We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

My Diary to Debt Freedom!

Comments

-

:mad:

So annoyed this morning. Went to the bank to take out £5 so I could get some lunch at work, and I had insufficient funds to the tune of -£59!! Paypal have given someone a refund for gift vouchers I sold them and they're saying the didn't get, so are helping themselves to the money from my bank account. Gutted - its one step forward three steps back I doubt I will have a leg to stand on here because I have no tracking details for the package and paypal always side with the buyer.

I doubt I will have a leg to stand on here because I have no tracking details for the package and paypal always side with the buyer.

So the £10 I get for the bike I have sold I'll have to use for lunch and hope there's enough change to get my son a haircut. This sucks so much!!1st Jan 2014 £20,600 / 1st Jan 2015 £15,572.90**Feeling Hopeful that 2015 will be our Debt Free Year**0 -

I need to drag my 13 year old to get his haircut at some point he looks like he has a mushroom for a head!

Good news on the bike, I think its nice when it goes to someone you know will get use out of it. I remember doing a car boot when my DS was little and I had a toddler slide a dealer was trying his hardest to knock me down on price and I wouldn't budge, then a lovely family came along with twin toddlers and they were playing on it so I offered it to them for 50p the look on the boys faces was brilliant and that of the dealer who was still stood there!Total DebtLoan [STRIKE]£2500[/STRIKE]£2284.97

[STRIKE]£10350[/STRIKE]£9734.97

[STRIKE]Wonga £400[/STRIKE], CC1 £200, CC2 £250, Loan £5500, Overdraft £1500

September step up challenge (no 54) Food £81/£250, Petrol £80/£400, Entertainment £0/£20 0

0 -

LoL Little Miss I hear ya! My son is just 2 but his hair is wild!! I grudge £9 for a kids haircut, but he looks so uncared for with his fuzzy ginger hair all over the place - it must be driving him mad just now with this heat!!

So the good news on the bike is counteracted by some bad news in the form of an evil payday loan I forgot I even took out at the time of our wedding. That will come off next week leaving me pretty much broke, so I'm going to pay the fee's and just over half of it, and then do a car boot sale, selling pages, massive clear out and sale for the last £250ish of it.

That will come off next week leaving me pretty much broke, so I'm going to pay the fee's and just over half of it, and then do a car boot sale, selling pages, massive clear out and sale for the last £250ish of it.

It really is one step forward and three back with me just now, but I am determined that I am going to change, so I will just have to deal with being skint and face up to the consequences of my old "act now care later" financial attitude.

On the plus side, if I get rid of this now, and have a major house clear out, then I will have all of my August pay to myself (and the wedding 0% credit card) so I will just have to do it. I will be on here all the time, telling myself its got to be done and looking for moral support, so bear with me and the whingy posts!!

I WILL manage this, its relatively small (£700) in comparison to my previous debts so should be able to blitz it!!

I think I look at the big picture a bit too much sometimes, if I break it down like this then its one step at a time......1st Jan 2014 £20,600 / 1st Jan 2015 £15,572.90**Feeling Hopeful that 2015 will be our Debt Free Year**0 -

Aw MrsSmith, you are having a rubbish day! Have a wee bit of chocolate (if you have any - I raid my kids' tins if I'm desperate) and have a good cry and hopefully things will get better for you. Once you and me are over the hump of the next month or two then things will settle down - they will (and are!) getting worse before they get better, but they will!

I have similar age (and sex) children to you and live in Scotland and got married recently, so have a feeling we'll have loads in common. Part of my c/c debt is things for my wedding that my DH would have vetoed if he'd known how much they cost, so I just whacked them on the c/c! Luckily my DH is a teacher so I don't have the childcare in the holidays problem, he has them all the time haha! I have gone to work with the car seats in my car today, so he's not very happy!

I am very interested in the Facebook saving £1/£2/£3 per week thing - have you started it yet? I've a feeling I may find this really tricky as we both get paid monthly, so might work out my own monthly version. If you haven't started it yet, we could pick a date and do it together?

Good luck lovely.MBNA = £4,000 / Next = £925 (approx. tbc on 19/8)

Tesco = £2,910.11 / Smile overdraft = £500

Bank of Scotland = £2,782.830 -

Thanks for popping by my diary scottishspendaholic! Its good to get moral support from someone in a similar situation to yourself, I definately think we have a lot in common too!

Yeah the next month - 6 weeks is going to be a pain but once thats over then it will be proper debt busting! I'm just thankful the card is 0% that we whacked the wedding stuff on, otherwise it would be driving me insane.

Thats brilliant that your DH is off during the kids hols, what a bonus! Or maybe not so much for you when you're at work and they are all at home chilling out!!

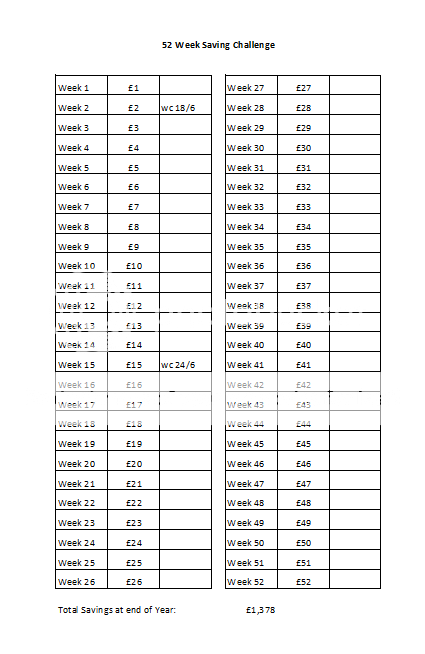

I will try and find a way to upload the £1/£2/£3 weekly saving thing, I couldn't do it direct on here because I have to upload the document to a site or something. Will try and do it tomorrow. I have started my own one, but am dotting back and forth between the weeks a bit - for example I'm monthly paid too, so on payweek I will do a bigger amount £40 upwards, and when I'm skint I'll do the £1-£10 ones, and everything else in between when I can manage if that makes any sense!!

I was planning on starting one for DH too without telling him. He has a bit of a habbit of hypothetically spending money in his head before its there, so I thought if I took money from the money he gives me for the credit card each week for his one, then I could start one for him. If the card is still looking high this time next year (which will be month 13 of 16 months at 0%) then we can use them to help blitz it - that would give us over £2,600 - says me speaking about my hubby for being hypothetical about money!!

I'll try and find a way to upload it and if you're up for it, I'd love to start one with you so we can motivate each other to keep it up!!

Off to pack a picnic for tomorrow, only working a half day then heading off somewhere nice with the kids. We do have some lovely parks, castles, lakes etc in Scotland when the weather is good enough to visit them!1st Jan 2014 £20,600 / 1st Jan 2015 £15,572.90**Feeling Hopeful that 2015 will be our Debt Free Year**0 -

Ahh I think it has worked!!

Here is the excel sheet scottishspendaholic - you can let me know what you think!

Mrs S x1st Jan 2014 £20,600 / 1st Jan 2015 £15,572.90**Feeling Hopeful that 2015 will be our Debt Free Year**0 -

Hi Mrs S

Stumbled across your diary

We have a very similar debt amount and df goal our cards included a fair amount from our wedding in 2011

our cards included a fair amount from our wedding in 2011

Your childcare costs are huge :eek: I am lucky that I have family members that help to keep my costs down

Sounds like you have a good plan. How annoying you now have to deal with the pay day thing

Have you any time off with the kids over the holidays?

I hope you have a lovely evening and have a great night sleep

OF xOrange Fairy

House Purchased April 19 CC1=? CC2=? DH CC= Mortgage Overpay = £0 Savings = £0 Xmas savings = £0 Weightloss = 0 lb0

CC1=? CC2=? DH CC= Mortgage Overpay = £0 Savings = £0 Xmas savings = £0 Weightloss = 0 lb0 -

Hi All!

Welcome to my diary orange fairy! I was determined that we wouldn't get carried away with the wedding, but we did! Hoping that we can be rid of the card really soon tho. One step at a time!

Yes childcare is extremely expensive in the holidays, its a bit of a nightmare really. Its an essential tho, so I just have to try not to think about it too much!

I know, these payday things are awful, I shouldn't have taken it in the first place, but I didn't want to have to ask my parents for money, which in hindsight would have been better for the finances, but not so for the pride. Never mind, I'll just have to try my best to blitz it in the next few weeks.

I have the first two weeks of August off, so only two more weeks to go and then holidays - looking forward to not having to get up and go anywhere! Although we probably will, but it will all be fun places (hopefully free places!)

I'm quite quiet at work today, so I may go and do a bit of financial planning. We get an annual increase at work based on performance, so the letters were on our desks this morning. Mine is an increase of £800 to my annual salary, so thats not to be sniffed at. Its effective 1st August, so won't see any difference in my pay until 25th August salary is paid in. I think I will just increase what I pay to my shares so that its going into "savings".

One goal I have is to pay £1000 off the credit card one month, so I'm thinking if I go and have a proper look at what comes in and goes out, then work out a way to do that, if we do it a couple of random months, the card should be gone pretty quick.

Wow - longer post that I had planned so will go for now and get lost in an excel spreadsheet!

Mrs S x1st Jan 2014 £20,600 / 1st Jan 2015 £15,572.90**Feeling Hopeful that 2015 will be our Debt Free Year**0 -

Great news on the payrise!Total DebtLoan [STRIKE]£2500[/STRIKE]£2284.97

[STRIKE]£10350[/STRIKE]£9734.97

[STRIKE]Wonga £400[/STRIKE], CC1 £200, CC2 £250, Loan £5500, Overdraft £1500

September step up challenge (no 54) Food £81/£250, Petrol £80/£400, Entertainment £0/£20 0

0 -

So I have done a mini-financial review/tidy up and done the following:

* Increased my share plan contribution at work to 8% of my salary

This might sound a lot, but we get to buy shares every six months at a discount of 15% so its a win/win unless the share price falls dramatically. I will sell whatever shares I have in January and chuck this straight at the card. It should be a minimum of £1000

* Looked through all our outgoings

* Have found that I'm still paying £7.95 a month for a National Trust for Scotland membership, that we've pretty much had the most of. Cancelled!

* Found 2 lots of Life Insurance that is coming out of our "joint" account. This needs reviewed as it is costing us £139.12 per month in total. I can get this through the benefits package at work, so will need to figure out if the cover would be the same and if so, cancel these, and take the ones from work.

* Updated my 52 Week Money Challenge for myself, and started one for hubby. He gives me weekly money for the credit card, so I will deduct his weekly savings from this before the credit card payment. THis should mean that next summer when the card is nearing its end of 0% we will have £1,378 each in savings, which would be a fantastic boost to paying off the card. If we don't owe that much, then I will see where else it could go towards.

I feel good that I have done these small things. I think I need to do these little things every few days so that I don't loose motivation.

My next job is to go and find a BIG bulldog clip for hubbys payslips and get them into date order over the weekend. We will need these when we eventually go and see the bank/financial advisor, so I would like to be prepared!....

The things I do to keep myself motivated!!

Happy Friday Everyone!

Mrs S x1st Jan 2014 £20,600 / 1st Jan 2015 £15,572.90**Feeling Hopeful that 2015 will be our Debt Free Year**0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards