which led to the GFC of 2008.

Google Greenspan and the financial crash.

That might be true but it doesn't help us demonstrate (or not) there's an obvious link between UK government debt and UK interest rates.

My big drop in mortgage interest rate was before 9/11 when in February 2001 my rate went from 7.74% to 4.55%. I didn't see any post 9/11 falls - well not of any consequence - it was 4.49% by 2005.

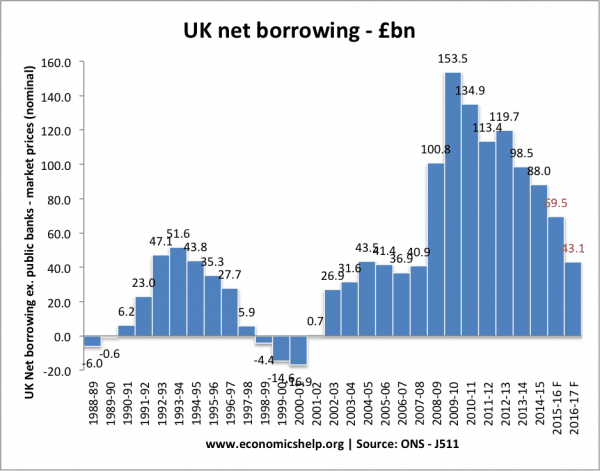

Here's a graph of UK net borrowing which shows UK debt going up and up apart from 3 years from 1998. You could overlay that with BoE rates and struggle to see any correlation at all apart from a very large increase in debt happening at the same time as interest rates falling. 0

0 -

IveSeenTheLight wrote: »You're entirely entitled to spoil your vote should you wish, however I just read that between 1979 and now, the number of spoilt papers have always been between 0.28% and 0.38%.

I'm not aware of earlier years.

It's therefor simply not newsworthy across the whole of the UK, but can be prominent in individual constituencies

I've asserted it'll be higher than usual this time but we'll have to wait and see.

I didn't rate any of the candidates and wanted to make that clear rather than being confused with someone who just couldn't be bothered. Mattered to me but, yes, in the scheme of things irrelevant.0 -

I've asserted it'll be higher than usual this time but we'll have to wait and see.

I didn't rate any of the candidates and wanted to make that clear rather than being confused with someone who just couldn't be bothered. Mattered to me but, yes, in the scheme of things irrelevant.

It was interesting to read that 8 out of 18 constituencies had more spoiled votes than one of the candidates.:wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards