We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Cash ISAs: The Best Currently Available List

Comments

-

Indeed, however Moneybox is not flexible.Ultrasonic said:

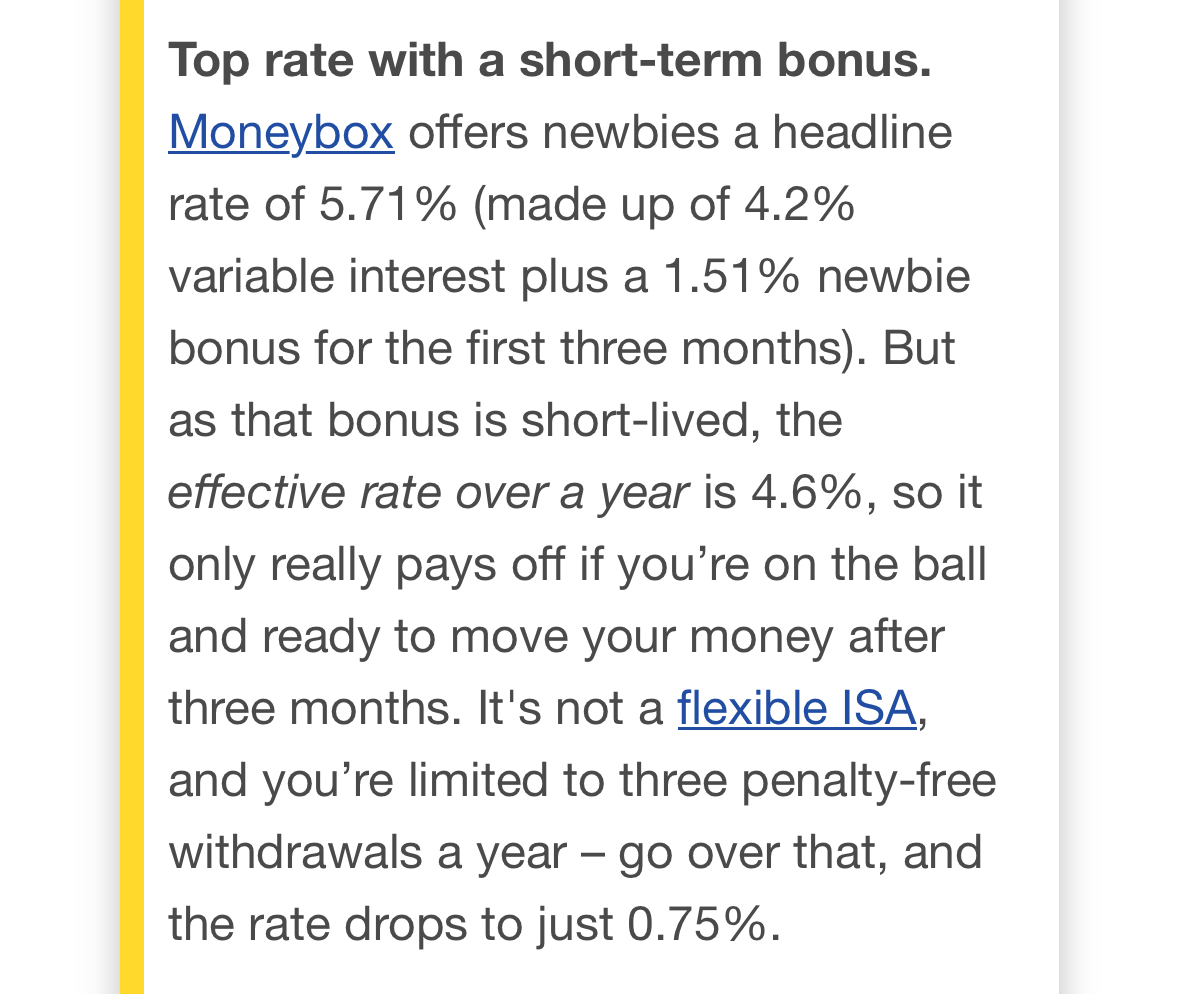

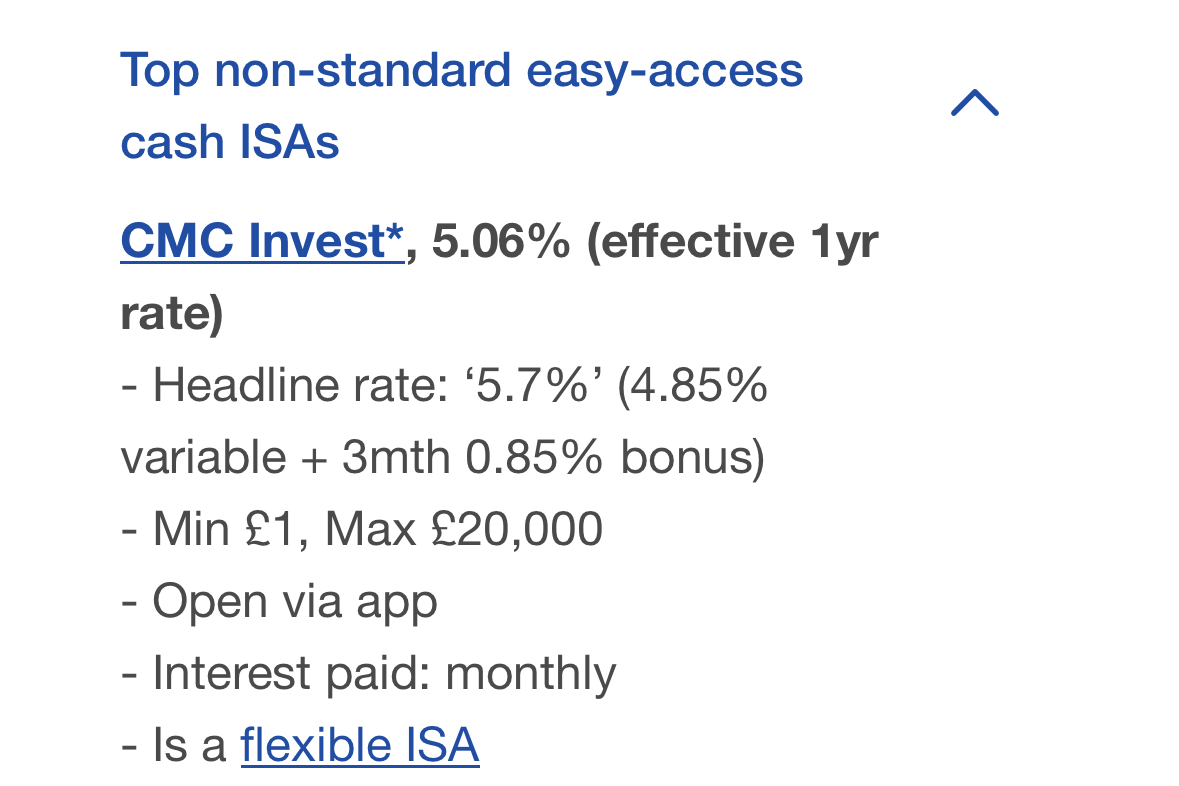

Note it is only that rate for 90 days. It is also mentioned on the main site page here if you've missed it, with a comment about the additional risk vs a regular cash ISA. If you want a short term higher rate like this then Moneybox offer something very similar with better protection.WLewer98 said:How do people feel about the CMC invest 5.70% flexible cash ISA? Does anyone already have the account or any experience with CMC?

The underlying interest rate of 4.85% is currently appealing, let alone the 0.85% bonus rate to total 5.70%!

Easy access Cash ISA | CMC Invest For reference from MSE:

For reference from MSE: 1

1 -

s71hj said:

The link takes you to something that seems to state its a flexible cash isa?masonic said:

It is an investment product, not a savings product. Some or all of the money will be held in a qualifying money market fund, which could decrease in value. Investment losses are not covered by the FSCS. If you wish to hold low risk investments, then the bonus is very tempting as an alternative to rolling your own in a S&S ISA.WLewer98 said:How do people feel about the CMC invest 5.70% flexible cash ISA? Does anyone already have the account or any experience with CMC?

The underlying interest rate of 4.85% is currently appealing, let alone the 0.85% bonus rate to total 5.70%!

Easy access Cash ISA | CMC InvestThat's correct, George Osbourne expanded the eligible products that can be held within the cash ISA to include low risk investments where capital is at risk, so you cannot assume simply because it is a cash ISA that your money is held in a deposit account and that any losses are eligible for FSCS protection. In the example of CMC, they use QMMF, so you could be exposed to losses.It's equivalent to investing in a short term money market fund within a S&S ISA, but with a bonus added on top.The fact you didn't realise this shows that the financial promotion is quite misleading. You'll see within the T&C that all is not as it appears. It is why MSE refers to it as "non-standard".5 -

I see the rate on the Moneybox Open Access Cash ISA is now 4.82% for new customers, down from 5.05%. It seems that they haven't reduced the underlying rate of 4.00% but have reduced the 12 month bonus from 1.05% to 0.82%. Minimum £500.0

-

Does anybody know how long it normally takes for Kent Reliance to reduce their rates on withdrawn easy access accounts?

Their NLA easy access cash ISAs issue 55 (withdrawn 10 April) and 56 (withdrawn 8 May) still pay more than their latest version at 4.36% and I am wondering if they have an habit of keeping the higher rate for a while? Should we expect an immediate reduction or maybe we will be getting some extra pence for a couple of months?0 -

Looks like Trading 212's core rate is dropping to 4.1%. I haven't received an email from them about the rate drop yet, but that's the rate that's being advertised to new customers (minus bonus). Still showing up as 4.35% on my account.2

-

Yes, down from 4.35%. The rate for new customers is down to 4.83% with a 12 month bonus of 0.73%. The rate seems designed to just tip Moneybox's Open Access Cash ISA (now 4.82% for new customers), Plum and Tembo.1

-

I wonder when the new rate kicks in for existing customers?0

-

Chip reducing their underlying rate to 4.06 but no email

Are institutions meant to email you about rate cuts?0 -

No, and they tell you that they will drop rates as soon as the BoE announce base rate changes when you sign up.VNX said:Chip reducing their underlying rate to 4.06 but no email

Are institutions meant to email you about rate cuts?0 -

This is a "tracker". You should know that if you've got one of these accounts.VNX said:Chip reducing their underlying rate to 4.06 but no email

Are institutions meant to email you about rate cuts?

"Basically, when the base rate moves up or down, your savings rate will move on the same day."1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards