We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

LVM's Aim for a New House and No Mortgage!

lvm

Posts: 1,544 Forumite

I’ve finally taken the plunge and here’s my very own Mortgage Free Wannabe Diary!! :j

So, I’ve been reading the MFW threads for far too long and feel the time is right to start my own diary and I’ve already joined the MFIT-T3 Challenge for 2012 to 2015. I do have a DFW diary HERE but I kinda feel it’s time to move onwards and upwards.

So, a little bit about me.I’m a 26 year old single (:() gal living in Edinburgh in my 2 bedroom flat I bought when I was 20.

I work full time although don’t exactly enjoy it much – the upside is I do get to work from home rather alot which is great. I also work every weekend and this helps bring in a little extra cash.

I also have a lodger (more extra cash I suppose!). After living on my own since I was around 17, I decided to take the plunge. It was definitely 3rd time lucky – the first 2 I had lasted around 6 weeks each but this one I’ve had for around a year and a half now and I’d hate to see him leave. He’s not exactly the most reliable with rent but it’s always paid at some point and I’d rather this than have someone I didn’t get along with.

The Debt

Anyway…my earlier years weren’t the most sensible and I got myself into a heap of credit card debt. My parents bailed me out to the tune of around £12,000 when I was about 20 I think.I didn’t learn my lesson and got myself into the same mess all over again so had over £10k of debt by my 24th birthday and I’d stopped paying my mortgage. Managed to have my “lightbulb moment” just before January 2011 and I’ve become the most financially savvy person ever since. I pay just £20.14 a month to debt collection agencies and they’re happy with this.

The Mortgage

I bought my flat on a Shared Equity scheme. Despite what everyone says, I’m happy with it as I don’t pay any charge or rent – just my very small mortgage. When I sell up, 50% of the sale price will go back to the builder/agent (no interest as far as I’m aware). So,I took out a £63,950 mortgage and due to all the debt problems and not making payments, it ended up at £65,000 after arrears had been paid. Since then, I’ve gradually increased the payments and now pay £300 a month (instead of £212) andI pay extra bits when I can (from mystery shopping or expenses I’m paid). The current balance is £63,689.90 (think it’s about £50 less actually but when I make extra payments they recalculate interest to the date the payment clears).

The Goal

I’ve joined the MFIT-T3Challenge but my goal is a little tricky. I am currently saving for a new house, still in Edinburgh(hopefully 3+ bedrooms) and need at least a £50k deposit. I should be able to get this by September 2014. After that, I’ll be aiming to overpay the new mortgage as much as I possibly can. I’ll also be renting out my current flat and getting a healthy amount of profit on it (fingers crossed!). I’m currently saving a fixed £1000 a month and this is invested into my Dad’s businesses with the agreement I get a 10% return. I’m currently at £19,000 (just over £23k including interest but I’m not counting that yet!) and I’ll be just shy of £27kby the end of the year.

So, I’m not doing too badly for myself at the moment. I suppose the worst thing to happen would be I lose my job…although saying that, I think I’d love the opportunity to be forced to go and find something else that I’d really love to do (no idea what that might be though!).

One thing I’d like to change in my life…I have no social life and I feel so bored sometimes . Friends live in other cities and are busy with work or kids and aren’t as flexible with their time as I am. I’d love to go on some amazing holidays and am in a position to do that but I don’t feel like I could go on my own. Kinda feel I should be settling down at my age now as well but with no knight in shining armour:cool: in the distance, I’ll just have to wait it out!

. Friends live in other cities and are busy with work or kids and aren’t as flexible with their time as I am. I’d love to go on some amazing holidays and am in a position to do that but I don’t feel like I could go on my own. Kinda feel I should be settling down at my age now as well but with no knight in shining armour:cool: in the distance, I’ll just have to wait it out!

Anyways, I think that’s enough from me for the time being. I’m hoping to update this regularly with my random thoughts and money stuff!

Off to find some other MFW diaries to subscribe to!

xx

So, I’ve been reading the MFW threads for far too long and feel the time is right to start my own diary and I’ve already joined the MFIT-T3 Challenge for 2012 to 2015. I do have a DFW diary HERE but I kinda feel it’s time to move onwards and upwards.

So, a little bit about me.I’m a 26 year old single (:() gal living in Edinburgh in my 2 bedroom flat I bought when I was 20.

I work full time although don’t exactly enjoy it much – the upside is I do get to work from home rather alot which is great. I also work every weekend and this helps bring in a little extra cash.

I also have a lodger (more extra cash I suppose!). After living on my own since I was around 17, I decided to take the plunge. It was definitely 3rd time lucky – the first 2 I had lasted around 6 weeks each but this one I’ve had for around a year and a half now and I’d hate to see him leave. He’s not exactly the most reliable with rent but it’s always paid at some point and I’d rather this than have someone I didn’t get along with.

The Debt

Anyway…my earlier years weren’t the most sensible and I got myself into a heap of credit card debt. My parents bailed me out to the tune of around £12,000 when I was about 20 I think.I didn’t learn my lesson and got myself into the same mess all over again so had over £10k of debt by my 24th birthday and I’d stopped paying my mortgage. Managed to have my “lightbulb moment” just before January 2011 and I’ve become the most financially savvy person ever since. I pay just £20.14 a month to debt collection agencies and they’re happy with this.

The Mortgage

I bought my flat on a Shared Equity scheme. Despite what everyone says, I’m happy with it as I don’t pay any charge or rent – just my very small mortgage. When I sell up, 50% of the sale price will go back to the builder/agent (no interest as far as I’m aware). So,I took out a £63,950 mortgage and due to all the debt problems and not making payments, it ended up at £65,000 after arrears had been paid. Since then, I’ve gradually increased the payments and now pay £300 a month (instead of £212) andI pay extra bits when I can (from mystery shopping or expenses I’m paid). The current balance is £63,689.90 (think it’s about £50 less actually but when I make extra payments they recalculate interest to the date the payment clears).

The Goal

I’ve joined the MFIT-T3Challenge but my goal is a little tricky. I am currently saving for a new house, still in Edinburgh(hopefully 3+ bedrooms) and need at least a £50k deposit. I should be able to get this by September 2014. After that, I’ll be aiming to overpay the new mortgage as much as I possibly can. I’ll also be renting out my current flat and getting a healthy amount of profit on it (fingers crossed!). I’m currently saving a fixed £1000 a month and this is invested into my Dad’s businesses with the agreement I get a 10% return. I’m currently at £19,000 (just over £23k including interest but I’m not counting that yet!) and I’ll be just shy of £27kby the end of the year.

So, I’m not doing too badly for myself at the moment. I suppose the worst thing to happen would be I lose my job…although saying that, I think I’d love the opportunity to be forced to go and find something else that I’d really love to do (no idea what that might be though!).

One thing I’d like to change in my life…I have no social life and I feel so bored sometimes

Anyways, I think that’s enough from me for the time being. I’m hoping to update this regularly with my random thoughts and money stuff!

Off to find some other MFW diaries to subscribe to!

xx

0

Comments

-

Statement of Affairs and Personal Balance Sheet

Household Information

Number of adults in household........... 2 (Me and lodger)

Number of children in household......... 0

Number of cars owned.................... 2 (Car and motorbike...think I may sell the bike soon though)

Monthly Income Details

Monthly income after tax................ 1413.85

Partners monthly income after tax....... 0

Benefits................................ 0

Other income............................ 850 (£350 rent from lodger, £500 from weekend work)

Total monthly income.................... 2263.85

Monthly Expense Details

Mortgage................................ 300 (rounded up from £212)

Secured/HP loan repayments.............. 0

Rent.................................... 0

Management charge (leasehold property).. 25.22

Council tax............................. 100 (I usually pay £200 for 6 months or when I can)

Electricity............................. 27 (£54 combined for G&E. Paid too little so this is covering that-should be £30)

Gas..................................... 27 (as above - and I'm on best rate available)

Oil..................................... 0

Water rates............................. 0

Telephone (land line)................... 9.5 (paid £114 for the year up front with TalkTalk)

Mobile phone............................ 15 (will probably buy iPhone handset and use £200 unused credit for a contract)

TV Licence.............................. 12.12

Satellite/Cable TV...................... 11.75 (will reduce this in Nov when contract up)

Internet Services....................... 3.25 (half price for 12 months with TalkTalk)

Groceries etc. ......................... 100 (total guess - should do a spending diary!)

Clothing................................ 50 (as above...I'm not too bad with this though)

Petrol/diesel........................... 0 (all mileage is reimbursed through work and I get twice as much back)

Road tax................................ 0 (Christmas/birthday pressie)

Car Insurance........................... 0 (Christmas pressie)

Car maintenance (including MOT)......... 0 (Christmas pressie)

Car parking............................. 0

Other travel............................ 0

Childcare/nursery....................... 0

Other child related expenses............ 0

Medical (prescriptions, dentist etc).... 0

Pet insurance/vet bills................. 0

Buildings insurance..................... 0 (I totally know I should have this but I don't)

Contents insurance...................... 0 (as above)

Life assurance ......................... 0 (not sure I need this. My employer will pay out 2 times salary to NOK)

Other insurance......................... 11.96 (Income protection for £500 - cheapest available)

Presents (birthday, christmas etc)...... 0 (I've done VSP challenge and already have over £500 for this year)

Haircuts................................ 10 (don't even spend this much!)

Entertainment........................... 0 (I have no life!)

Holiday................................. 0 (I save in advance with any money left over - don't have too many hols)

Emergency fund.......................... 0 (I have insurance and happy I could live comfortable for a year)

Savings for New Home Furniture.......... 375

Savings for "Treats".................... 125

Monthly Savings......................... 1000

Total monthly expenses.................. 2202.8

Assets

Cash.................................... 20994.8

House value (Gross)..................... 65000 (really £130k but only half is mine - I'm probably being generous here!)

Shares and bonds........................ 0

Car(s).................................. 1800 (£1000 car, £800 bike. Car might have to be replaced soon and bike sold)

Other assets............................ 0

Total Assets............................ 87794.8

Secured & HP Debts

Description....................Debt......Monthly...APR

Mortgage...................... 63689.9..(300)......3.99

Total secured & HP debts...... 63689.9...-.........-

Unsecured Debts

Description....................Debt......Monthly...APR

Old Debt.......................3383.94...20.14.....0 (all defaulted in 2008 so no interest)

Total unsecured debts..........3383.94...20.14.....-

Monthly Budget Summary

Total monthly income.................... 2,263.85

Expenses (including HP & secured debts). 2,202.8

Available for debt repayments........... 61.05

Monthly UNsecured debt repayments....... 20.14

Amount left after debt repayments....... 40.91 (usually more than this which goes to "Holiday" and "Car" savings accounts)

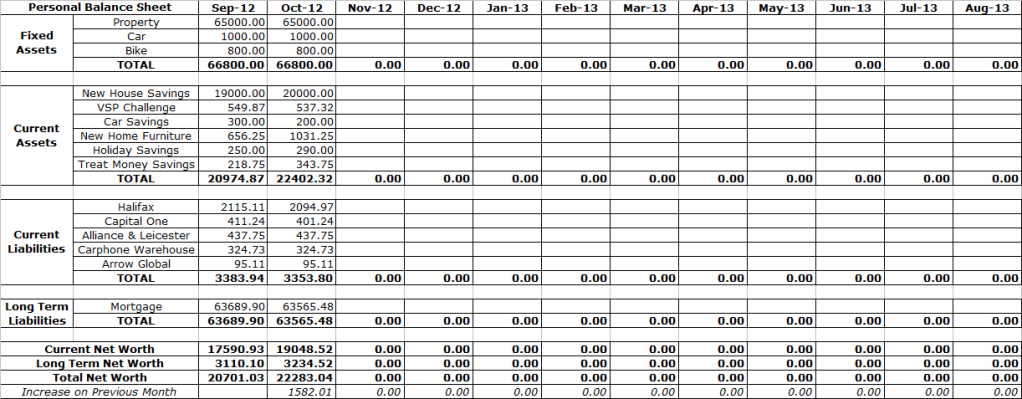

Personal Balance Sheet Summary

Total assets (things you own)........... 87,794.8

Total HP & Secured debt................. -63,689.9

Total Unsecured debt.................... -3,383.94

Net Assets.............................. 20,720.96

Created using the SOA calculator at www.stoozing.com.

Reproduced on Moneysavingexpert with permission, using IE browser.

Comments/Suggestions welcome!0 -

0

0 -

Hi IVM :j

Welcome and I hope you enjoy your mortgage free journey.

One thing that you have already mentioned is the insurance. Most companies will insist on House insurance, as part of your mortgage contract.

Imagine there is a gas leak in the street, and your house and others are blown to bits. It happened recently, was on the news and it killed a child as well. It also protects your lodger, or whoever you have living with you, what if he/she left the bath running and your ceiling falls through. You may say it never happens but my son did just that and the whole of the kitchen ceiling had to be replaced.

Life insurance, is also so important, what happens to your mortgage, (the bit you owe and the bit on shared equity). Someone will be left to deal with your estate, your debt's will be expected to be paid from your estate and the average funeral costs almost £3K. I know this as my father died recently.

The following are really very important, Life insurance (the younger you get this the less it will cost per month), House insurance (check your mortgage for insurance clauses) and contents insurance (do you really what to replace everything in your house because of a flood, fire or burglary). There is also a need for a will, your estate will not automatically fall to your parents, if no will, it can be contested by well anyone i.e your lodger could say that your favorite personal item was promised to him/her by you. Hope this helps in making your decisions for protecting your assets and future. Good Luck:)Mortgage: Aug 12 £114,984.74 - Jun 14 £94000.00 = Total Payments £20984.74

Albert Einstein - “Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it.”0 -

Hi exarmydreamer,

Thanks for the info. I think the building and contents insurance is something I'll definitely need to look into quickly. And life insurance, maybe something I'll think about in the not-too-distant future.

Think I've been too focussed on saving as much cash as possible that I saw them as "non-essential"!0 -

Hi, found you. Your journey does sound a little more complicated than mine, but you seem to have it all under control. :T

Keep us updated with your progress and any marvelous money saving ideas you have.Fashion on a ration 0 of 660 -

debt collection agency---stood out

the small payment to them---prob covers fee---not payments

what exactly are they doing for you?£48515 interest £181 (2009)debt/mortgage-MFIT/T2/T3

debt/mortgage free 28/11/14

vanguard shares index isa £1000

credit union £400

emergency fund£500

#81 save 2018£42000 -

black_taxi wrote: »debt collection agency---stood out

the small payment to them---prob covers fee---not payments

what exactly are they doing for you?

It's not a debt management company or anything, they are just normal collection agencies. The full payment goes against the outstanding balance. The debt was sold around many times before I bothered doing anything hence no interest for many many years. I've attempted final settlements but they won't give me the wording I want (one will only give me a partial settlement and another will only agree 80% of balance).0 -

Hi, found you. Your journey does sound a little more complicated than mine, but you seem to have it all under control. :T

Keep us updated with your progress and any marvelous money saving ideas you have.

Glad you found me :-)

I'm always on the hunt for moneysavingexpert ideas but they seem to be few and far between nowadays.0 -

So, first full day in my quest for mortgage freedomness and it's been a NSD. Unfortunately tomorrow won't go as well as I've promised my lodger I'll make dinner! Never mind!

Been trying to clear out come of the masses of junk in my flat and I never seem to finally get rid of anything. I've managed to put a full bag of stuff together to take to a charity shop (not worth ebaying) and I think I could have some stuff worthy of Gumtree/eBay but not got round to checking yet.

One thing I really want to get rid of is about 4 different collections of encyclopaedias. Unfortunately the 2 good collections seem to have 1 book missing from each and I keep thinking I'll come across them. Reckon I could get about £100 for them as well.

Anyway, plan is to be a bit more organised tomorrow and do at least one thing that's going to make me some money to put on the mortgage.

Until tomorrow...0 -

Well, I think Halifax have cottoned on to my MFW objective!

Got a letter from them yesterday asking if my repayment plan was still on track to repay my mortgage at the end of them term (I'm on interest only) and that if I wanted to could change to repayment or make regular overpayments.

Well, I've bet you to it Halifax and you'll have all your money back a lot quicker than you think!

Anyway, on the moneysaving front, I've stuck 3 things on eBay, had bids on 2 of them within a couple of hours and reckon all 3 will sell.

I don't seem to have any money coming in from extra sources at the moment. I'm still owed £300 from a mystery shopping company who appears to be committing financial suicide (!!!) and I'm still owed rent from lodger for this month. Apart from that, nothing else on the cards.

I have to stay away from home Monday-Friday for the next 3 weeks for work so hopefully I won't spend anything as all hotel and meals are paid for. The 2nd and 3rd week, I'll buy stuff from supermarket using an allowance I get and stock up on cupboard stuff so I don't need to pay for anything myself :-)

Anyway, I should be working so until laters!!0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards