We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Mortgage Free in Three - Take 3 challenge (MFiT-T3)

financialbliss

Posts: 1,952 Forumite

Read our Mortgage Guides for fully researched, up to date help on cutting your mortgage

If you haven’t already, join the forum to join the challenge. If you aren’t sure how it all works, watch our New to Forum? Intro Guide.

The Mortgage Free in Three - Take 3 challenge (MFiT-T3)

If you haven’t already, join the forum to join the challenge. If you aren’t sure how it all works, watch our New to Forum? Intro Guide.

The Mortgage Free in Three - Take 3 challenge (MFiT-T3)

This is a the third in a series of three year mortgage challenges on this MFW board. Anyone who has joined a previous challenge should be aware of the format and timescales. If not see the next few posts below.

This third challenge runs from December 2012 to December 2015 and is open to anyone who wants to devote the next three years to greatly reduce or completely pay off their mortgage, or build up a pot of savings.

Below is a list of the challengers who have signed up and their own challenge:

1. financialbliss. Build up my savings from £0 to £30,000.

2. Alion. Reduce my mortgage from £270,000 to £225,000.

3. lvm. Build up my savings from £23,322 to £60,000.

4. black taxi. Completely clear my £21,000 mortgage.

5. greent. Completely clear my £53,210 mortgage.

6. icklehelen. Reduce my mortgage from £72,500 to £54,500.

7. megela. Reduce my mortgage from £106,316 to £80,000.

8. gallygirl. Completely clear my £96,841 mortgage.

9. Ewig. Completely clear my £40,000 mortgage.

10. Double Trouble. Reduce my mortgage from £234,000 to £134,000.

11. Spiggle. Completely clear my £38,346 mortgage.

12. Tilly MFW in 6 YRS. Reduce my mortgage from £258,000 to £60,000.

13. VoucherMan. Reduce my mortgage from £50,208 to £28,000.

14. FlashBarry. Completely clear my £88,100 mortgage.

15. QB Wolf. Reduce my mortgage from £184,000 to £145,000.

16. JoeyGrey. Completely clear my £19,581 mortgage.

17. wantabetterlife. Reduce my mortgage from £132,817 to £99,999.

18. mortgagenomore. Completely clear my £18,650 mortgage.

19. uzubairu. Completely clear my £13,157 mortgage.

20. mfwin2019. Reduce my mortgage from £147,772 to £90,000.

21. spidystrider. Reduce my mortgage from £72,277 to £25,000.

22. AvidSaver. Reduce my mortgage from £192,955 to £140,000.

23. cake21. Completely clear my £54,745 mortgage.

24. foxblade. Completely clear my £28,000 mortgage.

25. Shooting star. Reduce my mortgage from £126,000 to £100,000.

26. Superfast_gran. Reduce my mortgage from £65,000 to £50,000.

27. coldcazzie. Build up my savings from £2,00 to £6,000.

28. RosieTiger. Completely clear my £11,000 mortgage.

29. pavlos_dog. Reduce my mortgage from £121,000 to £106,000.

30. OS QS. Reduce my mortgage from £133,650 to £90,000.

31. beth111. Reduce my mortgage from £147,083 to £125,000.

32. skaps.Reduce my mortgage from £213,343 to £200,343.

33. TallGirl. Build up my savings from £11,098 to £30,000.

34. SHOULDI. Completely clear my £88,000 mortgage.

35. curlygirl1971. Reduce my mortgage from £24,473 to £14,473.

36. moneysavingotter. Completely clear my £57,000 mortgage.

37. liuhutOz. Reduce my mortgage from £41,500 to £20,000.

38. HelenDaveKids. Reduce my mortgage from £86,400 to £33,000.

39. MuffinTops. Completely clear my £62,000 mortgage.

40. Starsailor. Reduce my mortgage from £193,700 to £125,000.

41. puddle96. Build up my savings from £0 to £18,000.

42. tjp70. Completely clear my £50,375 mortgage.

43. beachie. Reduce my mortgage from £85,750 to £42,875.

44. CathT. Reduce my mortgage from £106,000 to £80,000.

45. Penny pauper. Reduce my mortgage from £127,155 to £100.000.

46. kjsmith7. Reduce my mortgage from £43,000 to £30,000.

47. SuperSecretSquirrel. Reduce my mortgage from £81,055 to £40,000.

48. Trying to be good. Completely clear my £146,000 mortgage.

49. hoobydoobydoo. Reduce my mortgage from £99,999 to £49,999.

50. ElusiveLucy. Completely clear my £43,790 mortgage.

51. someday soon. Completely clear my £24,500 mortgage.

52. canne. Completely clear my $57,220 mortgage.

53. ammonite. Build up my savings from £0 to £40,000.

54. unhappy_shopper. Completely clear my £115,000 mortgage.

55. chocoholic_chic. Reduce my mortgage from £98,500 to £76,000.

56. Moneybag. Build up my savings from £0 to £15,000.

57. Isca. Reduce my mortgage from £55,000 to £35,000.

58. ShALLaX. Completely clear my £73,391 mortgage.

59. abouttimetoo. Reduce mortgage from £64,500 to £30,000.

60. teapot2. Completely clear my £29,964 mortgage.

61. diadeb. Reduce my mortgage by £50,000

62. bownyboy. Reduce my mortgage from £125,00 to £82,000.

63. MotorMouth. Completely clear my £147,327 mortgage.

64. shala_moo. Reduce my mortgage from £171,501 to £127,000.

65. Kwaker_Knacker. Completely clear my £30,450 mortgage.

66. littlefred169. Reduce my mortgage from £86,471 to £74,000.

67. PetitePeche. Reduce my mortgage from £149,885 to £110,000.

68. FreedomGirl. Build up my savings from £39,649 to £99,999.

69. Welshlassie. Reduce mortgage from £179,058 to £165,000.

70. ajmoney. Reduce my mortgage from £136,938 to £100,000.

71. SusanneCape. Reduce my mortgage from £125,900 to £80,000.

72. Matt The Chippy. Reduce my mortgage from £93,000 to £70,000.

73. tiredredhead. Reduce my mortgage from £220,000 to £180,000.

74. TwinnyD. Reduce my mortgage from £75,600 to £45,000.

75. 666paw. Reduce my mortgage from £47,800 to £30,000.

76. remote_control. Reduce my mortgage from £123,500 to £99,999.

77. anonymous. Reduce my mortgage from £139,699 to £120,000.

78. Stingy_3000. Reduce my mortgage from £137,600 to £45,650.

79. slowlyfading. Reduce my mortgage from £123,000 to £99,999.

80. Taranaman. Reduce my mortgage from £184,808 to £90,000.

81. slarlet10. Completely clear my £54,472 mortgage.

82. newgirly. Reduce my mortgage from £178,550 to £146,175.

83. marinia75. Reduce my mortgage from £238,525 to £200,000.

84. happycamel. Reduce my mortgage from £256,800 to £241,800.

85. PrincessLou. Reduce my mortgage from £126,000 to £100,000.

86. Peonie. Reduce my mortgage from £145,800 to £125,000.

87. Aless. Completely clear my £94,507 mortgage.

88. samtoby. Reduce my mortgage from £110,920 to £85,920.

89. the end of the rainbow. Build up my savings from £0 to £40,000.

90. babyb06. Reduce my mortgage from £247,000 to £200,000.

91. uzubairu. Build up my savings from £0 to £35,000.

92. icontinuetodream. Reduce my mortgage from £55,843 to £10,000.

93. I want a baby. Reduce my mortgage from £97,500 to £84,000.

94. Southernman. Reduce my mortgage from £82,000 to £60,000.

95. ChickenFriedRice. Reduce my mortgage from £180,515 to £130,000.

96. brizzledfw. Reduce my mortgage from £183,000 to £120,000.

97. trix-a-belle. Reduce my mortgage from £26,865 to £2,500.

98. lawbee. Reduce my mortgage from £72,000 to £60,000.

99. SparkleBlack. Reduce my mortgage from £205,000 to £165,000.

100. TheWebDev. Reduce my mortgage from £121,000 to £96,000.

101. Needhelpsaving. Reduce my mortgage from £100,000 to £86,000.

102. muddywhitechicken. Reduce my mortgage from £165,520 to £125,000.

103. Skittle. Reduce my mortgage from £99,000 to £65,000.

104. lilyp. Completely clear my £46,000 mortgage.

105. Mrs Money Penny. Reduce my mortgage from £89,220 to £50,000.

106. tattycath. Reduce my mortgage from £74,800 to £48,000.

107. Fluffypigs. Reduce my mortgage from £162,496 to £128,516.

108. taka. Build up my savings from £0 to £11,184.

109. Poppy_Golightly. Build up my savings from £50 to £249,000.

110. zebedeesaysboing. Reduce my mortgage from £156,499 to £126,499.

111. GoldenSand. Reduce my mortgage from £72,000 to £54,000.

112. exarmydreamer. Reduce my mortgage from £109,000 to £85,000.

113. MortgageFreeby50. Reduce my mortgage from £199,369 to £177,850.

114. SillySod. Completely clear my £175,000 mortgage.

115. rockabelle. Reduce my mortgage from £246,000 to £190,000.

116. Shineyhappy. Completely clear my £160,000 mortgage.

117. norfolkdream. Completely clear my £44,842 mortgage.

118. Mrs-hoppy. Completely clear my £70,829 mortgage.

119. jeanniefaethecarse. Completely clear my £60,000 mortgage.

120. CaroB. Completely clear my £35,884 mortgage.

121. hypno06. Reduce my mortgage from £154,655 to £125,000.

122. PurpleJellyFish. Reduce my mortgage from £60,000 to £50,000.

123. jimmyjones. Reduce my mortgage from £79,000 to £10,000.

124. Snood. Reduce my mortgage from £143,700 to £113,700.

125. Mardybum15. Reduce my mortgage from £35,327 to £20,000.

126. Lomcevak. Reduce my mortgage from £186,369 to £150,00.

127. littlemonkeywolf. Reduce my mortgage from £80,000 to £60,000.

128. ictquizzer. Reduce my mortgage from £81,250 to £50,000.

129. Suffolk lass.Reduce my mortgage from £167,649 to £115,000.

130. irishlassie. Reduce my mortgage from £63,528 to £18,528.

131. glitterball. Completely clear my £21,000 mortgage.

132. seeking happiness. Completely clear my £91,141 mortgage.

133. sammy70. Build up my savings from £0 to £25,000.

134. Calfuray. Reduce my mortgage from £57,050 to £50,000.

135. secretsavers. Completely clear my £13,880 mortgage.

136. life is sweet. Reduce my mortgage from £80,500 to £62,000.

137. gjb1503. Reduce my mortgage from £148,372 to £126,772

138. ShelleyC. Build up my savings from £0 to £50,000.

139. newbaby. Reduce my mortgage from £78,000 to £50,000.

140. Courgette. Reduce my mortgage from £104,500 to £80,000.

141. lulabelle1. Reduce my mortgage from £107,000 to £30,000.

142. mrsmumbles. Completely clear my £126,000 mortgage.

143. *Jellie*. Build up my savings from £30,193 to £66,193.

144. eeker. Reduce my mortgage from £132,000 to £100,000.

145. YoungBusinessman. Reduce my mortgage from £100,000 to £70,000.

146. PaddyPaws. Reduce my mortgage from £61,274 to £40,000.

147. egon. Reduce my mortgage from €215,156 to €200,000.

148. Twiggy_34. Reduce my mortgage from £68,000 to £60,000.

149. Gizmo247. Completely clear my £46,447 mortgage.

150. akamustang. Reduce my mortgage from £96,791 to £80,000.

151. Bobbi13. Reduce my mortgage from £175,000 to £130,000.

152. gc_bus. Completely clear my £61,000 mortgage.

153. drinkduffbeers. Completely clear my £47,000 mortgage.

154. snappybadger.Reduce my mortgage from £120,693 to £84,000.

155. kateyliz. Build up my savings from £0 to £2,000.

156. uropachild. Reduce my mortgage from £85,447 to £50,000.

157. tootoo. Build up my savings from £0 to £3,000.

158. BlueDaisy. Reduce my mortgage from £76,920 to £57,000.

159. mummy18. Reduce my mortgage from £137,075 to £90,000.

160. BlueMoo. Reduce my mortgage from £173,000 to £150,000.

161. StrawberryJam132. Reduce my mortgage from £54,665 to £42,000.

162. Kerfuffle. Reduce my mortgage from £102,486 to £78,000.

Please see the posts immediately below for further information. Good luck in your own challenges.

Financial Bliss.

Mortgage and debt free. Building up savings...

0

Comments

-

Questions and Answers...

Q. Why are you doing this?

Having been part of the two previous mortgage three in three challenges and running the second, I recently offered to run a third challenge.

Having studied the MFW board recently, people appear to have one of three objectives and this will be reflected in this third three year challenge:- Completely clear my mortgage

- Reduce my mortgage

- Build up my savings

Q. Is this challenge for me?

This is a 3 year challenge. I'm proposing that we have regular updates every 3 months, ie 12 updates over the course of the 36 months. If you don't think you can provide regular mortgage updates over the course of 3 years, then perhaps this isn’t the challenge for you.

There are regular annual challenges on this board which you can join if you feel a three year challenge is too long for you.

Q. What are the timescales?

The challenge will officially start on 12/12/12 and it will complete on 12/12/15. See post #4 directly below which gives a suggested progress chart update schedule.

Q. How do I join?

Using the previous challenge updates form as a baseline, I’ve updated the form to include registering / setting and updating your objective and also providing chart updates. You can use this update form to register.

Q. What if I can’t clear my mortgage in the 3 year period?

You don’t have to pledge to clear your mortgage completely to enter this challenge. Everyone’s circumstances are going to be different, so look at what you can realistically attain and set your own challenge goal accordingly.

Q. What information do you need about my own challenge?

I’ll need an estimate of your mortgage on 12/12/12, although the update form can be used to provide an accurate figure at that time.

Also, I’ll need a figure of where you would like to be by the end of the challenge, ie a challenge start and end value, eg:

Completely pay off my £125,000 mortgage.

Reduce mortgage from £48,000 to £30,000.

Q. What happens when I register my challenge objective?

We will allocate you a MFiT-T3 quest number, add you to post #1 and the progress chart and PM you back with your number.

Q. Why haven’t you responded to my private message (PM) yet?

I’ve very limited internet access at work (personal use at lunch times only) and while I may have noticed your post in this thread, you’re very unlikely to get an immediate reply. I’m hoping to reply to PMs within 3 days (and much sooner if I can), which I think is a reasonable time scale considering I’m managing this challenge in my own time.

Q. I have a mortgage free diary. Can you link to it in post #1?

If you have a mortgage diary, then it's not a problem to link to it in post number 1. The main "problem" is that we will need to be aware of your diary. Note: You can now use the updates form to make us aware of your diary.

Q. I’ve made an overpayment – what do I do now?

Not a lot I’m afraid. Unlike other annual challenge threads, which are only running for 12 months, keeping track of payments / overpayments on a monthly basis for everyone is probably too much admin work in a 3 year challenge. Feel free to mention any significant overpayments in this challenge thread, but as long as you give a mortgage update at the chart update schedules, your mortgage reduction will get logged.

Q. When can I give a figure for a chart update?

The chart update schedule in post #4 gives the dates each chart will be published, ie on the 12th day of every third month. The first chart is due to be published on 12th March 2013. If your mortgage payment is taken on the first of the month, so you may want to report your mortgage as soon as the payment clears when we are in a chart month. That then gives us enough time to gather and publish the data.

Q. What information do you need in a chart update?

Hopefully you have gave an accurate starting mortgage value, so updating us with a current mortgage value will show the reduction made in each 3 month period. Your forum name, challenger number and current mortgage balance is all we need.

Q. How do I provide information for a chart update?

There are 2 ways of providing an update, with '1' being the preferred method.

1. Google Docs chart update form:

See post #4 for details.

This has a benefit over private messages (PMs) as an update via the above form won't fill up our private message box. Using this update form does not update any chart directly, but instead goes to a "holding" chart so the information can first be checked. Values entered other than as we approach a chart date or the challenge start may be disregarded.

2. Private message (PM) to FinancialBliss.

There is a good chance my private message mailbox will get full, so if that is the case, try option 1.

Q. What about the 12/12/15 chart?

Not 100% sure how to handle this one, but rather than publish the last chart on that date, we could make 12/12/15 the last date in the challenge that you can make a payment / overpayment. Once everyone has got back to us with a final mortgage value, we then publish a final chart.

Q. What happens if I become mortgage free during the challenge?

Do tell us as soon as possible including the date you became mortgage free and we will add you to the list of questees who became mortgage free during the challenge.

Q. What if I want to leave this challenge?

While I hope this won’t be the case, perhaps a change in circumstances may dictate this? Rather than just leave with everyone wondering why we have had no updates from you, we would appreciate if you could let us know you are leaving the challenge. You don’t have to give a reason. This is just so we can update our active challengers.

Q. How do I bookmark this challenge so I can locate it easily?

The easiest way to store the address of this challenge is to bookmark it in your web browser. You don't actually need to be logged in to the MSE forums in order to view the challenge. Simply click on this link:

which will take you to page one of this challenge thread. Once you are there, bookmark it in your browser.

Internet Explorer (IE).

Favourites, Add to Favourites.

Firefox.

Bookmarks... Bookmark this page. Or Double click on the star in the address bar to file the bookmark somewhere.

The process will be similar in other browsers. Every time you want to locate this challenge, simply fire up your web browser and use the bookmark.

Q. Where can I find the first two challenges?

Each of the previous challenges have their own threads and can be found here.

Original MFiT challenge:

https://forums.moneysavingexpert.com/discussion/435291

Second installment of MFiT challenge - MFiT-T2:

https://forums.moneysavingexpert.com/discussion/1402631

Q. I have a question that you haven’t covered.

Hopefully the challenge is simple enough. If you do have a question, please PM myself or post in this thread and we will try to help / add the question and answer to this list.

Best of luck everyone.

Financial Bliss.Mortgage and debt free. Building up savings...0 -

Announcements.

Intending to use this post for any announcements relating to this challenge, so do check back here regularly.

Challenge is still open. Feel free to register and post in this thread... :j

Thanks,

Financial Bliss.Mortgage and debt free. Building up savings...0 -

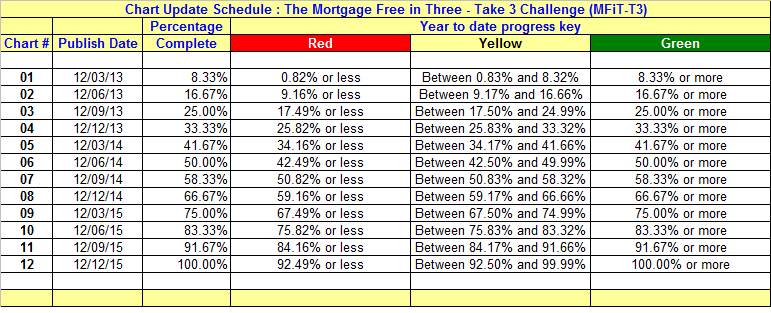

Chart update schedule.

As this is a three year challenge, I’m proposing that we have regular progress updates every 3 months on the 12th of the month.

Each chart is 8.33% of the challenge. On each chart is a percentage complete column for each questee. If you're on track, then your entry will be green. If you're slightly behind schedule, then your entry will be yellow. If you're further behind schedule, then your entry will be red. See the table below for details:

Note: As charts will be published on the 12th of each chart month - if you could have your updates in by the 11th of a chart month at the latest, that would be ideal.

The preferred method of updating your mortgage balance is via the Google Docs chart update form.

Registration / updates form.

The form below can be used to register for and provide updates for the challenge.

Registration / update form: The MFiT-T3 form

Hopefully this is simple enough to follow...

Thanks,

Financial Bliss.Mortgage and debt free. Building up savings...0 -

This post will always be used to enable you to locate the current chart, the chart summary and links to each of the previous charts and analysis for each chart.

Current chart.

The current chart is Chart 09, which [STRIKE]will be[/STRIKE] should have been published on 12th March 2015.

Current chart: Chart 09

Previous charts.

Chart 01

Chart 02

Chart 03

Chart 04

Chart 05

Chart 06

Chart 07

Chart 08

Thanks,

Financial Bliss.Mortgage and debt free. Building up savings...0 -

MFiT-T3 mortgage free roll of honour.

This post lists challengers who have become mortgage free during this mortgage free challenge. In order to be included in this list, we need to know your mortgage free date as this is used in the chart.

Link to mortgage free roll of honour:

Thanks,

Financial Bliss.Mortgage and debt free. Building up savings...0 -

Ok. That's the formal stuff out of the way. What's the deal then?

In a nutshell, register and set an objective. This objective is divided by 12 with their being 12 charts and you provide 12 updates during the challenge.

Providing you're on track to hit your goal, your chart progress colour will be green. If you're a little off your objective your chart progress colour will be yellow and if you're a little further behind, you're in the red zone :eek:

Keep an eye on these first few posts in this challenge thread as they will be updated with links to charts and further information in the coming weeks and months.

Get your calculator out, set an objective and register.

Enjoy,

Financial Bliss.Mortgage and debt free. Building up savings...0 -

Thank you for organising this again - I'll work out my objectives once I've sorted out the new mortgage.29/01/07 - Took on our first home for £225k, mortgage of £200,700, reduced to £70,224.44 in 6yrs

16/11/12 - Moved to our forever home for £427k, mortgage of £270,999

MFIT-T3 #2 - Reduce (new) mortgage from £270k to £225k whilst renovating and with our first baby on the way! £265,654.56 so far0 -

Oooohhh, I'm so excited! That's me registered!!

I reckon I'll have a tricky 3 years...plan is to save as much as possible until Sept 2014 then buy a new house where I'll then try and clear the mortgage. Whilst saving for new house, I'm also trying to pay a little extra off current mortgage as and when I can.

I'll pretend I'm just saving cash for the time being and will start a proper diary (need to stop using my DFW one) from December/January.

This had made my day :-)0 -

Thanks so much FB. I've registered-I think. Hoping to really stretch myself this time and pay of 25K in the 3 years.GE 36 *MFD may 2043

MFIT-T5 #60 £136,850.30

Mortgage overpayments 2019 - £285.96

2020 Jan-£40-feb-£18.28.march-£25

Christmas savings card 2020 £20/£100

Emergency savings £100/£500

12/3/17 175lb - 06/11/2019 152lb0 -

Thanks, fb! I think I've registered, too!

Am looking to hopefully clear mtge in the next challenge, so need to step my game up

Am looking to hopefully clear mtge in the next challenge, so need to step my game up  I am the master of my fate; I am the captain of my soulRepaid mtge early (orig 11/25) 01/09 £124616 01/11 £89873 01/13 £52546 01/15 £12133 07/15 £NILNet sales 2024: £200

I am the master of my fate; I am the captain of my soulRepaid mtge early (orig 11/25) 01/09 £124616 01/11 £89873 01/13 £52546 01/15 £12133 07/15 £NILNet sales 2024: £200

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards